PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939035

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939035

United States Renewable Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

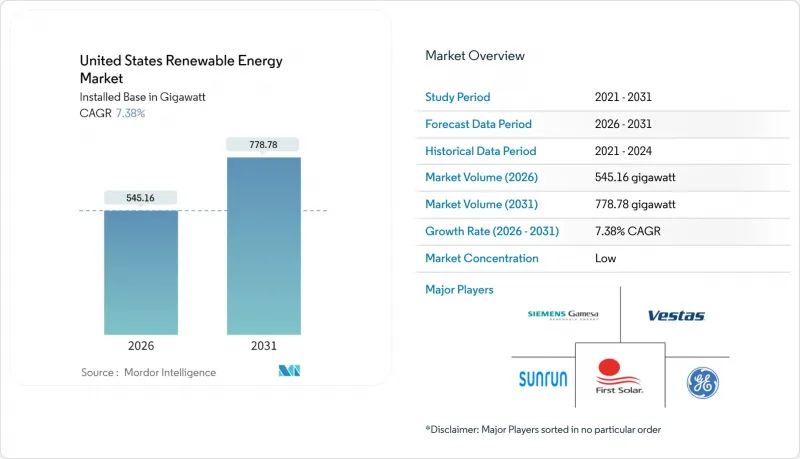

The United States Renewable Energy Market was valued at 507.67 gigawatt in 2025 and estimated to grow from 545.16 gigawatt in 2026 to reach 778.78 gigawatt by 2031, at a CAGR of 7.38% during the forecast period (2026-2031).

Federal incentives under the Inflation Reduction Act, steep cost declines in solar photovoltaic and wind equipment, and record-high corporate clean-electricity commitments are driving an investment cycle that no longer depends solely on subsidies. Transmission reforms, battery-plus-renewable project structures, and domestic manufacturing expansion further strengthen the economics of the US renewable energy market. Solar holds the leading 41.2% technology share, while wind remains a foundational resource, and storage solutions accelerate grid flexibility. Utilities still dominate installed capacity, yet distributed resources in homes and businesses grow quickly, reshaping revenue models and spurring service innovation across the US renewable energy market.

United States Renewable Energy Market Trends and Insights

Extension of Federal Investment & Production Tax Credits

Long-term certainty through 2032 for the 30% investment tax credit on solar and USD 26 per MWh production tax credit for wind keeps the US renewable energy market on a steady build schedule, avoiding the historical boom-bust pattern.Domestic-content bonuses lift effective credits by 10 percentage points and have already encouraged a 40% increase in US solar panel output during 2024. Layered manufacturing credits, worth up to USD 0.07 per watt for solar cells, further improve project economics and anchor new factories in traditional industrial states, broadening the tax base benefits of the US renewable energy market.

Rapid Decline in Solar-PV & Wind LCOE

Utility-scale solar reached USD 0.048 per kWh and onshore wind USD 0.033 per kWh in 2024, both undercutting combined-cycle gas prices without subsidies. Larger turbines, high-density cell architectures, and supply-chain optimization compress capital costs, while energy storage attachments convert variable output into dispatchable power. Corporate buyers treat these falling prices as a hedge against fossil-fuel volatility, adding momentum to the US renewable energy market's project pipeline and creating predictable revenue streams for investors.

Transmission Bottlenecks & Interconnection Queues

The interconnection backlog hit 2.6 TW by 2024, quadrupling 2020 levels and delaying projects by 4-5 years. Although FERC Order 2023 imposes cluster-study rules and commercial readiness screens, most pending applications still face network upgrades valued at more than USD 1 million per MW. The Great Plains, rich in wind, sees development stymied without conduits to load centers, resulting in trimmed near-term additions in the US renewable energy market.

