PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885855

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885855

Precision Fermentation-Based Protein Hydrolysates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

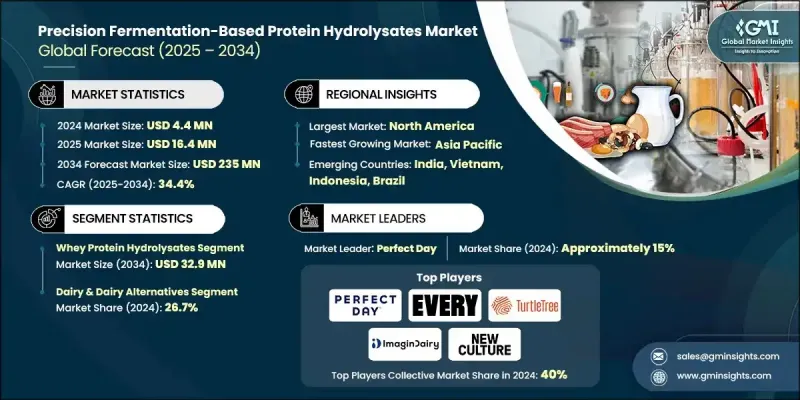

The Global Precision Fermentation-Based Protein Hydrolysates Market was valued at USD 4.4 million in 2024 and is estimated to grow at a CAGR of 34.4% to reach USD 235 million by 2034.

Market momentum is accelerating due to multiple reinforcing factors, including regulatory progress that is opening the door for novel precision-fermented proteins to enter commercial channels as foundational materials for hydrolysate production. Large-capacity fermentation plants exceeding 100,000 liters are being brought online, significantly boosting supply potential. As optimization improves and scaling efficiencies advance, production costs are expected to become increasingly competitive with conventional protein sources. At the same time, application development is broadening as companies in nutrition, food technologies, and pharmaceuticals integrate precision-fermented hydrolysates into new product pipelines. Revenue opportunities span high-value uses across infant nutrition, medical formulations, active lifestyle supplements, functional food ingredients, cosmetic applications, and specialty animal nutrition. These hydrolysates are also being designed to deliver bioactive compounds that have demonstrated benefits such as antioxidant, antimicrobial, antihypertensive, mineral-binding, or immune-supportive effects through clinical findings, adding further differentiation to these premium ingredients.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.4 Million |

| Forecast Value | $235 Million |

| CAGR | 34.4% |

The whey protein hydrolysates segment is expected to reach USD 32.9 million by 2034 at a projected CAGR of 30.3%. This segment is the most established among protein sources due to long-standing use across sports nutrition, infant formulations, and functional food applications. Its primary protein fraction offers notable functional properties, including effective foaming, emulsification, and gel formation, which are often enhanced through targeted hydrolysis.

The dairy and dairy alternatives segment held a 26.7% share in 2024 and is anticipated to grow at a 29.2% CAGR between 2025 and 2034. This category remains the largest application area because consumers are familiar with dairy proteins and manufacturers rely on the functional performance of these proteins in beverages, cultured dairy items, frozen desserts, and other protein-enriched foods. Growing industry collaborations continue to support higher adoption of precision-fermented hydrolysates across mainstream consumer products.

North America Precision Fermentation-Based Protein Hydrolysates Market captured 41.9% share in 2024, supported by an advanced biotechnology landscape, favorable regulatory pathways, and a strong presence of companies specializing in precision fermentation. In the United States, a streamlined regulatory route allows many applicants to move through approval stages in roughly 10-12 months, compared with longer timelines in certain other regions.

Key companies active in the Precision Fermentation-Based Protein Hydrolysates Market include Change Foods, Clara Foods, Cubiq Foods, Formo, Fybraworks Foods, Geltor, Helaina, Imagindairy, Jellatech, Modern Meadow, Motif FoodWorks, New Culture, Onego Bio, Perfect Day, Provectus Algae, Remilk, Spiber, The EVERY Company, TurtleTree, and Vivici. Companies strengthening their foothold in the Precision Fermentation-Based Protein Hydrolysates Market are implementing strategies focused on scaling production, improving cost efficiency, and accelerating product innovation. Many organizations are investing in high-capacity fermentation systems to increase output while refining downstream processing to raise purity and yield. Strategic collaborations with food, nutrition, and biotech firms are helping expand application development and secure long-term demand. Businesses are also prioritizing regulatory readiness to shorten approval cycles and enhance market access. In addition, firms are engineering proteins and hydrolysates with specialized functional and bioactive profiles to create differentiated, high-margin product lines that support competitive positioning.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries ( Note: the trade statistics will be provided for key countries only)

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Million) (Tons)

- 5.1 Key trends

- 5.2 Casein Hydrolysates

- 5.3 Whey Protein Hydrolysates

- 5.4 Lactoferrin Hydrolysates

- 5.5 Ovalbumin Hydrolysates

- 5.6 Ovomucoid Hydrolysates

- 5.7 Myoglobin Hydrolysates

- 5.8 Leghemoglobin Hydrolysates

- 5.9 Collagen Hydrolysates

- 5.10 Elastin Hydrolysates

- 5.11 Enzyme Hydrolysates

- 5.12 Growth Factor Hydrolysates

- 5.13 Functional Peptide Concentrates

- 5.14 Microbial Protein Hydrolysates

- 5.15 Others

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Tons)

- 6.1 Key trends

- 6.2 Dairy & Dairy Alternatives

- 6.2.1 Fluid Milk & Milk Alternatives

- 6.2.1.1 Whole Milk Analogues

- 6.2.1.2 Skim & Low-Fat Milk Analogues

- 6.2.1.3 Flavored Milk Alternatives

- 6.2.1.4 Barista-Grade Milk Alternatives

- 6.2.2 Cheese Analogues

- 6.2.2.1 Mozzarella (Pizza, Food Service)

- 6.2.2.2 Cheddar & Hard Cheeses

- 6.2.2.3 Cream Cheese & Soft Cheeses

- 6.2.2.4 Processed Cheese Products

- 6.2.3 Yogurt & Fermented Alternatives

- 6.2.3.1 Greek-Style Yogurt

- 6.2.3.2 Drinkable Yogurt

- 6.2.3.3 Probiotic Formulations

- 6.2.4 Ice Cream & Frozen Desserts

- 6.2.4.1 Premium Ice Cream

- 6.2.4.2 Frozen Yogurt

- 6.2.4.3 Novelties & Bars

- 6.2.5 Cream, Butter & Spread Alternatives

- 6.2.6 Dairy Ingredient Replacers

- 6.2.6.1 Whey Protein Replacers

- 6.2.6.2 Caseinate Replacers

- 6.2.6.3 Milk Protein Isolate Replacers

- 6.2.1 Fluid Milk & Milk Alternatives

- 6.3 Bakery & Confectionery

- 6.3.1 Bread & Rolls

- 6.3.1.1 Sandwich Bread

- 6.3.1.2 Artisan Breads

- 6.3.1.3 Buns & Rolls

- 6.3.2 Cakes & Pastries

- 6.3.2.1 Layer Cakes

- 6.3.2.2 Muffins & Cupcakes

- 6.3.2.3 Danish & Croissants

- 6.3.3 Cookies & Biscuits

- 6.3.4 Egg Wash Replacers

- 6.3.5 Confectionery & Sweet Applications

- 6.3.5.1 Marshmallows & Nougat (Aerators, Texture)

- 6.3.5.2 Gummies & Jellies (Collagen, Fortification)

- 6.3.5.3 Chocolate & Coatings (Milk Protein Replacers)

- 6.3.1 Bread & Rolls

- 6.4 Beverages

- 6.4.1 Protein Waters

- 6.4.1.1 Clear Protein Waters

- 6.4.1.2 Electrolyte & Functional Waters

- 6.4.2 Sports & Energy Drinks

- 6.4.2.1 Isotonic Drinks

- 6.4.2.2 Protein-Enriched Energy Drinks

- 6.4.2.3 Pre-Workout/Intra-Workout Drinks

- 6.4.3 RTD Protein Shakes

- 6.4.3.1 Plant-Based Protein Shakes

- 6.4.3.2 Clear RTD Protein Shakes

- 6.4.3.3 Meal Replacements

- 6.4.4 Juice & Low pH Beverages

- 6.4.4.1 Juice Blends

- 6.4.4.2 Carbonated Beverages

- 6.4.4.3 Acidic Functionals

- 6.4.5 Alcoholic Applications

- 6.4.5.1 Beer (Stabilizers)

- 6.4.5.2 Wine (Fining Agents)

- 6.4.5.3 Protein-Fortified Alcoholic Beverages

- 6.4.1 Protein Waters

- 6.5 Meat, Seafood & Culinary Applications

- 6.5.1 Plant-Based Meat Applications

- 6.5.1.1 Burgers & Patties

- 6.5.1.2 Whole Cuts (Steaks, Chicken Analogues)

- 6.5.1.3 Structured Meat Alternatives

- 6.5.1.4 Myoglobin/Heme for Flavor & Aroma

- 6.5.2 Cultivated Meat Media & Inputs

- 6.5.2.1 Growth Factors (IGF, FGF, TGF-a)

- 6.5.2.2 Serum & Amino Acid Replacers

- 6.5.2.3 Scaffold Proteins (Collagen, ECM analogues)

- 6.5.3 Seafood Analogues

- 6.5.3.1 Finfish (Tuna, Salmon analogues)

- 6.5.3.2 Crustaceans (Shrimp, Crab)

- 6.5.4 Culinary Applications (General Savory)

- 6.5.4.1 Soups & Broths (Dairy/Meat analogues)

- 6.5.4.2 Sauces, Gravies & Emulsions

- 6.5.4.3 Dressings and Condiments

- 6.5.4.4 Instant Meals, RTE, Convenience Foods

- 6.5.1 Plant-Based Meat Applications

- 6.6 Sports & Active Lifestyle Nutrition

- 6.6.1 Protein Powders

- 6.6.1.1 Fermented Whey Analogues

- 6.6.1.2 Fermented Casein & Egg Analogues

- 6.6.1.3 Multi-Source Blends

- 6.6.2 Functional Protein Bars & Snacks

- 6.6.3 Recovery & Endurance Products

- 6.6.3.1 BCAA-Focused Products

- 6.6.3.2 Muscle/Joint/Immune Benefits

- 6.6.3.3 Post-Workout Drink Mixes

- 6.6.4 Clean Label & Performance Hydrosolubles

- 6.6.1 Protein Powders

- 6.7 Medical & Clinical Nutrition

- 6.7.1 Peptide-Based Enteral Formulas

- 6.7.1.1 Semi-Elemental

- 6.7.1.2 Elemental

- 6.7.2 Oral Medical Nutrition

- 6.7.2.1 Cancer, COPD, Geriatric

- 6.7.3 Therapeutic Applications

- 6.7.3.1 Hepatic/renal diets

- 6.7.3.2 Immune support

- 6.7.3.3 Post-surgical recovery

- 6.7.4 Pharmacological Peptides

- 6.7.4.1 Fischer Ratio Oligopeptides

- 6.7.4.2 Immune-modulating Hydrolysates

- 6.7.1 Peptide-Based Enteral Formulas

- 6.8 Infant & Pediatric Nutrition

- 6.8.1 Infant Formula (0-6 months)

- 6.8.1.1 Partially Hydrolyzed

- 6.8.1.2 Extensively Hydrolyzed

- 6.8.1.3 Amino Acid-Based

- 6.8.2 Follow-On & Toddler Formula (6-24 months)

- 6.8.2.1 Hydrolyzed Follow-On

- 6.8.2.2 Growing-Up Milk

- 6.8.3 CMP-Allergy and Hypoallergenic Products

- 6.8.4 Lactoferrin & Bioactive Peptides

- 6.8.4.1 Immune and Gut Function Support

- 6.8.1 Infant Formula (0-6 months)

- 6.9 Dietary Supplements & Functional Wellness

- 6.9.1 Dietary Protein Supplements

- 6.9.1.1 Powders, Capsules

- 6.9.1.2 Protein Shots

- 6.9.2 Functional Gummies & Beverages

- 6.9.3 Bioactive Peptides by Function

- 6.9.3.1 Cardiovascular Support (ACE inhibitors)

- 6.9.3.2 Antioxidants

- 6.9.3.3 Antimicrobials

- 6.9.3.4 Immune-Modulators

- 6.9.3.5 Cognitive / Stress Support Peptides

- 6.9.1 Dietary Protein Supplements

- 6.10 Cosmeceuticals & Personal Care

- 6.10.1 Skincare Products

- 6.10.1.1 Collagen-Boosting Creams

- 6.10.1.2 Anti-Aging Serums

- 6.10.1.3 Moisturizers & Eye Creams

- 6.10.2 Hair & Scalp Products

- 6.10.2.1 Hydrosoluble Keratin-style Proteins

- 6.10.2.2 Hair Repair Peptides

- 6.10.3 Oral & Dental Care

- 6.10.3.1 Peptide Mouthwashes

- 6.10.3.2 Oral Hygiene Supplements

- 6.10.1 Skincare Products

- 6.11 Animal Nutrition

- 6.11.1 Pet Food (Dogs & Cats)

- 6.11.1.1 Protein-Enhanced Kibble, Wet Food, Treats

- 6.11.2 Aquaculture Feed

- 6.11.2.1 Salmon, Shrimp, Trout - Digestibility-enhancing Peptides

- 6.11.3 Livestock Feed Additives

- 6.11.3.1 Swine, Poultry, Ruminant Performance

- 6.11.3.2 Immune & Gut Health Peptides

- 6.11.1 Pet Food (Dogs & Cats)

- 6.12 Pharmaceuticals & Biotherapeutics

- 6.12.1 Therapeutic Peptides (e.g., GLP-1 analogues)

- 6.12.2 Biosimilar Peptides

- 6.12.3 Peptide-based APIs

- 6.12.4 Drug Delivery Peptide Scaffolds

- 6.12.5 Wound Healing & Regenerative Therapies

- 6.12.6 Antimicrobial & Topical Therapeutics

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.4.6 Rest of Asia Pacific

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.5.4 Rest of Latin America

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

- 7.6.4 Rest of Middle East and Africa

Chapter 8 Company Profiles

- 8.1 Change Foods

- 8.2 Clara Foods

- 8.3 Cubiq Foods

- 8.4 Formo

- 8.5 Fybraworks Foods

- 8.6 Geltor

- 8.7 Helaina

- 8.8 Imagindairy

- 8.9 Jellatech

- 8.10 Modern Meadow

- 8.11 Motif FoodWorks

- 8.12 New Culture

- 8.13 Onego Bio

- 8.14 Perfect Day

- 8.15 Provectus Algae

- 8.16 Remilk

- 8.17 Spiber

- 8.18 The EVERY Company

- 8.19 TurtleTree

- 8.20 Vivici

- 8.21 Others