PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937375

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937375

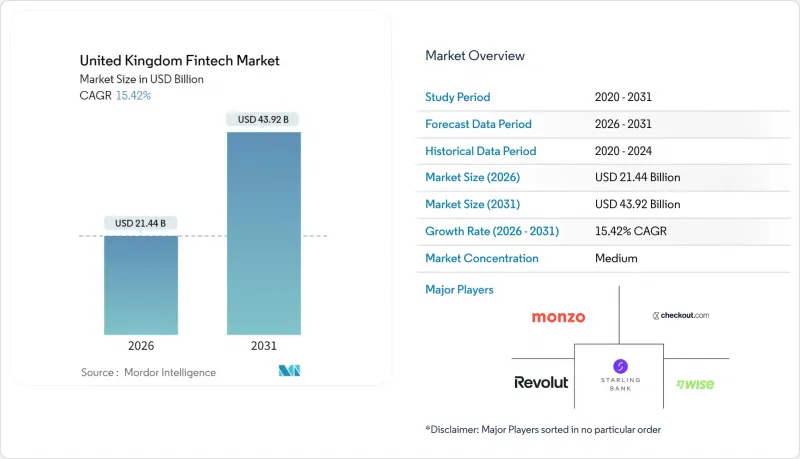

United Kingdom Fintech - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

United Kingdom fintech market size in 2026 is estimated at USD 21.44 billion, growing from 2025 value of USD 18.57 billion with 2031 projections showing USD 43.92 billion, growing at 15.42% CAGR over 2026-2031.

Open banking adoption, real-time payments, and a supportive regulatory sandbox framework are expanding addressable demand even as macro-uncertainty reshapes funding patterns. London retains its magnetic pull for venture capital, yet regional hubs in Manchester and Edinburgh are capturing specialized niches. Neobanks move from growth to profitability, while embedded finance deepens retailer-fintech partnerships. Technology adoption, especially artificial intelligence, underpins cost-efficient scale-ups and positions the United Kingdom fintech market for sustained double-digit growth.

United Kingdom Fintech Market Trends and Insights

Open Banking Regulations Accelerate API-Based Payments

Seven million UK consumers actively used open-banking services in 2024, unlocking standardized API access for third-party providers. Mandatory data-sharing spurred a 30% rise in account-to-account transactions and enabled niche payment firms to bypass incumbent card networks. The regulatory design, championed by the Financial Conduct Authority (FCA), positions the United Kingdom fintech market as a benchmark for competition-led innovation. Payment providers now integrate real-time settlement and identity verification, lowering merchant fees and fuelling broader embedded-finance use cases. Elevated interoperability also reduces customer switching friction, intensifying competitive pressure on legacy processors.

Post-Brexit Regulatory Sandboxes Attract Global Entrants

Since 2016, the FCA sandbox has admitted 55 firms, and the Digital Securities Sandbox opened to 12 additional international participants in March 2025. Controlled testing cuts compliance costs and time-to-market, drawing firms from Singapore and the United States. A new AI-testing corridor, announced in January 2025, broadens the scope to algorithmic underwriting and autonomous trading. Cross-border memoranda between the FCA and Canadian, Australian, and Japanese regulators streamline passporting, thereby anchoring the United Kingdom fintech market as a launchpad for multi-jurisdictional scale-ups.

Rising Cloud-Compliance Costs Under UK GDPR and Resilience Rules

Full implementation of operational-resilience mandates by March 2025 requires granular mapping of important business services and severe-but-plausible scenario tests. Fintechs leveraging hyperscale cloud providers must evidence end-to-end controls, increasing audit frequency, and vendor-management expense. The Digital Operational Resilience Act, effective January 2025, layers additional ICT-risk reporting on top of UK GDPR obligations. Smaller firms face trade-offs between feature development and compliance, changing cost curves across the United Kingdom fintech market.

Other drivers and restraints analyzed in the detailed report include:

- Nationwide Faster Payments & RTP Infrastructure Boost Digital Wallet Uptake

- London Talent Pool and Venture Capital Density Catalyze Scale-Ups

- Digital Fraud and APP-Scam Losses Dent Consumer Trust

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Digital Payments retained 32.15% of the United Kingdom fintech market size in 2025, yet Neobanking posted the fastest outlook with a 19.18% CAGR to 2031. Record profitability at Revolut and Starling demonstrates viable unit-economics once scale is reached. Revolut secured a UK banking licence in July 2024, expanding deposit-funded margins and improving product cross-sell. Digital Lending to SMEs accelerates as regional credit gaps broaden. Insurtech deploys data analytics to refine underwriting, while Digital Investments benefit from AI-led portfolio visualization. The Bank of England's AI Consortium, launched in September 2024, catalyzes algorithmic innovation across propositions, adding depth to the United Kingdom fintech market.

