PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885797

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885797

Next-Generation Protein Hydrolysates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

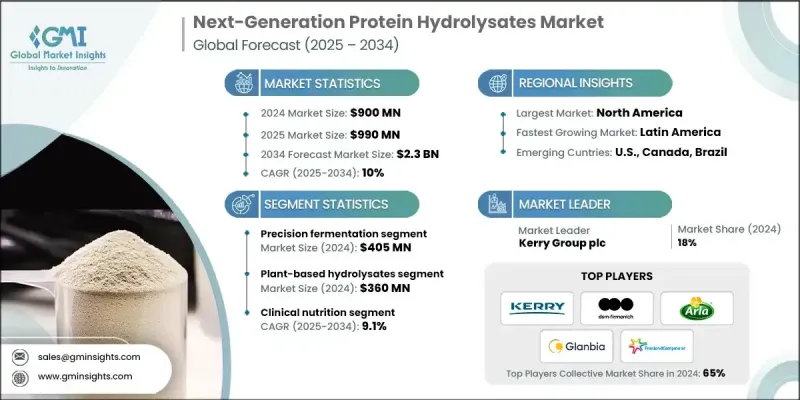

The Global Next-Generation Protein Hydrolysates Market was valued at USD 900 million in 2024 and is estimated to grow at a CAGR of 10% to reach USD 2.3 billion by 2034.

Demand for tailored nutrition is accelerating product adoption as consumers and healthcare practitioners increasingly seek ingredient profiles aligned with metabolic needs, dietary sensitivities, and specialized nutrition programs. Globally expanding preventive health initiatives and digitally guided diet systems are encouraging the inclusion of fast-absorbing peptide ingredients in personalized formulations. Rising health consciousness and the popularity of functional foods continue to reinforce market momentum. National reports across multiple regions highlight ongoing growth in protein-fortified foods and beverages, creating opportunities for hydrolysates due to their high digestibility and reduced allergenic potential. Brands are incorporating these peptides into ready-to-drink formulas, nutrition beverages, fortified snacks, and clinical dietary products to appeal to wellness-focused buyers and clean-label priorities. Higher investment in self-care and broader retail access to protein-rich foods are supporting this shift. Advances in precision fermentation also influence market development by enabling consistent peptide structures, higher purity levels, and stronger bioactivity while decreasing dependency on variable conventional raw material sources.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $900 Million |

| Forecast Value | $2.3 Billion |

| CAGR | 10% |

The precision fermentation segment accounted for USD 405 million in 2024. This approach holds a sizable share because producers rely on its ability to deliver uniform, functional peptides with enhanced absorption properties. The method's scalability, reduced batch variation, and compatibility with clean-label specifications have made it a favored route for applications in medical nutrition, performance formulas, and specialty protein categories.

The plant-based hydrolysates segment reached USD 360 million in 2024. This segment commands a large share as developers work to meet rising interest in allergen-friendly, sustainable, and clean-label proteins. A wide portfolio of soy, pea, wheat, and rice hydrolysates enables efficient production and supports tailored amino acid compositions for lifestyle beverages, sports products, and metabolic nutrition. Their rapidly commercialized neutral-flavor and highly soluble varieties are strengthening vegan and flexitarian product lines across established and emerging brands.

North America Next-Generation Protein Hydrolysates Market held 38% share in 2024, with the United States contributing most of this share. Growth is supported by a mature nutrition sector, strong demand for clinical nutritional solutions, and the presence of multiple sports and performance nutrition companies. Advancements in hydrolyzed proteins for medical diets, especially for older adults and individuals recovering from medical procedures, are driving additional uptake. Rising interest in clean-label proteins that are easy to digest and suitable for those with sensitivities further reinforces market expansion.

Leading names in the Next-Generation Protein Hydrolysates Market include Glanbia Nutritionals, Kerry Group plc, DSM-Firmenich, FrieslandCampina Ingredients, Arla Foods Ingredients, Tessenderlo Group, Perfect Day, Geltor, GEA, Carbery, NiHTEK, Fonterra, and Kemin Industries. Companies competing in the Next-Generation Protein Hydrolysates Market are strengthening their positions by expanding R&D pipelines, building long-term partnerships, and investing in scalable production systems. Many firms are advancing precision fermentation and enhanced hydrolysis techniques to deliver peptides with predictable functionality, improved absorption, and consistent purity. Strategic collaborations with nutrition brands, healthcare organizations, and formulation specialists help accelerate product testing and commercial deployment. Manufacturers are also diversifying raw material sources to stabilize supply chains and broaden their clean-label offerings.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology Type

- 2.2.3 Protein Source

- 2.2.4 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for personalized nutritional solutions

- 3.2.1.2 Growing health consciousness & functional food trends

- 3.2.1.3 Technological advancements in precision fermentation

- 3.2.1.4 Increasing sports & performance nutrition

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production costs & technology investment requirements

- 3.2.2.2 Complex regulatory approval processes

- 3.2.2.3 Limited consumer awareness of next-generation benefits

- 3.2.3 Market opportunities

- 3.2.3.1 Sustainable protein source development

- 3.2.3.2 Pharmaceutical & therapeutic applications expansion

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 Product

- 3.8 Future market trends

- 3.9 Technology and Innovation Landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Technology Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Precision fermentation

- 5.3 Enzyme immobilization & advanced enzymatic hydrolysis

- 5.4 Bioactive peptide extraction

- 5.5 Membrane filtration & fractionation

- 5.6 Supercritical fluid processing

Chapter 6 Market Estimates and Forecast, By Protein Source, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Plant-based hydrolysates

- 6.2.1 Soy protein hydrolysates

- 6.2.2 Pea protein hydrolysates

- 6.2.3 Rice protein hydrolysates

- 6.2.4 Wheat protein hydrolysates

- 6.2.5 Others

- 6.3 Animal-based hydrolysates

- 6.3.1 Whey protein hydrolysates

- 6.3.2 Egg protein hydrolysates

- 6.3.3 Collagen hydrolysates

- 6.4 Marine-based hydrolysates

- 6.4.1 Fish protein hydrolysates

- 6.4.2 Shellfish & seaweed protein

- 6.4.3 Algae & seaweed derived hydrolysates

- 6.5 Microbial hydrolysates

- 6.5.1 Single-cell protein

- 6.5.2 Yeast & bacterial protein

- 6.6 Insect-based hydrolysates

- 6.6.1 Cricket & Mealworm protein

- 6.6.2 Black soldier fly

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Clinical nutrition

- 7.3 Sports & performance nutrition

- 7.3.1 Protein powder & blends

- 7.3.2 Hydration & electrolyte

- 7.3.3 Collagen peptide based

- 7.3.4 Energy gels and bars

- 7.4 Infant & pediatric nutrition

- 7.4.1 Hypoallergenic formula

- 7.4.2 Toddler & pediatric formulation

- 7.5 Functional foods & beverages

- 7.5.1 Fortified snacks

- 7.5.2 Plant based drinks

- 7.5.3 Ready to drink beverages

- 7.5.4 Functional juice

- 7.6 Personal care & cosmetics

- 7.6.1 Skincare

- 7.6.2 Haircare

- 7.6.3 Oral & dermal peptide

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Kerry Group plc

- 9.2 DSM-Firmenich

- 9.3 Arla Foods Ingredients

- 9.4 Glanbia Nutritionals

- 9.5 FrieslandCampina Ingredients

- 9.6 Tessenderlo Group

- 9.7 Fonterra

- 9.8 Perfect Day

- 9.9 Geltor

- 9.10 Kemin Industries

- 9.11 Carbery

- 9.12 NiHTEK