PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885826

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885826

Organic Protein Hydrolysates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

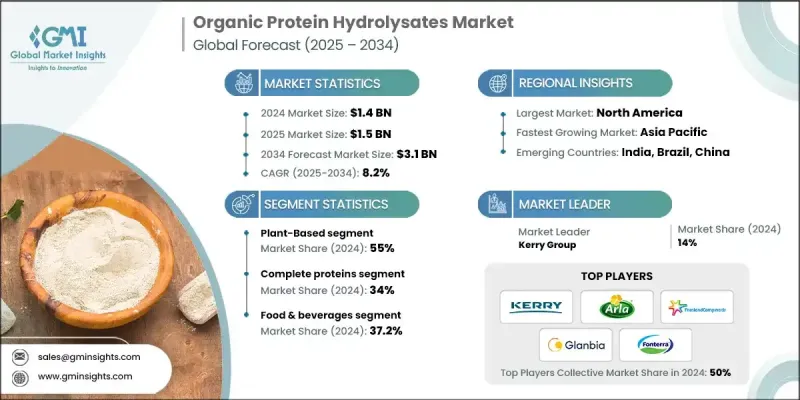

The Global Organic Protein Hydrolysates Market was valued at USD 1.4 billion in 2024 and is estimated to grow at a CAGR of 8.2% to reach USD 3.1 billion by 2034.

Demand is accelerating as organic nutrition, high-protein dietary trends, and personalized nutrition converge, increasing the need for hydrolyzed organic proteins across multiple consumer and industrial segments. Their bioactive characteristics, reduced allergenic potential, and improved absorption rates continue to drive product development and support premium pricing. Broader adoption within functional and processed foods is expected as the global market shifts toward more concentrated and specialized protein formats. Rising interest in wellness, increased use of organic bio-based inputs, and growth in sports, medical, and lifestyle nutrition have strengthened the appeal of hydrolysates. Regulatory backing for organic agriculture, combined with advancements in enzymatic processing, is expanding production capabilities. Penetration is also rising in infant, pediatric, and medical nutrition due to the need for gentler and easier-to-digest protein sources. These factors collectively reinforce long-term momentum for organic protein hydrolysates worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $3.1 Billion |

| CAGR | 8.2% |

The plant-based sources segment held a 55% share in 2024 and will grow at an 8% CAGR through 2034. The category continues to grow as manufacturers broaden their raw material portfolios across new botanical and marine sources to achieve customized amino acid compositions and functional characteristics. Sustainability concerns, non-GMO positioning, and consumer preference for responsible sourcing remain particularly strong across North American and European markets.

The complete proteins segment held a 34% share in 2024 and is expected to grow at an 8.6% CAGR through 2034. Demand for full amino acid profiles and advanced functional attributes is shaping protein-type differentiation. Dairy-derived proteins remain dominant in clinical and performance nutrition, while collagen-based ingredients maintain strong traction in mobility and beauty-focused segments. The market is gradually shifting toward more specialized peptide formulations aimed at targeted health positioning and intellectual property-based product claims.

North America Organic Protein Hydrolysates Market generated USD 428 million in 2024 to reach USD 952 million by 2034. The region benefits from a mature organic nutrition culture, strong adoption in sports and pet products, and a consumer base willing to pay for high-quality, clean-label proteins. The United States, known for rapid innovation in health and nutrition, continues to expand the commercialization of organic protein hydrolysates across diverse product categories, especially in advanced performance and clinical applications.

