PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940810

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940810

Thailand Cybersecurity - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

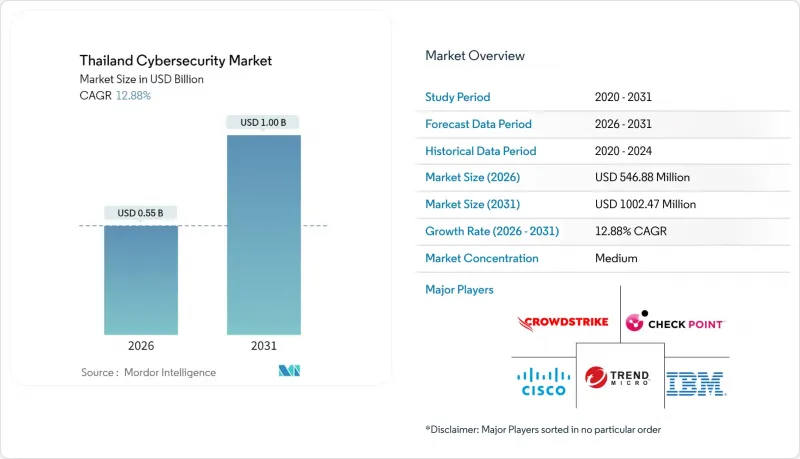

The Thailand cybersecurity market was valued at USD 484.48 million in 2025 and estimated to grow from USD 546.88 million in 2026 to reach USD 1002.47 million by 2031, at a CAGR of 12.88% during the forecast period (2026-2031).

Payment-system digitalization, public-sector cloud migration, and industrial 5G adoption are expanding the threat surface and turning cybersecurity spending into critical infrastructure outlays. The National Digital ID platform, PromptPay growth, and G-Cloud policy have pushed organizations toward zero-trust architectures and cloud-native security controls. Vendors that combine Thai-language support, PDPA compliance automation, and managed service delivery continue to out-perform product-only competitors. The talent gap and SME cost sensitivity remain constraints, yet rising ransomware incidents and CII regulations keep cyber risk on executive agendas nationwide.

Thailand Cybersecurity Market Trends and Insights

Accelerated Digital-Banking Adoption in Thai BFSI

PromptPay processed 9.2 billion transactions worth THB 13.9 trillion (USD 0.427 trillion ) in 2023, exposing new attack surfaces in mobile and open-API banking. Financial institutions are deploying application firewalls, transaction-level anomaly analytics, and identity orchestration to meet sandbox requirements and protect mobile channels. Zero-trust frameworks built on strong authentication and micro-segmentation are replacing firewall-centric designs. Spending priorities are shifting from incident response toward continuous threat hunting that satisfies the Financial Institutions Business Act. Vendor differentiation now favors integrated platforms that automate compliance reporting and reduce mean-time-to-detect across hybrid environments.

Fast-Track Government Cloud Migration (G-Cloud and NDID)

The Digital Government Development Agency allocated THB 1 billion (USD 0.03 billion) for cloud services in FY 2025, accelerating G-Cloud rollouts across ministries. NDID enrollment has surpassed 50 million citizens, driving procurement of biometric identity governance and encryption key management. Agencies must comply with the 2025 Website Security Standard, which mandates encryption, role-based access, and incident response playbooks. International vendors have entered memoranda with NCSA to localize threat-intelligence feeds and Thai-language SOC training. Cloud security posture management and compliance automation tools dominate tender lists as multi-cloud complexity rises.

Shortage of Thai-Language Cybersecurity Talent

Only 0.58 million citizens possess adequate digital skills, and annual IT graduate output is roughly 3,500 professionals. Salary inflation of 25-30% in Bangkok prompts firms to outsource SOC operations or delay projects. Localized certification pathways remain scarce, so ISC2 and NCSA launched a program to train 10,000 practitioners by 2026. Nevertheless, most provincial enterprises rely on generalist IT staff to manage security tooling, lowering defense maturity and elevating breach risk. The talent shortfall prolongs procurement cycles and favors managed service models that embed expertise.

Other drivers and restraints analyzed in the detailed report include:

- 5G Rollout Spurring IoT-Edge Security Demand

- Rapid Growth of Thailand E-Commerce GMV

- Price-Sensitive SME Buyer Behavior

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions held the largest 60.88% Thailand cybersecurity market share in 2025, underscoring the residual reliance on perimeter controls. The segment remains vital for branch connectivity and OT segregation, but its growth pace is moderating as budgets pivot to cloud resilience. Cloud Security leads the innovation curve with a 16.05% CAGR, propelled by G-Cloud rollouts and multi-cloud adoption among fintech and e-commerce operators. Vendors that fuse workload-centric micro-segmentation, CASB functions, and compliance dashboards resonate with buyers seeking NDID alignment. Professional Services and Managed Services expand as enterprises confront complex optimization and skills shortages. Endpoint, data, and identity modules integrate AI-based anomaly detection that learns from Thai-language data sets, helping teams cut alert noise and accelerate response.

Cloud-native protection also amplifies demand for posture-management tools that benchmark configurations against PDPA and CII baselines. Application Security spending rises alongside API-driven banking and super-app ecosystems. Data Security urgency grows after 5,273 leak cases, pushing tokenization and DLP adoption inside payment workflows. Thailand cybersecurity market size for data-centric controls is climbing as retailers and hospitals encrypt sensitive fields ahead of cloud migration deadlines. The offering mix is shifting from hardware appliances toward SaaS platforms that bundle threat intelligence, automation, and localized compliance artifacts, a trend expected to reshape procurement scoring models by 2030.

Cloud deployments captured 64.26% share of the Thailand cybersecurity market size in 2025 and are set to grow at a 14.20% CAGR through 2031. The government's Cloud First policy, AWS's USD 5 billion infrastructure pledge, and Microsoft's Government Security Program have tipped new projects toward IaaS and PaaS. BFSI regulators now permit public cloud workloads in regulatory sandboxes, encouraging banks to migrate non-core applications and adopt API security gateways. Cross-border data-flow requirements drive uptake of tenant-controlled encryption keys and sovereign cloud zones operated by National Telecom.

On-premise solutions still hold sway in utilities, transport, and legacy SCADA operators where air-gaps and deterministic latency matter. Hybrid environments emerge as plants connect OT networks to cloud analytics platforms, requiring unified management planes that span firewall appliances and cloud workload agents. Vendors supplying both form factors with a single policy engine win favor. Thailand cybersecurity market share for on-premise deployments gradually declines as refresh cycles favor virtual form factors even inside private data centers. Integration of 5G MEC nodes into cloud dashboards exemplifies the converging deployment story.

The Thailand Cybersecurity Market Report is Segmented by Offering (Solutions, Services), Deployment Mode (On-Premise, Cloud), End-User Vertical (BFSI, Healthcare, IT and Telecom, and More), End-User Enterprise Size (Small and Medium Enterprises, Large Enterprises). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Cisco Systems, Inc.

- Palo Alto Networks, Inc.

- Fortinet, Inc.

- Check Point Software Technologies Ltd.

- Trend Micro Incorporated

- CrowdStrike Holdings, Inc.

- McAfee LLC

- International Business Machines Corporation

- Microsoft Corporation

- Amazon Web Services, Inc.

- Atos SE

- Thales Group

- NEC Corporation

- Accenture plc

- Deloitte Touche Tohmatsu Ltd.

- MFEC Public Company Limited

- G-Able Company Limited

- ACinfotec Company Limited

- National Telecom Public Company Limited

- Bangkok Systems and Software Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated digital-banking adoption in Thai BFSI

- 4.2.2 Fast-track government cloud migration (G-Cloud and NDID)

- 4.2.3 5G rollout spurring IoT-edge security demand

- 4.2.4 Rapid growth of Thailand E-commerce GMV

- 4.2.5 Surge in ransomware-as-a-service attacks on SMEs

- 4.2.6 OT/ICS security gaps in Eastern Economic Corridor

- 4.3 Market Restraints

- 4.3.1 Shortage of Thai-language cybersecurity talent

- 4.3.2 Price-sensitive SME buyer behavior

- 4.3.3 Legacy critical-infrastructure systems difficult to patch

- 4.3.4 Fragmented cyber-insurance landscape

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Impact of Macroeconomic Factors on the Market

- 4.7 Regulatory Landscape

- 4.8 Technological Outlook

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Offering

- 5.1.1 Solutions

- 5.1.1.1 Application Security

- 5.1.1.2 Cloud Security

- 5.1.1.3 Data Security

- 5.1.1.4 Identity and Access Management

- 5.1.1.5 Infrastructure Protection

- 5.1.1.6 Integrated Risk Management

- 5.1.1.7 Network Security Equipment

- 5.1.1.8 Endpoint Security

- 5.1.2 Services

- 5.1.2.1 Professional Services

- 5.1.2.2 Managed Services

- 5.1.1 Solutions

- 5.2 By Deployment Mode

- 5.2.1 On-Premise

- 5.2.2 Cloud

- 5.3 By End-User Vertical

- 5.3.1 BFSI

- 5.3.2 Healthcare

- 5.3.3 IT and Telecom

- 5.3.4 Industrial and Defense

- 5.3.5 Manufacturing

- 5.3.6 Retail and E-commerce

- 5.3.7 Energy and Utilities

- 5.3.8 Others

- 5.4 By Enterprise Size

- 5.4.1 Small and Medium Enterprises (SMEs)

- 5.4.2 Large Enterprises

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Cisco Systems, Inc.

- 6.4.2 Palo Alto Networks, Inc.

- 6.4.3 Fortinet, Inc.

- 6.4.4 Check Point Software Technologies Ltd.

- 6.4.5 Trend Micro Incorporated

- 6.4.6 CrowdStrike Holdings, Inc.

- 6.4.7 McAfee LLC

- 6.4.8 International Business Machines Corporation

- 6.4.9 Microsoft Corporation

- 6.4.10 Amazon Web Services, Inc.

- 6.4.11 Atos SE

- 6.4.12 Thales Group

- 6.4.13 NEC Corporation

- 6.4.14 Accenture plc

- 6.4.15 Deloitte Touche Tohmatsu Ltd.

- 6.4.16 MFEC Public Company Limited

- 6.4.17 G-Able Company Limited

- 6.4.18 ACinfotec Company Limited

- 6.4.19 National Telecom Public Company Limited

- 6.4.20 Bangkok Systems and Software Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment