PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939743

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939743

Europe Contract Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

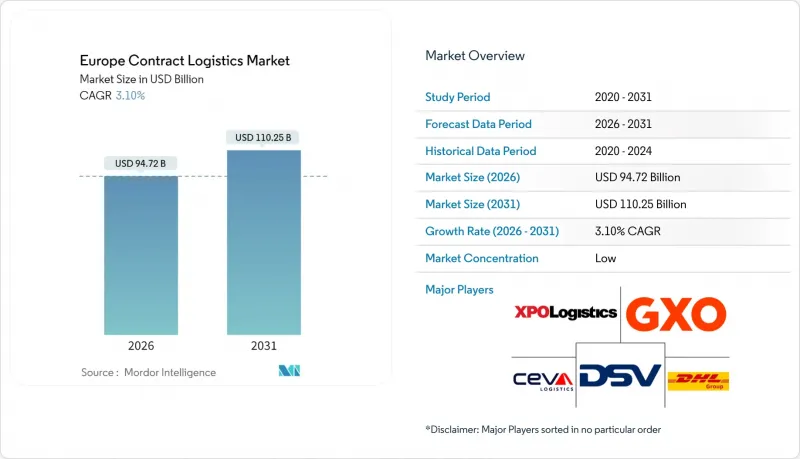

The Europe Contract Logistics Market size in 2026 is estimated at USD 94.72 billion, growing from 2025 value of USD 91.87 billion with 2031 projections showing USD 110.25 billion, growing at 3.10% CAGR over 2026-2031.

The mature landscape is steadily pivoting toward value-added solutions as e-commerce fulfillment, supply-chain resilience, and AI-enabled optimization transform traditional operating models. Nearshoring into Eastern Europe is redrawing trade corridors, while sustainability targets under the EU Fit for 55 package amplify investment in low-carbon transport assets and green warehousing. Intensifying consolidation-exemplified by DSV's recent mega-acquisition of DB Schenker-shows providers chasing economies of scale to blunt labor shortages, real-estate inflation, and regulatory complexity. Providers that embed robotics, end-to-end visibility platforms, and flexible warehousing footprints are best placed to capture the next wave of outsourced demand across the Europe contract logistics market.

Europe Contract Logistics Market Trends and Insights

E-commerce Boom Accelerates Outsourced Fulfillment

Third-party logistics (3PL) operators are capturing rising e-commerce volumes as retailers shift toward asset-light models that trade fixed real-estate costs for flexible warehousing contracts. Demand for XXL distribution centers has tightened availability, prompting retailers to secure long leases while outsourcing day-to-day operations to 3PLs. Providers are investing in omnichannel sortation, robotic picking, and carrier-agnostic last-mile networks to achieve same-day delivery targets across the Europe contract logistics market. High return rates in fashion and footwear elevate reverse-logistics complexity, making integrated returns processing a standard feature of new contracts. Early movers that bundle fulfillment and returns under one technology stack enhance customer stickiness and unlock premium pricing.

Post-COVID Supply-Chain Resilience Initiatives

The pandemic reframed resilience from a cost center to a board-level priority, driving dual-sourcing, regional buffers, and supplier diversification across Europe. Multimodal visibility systems that consolidate ocean, road, rail, and air events into a single dashboard are now core selection criteria when tendering for Europe contract logistics market contracts. Customers prioritize 3PLs capable of orchestrating parallel inventory locations and dynamically rerouting freight during disruption. Providers that invested in control-tower architectures in 2024-2025 report win-rate uplifts as shippers seek data-rich partners able to evidence contingency playbooks. The visibility imperative extends to ESG reporting, with real-time carbon tracking increasingly written into service-level agreements.

Driver & Warehouse-Labor Shortages

Europe faces a looming shortfall of professional truck drivers, with the International Road Transport Union warning that vacancies could top 2 million by 2026. Warehouse attrition has accelerated as aging workforces retire faster than recruits enter the sector. Operators respond through signing bonuses, flexible schedules, and in-house training academies, but wage inflation squeezes margins in the Europe contract logistics market. Automation offsets some pressure, yet up-front capex and change-management cycles lengthen payback periods. Service disruptions and capacity rationing risk eroding customer satisfaction unless workforce strategies are modernized.

Other drivers and restraints analyzed in the detailed report include:

- Eastern Europe Near-Shoring of Manufacturing

- AI-Driven Warehouse & Route Optimization

- Fragmented Competitive Pricing Pressure

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Transportation services captured 60.35% of the Europe contract logistics market share in 2025 as road, rail, air, and sea movements underpin continental trade. Yet Warehousing & Distribution is growing fastest at 3.92% CAGR to 2031 as shippers prioritize inventory positioning over pure transit speed. The Europe contract logistics market size allocated to Transportation remains healthy, but value is shifting toward integrated bundles that combine freight, storage, and light manufacturing tasks. Rail freight slipped 0.7% in 2024, underscoring modal constraints despite EU ambitions to double its share. Road continues to dominate door-to-door flows, although carrier networks now embed digital freight platforms for dynamic routing. Air freight retains a niche, serving high-value or time-critical goods, while short-sea lanes link Mediterranean and Baltic gateways into wider multimodal offerings.

A parallel narrative unfolds in Warehousing & Distribution. Demand for XXL hubs near population centers collides with scarce land and stricter zoning, inflating prime rents. Operators mitigate costs by adopting high-bay automation, mezzanine robotics, and dark-store configurations that triple throughput per square meter. Cold-chain extensions support pharmaceuticals and fresh food, deepening technical barriers to entry. Consequently, contracts now stipulate performance metrics beyond pallet moves, tracking pick accuracy, reverse-logistics cycles, and micro-fulfillment turnaround. The Europe contract logistics market thus rewards firms able to marry real-estate acumen with advanced process engineering.

The Europe Contract Logistics Market Report is Segmented by Service Type (Transportation, Warehousing & Distribution, and Value-Added Services), Contract Duration (1-3 Years and Above 3 Years), End-User Industry (Manufacturing & Automotive, Retail & E-Commerce, Healthcare & Pharmaceuticals, and More), Country (Germany, United Kingdom, France, Italy, Spain, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Deutsche Post DHL Group

- DSV

- GXO Logistics

- XPO Logistics

- CEVA Logistics

- Geodis

- Kuehne + Nagel

- Rhenus Logistics

- ID Logistics

- Hellmann Worldwide Logistics

- DACHSER

- United Parcel Service (UPS SCS)

- Neovia Logistics

- FIEGE Logistik Stiftung & Co. KG

- Savino Del Bene

- Rohlig Logistics

- BLG Logistics Group

- Groupe BBL

- Raben Group

- Noerpel Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce boom accelerates outsourced fulfilment

- 4.2.2 Post-COVID supply-chain resilience initiatives

- 4.2.3 Eastern-Europe near-shoring of manufacturing

- 4.2.4 AI-driven warehouse & route optimisation

- 4.2.5 EU "Fit-for-55" decarbonisation incentives

- 4.2.6 Integrated reverse-logistics demand from returns

- 4.3 Market Restraints

- 4.3.1 Driver & warehouse-labour shortages

- 4.3.2 Fragmented competitive pricing pressure

- 4.3.3 Surging ESG-compliant warehouse real-estate costs

- 4.3.4 Complex multi-country customs / VAT compliance

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power - Buyers

- 4.7.3 Bargaining Power - Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

- 4.8 E-commerce (Domestic & Cross-border) Insights

- 4.9 After-sales / Reverse-logistics Insights

- 4.10 Brexit Implications

- 4.11 Impact of COVID-19 & Geo-Political Events

5 Market Size & Growth Forecasts

- 5.1 By Service Type

- 5.1.1 Transportation

- 5.1.1.1 Road

- 5.1.1.2 Rail

- 5.1.1.3 Air

- 5.1.1.4 Sea

- 5.1.2 Warehousing & Distribution

- 5.1.3 Value-added Services (Assembly, Labelling, Kitting)

- 5.1.1 Transportation

- 5.2 By Contract Duration

- 5.2.1 1 - 3 Years

- 5.2.2 Above 3 years

- 5.3 By End-user Industry

- 5.3.1 Manufacturing & Automotive

- 5.3.2 Food & Beverage

- 5.3.3 Retail & E-commerce

- 5.3.4 Healthcare & Pharmaceuticals

- 5.3.5 Chemicals

- 5.3.6 Other Industries

- 5.4 By Country

- 5.4.1 Germany

- 5.4.2 United Kingdom

- 5.4.3 France

- 5.4.4 Italy

- 5.4.5 Spain

- 5.4.6 Netherlands

- 5.4.7 Poland

- 5.4.8 Belgium

- 5.4.9 Sweden

- 5.4.10 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, JV, Innovation)

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Deutsche Post DHL Group

- 6.4.2 DSV

- 6.4.3 GXO Logistics

- 6.4.4 XPO Logistics

- 6.4.5 CEVA Logistics

- 6.4.6 Geodis

- 6.4.7 Kuehne + Nagel

- 6.4.8 Rhenus Logistics

- 6.4.9 ID Logistics

- 6.4.10 Hellmann Worldwide Logistics

- 6.4.11 DACHSER

- 6.4.12 United Parcel Service (UPS SCS)

- 6.4.13 Neovia Logistics

- 6.4.14 FIEGE Logistik Stiftung & Co. KG

- 6.4.15 Savino Del Bene

- 6.4.16 Rohlig Logistics

- 6.4.17 BLG Logistics Group

- 6.4.18 Groupe BBL

- 6.4.19 Raben Group

- 6.4.20 Noerpel Group

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment

8 Appendix

- 8.1 GDP Contribution by Industry

- 8.2 Capital-flow Insights

- 8.3 External-trade Statistics

- 8.4 Key Import / Export Corridors