PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939004

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939004

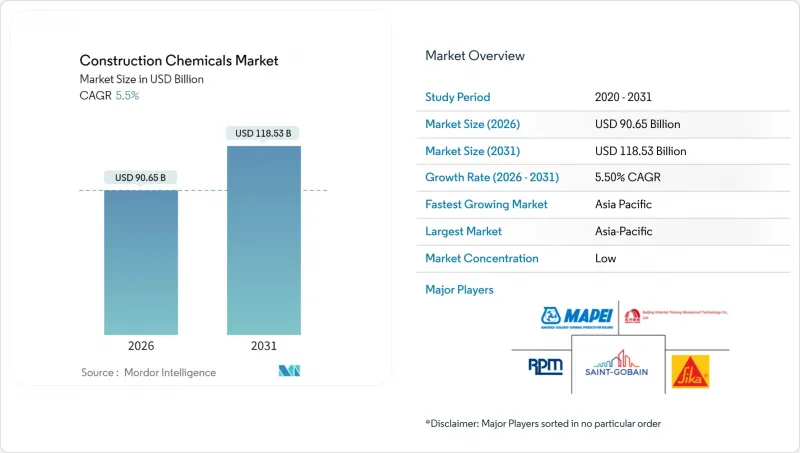

Construction Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Construction Chemicals Market size in 2026 is estimated at USD 90.65 billion, growing from 2025 value of USD 85.92 billion with 2031 projections showing USD 118.53 billion, growing at 5.5% CAGR over 2026-2031.

Robust urban infrastructure pipelines, tighter green-building mandates, and steady residential demand together strengthen the construction chemicals market growth outlook. Waterproofing systems anchor product revenues because insurers and code officials prioritize moisture protection, while advanced surface treatments gain traction in automated precast yards. Regional momentum remains centered in Asia-Pacific, where megaproject pipelines accelerate specialty chemical adoption. Across mature economies, asset rehabilitation programs sustain volume when new-build activity plateaus. Competitive dynamics favor suppliers that marry formulation science with on-site technical service, helping contractors meet stricter performance specifications.

Global Construction Chemicals Market Trends and Insights

Urbanization-Led Infrastructure Boom Drives Emerging-Market Demand

Sustained city building programs in Asia-Pacific drive bulk consumption of admixtures, waterproofers, and curing compounds that improve durability in congested job sites. India's USD 1.4 trillion National Infrastructure Pipeline offers a similar catalyst, with large highway and metro packages specifying low-shrinkage concrete admixtures for slab continuity. UN-Habitat forecasts 2.5 billion additional urban residents by 2050, implying a long runway for chemical demand tied to transit, utilities, and high-rise housing. Contractors also lean on fast-setting grouts to keep megaproject schedules on track. Taken together, these factors embed a structural pull for the construction chemicals market that transcends short-cycle fluctuations.

Green-building Codes Boost Admixture Demand

Energy-performance directives now force designers to cap embodied carbon, pushing concrete producers to adopt high-range water reducers and supplementary cementitious materials. The European Union requires all new buildings to achieve net-zero emissions by 2030 under the Energy Performance of Buildings Directive. U.S. LEED v4.1 and BREEAM standards likewise reward low-VOC sealants and bio-based coatings, stimulating premium niches for soy-polyol polyurethane membranes. Product registries such as EPA Safer Choice further influence contractor specifications toward water-borne systems. Suppliers that reformulate ahead of code deadlines capture specification loyalty and reinforce pricing power within the construction chemicals market.

Petro-chemical Price Volatility

Fluctuating oil and derivative feedstock prices compress supplier margins and complicate contractor budgeting. Brent crude traded between USD 70 and USD 90 per barrel throughout 2024, pulling propylene and epoxy resin prices along the same path. Manufacturers absorb cost spikes or issue surcharges that sometimes delay jobsite adoption of premium products. Heightened geopolitical risks further disrupt supply chains, prompting formulators to diversify into bio-based polyols or recycled polymers. Short-term uncertainty therefore trims the forecast growth slope of the construction chemicals market until feedstock trends stabilize.

Other drivers and restraints analyzed in the detailed report include:

- Government Post-COVID Stimulus for Construction

- Aging Assets Spur Repair and Rehabilitation Spend

- Stricter VOC Limits on Solvent-borne Products

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Waterproofing solutions captured 35.10% of construction chemicals market share in 2025, illustrating their central role in safeguarding concrete and masonry against moisture intrusion. The sub-segment benefits from stricter building codes that specify full-basement tanking, green-roof membranes, and negative-side coatings on water-retaining structures. Infrastructure agencies in flood-prone regions demand elastomeric sheets that can bridge 2 mm-wide cracks, supporting premium pricing even when commodity polymers fluctuate. Manufacturers integrate nanoclay barriers into polymer chains to cut permeance by 40%, strengthening brand differentiation.

The fastest-growing surface-treatment chemicals segment posts a 6.65% CAGR, fueled by automated precast factories that apply curing compounds by robot to enhance batch consistency. Demand also rises for lithium-silicate hardeners that cut dusting in logistics warehouses. Admixture portfolios continue to evolve with polycarboxylate ether superplasticizers that deliver 25 MPa in 24 hours, enabling form-reuse cycles critical to modular construction.

The Construction Chemicals Report is Segmented by Product (Adhesives, Anchors and Grouts, Concrete Admixtures, Concrete Protective Coatings, Flooring Resins, Repair and Rehabilitation Chemicals, Sealants, and More), End-Use Sector (Commercial, Industrial and Institutional, Infrastructure, and Residential), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia-Pacific held 41.10% construction chemicals market share in 2025 and maintains the highest 6.12% CAGR through 2031. China anchors demand with Belt and Road rail lines and coastal port upgrades that specify low-chloride admixtures for marine exposure. India's Smart Cities Mission triggers rooftop waterproofing and paving sealant purchases across 100 municipalities, while Southeast Asia accelerates industrial park builds that require anti-carbonation coatings. Price-sensitive contractors favor locally blended formulations yet consult multinational suppliers for complex bridge decks, enabling cooperative production agreements that deepen regional penetration.

North America contributes steady revenue on the back of public-sector modernization. The USD 550 billion federal infrastructure act channels funds into 15,000 highway-lane-mile resurfacing projects that need fiber-modified patching mortars. Building codes such as the International Residential Code mandate dampproof courses in basements, supporting retail membrane sales. Growth in the United States and Canada therefore offsets cyclic softness in private commercial starts, keeping the construction chemicals market on a positive slope.

Europe shows mature yet innovation-driven behavior. Carbon-neutrality goals in the European Green Deal demand clinker-reduced cements, advancing demand for high-range water reducers and silane sealers that restrict carbonation. Aging bridge stock in Germany and Italy spurs cathodic-protection grout usage, while Scandinavia pioneers bio-based polyurethane foams for below-grade insulation.

- 3M

- Akzo Nobel N.V.

- Ardex Group

- Arkema

- Asian Paints

- Beijing Oriental Yuhong Waterproof Technology Co., Ltd.

- CEMEX S.A.B. de C.V.

- Dow

- H.B. Fuller Company

- Henkel AG and Co. KGaA

- Jiangsu Subote New Material Co., Ltd.

- KCC Corporation

- LATICRETE International, Inc.

- MAPEI S.p.A.

- MC-Bauchemie

- Pidilite Industries Ltd.

- PPG Industries Inc.

- RPM International Inc.

- Saint-Gobain

- Sika AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Urbanization-led infrastructure boom

- 4.2.2 Green-building codes boost admixture demand

- 4.2.3 Government post-COVID stimulus for construction

- 4.2.4 Aging assets spur repair and rehabilitation spend

- 4.2.5 3D-printed concrete adoption needs specialty mixes

- 4.3 Market Restraints

- 4.3.1 Petro-chemical price volatility

- 4.3.2 Stricter VOC limits on solvent-borne products

- 4.3.3 Skill gap in dosing advanced admixtures

- 4.4 Value Chain Analysis

- 4.5 Regulatory Framework

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

- 4.7 Pricing Trend Analysis (Selected Raw Materials)

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Adhesives

- 5.1.1.1 Hot-melt

- 5.1.1.2 Reactive

- 5.1.1.3 Solvent-borne

- 5.1.1.4 Water-borne

- 5.1.2 Anchors and Grouts

- 5.1.2.1 Cementitious

- 5.1.2.2 Resin

- 5.1.3 Concrete Admixtures

- 5.1.3.1 Accelerator

- 5.1.3.2 Air-entraining

- 5.1.3.3 High Range Water Reducer (Super Plasticizer)

- 5.1.3.4 Retarder

- 5.1.3.5 Shrinkage-reducing

- 5.1.3.6 Viscosity Modifier

- 5.1.3.7 Water Reducer (Plasticizer)

- 5.1.3.8 Other Types

- 5.1.4 Concrete Protective Coatings

- 5.1.4.1 Acrylic

- 5.1.4.2 Alkyd

- 5.1.4.3 Epoxy

- 5.1.4.4 Polyurethane

- 5.1.4.5 Other Resins

- 5.1.5 Flooring Resins

- 5.1.5.1 Acrylic

- 5.1.5.2 Epoxy

- 5.1.5.3 Polyaspartic

- 5.1.5.4 Polyurethane

- 5.1.5.5 Other Resins

- 5.1.6 Repair and Rehabilitation Chemicals

- 5.1.6.1 Fiber-wrapping systems

- 5.1.6.2 Injection grouts

- 5.1.6.3 Micro-concrete mortars

- 5.1.6.4 Modified mortars

- 5.1.6.5 Rebar protectors

- 5.1.7 Sealants

- 5.1.7.1 Acrylic

- 5.1.7.2 Epoxy

- 5.1.7.3 Polyurethane

- 5.1.7.4 Silicone

- 5.1.7.5 Other Resins

- 5.1.8 Surface-treatment Chemicals

- 5.1.8.1 Curing compounds

- 5.1.8.2 Mold-release agents

- 5.1.8.3 Other Types

- 5.1.9 Waterproofing Solutions

- 5.1.9.1 Chemicals

- 5.1.9.2 Membranes

- 5.1.1 Adhesives

- 5.2 By End-Use Sector

- 5.2.1 Commercial

- 5.2.2 Industrial and Institutional

- 5.2.3 Infrastructure

- 5.2.4 Residential

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Australia

- 5.3.1.6 Indonesia

- 5.3.1.7 Malaysia

- 5.3.1.8 Thailand

- 5.3.1.9 Vietnam

- 5.3.1.10 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 France

- 5.3.3.3 Italy

- 5.3.3.4 Spain

- 5.3.3.5 United Kingdom

- 5.3.3.6 Russia

- 5.3.3.7 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 3M

- 6.4.2 Akzo Nobel N.V.

- 6.4.3 Ardex Group

- 6.4.4 Arkema

- 6.4.5 Asian Paints

- 6.4.6 Beijing Oriental Yuhong Waterproof Technology Co., Ltd.

- 6.4.7 CEMEX S.A.B. de C.V.

- 6.4.8 Dow

- 6.4.9 H.B. Fuller Company

- 6.4.10 Henkel AG and Co. KGaA

- 6.4.11 Jiangsu Subote New Material Co., Ltd.

- 6.4.12 KCC Corporation

- 6.4.13 LATICRETE International, Inc.

- 6.4.14 MAPEI S.p.A.

- 6.4.15 MC-Bauchemie

- 6.4.16 Pidilite Industries Ltd.

- 6.4.17 PPG Industries Inc.

- 6.4.18 RPM International Inc.

- 6.4.19 Saint-Gobain

- 6.4.20 Sika AG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

8 Key Strategic Questions for CEOs