Customer acquisition costs for neobanks fall as embedded-finance partners bundle accounts inside retail checkout journeys. Profitability inflection points align with higher interchange income and fee-based revenues, such as crypto trading. Alternative lenders leverage open-banking data for cash-flow underwriting, cutting decision times for SMEs. Wealth-tech providers democratize fractional investing, while Insurtech firms automate claims, raising user satisfaction. Collectively, these shifts underline the structural re-rating occurring in the United Kingdom fintech industry.

The United Kingdom Fintech Market is Segmented by Service Proposition (Digital Payments, Digital Lending and Financing, Digital Investments, Insurtech, and Neobanking), by End-User (Retail and Businesses), and by User Interface (Mobile Applications, Web / Browser, and POS / IoT Devices). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Revolut Ltd

- Monzo Bank Ltd

- Wise plc

- Starling Bank Ltd

- Checkout.com

- Zopa Bank Ltd

- OakNorth Bank plc

- Klarna Bank AB (UK Ops)

- Stripe Payments UK Ltd

- GoCardless Ltd

- Atom Bank plc

- Zepz

- PaySafe Group Ltd

- Tide Platform Ltd

- Onfido Ltd

- Soldo Ltd

- Nutmeg Saving & Investment Ltd

- Rapyd Financial Network (UK)

- Funding Circle UK

- PensionBee plc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Open Banking Regulations Accelerating API-Based Payment Innovation in UK

- 4.2.2 Post-Brexit UK Regulatory Sandboxes Attracting Global Fintech Expansion

- 4.2.3 Nationwide Faster Payments & RTP Infrastructure Boosting Digital Wallet Adoption

- 4.2.4 London's FinServ Talent Pool & VC Funding Density Catalyzing Fintech Scale-ups

- 4.2.5 SME Demand for Alternative Lending Amid Bank De-Risking in UK Regions

- 4.2.6 Embedded Finance Partnerships with Retailers Scaling Consumer BNPL Penetration

- 4.3 Market Restraints

- 4.3.1 Heightened FCA Scrutiny on Financial Promotions Limiting Fintech Marketing Spend

- 4.3.2 Rising Cloud Compliance Costs under UK GDPR & Operational Resilience Rules

- 4.3.3 Digital Fraud & APP-Scam Losses Eroding Consumer Trust in Neobanks

- 4.3.4 Funding Contraction Post-2022 Valuation Reset Stalling Late-Stage Fintech Rounds

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory or Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Investment & Funding Trend Analysis

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Service Proposition

- 5.1.1 Digital Payments

- 5.1.2 Digital Lending and Financing

- 5.1.3 Digital Investments

- 5.1.4 Insurtech

- 5.1.5 Neobanking

- 5.2 By End-User

- 5.2.1 Retail

- 5.2.2 Businesses

- 5.3 By User Interface

- 5.3.1 Mobile Applications

- 5.3.2 Web / Browser

- 5.3.3 POS / IoT Devices

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for Key Companies, Products & Services, and Recent Developments)

- 6.4.1 Revolut Ltd

- 6.4.2 Monzo Bank Ltd

- 6.4.3 Wise plc

- 6.4.4 Starling Bank Ltd

- 6.4.5 Checkout.com

- 6.4.6 Zopa Bank Ltd

- 6.4.7 OakNorth Bank plc

- 6.4.8 Klarna Bank AB (UK Ops)

- 6.4.9 Stripe Payments UK Ltd

- 6.4.10 GoCardless Ltd

- 6.4.11 Atom Bank plc

- 6.4.12 Zepz

- 6.4.13 PaySafe Group Ltd

- 6.4.14 Tide Platform Ltd

- 6.4.15 Onfido Ltd

- 6.4.16 Soldo Ltd

- 6.4.17 Nutmeg Saving & Investment Ltd

- 6.4.18 Rapyd Financial Network (UK)

- 6.4.19 Funding Circle UK

- 6.4.20 PensionBee plc

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment