PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939601

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939601

South America Feed Additives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

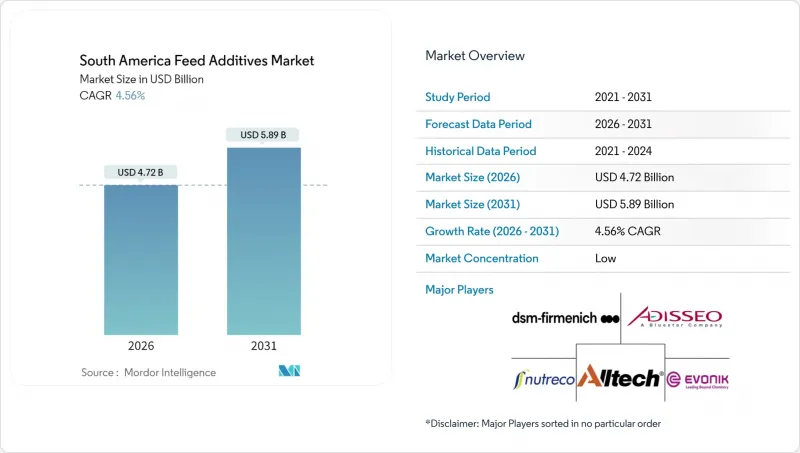

The South America feed additives market was valued at USD 4.51 billion in 2025 and estimated to grow from USD 4.72 billion in 2026 to reach USD 5.89 billion by 2031, at a CAGR of 4.56% during the forecast period (2026-2031).

This growth reflects resilient demand for nutritional and functional ingredients across livestock and aquaculture systems. The region benefits from consistent raw material availability, supported by strong corn and soybean harvests, particularly in Brazil and Argentina. Rising poultry and salmon production is expanding the use of performance-enhancing additives. According to OECD, Argentina's poultry meat consumption climbed from 2.13 million metric tons in 2022 to 2.32 million metric tons in 2024. FAOSTAT data shows sheep meat production increased from 258,961 metric tons in 2022 to 335,764 metric tons in 2023. Regulatory improvements in Brazil and Argentina have shortened product approval cycles, encouraging innovation and faster market entry. Additionally, local production of lysine and methionine from soybean feedstocks helps shield regional buyers from currency fluctuations, ensuring cost stability. These combined factors position South America as a competitive supplier of advanced feed solutions, even as currency volatility and fragmented feed-mill capacity challenge short-term margins.

South America Feed Additives Market Trends and Insights

Robust Growth in Industrial Poultry and Swine Production

Industrial poultry and swine production continues to expand across South America, driving demand for amino acids and enzymes that improve feed efficiency. Large-scale feed mills and integrated systems support higher inclusion rates of premium additives. Export-oriented models raise carcass-quality standards, encouraging the use of nutritional enhancers. Swine feed demand also grows steadily, reinforcing the need for value-added formulations that improve feed-conversion ratios. With feed costs representing a major portion of total production expenses, additives that enhance nutrient utilization become essential tools for maintaining profitability in competitive livestock hubs.

Rising Cost-Benefit Focus on Feed Efficiency

Volatile commodity prices and shifting currencies pressure producer margins, prompting greater interest in additives that improve feed efficiency. Enzymes and balanced amino-acid profiles help unlock energy from standard corn-soy diets. Precision-feeding platforms enable real-time ration adjustments, boosting profitability and reducing waste. In regions facing high energy costs, formulations that enhance animal resilience and reduce reliance on electricity-intensive systems gain traction. Carbohydrases and phytases extract more digestible nutrients, while data-driven analytics link additive use to measurable financial outcomes, reinforcing their role in cost-effective livestock management.

Currency Volatility Inflates Imported Additive Prices

Fluctuating exchange rates across South America increase the cost of imported feed additives, particularly vitamins and trace minerals. Local currencies often weaken against the dollar, eroding purchasing power and straining budgets. Rising energy tariffs further pressure operational costs, prompting mills to seek lower-cost alternatives or delay premium additive trials. Strategies such as dual sourcing, forward contracts, and increased reliance on domestic amino acid production help mitigate these challenges. Despite financial headwinds, producers continue to prioritize additives that deliver measurable efficiency and resilience benefits.

