PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940732

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940732

China Travel Retail - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

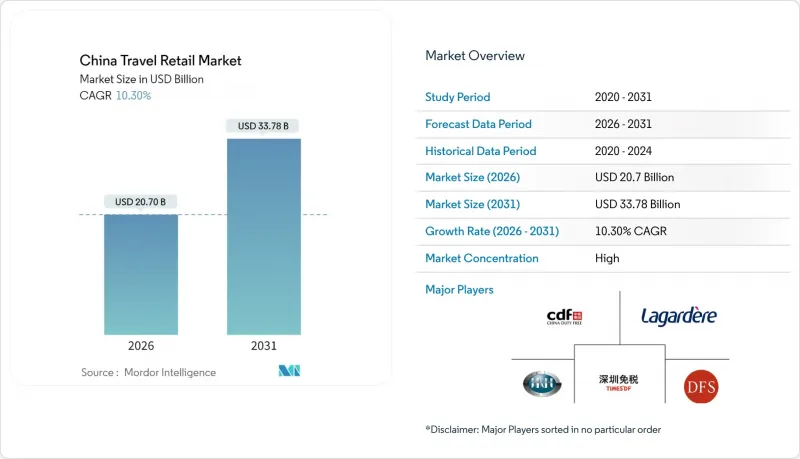

China travel retail market size in 2026 is estimated at USD 20.7 billion, growing from 2025 value of USD 18.77 billion with 2031 projections showing USD 33.78 billion, growing at 10.3% CAGR over 2026-2031.

Expansion stems from rising domestic disposable income, duty-free policy liberalization, and travellers' appetite for premium products that had previously been bought abroad. The sector also benefits from persistent investment in airports, cruise terminals, and railway hubs that shorten travel time and widen retail footprints. Digital payment ubiquity has removed friction for inbound visitors, while policy-backed downtown duty-free formats make luxury goods accessible beyond ports of entry. Finally, concentrated competitive dynamics give leading operators the scale to launch omnichannel platforms that extend engagement well beyond the traditional departure gate.

China Travel Retail Market Trends and Insights

Expansion of Offshore Duty-Free Quotas & Hainan Free Trade Port Policies

Duty-free shopping caps in Hainan now stand at CNY 100,000 (USD 13,697.8) per visitor, a ceiling that has entrenched the island as a domestic luxury hot spot . Retail sales there climbed by 25.4% year-on-year to CNY 43.76 billion (USD 5.99 billion) in 2023 as millions of shoppers embraced one-stop vacation buying. The province continues to test new fulfillment options, such as at-home delivery, that extend the redemption window and reduce congestion. Ongoing construction of the Haikou International Duty-Free Complex and the rollout of the Block C Global Beauty Plaza show authorities remain committed to channel diversification. Policymakers elsewhere are monitoring the blueprint, yet replication requires matched infrastructure and equally supportive tax regimes.

Rebound of Domestic & Outbound Passenger Traffic Post-COVID

In 2024, China's domestic passenger traffic demonstrated robust growth, surpassing pre-pandemic levels, while international passenger volumes showed a significant rebound, achieving substantial recovery compared to 2019 figures. This highlights the strong resurgence of the aviation sector in China, driven by increased travel demand and easing restrictions. Government visa-free programs now cover 38 nations and allow longer transits for 54 countries, spurring a 22.9% jump in foreign entries during national holidays . Chinese outbound travellers spent USD 133.8 billion in 2019, with a notable shift toward experiences that can be curated in-flight or at destination retail. Simultaneously, inbound visitor counts hit 132 million and generated USD 94.2 billion in spending, replenishing airport footfall and duty-free baskets. Operators capable of merchandising both Chinese and foreign shopper preferences gain a double-engine revenue boost.

Regulatory Volatility on Licensing & Allowance Thresholds

China's upcoming Tariff Law, effective December 2024, introduces significant regulatory changes that are expected to impact various business operations. The reduction in cigar allowances from 50/100 sticks to 10/20 reflects the government's commitment to public health objectives. Additionally, the extension of the duty-refund claim period to three years provides businesses with a longer timeframe to recover eligible duties, potentially improving cash flow management. However, these measures necessitate a strategic reassessment of product assortments and volume forecasting by retailers to align with the new regulatory landscape. Simultaneously, revisions to e-commerce import regulations have removed the requirement for warehouse registration, streamlining certain operational processes. Yet, the imposition of additional duties on low-value goods introduces new cost pressures, complicating the financial structures of omnichannel strategies. Moreover, the varying prerequisites for downtown duty-free licensing across municipalities create inconsistent compliance requirements, increasing operational complexity and prolonging the time required to launch new outlets. To navigate these regulatory shifts effectively, businesses are prioritizing investments in advanced regulatory analytics and establishing cross-city audit teams. These measures are designed to enhance agility, enabling operators to monitor compliance requirements closely and implement timely adjustments to mitigate risks and capitalize on emerging opportunities.

Other drivers and restraints analyzed in the detailed report include:

- Premiumization of Beauty & Luxury Categories Among Chinese Travelers

- Experiential "Digital-Heritage" Retail Design Boosting Spend

- Macroeconomic Softness Curbing Discretionary Luxury Spend

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fragrances & cosmetics captured 36.12% of the China travel retail market share in 2025, making it the anchor category for most duty-free operators. The sub-sector enjoys high replenishment frequency, low shipping complication, and strong promotional elasticity, attributes that uphold footfall even during economic lulls. The wine and spirits sector, despite its relatively smaller market base, is projected to experience robust growth through 2031. This expansion is driven by increasing consumer sophistication and a growing preference for premium products, including single-malt whiskies, craft gins, and New-World wines. These trends highlight a shift in consumer behavior toward more nuanced and high-quality offerings within the sector. Demand rises sharply before Lunar New Year and Golden Week, periods when gifting culture peaks and duty-free price gaps over domestic retail widen.

The Chinese travel retail market for wine and spirits is anticipated to witness significant growth by 2031, driven by the increasing adoption of innovative retail strategies. Cruise-line bars and curated airport tasting lounges are leveraging experiential sampling to enhance consumer engagement and drive sales conversions, thereby contributing to the market's expansion. Beauty brands continue to refine shade assortments for Chinese skin tones and leverage livestream ambassadors to trigger real-time shopping from airport lounges. Electronics, jewellery, and watches benefit from tax-free savings on high-ticket items, yet their success hinges on inventory velocity and after-sales service assurances that match domestic-store expectations. Tobacco remains a government-controlled staple, though allowance tightening caps upside and pushes shoppers toward duty-paid limited editions.

China Travel Retail Market Segment by Product Type (Fashion & Accessories, Wine and Spirits, and Other), Distribution Channel (Airports, Cruise Liners, and Other), Traveler Demographics (Business Travelers, Leisure Travelers, and Other), Geography (East China, South-Central China, and Other). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- China Tourism Group Duty Free Corporation (CTGDF)

- Shenzhen Duty Free Group Co., Ltd.

- Sunrise Duty Free Co., Ltd.

- Zhuhai Duty Free Group Co., Ltd.

- Hainan Tourism Investment Duty Free Co., Ltd.

- Lagardere Travel Retail China

- DFS Group (China)

- Heinemann Asia Pacific (China)

- Lotte Duty Free China

- King Power Group (HK) Ltd.

- China National Service Corporation (CNSC) Duty Free

- Oriental Duty Free (Qingdao)

- Guangdong Airport Authority Duty Free

- Sanya International Duty Free Shopping Complex

- Bailian Group Duty Free

- Chow Tai Fook Jewellery - Travel Retail

- Estee Lauder Companies - Travel Retail APAC

- Shiseido Travel Retail China

- Pernod Ricard Global Travel Retail China

- Diageo Global Travel Retail China

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of offshore duty-free quotas and Hainan Free Trade Port policies

- 4.2.2 Rebound of domestic and outbound passenger traffic post-COVID

- 4.2.3 Premiumisation of beauty and luxury categories among Chinese travellers

- 4.2.4 Experiential 'digital-heritage' retail design boosting spend

- 4.2.5 Rise of ultra-high-net-worth private-jet lounge retailing

- 4.2.6 AI-powered personalization & virtual shopping concierges

- 4.3 Market Restraints

- 4.3.1 Regulatory volatility on licensing and allowance thresholds

- 4.3.2 Macroeconomic softness curbing discretionary luxury spend

- 4.3.3 Downtown duty-free and livestream e-commerce cannibalisation

- 4.3.4 ESG backlash constraining tobacco and alcohol shelf space

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size and Growth Forecast

- 5.1 By Product Type

- 5.1.1 Fashion and Accessories

- 5.1.2 Wine and Spirits

- 5.1.3 Tobacco

- 5.1.4 Food and Confectionery

- 5.1.5 Fragrances and Cosmetics

- 5.1.6 Other Product Types (Stationery, Electronics, Watches, Jewellery, etc.)

- 5.2 By Distribution Channel

- 5.2.1 Airports

- 5.2.2 Cruise Liners

- 5.2.3 Railway Stations

- 5.2.4 Other Distribution Channels

- 5.3 By Traveler Demographics

- 5.3.1 Business Travelers

- 5.3.2 Leisure Travelers

- 5.3.3 Visiting Friends and Relatives (VFR)

- 5.3.4 Medical and Wellness Tourists

- 5.3.5 Student Travelers

- 5.4 By Geography

- 5.4.1 East China

- 5.4.2 South-Central China

- 5.4.3 North China

- 5.4.4 Northeast China

- 5.4.5 Southwest China

- 5.4.6 Northwest China

- 5.4.7 Hainan Province

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 China Tourism Group Duty Free Corporation (CTGDF)

- 6.4.2 Shenzhen Duty Free Group Co., Ltd.

- 6.4.3 Sunrise Duty Free Co., Ltd.

- 6.4.4 Zhuhai Duty Free Group Co., Ltd.

- 6.4.5 Hainan Tourism Investment Duty Free Co., Ltd.

- 6.4.6 Lagardere Travel Retail China

- 6.4.7 DFS Group (China)

- 6.4.8 Heinemann Asia Pacific (China)

- 6.4.9 Lotte Duty Free China

- 6.4.10 King Power Group (HK) Ltd.

- 6.4.11 China National Service Corporation (CNSC) Duty Free

- 6.4.12 Oriental Duty Free (Qingdao)

- 6.4.13 Guangdong Airport Authority Duty Free

- 6.4.14 Sanya International Duty Free Shopping Complex

- 6.4.15 Bailian Group Duty Free

- 6.4.16 Chow Tai Fook Jewellery - Travel Retail

- 6.4.17 Estee Lauder Companies - Travel Retail APAC

- 6.4.18 Shiseido Travel Retail China

- 6.4.19 Pernod Ricard Global Travel Retail China

- 6.4.20 Diageo Global Travel Retail China

7 Market Opportunities and Future Outlook

- 7.1 Omni-channel click-&-collect platforms linking Hainan offshore duty-free with major tier-1 city airports

- 7.2 "Quiet-luxury" Chinese designer brands in railway-station travel retail formats