PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940803

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940803

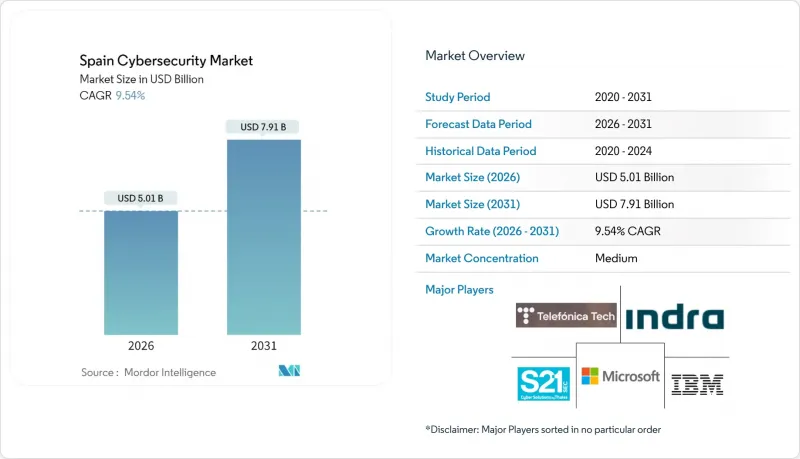

Spain Cybersecurity - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Spain cybersecurity market is expected to grow from USD 4.57 billion in 2025 to USD 5.01 billion in 2026 and is forecast to reach USD 7.91 billion by 2031 at 9.54% CAGR over 2026-2031.

Spain's decision to position itself as a continental cybersecurity hub, combined with surging ransomware activity and strict EU-level mandates, is fuelling sustained spending on cloud-based protection, managed detection, and quantum-safe encryption solutions. Public-sector programs such as the EUR 1.2 billion National Cybersecurity Strategy, the Digital Spain 2026 roadmap, and the CorA cloud migration plan are enlarging the domestic addressable base for vendors. Rapid 5G rollout, tourism-led cashless retail, and growing industrial digitisation further widen the attack surface, prompting enterprises to prioritise security orchestration and incident-response outsourcing. Although the talent shortage and budget limits at micro-SMEs act as headwinds, Spain's vibrant start-up ecosystem and targeted public subsidies continue to draw foreign capital and technology partnerships into the Spain cybersecurity market.

Spain Cybersecurity Market Trends and Insights

Spain's EUR 1.2 billion National Cybersecurity Strategy accelerating security spend

Government pledges to channel 2% of GDP into security and defence in 2025 include a dedicated 31.16% slice for telecom and cyber capabilities. The resulting flow of EUR 1.2 billion is being directed toward quantum-safe cryptography pilots, large-scale SOC upgrades, and workforce programmes that aim to elevate Spain into the global top five for cyber innovation. Spanish banks have already doubled technology outlays, prompting a parallel surge in network-security and IAM contracts within the Spain cybersecurity market .

Rapid digitalisation of SMEs under Digital Spain 2026 expanding attack surface

Digital Spain 2026 targets the upskilling of 500,000 workers and dispenses grants that offset security adoption costs, yet 70% of current attacks hit SMEs, exposing gaps in basic controls. Kit Digital subsidies now finance enterprise-grade firewalls and MDR subscriptions for firms with 10-49 staff, stimulating vendor focus on lightweight, automated offerings that anchor new revenue in the Spain cybersecurity market.

Scarcity of certified cybersecurity talent

INCIBE estimates that Spain needed 99,600 specialists in 2025, up from 83,000 vacancies the previous year. Post-quantum cryptography and AI-enabled threat hunting skills are especially rare, prompting enterprises to outsource monitoring to local MSSPs that run 24/7 SOCs. Although INCIBE and Digital Spain programmes deliver free courses, the pipeline remains insufficient, curbing in-house deployment pace across the Spain cybersecurity market.

Other drivers and restraints analyzed in the detailed report include:

- CorA plan cloud adoption boosting native cloud-security demand

- 5G rollout intensifying edge threats and network-security investment

- Budget constraints among micro-SMEs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions accounted for 69.12% of 2025 revenue and continue to anchor the Spain cybersecurity market as organisations bolster core defences such as NGFWs, EDR and IAM. Compliance with the NIS2 Directive spurs enterprise spending on application security, while autonomous-community agencies prioritise ENS-aligned cloud controls. Managed services, the fastest-growing subsegment, respond to skills shortages by supplying remote SOC functions that compress mean time to detect by 48%. Telefonica Tech now analyses more than 4,000 cloud alerts daily for Spanish customers, illustrating how domestic providers convert local expertise into competitive differentiation within the Spain cybersecurity market.

Demand for professional services endures, centred on ENS audits and NIS2 readiness. Energy utilities relied on Indra consultants to redesign OT segmentation after a 43% attack spike in 2024. Meanwhile, startups automate onboarding and policy configuration to streamline SME adoption. The dual trajectory of high-end managed services and self-service SaaS keeps solutions in the lead even as service revenues accelerate, reinforcing the overall Spain cybersecurity market size outlook.

Cloud deployments captured 62.18% revenue in 2025 and are forecast to advance at a 13.12% CAGR. CorA mandates, multicloud strategies, and sovereign hosting requirements push agencies and banks to treat identity as the new perimeter. ENS "Alto" certification has become a baseline vendor qualification, raising barriers to entry and concentrating spend among compliant suppliers. On-premise controls persist in defence and critical utilities, but hybrid topologies dominate large-enterprise roadmaps, requiring unified policy engines that span SaaS, IaaS, and legacy assets inside the Spain cybersecurity market.

For SMEs, cloud security removes capital expense and provides instant access to threat intelligence feeds. Canary Islands emergency services secured citizen data by encrypting all workloads in a sovereign cloud, showing how public agencies can balance protection and latency requirements. This broad adoption underlines why cloud's share of the Spain cybersecurity market size will widen further by 2031.

The Cybersecurity Market in Spain Report Segments the Industry Into by Offering (Solutions, and Services), Deployment Mode (On-Premise, and Cloud), End-User Vertical (BFSI, Healthcare, IT and Telecom, Industrial and Defense, Manufacturing, Retail and E-Commerce, Energy and Utilities, Manufacturing, and Others), and End-User Enterprise Size (Small and Medium Enterprises (SMEs), and Large Enterprises).

List of Companies Covered in this Report:

- Telefonica Tech (Cybersecurity & Cloud Tech SLU)

- Indra Sistemas SA

- Grupo S21Sec (Thales)

- Microsoft Corp.

- IBM Corporation

- Cisco Systems Inc.

- Palo Alto Networks Inc.

- Check Point Software Technologies Ltd.

- Fortinet Inc.

- Accenture plc

- Atos SE

- Capgemini SE

- Orange Cyberdefense (Orange Espana)

- Secureworks Inc.

- ESET Espana

- Sophos Ltd.

- Trend Micro Inc.

- CrowdStrike Holdings Inc.

- Alias Robotics SL

- Titanium Industrial Security SL

- Evolium Technologies SLU (Redtrust)

- Outpost24 Group (Blueliv)

- Acuntia SAU (Axians)

- GMV Innovating Solutions

- Everis (NTT DATA Spain)

- KPMG Spain

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Spain's EUR 1.2 B National Cybersecurity Strategy Accelerating Security Spend

- 4.2.2 Rapid Digitalisation of SMEs under "Digital Spain 2026" Expanding Attack Surface

- 4.2.3 Cloud Adoption by Public Administration (CorA Plan) Boosting Native Cloud-Security Demand

- 4.2.4 5G Roll-out Intensifying Edge Threats and Network-Security Investment

- 4.2.5 Tourism-Led Cashless Retail Boom Driving Payment-Fraud Mitigation

- 4.2.6 Heightened Nation-State Threat Activity Targeting Spanish Critical Infrastructure

- 4.3 Market Restraints

- 4.3.1 Scarcity of Certified Cybersecurity Talent

- 4.3.2 Budget Constraints among Micro-SMEs

- 4.3.3 Fragmented Regional Procurement Processes

- 4.3.4 Dependence on Imported Security Technologies

- 4.4 Evaluation of Critical Regulatory Framework

- 4.5 Value Chain Analysis

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Key Use Cases and Case Studies

- 4.9 Impact on Macroeconomic Factors of the Market

- 4.10 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Offering

- 5.1.1 Solutions

- 5.1.1.1 Application Security

- 5.1.1.2 Cloud Security

- 5.1.1.3 Data Security

- 5.1.1.4 Identity and Access Management

- 5.1.1.5 Infrastructure Protection

- 5.1.1.6 Integrated Risk Management

- 5.1.1.7 Network Security Equipment

- 5.1.1.8 Endpoint Security

- 5.1.1.9 Other Services

- 5.1.2 Services

- 5.1.2.1 Professional Services

- 5.1.2.2 Managed Services

- 5.1.1 Solutions

- 5.2 By Deployment Mode

- 5.2.1 On-Premise

- 5.2.2 Cloud

- 5.3 By End-User Vertical

- 5.3.1 BFSI

- 5.3.2 Healthcare

- 5.3.3 IT and Telecom

- 5.3.4 Industrial and Defense

- 5.3.5 Manufacturing

- 5.3.6 Retail and E-commerce

- 5.3.7 Energy and Utilities

- 5.3.8 Manufacturing

- 5.3.9 Others

- 5.4 By End-User Enterprise Size

- 5.4.1 Small and Medium Enterprises (SMEs)

- 5.4.2 Large Enterprises

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Telefonica Tech (Cybersecurity & Cloud Tech SLU)

- 6.4.2 Indra Sistemas SA

- 6.4.3 Grupo S21Sec (Thales)

- 6.4.4 Microsoft Corp.

- 6.4.5 IBM Corporation

- 6.4.6 Cisco Systems Inc.

- 6.4.7 Palo Alto Networks Inc.

- 6.4.8 Check Point Software Technologies Ltd.

- 6.4.9 Fortinet Inc.

- 6.4.10 Accenture plc

- 6.4.11 Atos SE

- 6.4.12 Capgemini SE

- 6.4.13 Orange Cyberdefense (Orange Espana)

- 6.4.14 Secureworks Inc.

- 6.4.15 ESET Espana

- 6.4.16 Sophos Ltd.

- 6.4.17 Trend Micro Inc.

- 6.4.18 CrowdStrike Holdings Inc.

- 6.4.19 Alias Robotics SL

- 6.4.20 Titanium Industrial Security SL

- 6.4.21 Evolium Technologies SLU (Redtrust)

- 6.4.22 Outpost24 Group (Blueliv)

- 6.4.23 Acuntia SAU (Axians)

- 6.4.24 GMV Innovating Solutions

- 6.4.25 Everis (NTT DATA Spain)

- 6.4.26 KPMG Spain

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment