PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1938988

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1938988

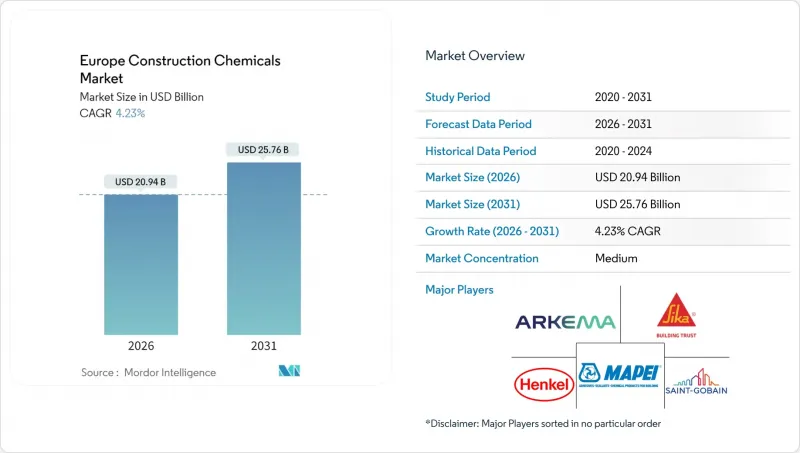

Europe Construction Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Europe Construction Chemicals market size in 2026 is estimated at USD 20.94 billion, growing from 2025 value of USD 20.09 billion with 2031 projections showing USD 25.76 billion, growing at 4.23% CAGR over 2026-2031.

Expansion continues despite cyclical construction slowdowns because public-sector stimulus under the EU Green Deal, the Energy Performance of Buildings Directive (EPBD), and the Connecting Europe Facility steers spending toward low-carbon materials and infrastructure upgrades. Suppliers that combine specialty formulations with verifiable environmental credentials are more likely to win specifications as project owners adopt mandatory Environmental Product Declarations (EPDs). Consolidation accelerates, illustrated by Saint-Gobain's USD 1.025 billion acquisition of FOSROC, while leaders such as Sika leverage geographic diversification and specialty product portfolios to protect margins. Raw-material cost volatility, chiefly in epoxy and polyurethane feedstocks, pressures profitability, yet innovation in bio-based, Per- and Polyfluoroalkyl Substances (PFAS)-free, and carbon-negative chemistries creates new revenue streams and improves regulatory resilience across the Europe Construction Chemicals market.

Europe Construction Chemicals Market Trends and Insights

EU Green Deal funding accelerates sustainable construction demand

The EUR 1 trillion Green Deal investment framework mandates low-carbon renovation across 35 million buildings by 2030, directly increasing volumes for bio-based admixtures, recycled-content waterproofing, and carbon-negative additives that underpin the Europe Construction Chemicals market. BASF's bio-based ethyl acrylate launch in late 2024 cut product carbon footprints by 30% while maintaining performance, signaling supplier realignment toward mandatory environmental product declarations under Construction Products Regulation 2024/3110. Financial incentives and green bond eligibility heighten customer preference for products with transparent life-cycle data, creating a premium segment within the Europe Construction Chemicals market. Government renovation subsidies make high-performance sealants, insulation adhesives, and liquid-applied membranes core purchasing priorities for municipal housing operators. As more funding flows from the Social Climate Fund in 2026, market demand for energy-efficient chemistries continues to outpace conventional alternatives, cementing the driver's medium-term importance.

EU Connecting Europe Facility boosts trans-border infrastructure spend

The EUR 33.7 billion CEF 2021-2027 program channels capital into rail, tunnel, and port projects, thereby increasing demand for specialty chemicals such as high-performance admixtures, rapid-setting mortars, and tunnel waterproofing along corridors like Rail Baltica and the Mediterranean link. Compliance with climate-resilient asset criteria favors carbon-fiber-reinforced systems and self-healing concrete, which extend the structure's lifespan. The Grand Paris Express, co-funded through CEF, alone consumes sizable volumes of spray-applied membranes and low-emission concrete accelerators. Suppliers able to certify multipurpose systems across several national standards secure bid advantages, reinforcing growth momentum for the Europe Construction Chemicals market until the program's close and anticipated sequel in 2028.

Volatile prices of epoxy, PU, and acrylic feedstocks

January 2025 spot epoxy resin prices increased by 1.73% as inventories tightened and anti-dumping duties of 10.8%-40.8% were imposed on Asian imports. Polyurethane precursors mirror crude volatility, while energy-intensive acrylic monomer chains face elevated European power costs. Smaller formulators often lack hedging or backward integration, which erodes margins and delays innovation spending. Some customers defer nonessential renovations, marginally dampening volumes in the Europe Construction Chemicals market. Although major producers negotiate long-term contracts, procurement uncertainty is expected to remain a pricing headwind through 2026.

Other drivers and restraints analyzed in the detailed report include:

- Stricter EPBD energy-efficiency codes increase demand for high-performance admixtures

- Carbon-neutral concrete initiatives adopt novel supplementary cementitious materials

- Stringent VOC and PFAS phase-out regulations restrict solvent-borne chemistries

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Waterproofing systems secured a 31.62% Europe Construction Chemicals market share in 2025, underpinned by stringent durability requirements for tunnels, basements, and bridge decks. The segment's dominance stems from high failure-cost avoidance, which makes end-users favor premium membranes and liquid-applied coatings despite the price premiums. The Europe Construction Chemicals market size for waterproofing grew steadily in 2024 as public-sector renovation grants prioritized moisture-control upgrades. Demand also benefits from rising flood-risk mitigation in riverine regions, encouraging uptake of negative-side slurry mortars and elastomeric overlays. Product innovation focuses on PFAS-free polymers, bio-based asphalt modifiers, and nano-silica-enhanced coatings that maintain adhesion under thermal cycling. SOPREMA's acquisition strategy combines bitumen, Polymethyl methacrylate (PMMA), and polyurethane technologies, offering system warranties that tighten customer lock-in. Meanwhile, suppliers are accelerating the development of digital detailing tools that integrate with BIM workflows, thereby improving specification compliance and reducing installation errors.

Concrete admixtures represent the fastest-growing product line, with a 5.05% CAGR to 2031, as infrastructure owners demand high-performance mixes that are compatible with low-carbon objectives. High-range water reducers, self-consolidating agents, and shrinkage-compensating additives command premium pricing, lifting the Europe Construction Chemicals market size for admixtures alongside volume growth. Regulatory pressure boosts demand for low-alkali accelerators and chromium-VI-reduced plasticizers, while R&D pipelines focus on nano-clay dispersion technologies that enhance the strength-to-cement ratio. Adhesives and sealants maintain stable demand across curtain-wall, flooring, and facade applications, yet PFAS phase-outs catalyze a wave of silicone and silane-terminated polymer replacements, reshaping competitive positioning inside the Europe Construction Chemicals industry. Flooring resins are gaining traction in data centers and logistics hubs, where static-dissipative and chemical-resistant surfaces are mission-critical. In contrast, anchors and grouts are securing moderate growth in wind-farm foundations and industrial plant retrofits.

The Europe Construction Chemicals Market Report is Segmented by Product (Adhesives, Anchors and Grouts, Concrete Admixtures, Concrete Protective Coatings, Flooring Resins, Sealants, and More), End-User Sector (Commercial, Industrial and Institutional, Infrastructure, and Residential), and Geography (France, Germany, Italy, Russia, Spain, United Kingdom, and Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Ardex Group

- Arkema (Bostik)

- CEMEX S.A.B de C.V

- HA-BE BETONCHEMIE

- Henkel AG and Co. KGaA

- Kao Chemicals Europe, S.L.U.

- Kingspan Group

- MAPEI S.p.A.

- MC-Bauchemie

- PCI Augsburg GmbH

- RPM International Inc.

- Saint-Gobain

- Schomburg

- Selena Group

- Sika AG

- SOPREMA Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EU Green Deal funding accelerates sustainable construction demand

- 4.2.2 EU Connecting Europe Facility boosts trans-border infrastructure spend

- 4.2.3 Stricter EPBD energy-efficiency codes increase demand for high-performance admixtures

- 4.2.4 Carbon-neutral concrete initiatives adopt novel supplementary cementitious materials

- 4.2.5 Growth of green-hydrogen mega-plants drives specialty grouts for cryogenic tanks

- 4.3 Market Restraints

- 4.3.1 Volatile prices of epoxy, PU, and acrylic feedstocks

- 4.3.2 Stringent VOC and PFAS phase-out regulations restrict solvent-borne chemistries

- 4.3.3 Shortage of certified applicators for advanced flooring and repair systems

- 4.4 Regulatory Landscape

- 4.5 Value Chain Analysis

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

- 4.7 End-use Sector Trends

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Adhesives

- 5.1.1.1 Hot-Melt

- 5.1.1.2 Reactive

- 5.1.1.3 Solvent-borne

- 5.1.1.4 Water-borne

- 5.1.2 Anchors and Grouts

- 5.1.2.1 Cementitious Fixing

- 5.1.2.2 Resin Fixing

- 5.1.3 Concrete Admixtures

- 5.1.3.1 Accelerator

- 5.1.3.2 Air-Entraining

- 5.1.3.3 Super-plasticizer

- 5.1.3.4 Retarder

- 5.1.3.5 Shrinkage-Reducer

- 5.1.3.6 Viscosity-Modifier

- 5.1.3.7 Plasticizer

- 5.1.3.8 Other Types

- 5.1.4 Concrete Protective Coatings

- 5.1.4.1 Acrylic

- 5.1.4.2 Alkyd

- 5.1.4.3 Epoxy

- 5.1.4.4 Polyurethane

- 5.1.4.5 Other Resins

- 5.1.5 Flooring Resins

- 5.1.5.1 Acrylic

- 5.1.5.2 Epoxy

- 5.1.5.3 Polyaspartic

- 5.1.5.4 Polyurethane

- 5.1.5.5 Other Resins

- 5.1.6 Repair and Rehabilitation Chemicals

- 5.1.6.1 Fiber-Wrapping Systems

- 5.1.6.2 Injection Grouting

- 5.1.6.3 Micro-concrete Mortars

- 5.1.6.4 Modified Mortars

- 5.1.6.5 Rebar Protectors

- 5.1.7 Sealants

- 5.1.7.1 Acrylic

- 5.1.7.2 Epoxy

- 5.1.7.3 Polyurethane

- 5.1.7.4 Silicone

- 5.1.7.5 Other Resins

- 5.1.8 Surface-Treatment Chemicals

- 5.1.8.1 Curing Compounds

- 5.1.8.2 Mold-Release Agents

- 5.1.8.3 Other Types

- 5.1.9 Waterproofing Solutions

- 5.1.9.1 Chemicals

- 5.1.9.2 Membranes

- 5.1.1 Adhesives

- 5.2 By End-User Sector

- 5.2.1 Commercial

- 5.2.2 Industrial and Institutional

- 5.2.3 Infrastructure

- 5.2.4 Residential

- 5.3 By Geography

- 5.3.1 France

- 5.3.2 Germany

- 5.3.3 Italy

- 5.3.4 Russia

- 5.3.5 Spain

- 5.3.6 United Kingdom

- 5.3.7 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share**(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Ardex Group

- 6.4.2 Arkema (Bostik)

- 6.4.3 CEMEX S.A.B de C.V

- 6.4.4 HA-BE BETONCHEMIE

- 6.4.5 Henkel AG and Co. KGaA

- 6.4.6 Kao Chemicals Europe, S.L.U.

- 6.4.7 Kingspan Group

- 6.4.8 MAPEI S.p.A.

- 6.4.9 MC-Bauchemie

- 6.4.10 PCI Augsburg GmbH

- 6.4.11 RPM International Inc.

- 6.4.12 Saint-Gobain

- 6.4.13 Schomburg

- 6.4.14 Selena Group

- 6.4.15 Sika AG

- 6.4.16 SOPREMA Group

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

8 Key Strategic Questions for CEOs