Other drivers and restraints analyzed in the detailed report include:

- Availability of Competitively Priced Soybean-based Amino Acids

- Rising Aquaculture Output Boosts Specialty Additives

- Fragmented Feed Mill Base Limits Value-added Adoption

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Amino acids held 20.55% of the South America feed additives market share in 2025, driven by integrators focusing on lysine and methionine balancing in corn-soy rations. Local crushing plants and fermentation facilities provide cost advantages for multinational and domestic producers. The stable supply chains minimize currency risk and increase confidence among poultry and swine operators in using amino acids to reduce crude-protein levels while maintaining growth performance. The demand is highest in Brazil's poultry regions and Argentina's swine production areas, where operations can efficiently procure high-purity powder and liquid methionine. The increasing adoption of layer diets, particularly low-protein formulations, strengthens amino acid usage.

Antioxidants are projected to grow at a 5.21% CAGR from 2026 to 2031, primarily due to increased demand from intensive aquaculture systems. Chilean salmon processors prefer combinations of natural tocopherols and polyphenolic extracts for filet color preservation and extended shelf life. Brazilian shrimp producers are adopting microalgae-derived antioxidants that provide both omega-3 enrichment and stress reduction benefits. These additives enhance immune function and reduce synthetic preservative usage across cage, pond, and recirculating systems.

The South America Feed Additives Market Report is Segmented by Additive (Acidifiers, Amino Acids, Antibiotics, Antioxidants, and More), by Animal (Aquaculture, Poultry, Ruminants, Swine, and More), and by Geography (Argentina, Brazil, Chile, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

List of Companies Covered in this Report:

- Adisseo France SAS (China National BlueStar Co. Ltd.)

- Alltech Inc.

- Archer-Daniels-Midland Company

- Cargill Incorporated

- DSM-Firmenich AG

- Evonik Industries AG

- IFF Danisco Animal Nutrition and Health

- Kemin Industries Inc.

- Novus International, Inc. (Mitsui & Co., Ltd.)

- Nutreco N.V. (SHV Holdings N.V.)

- BASF SE

- BioMar A/S (Schouw & Co.)

- CJ CheilJedang Corp. (CJ Corporation)

- Elanco Animal Health Incorporated

- Phibro Animal Health Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY AND KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions and Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Animal Headcount

- 4.1.1 Poultry

- 4.1.2 Ruminants

- 4.1.3 Swine

- 4.2 Feed Production

- 4.2.1 Aquaculture

- 4.2.2 Poultry

- 4.2.3 Ruminants

- 4.2.4 Swine

- 4.3 Regulatory Framework

- 4.3.1 Argentina

- 4.3.2 Brazil

- 4.3.3 Chile

- 4.4 Value Chain and Distribution Channel Analysis

- 4.5 Market Drivers

- 4.5.1 Robust Growth in Industrial Poultry and Swine Production

- 4.5.2 Rising Cost-Benefit Focus on Feed Efficiency

- 4.5.3 Availability of Competitively Priced Soybean-based Amino Acids

- 4.5.4 Rising Aquaculture Output Boosts Specialty Additives

- 4.5.5 Local Sourcing of Quillaja Saponin Lowers Phytogenic Costs

- 4.5.6 AI-enabled Precision Feeding Adoption

- 4.6 Market Restraints

- 4.6.1 Currency Volatility Inflates Imported Additive Prices

- 4.6.2 Fragmented Feed Mill Base Limits Value-added Adoption

- 4.6.3 Short-term Oversupply in Vitamin Supply Chain Compresses Margins

- 4.6.4 Slow Regulatory Approvals for Novel Microbial Strains

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 By Additive

- 5.1.1 Acidifiers

- 5.1.1.1 Fumaric Acid

- 5.1.1.2 Lactic Acid

- 5.1.1.3 Propionic Acid

- 5.1.1.4 Other Acidifiers

- 5.1.2 Amino Acids

- 5.1.2.1 Lysine

- 5.1.2.2 Methionine

- 5.1.2.3 Threonine

- 5.1.2.4 Tryptophan

- 5.1.2.5 Other Amino Acids

- 5.1.3 Antibiotics

- 5.1.3.1 Bacitracin

- 5.1.3.2 Penicillins

- 5.1.3.3 Tetracyclines

- 5.1.3.4 Tylosin

- 5.1.3.5 Other Antibiotics

- 5.1.4 Antioxidants

- 5.1.4.1 Butylated Hydroxyanisole (BHA)

- 5.1.4.2 Butylated Hydroxytoluene (BHT)

- 5.1.4.3 Citric Acid

- 5.1.4.4 Ethoxyquin

- 5.1.4.5 Propyl Gallate

- 5.1.4.6 Tocopherols

- 5.1.4.7 Other Antioxidants

- 5.1.5 Binders

- 5.1.5.1 Natural Binders

- 5.1.5.2 Synthetic Binders

- 5.1.6 Enzymes

- 5.1.6.1 Carbohydrases

- 5.1.6.2 Phytases

- 5.1.6.3 Other Enzymes

- 5.1.7 Flavors & Sweeteners

- 5.1.7.1 Flavors

- 5.1.7.2 Sweeteners

- 5.1.8 Minerals

- 5.1.8.1 Macrominerals

- 5.1.8.2 Microminerals

- 5.1.9 Mycotoxin Detoxifiers

- 5.1.9.1 Binders

- 5.1.9.2 Biotransformers

- 5.1.10 Phytogenics

- 5.1.10.1 Essential Oil

- 5.1.10.2 Herbs & Spices

- 5.1.10.3 Other Phytogenics

- 5.1.11 Pigments

- 5.1.11.1 Carotenoids

- 5.1.11.2 Curcumin & Spirulina

- 5.1.12 Prebiotics

- 5.1.12.1 Fructo Oligosaccharides

- 5.1.12.2 Galacto Oligosaccharides

- 5.1.12.3 Inulin

- 5.1.12.4 Lactulose

- 5.1.12.5 Mannan Oligosaccharides

- 5.1.12.6 Xylo Oligosaccharides

- 5.1.12.7 Other Prebiotics

- 5.1.13 Probiotics

- 5.1.13.1 Bifidobacteria

- 5.1.13.2 Enterococcus

- 5.1.13.3 Lactobacilli

- 5.1.13.4 Pediococcus

- 5.1.13.5 Streptococcus

- 5.1.13.6 Other Probiotics

- 5.1.14 Vitamins

- 5.1.14.1 Vitamin A

- 5.1.14.2 Vitamin B

- 5.1.14.3 Vitamin C

- 5.1.14.4 Vitamin E

- 5.1.14.5 Other Vitamins

- 5.1.15 Yeast

- 5.1.15.1 Live Yeast

- 5.1.15.2 Selenium Yeast

- 5.1.15.3 Spent Yeast

- 5.1.15.4 Torula Dried Yeast

- 5.1.15.5 Whey Yeast

- 5.1.15.6 Yeast Derivatives

- 5.1.1 Acidifiers

- 5.2 By Animal

- 5.2.1 Aquaculture

- 5.2.1.1 Fish

- 5.2.1.2 Shrimp

- 5.2.1.3 Other Aquaculture Species

- 5.2.2 Poultry

- 5.2.2.1 Broiler

- 5.2.2.2 Layer

- 5.2.2.3 Other Poultry Birds

- 5.2.3 Ruminants

- 5.2.3.1 Beef Cattle

- 5.2.3.2 Dairy Cattle

- 5.2.3.3 Other Ruminants

- 5.2.4 Swine

- 5.2.5 Other Animals

- 5.2.1 Aquaculture

- 5.3 By Geography

- 5.3.1 Argentina

- 5.3.2 Brazil

- 5.3.3 Chile

- 5.3.4 Rest of South America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Adisseo France SAS (China National BlueStar Co. Ltd.)

- 6.4.2 Alltech Inc.

- 6.4.3 Archer-Daniels-Midland Company

- 6.4.4 Cargill Incorporated

- 6.4.5 DSM-Firmenich AG

- 6.4.6 Evonik Industries AG

- 6.4.7 IFF Danisco Animal Nutrition and Health

- 6.4.8 Kemin Industries Inc.

- 6.4.9 Novus International, Inc. (Mitsui & Co., Ltd.)

- 6.4.10 Nutreco N.V. (SHV Holdings N.V.)

- 6.4.11 BASF SE

- 6.4.12 BioMar A/S (Schouw & Co.)

- 6.4.13 CJ CheilJedang Corp. (CJ Corporation)

- 6.4.14 Elanco Animal Health Incorporated

- 6.4.15 Phibro Animal Health Corporation

7 KEY STRATEGIC QUESTIONS FOR FEED ADDITIVE CEOS