Other drivers and restraints analyzed in the detailed report include:

- Corporate Net-Zero & RE100 Procurement Targets

- Inflation Reduction Act-linked Manufacturing Upswing

- Volatility in Commodity Prices for Turbines & Panels

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solar technology accounted for 40.80% of the US renewable energy market share in 2025 and is projected to grow at the fastest rate, with a 12.05% CAGR, to 2031. Pairing with batteries means that 85% of new utility solar installations include storage, turning midday generation into peaking capacity and raising revenue certainty. Agrivoltaics blends crop production and photovoltaics, easing land constraints while improving farmer economics. Wind still anchors many portfolios and benefits from taller towers and larger rotors that expand viable terrain. Offshore wind gains momentum through federal lease auctions and state solicitations totaling 15 GW. Hydropower and geothermal energy offer dependable capacity, yet resource limitations and higher upfront costs slow their relative advancement. Technology mix decisions now reflect grid-service value in addition to kilowatt-hour prices, reshaping investment logic inside the US renewable energy market.

The US renewable energy market size for solar alone is expected to reach 326.4 GW by 2031, while onshore wind is projected to expand to 253.1 GW amid regional transmission upgrades. Emerging resources, such as enhanced geothermal systems and marine energy, exhibit modest baselines, but pilot projects reveal scalability once costs are optimized. In aggregate, technology diversification cushions weather-related output swings and strengthens reliability as penetration rises beyond 50% in leading states.

The United States Renewable Energy Market Report is Segmented by Technology (Solar Energy, Wind Energy, Hydropower, Bioenergy, Geothermal, and Ocean Energy) and End-User (Utilities, Commercial and Industrial, and Residential). The Market Sizes and Forecasts are Provided in Terms of Installed Capacity (GW).

List of Companies Covered in this Report:

- NextEra Energy, Inc.

- Invenergy LLC

- Orsted US Offshore Wind

- General Electric Company

- Vestas Wind Systems A/S

- First Solar, Inc.

- Canadian Solar Inc.

- Sunrun Inc.

- Enphase Energy, Inc.

- Siemens Gamesa Renewable Energy S.A.

- Brookfield Renewable Partners L.P.

- Pattern Energy Group LP

- AES Clean Energy

- Dominion Energy, Inc.

- Duke Energy Renewables

- EDF Renewables North America

- EDP Renewables North America LLC

- Clearway Energy Group LLC

- Mitsubishi Power Americas, Inc.

- Trina Solar Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Extension of Federal Investment & Production Tax Credits

- 4.2.2 Rapid Decline in Solar-PV & Wind LCOE

- 4.2.3 Corporate Net-Zero & RE100 Procurement Targets

- 4.2.4 Inflation Reduction Act-linked Manufacturing Upswing

- 4.2.5 Grid-enhancing Technologies enabling higher renewable penetration

- 4.3 Market Restraints

- 4.3.1 Transmission Bottlenecks & Interconnection Queues

- 4.3.2 Volatility in Commodity Prices for Turbines & Panels

- 4.3.3 Community Opposition to Utility-Scale Projects

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porters Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 PESTLE Analysis

5 Market Size & Growth Forecasts

- 5.1 By Technology

- 5.1.1 Solar Energy (PV and CSP)

- 5.1.2 Wind Energy (Onshore and Offshore)

- 5.1.3 Hydropower (Small, Large, PSH)

- 5.1.4 Bioenergy

- 5.1.5 Geothermal

- 5.1.6 Ocean Energy (Tidal and Wave)

- 5.2 By End-User

- 5.2.1 Utilities

- 5.2.2 Commercial and Industrial

- 5.2.3 Residential

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, JVs, Funding, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Products & Services, Recent Developments)

- 6.4.1 NextEra Energy, Inc.

- 6.4.2 Invenergy LLC

- 6.4.3 Orsted US Offshore Wind

- 6.4.4 General Electric Company

- 6.4.5 Vestas Wind Systems A/S

- 6.4.6 First Solar, Inc.

- 6.4.7 Canadian Solar Inc.

- 6.4.8 Sunrun Inc.

- 6.4.9 Enphase Energy, Inc.

- 6.4.10 Siemens Gamesa Renewable Energy S.A.

- 6.4.11 Brookfield Renewable Partners L.P.

- 6.4.12 Pattern Energy Group LP

- 6.4.13 AES Clean Energy

- 6.4.14 Dominion Energy, Inc.

- 6.4.15 Duke Energy Renewables

- 6.4.16 EDF Renewables North America

- 6.4.17 EDP Renewables North America LLC

- 6.4.18 Clearway Energy Group LLC

- 6.4.19 Mitsubishi Power Americas, Inc.

- 6.4.20 Trina Solar Co., Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment