PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937334

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937334

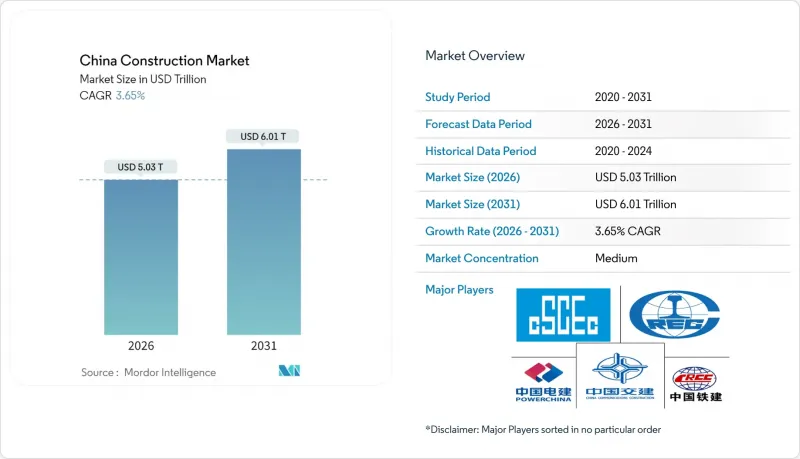

China Construction - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The China Construction Market is expected to grow from USD 4.85 trillion in 2025 to USD 5.03 trillion in 2026 and is forecast to reach USD 6.01 trillion by 2031 at 3.65% CAGR over 2026-2031.

Robust public spending on underground utilities, sustained urbanization that is pulling millions into city centers, heightened digitalization of approvals, and spill-over demand from domestic Belt and Road Initiative (BRI) corridors are keeping project pipelines active despite property-sector turbulence. Public-private partnership models and infrastructure investment trusts are making it easier for non-state capital to participate in transport, energy, and urban renewal schemes. Technology adoption is quickening: building information modeling (BIM), robotics, and modular manufacturing are compressing schedules and reducing defects. At the same time, cost pressures from an aging workforce and stricter green-finance rules are compelling builders to rethink conventional on-site methods in favor of prefabrication. Regional activity is spreading westward as the government tries to balance growth, while market leaders lean on scale, integrated design-build expertise, and government ties to maintain their edge.

China Construction Market Trends and Insights

Government Infrastructure Stimulus Packages

China is channeling USD 571.4 billion into "hidden infrastructure" such as underground pipelines, gas grids, and heating networks. The program emphasizes disaster-prevention upgrades and smart-city technologies, which in turn favor contractors with advanced engineering, BIM, and IoT capabilities. Fixed-asset data show 5.6% year-on-year growth in infrastructure outlays during early 2025, with water-conservancy investments leaping 39.1%, underscoring strong near-term momentum. Local authorities must meet green-building codes, linking stimulus funding to energy-efficiency metrics and amplifying demand for high-performance materials.

Urbanization-Driven Housing Demand

China's five-year plan aims for a 70% urbanization rate, granting roughly 300 million migrant workers access to city services through hukou reform. The shift fuels a steady need for affordable apartments plus supporting hospitals, schools, and transit. Central and western provinces are now logging quicker urban growth than the coast, widening geographic demand. Policy directives prioritize inclusive, affordable homes, creating predictable workflows for builders skilled in standardized, low-cost designs.

Shrinking Local-Government Land-Sale Revenues

Land sales finance up to 30% of municipal budgets, but weaker housing demand in smaller cities is shrinking auction receipts and curbing funds available for new projects. Local authorities respond by delaying or downsizing public works pipelines, dampening near-term opportunities for contractors dependent on municipal orders. Fiscal reforms under discussion may diversify revenue streams, yet timelines remain uncertain, adding risk to bid pipelines.

Other drivers and restraints analyzed in the detailed report include:

- Digital Project-Approval Platforms (BIM-Powered)

- Domestic BRI Corridor Spill-Over Projects

- Persistent Residential Oversupply in Lower-Tier Cities

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Infrastructure captured 5.41% CAGR prospects, outpacing all other sectors as the state prioritizes transport links, water conservancy, and utility upgrades. Within the China construction market, residential retained a 35.10% share in 2025, backed by migrant-friendly housing subsidies. Industrial and logistics facilities are surging on e-commerce and supply-chain localization, while traditional office towers slow amid remote-work adoption.

Government outlays for the 158-km fully automated highway and the USD 571.4 billion hidden-infrastructure program underscore commitment to resilient networks. Renewables-ready grid projects and the Pinglu Canal add multi-year volume. Apartment blocks remain core, yet low-density villas around Tier-2 suburbs are gaining ground as commuters seek larger living spaces. Tight green-building rules steer both public and residential segments toward higher-spec insulation, boosting demand for energy-efficient materials.

New construction commanded 77.05% of 2025 spend in the China construction market, yet renovations are forecast to climb 5.22% annually to 2031 as urban-renewal campaigns intensify. Multi-family retrofits improve energy performance and seismic safety, aligning with green bond eligibility and special-purpose bond issuance.

