PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1938998

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1938998

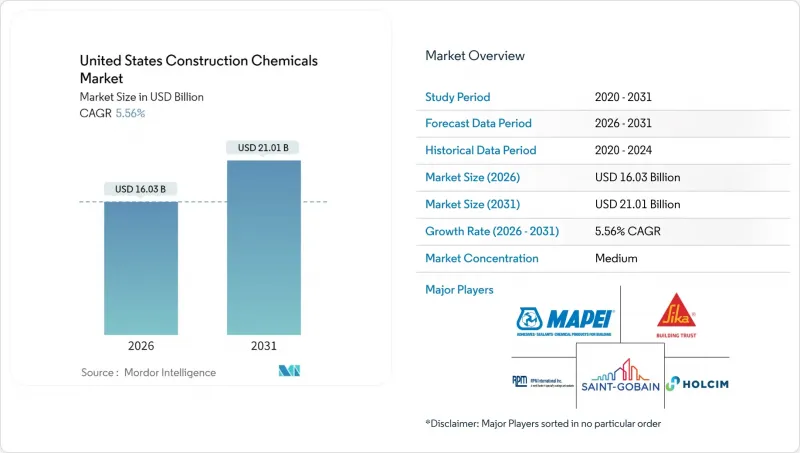

United States Construction Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The United States Construction Chemicals Market is expected to grow from USD 15.19 billion in 2025 to USD 16.03 billion in 2026 and is forecast to reach USD 21.01 billion by 2031 at 5.56% CAGR over 2026-2031.

Multiple federal infrastructure programs, tightening building codes, and rapid digitalization of job-site workflows are sustaining demand even as volatile petroleum inputs and labor shortages weigh on margins. Federal procurement preferences for low-carbon materials are accelerating the shift toward bio-based admixtures and low-VOC coatings, while investments in data centers and semiconductors are expanding the addressable market for high-performance flooring systems. Climate resilience legislation, particularly in hurricane-prone states, is driving higher specification rates for waterproofing membranes that can withstand wind-driven rain and hydrostatic pressure. At the same time, vertical integration moves by large producers are compressing distributor margins yet providing downstream contractors with more predictable supply in an otherwise strained logistics environment.

United States Construction Chemicals Market Trends and Insights

Infrastructure-Bill Funded Mega-Projects

Federal spending channeled through the Infrastructure Investment and Jobs Act is accelerating demand for high-durability admixtures, corrosion-resistant coatings, and crystalline waterproofing systems that extend bridge and tunnel service life by more than six decades. Contractors undertaking rail realignments and port expansions increasingly specify low-shrinkage superplasticizers that improve pumpability on congested sites. Suppliers with mobile batching laboratories are winning multi-year supply agreements because continuous mix verification is now written into many public contracts. Regional clusters around interstate corridors enable manufacturers to shorten lead times, lower freight costs, and provide onsite technical training that mitigates application errors.

Housing-Start Rebound and Repair Backlog

Single-family permits are rising in tandem with declining mortgage rates, while a USD 574.3 billion home-improvement sector is pushing pent-up repair work into 2025. The dual flow of new builds and retrofits favors multi-purpose waterproofing membranes, low-VOC sealants, and crack-bridging repair mortars that enable occupied-building renovations without lengthy shutdowns. The US construction chemicals market continually benefits from do-it-yourself channels where smaller packaging formats and color-matched sealants produce repeat consumer purchases. Distributors that bundle moisture-barrier products with surface treatments are capturing higher basket values because homeowners frequently tackle insulation, flooring, and facade upgrades in a single project cycle.

Volatile Petroleum-Derived Raw-Material Prices

Epoxy-resin prices rose in 2025 amid logistics bottlenecks, widening bid-price spread for flooring contractors, and forcing escalator clauses into fixed-sum contracts. Smaller regional blenders lacking hedging mechanisms face working-capital pinch points as payment cycles stretch, prompting consolidation within the US construction chemicals market. Some manufacturers are reformulating toward bio-based diluents and reclaimed PET polyols to cushion margin swings, though supply volumes remain limited. Raw-material volatility also complicates public-project budgeting because many states lock annual appropriations well before bid openings, creating a mismatch between funding and procurement costs.

Other drivers and restraints analyzed in the detailed report include:

- Shift Toward High-Performance and Green Admixtures

- Code-Driven Uptake of Waterproofing and Protective Coatings

- Skilled Applicator Shortage for Advanced Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Waterproofing solutions generated the largest share of the United States construction chemicals market at 34.42% in 2025 and are expected to expand at a 6.05% CAGR through 2031. This dominance reflects code-mandated continuous air barriers and insurance-driven moisture control upgrades in both commercial and residential builds. Liquid-applied membranes are outpacing sheet goods because spray application seamlessly wraps complex penetrations, eliminating seams that can become failure points. Rising hurricane frequency encourages builders in coastal ZIP codes to choose elastomeric membranes tested to withstand 10,000 fatigue cycles, a feature that commands a 15% price premium yet lowers lifetime repair expense.

Seamless membrane uptake benefits one-part, moisture-cure polyurethane chemistries that tolerate damp substrates common in fast-track schedules. Contractors report that new low-odor formulations enable interior application without the need for negative-pressure tents, thereby expanding usage to subterranean parking decks. Sustainability metrics matter too, and water-borne acrylic membranes with 35% recycled content now qualify for federal tax incentives on public housing projects. With the EPA exploring stricter solvent cutoffs, producers are investing in silyl-terminated polyether backbones that combine flexibility with ultralow VOC outputs. Together, these dynamics position waterproofing systems to preserve the leading title in the United States construction chemicals market through the forecast horizon.

The United States Construction Chemicals Report is Segmented by Product (Adhesives, Anchors and Grouts, Concrete Admixtures, Concrete Protective Coatings, Flooring Resins, Repair and Rehabilitation Chemicals, Sealants, Surface-Treatment Chemicals, and More), and End-Use Sector (Commercial, Industrial and Institutional, Infrastructure, and Residential). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- 3M

- Arkema

- Ashland

- Dow

- Kingspan Group

- Henkel AG & Co. KGaA

- HOLCIM

- ARDEX Americas

- MAPEI S.p.A.

- LATICRETE International, Inc

- RPM International Inc.

- Sika AG

- Saint-Gobain

- Xypex USA

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Infrastructure-bill funded mega-projects

- 4.2.2 Housing-start rebound and repair backlog

- 4.2.3 Shift toward high-performance and green admixtures

- 4.2.4 Code-driven uptake of waterproofing and protective coatings

- 4.2.5 Data-center boom fueling specialty flooring demand

- 4.3 Market Restraints

- 4.3.1 Volatile petroleum-derived raw material prices

- 4.3.2 Tightening VOC and toxic-chemical regulations

- 4.3.3 Skilled applicator shortage for advanced systems

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces

- 4.6.1 Competitive Rivalry

- 4.6.2 Threat of New Entrants

- 4.6.3 Bargaining Power - Suppliers

- 4.6.4 Bargaining Power - Buyers

- 4.6.5 Threat of Substitutes

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Adhesives

- 5.1.1.1 Hot-Melt

- 5.1.1.2 Reactive

- 5.1.1.3 Solvent-borne

- 5.1.1.4 Water-borne

- 5.1.2 Anchors and Grouts

- 5.1.2.1 Cementitious Fixing

- 5.1.2.2 Resin Fixing

- 5.1.3 Concrete Admixtures

- 5.1.3.1 Accelerator

- 5.1.3.2 Air-Entraining

- 5.1.3.3 Super-plasticizer

- 5.1.3.4 Retarder

- 5.1.3.5 Shrinkage-Reducer

- 5.1.3.6 Viscosity-Modifier

- 5.1.3.7 Plasticizer

- 5.1.3.8 Other Types

- 5.1.4 Concrete Protective Coatings

- 5.1.4.1 Acrylic

- 5.1.4.2 Alkyd

- 5.1.4.3 Epoxy

- 5.1.4.4 Polyurethane

- 5.1.4.5 Other Resins

- 5.1.5 Flooring Resins

- 5.1.5.1 Acrylic

- 5.1.5.2 Epoxy

- 5.1.5.3 Polyaspartic

- 5.1.5.4 Polyurethane

- 5.1.5.5 Other Resins

- 5.1.6 Repair and Rehabilitation Chemicals

- 5.1.6.1 Fiber-Wrapping Systems

- 5.1.6.2 Injection Grouting

- 5.1.6.3 Micro-concrete Mortars

- 5.1.6.4 Modified Mortars

- 5.1.6.5 Rebar Protectors

- 5.1.7 Sealants

- 5.1.7.1 Acrylic

- 5.1.7.2 Epoxy

- 5.1.7.3 Polyurethane

- 5.1.7.4 Silicone

- 5.1.7.5 Other Resins

- 5.1.8 Surface-Treatment Chemicals

- 5.1.8.1 Curing Compounds

- 5.1.8.2 Mold-Release Agents

- 5.1.8.3 Other Types

- 5.1.9 Waterproofing Solutions

- 5.1.9.1 Chemicals

- 5.1.9.2 Membranes

- 5.1.1 Adhesives

- 5.2 By End-User Sector

- 5.2.1 Commercial

- 5.2.2 Industrial and Institutional

- 5.2.3 Infrastructure

- 5.2.4 Residential

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share**(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 3M

- 6.4.2 Arkema

- 6.4.3 Ashland

- 6.4.4 Dow

- 6.4.5 Kingspan Group

- 6.4.6 Henkel AG & Co. KGaA

- 6.4.7 HOLCIM

- 6.4.8 ARDEX Americas

- 6.4.9 MAPEI S.p.A.

- 6.4.10 LATICRETE International, Inc

- 6.4.11 RPM International Inc.

- 6.4.12 Sika AG

- 6.4.13 Saint-Gobain

- 6.4.14 Xypex USA

7 Market Opportunities Future Outlook

- 7.1 White-space and Unmet-need Assessment

8 Key Strategic Questions for CEOs