Owners favor renovation because prime city plots are limited and demolition carries social costs. Conversion of aging malls into mixed-use community hubs and office-to-apartment reconfigurations are examples of lucrative upgrades. Fiscally, renovations' lower land-acquisition costs and quicker approvals translate into higher margins for specialist contractors versed in live-environment work. The China construction market size for large-scale retrofits is therefore expanding even faster than ground-up projects in mature metros.

The China Construction Market Report is Segmented by Sector (Residential, Commercial, Infrastructure), by Construction Type (New Construction, Renovation), by Construction Method (Conventional On-Site, Modern Methods of Construction), by Investment Source (Public, Private), and by Geography (Jiangsu, Guangdong, Zhejiang, Beijing, Shanghai, Rest of China). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- China State Construction Engineering (CSCEC)

- China Railway Group (CREC)

- China Railway Construction (CRCC)

- China Communications Construction (CCCC)

- Power Construction Corporation (PowerChina)

- China Metallurgical Group (MCC)

- China Energy Engineering Corporation (CEEC)

- Shanghai Construction Group

- China National Chemical Engineering (CNCEC)

- China Petroleum Engineering (CPEC)

- Beijing Construction Engineering Group

- Sinohydro

- CRRC Urban Construction

- Beijing Urban Construction Group

- Jiangsu Nantong No.2 Construction

- Huashi Group

- Zhejiang Construction Investment Group

- China Harbour Engineering

- Longfor Construction

- Country Garden Construction

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government infrastructure stimulus packages

- 4.2.2 Urbanisation-driven housing demand

- 4.2.3 Digital project-approval platforms (BIM-powered)

- 4.2.4 Domestic BRI corridor spill-over projects

- 4.2.5 Mandatory prefabrication quotas in Tier-1 cities

- 4.3 Market Restraints

- 4.3.1 Persistent residential oversupply in lower-tier cities

- 4.3.2 Escalating skilled-labour costs

- 4.3.3 ESG-linked lending caps on carbon-intensive builds

- 4.3.4 Shrinking local-government land-sale revenues

- 4.4 Value / Supply-Chain Analysis

- 4.4.1 Overview

- 4.4.2 Real Estate Developers and Contractors - Key Quantitative and Qualitative Insights

- 4.4.3 Architectural and Engineering Companies - Key Quantitative and Qualitative Insights

- 4.4.4 Building Material and Equipment Companies - Key Quantitative and Qualitative Insights

- 4.5 Government Initiatives & Vision

- 4.6 Regulatory Landscape

- 4.7 Technological Outlook

- 4.8 Industry Attractiveness - Porter's Five Force Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Pricing (Construction Materials) and Construction Cost (Materials, Labour, Equipment) Analysis

- 4.10 Comparison of Key Industry Metrics of the China with Other Countries

- 4.11 Key Upcoming/Ongoing Projects (with a focus on Mega Projects)

5 Market Size & Growth Forecasts (Value, In USD Billion)

- 5.1 By Sector

- 5.1.1 Residential

- 5.1.1.1 Apartments/Condominiums

- 5.1.1.2 Villas/Landed Houses

- 5.1.2 Commercial

- 5.1.2.1 Office

- 5.1.2.2 Retail

- 5.1.2.3 Industrial and Logistics

- 5.1.2.4 Others

- 5.1.3 Infrastructure

- 5.1.3.1 Transportation Infrastructure (Roadways, Railways, Airways, others)

- 5.1.3.2 Energy & Utilities

- 5.1.3.3 Others

- 5.1.1 Residential

- 5.2 By Construction Type

- 5.2.1 New Construction

- 5.2.2 Renovation

- 5.3 By Construction Method

- 5.3.1 Conventional On-Site

- 5.3.2 Modern Methods of Construction (Prefabricated, Modular, etc)

- 5.4 By Investment Source

- 5.4.1 Public

- 5.4.2 Private

- 5.5 By Geography

- 5.5.1 Jiangsu

- 5.5.2 Guangdong

- 5.5.3 Zhejiang

- 5.5.4 Beijing

- 5.5.5 Shanghai

- 5.5.6 Rest Of China

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 China State Construction Engineering (CSCEC)

- 6.4.2 China Railway Group (CREC)

- 6.4.3 China Railway Construction (CRCC)

- 6.4.4 China Communications Construction (CCCC)

- 6.4.5 Power Construction Corporation (PowerChina)

- 6.4.6 China Metallurgical Group (MCC)

- 6.4.7 China Energy Engineering Corporation (CEEC)

- 6.4.8 Shanghai Construction Group

- 6.4.9 China National Chemical Engineering (CNCEC)

- 6.4.10 China Petroleum Engineering (CPEC)

- 6.4.11 Beijing Construction Engineering Group

- 6.4.12 Sinohydro

- 6.4.13 CRRC Urban Construction

- 6.4.14 Beijing Urban Construction Group

- 6.4.15 Jiangsu Nantong No.2 Construction

- 6.4.16 Huashi Group

- 6.4.17 Zhejiang Construction Investment Group

- 6.4.18 China Harbour Engineering

- 6.4.19 Longfor Construction

- 6.4.20 Country Garden Construction

7 Market Opportunities & Future Outlook