Key companies active in the Organic Protein Hydrolysates Market include Arla Foods Ingredients, Kerry Group, FrieslandCampina Ingredients, Glanbia Nutritionals, Hilmar Ingredients, Fonterra Co-operative Group, Lactalis Ingredients, A. Costantino & C. S.p.A., Essentia Protein Solutions, VITAMINAS, S.A. (Bioiberica Group), Armor Proteines, AMCO Proteins, Tate & Lyle, ADM (Archer Daniels Midland), Cargill, Ingredion Incorporated, Roquette Freres, Symrise, Gelita AG, and Weishardt Group. Companies in the Global Organic Protein Hydrolysates Market are strengthening their competitive positioning through targeted innovation, strategic portfolio expansion, and improved processing capabilities. Many are investing in advanced enzymatic technologies to create differentiated peptide profiles tailored for specific health and performance needs. Firms are also expanding raw material sourcing to include a broader mix of plant and animal proteins to serve diverse applications and regulatory preferences. Strategic collaborations with formulators and nutrition brands help accelerate go-to-market pathways and support specialized product development.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Source

- 2.2.3 Protein Type

- 2.2.4 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for clean-label, organic proteins

- 3.2.1.2 Growth in sports, infant, clinical nutrition

- 3.2.1.3 Advances in enzymatic processing technologies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production costs versus conventional proteins

- 3.2.2.2 Limited raw material availability and certification

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into organic biostimulants and agrinutrition

- 3.2.3.2 Plant-based and allergen-free formulation trends

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By Source

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Source, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Plant-Based

- 5.2.1 Soy

- 5.2.2 Wheat

- 5.2.3 Pea

- 5.2.4 Rice

- 5.2.5 Corn

- 5.2.6 Oilseeds (e.g., sunflower, rapeseed)

- 5.2.7 Other plant sources

- 5.3 Animal-Based

- 5.3.1 Milk (casein, whey)

- 5.3.2 Egg

- 5.3.3 Meat & Poultry

- 5.3.4 Fish & Marine

- 5.3.5 Collagen & Gelatin

- 5.4 Other sources

Chapter 6 Market Estimates and Forecast, By Protein Type, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Complete Proteins (all essential amino acids)

- 6.3 Incomplete Proteins

- 6.4 Collagen & Gelatin Proteins

- 6.5 Casein & Whey Proteins

- 6.6 Specialty / Functional Proteins (bioactive peptides, tailored blends)

Chapter 7 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food & Beverages

- 7.2.1 Functional Foods

- 7.2.2 Sports Nutrition & Performance Products

- 7.2.3 Infant & Clinical Nutrition

- 7.2.4 Bakery & Confectionery

- 7.2.5 Dairy & Dairy Alternatives

- 7.2.6 Meat Analogs & Meat Products

- 7.2.7 Beverages (RTD, powdered drinks, smoothies)

- 7.2.8 Snacks & Convenience Foods

- 7.3 Animal Nutrition

- 7.3.1 Pet Food (dogs, cats, others)

- 7.3.2 Aquafeed (fish, shrimp, others)

- 7.3.3 Livestock Feed (poultry, swine, ruminants)

- 7.3.4 Specialty & Performance Feeds

- 7.4 Agriculture & Crop Nutrition

- 7.4.1 Biostimulants & Plant Growth Promoters

- 7.4.2 Foliar Sprays

- 7.4.3 Soil Amendments

- 7.4.4 Seed Treatments

- 7.5 Cosmetics & Personal Care

- 7.5.1 Skin Care

- 7.5.2 Hair Care

- 7.5.3 Nutricosmetics / Beauty-from-within

- 7.6 Pharmaceuticals & Nutraceuticals

- 7.6.1 Dietary Supplements

- 7.6.2 Medical & Clinical Nutrition

- 7.6.3 Drug Delivery & Specialty Formulations

- 7.7 Industrial & Other Applications

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Arla Foods Ingredients

- 9.2 Kerry Group

- 9.3 FrieslandCampina Ingredients

- 9.4 Glanbia Nutritionals

- 9.5 Hilmar Ingredients

- 9.6 Fonterra Co-operative Group

- 9.7 Lactalis Ingredients

- 9.8 A. Costantino & C. S.p.A.

- 9.9 Essentia Protein Solutions

- 9.10 VITAMINAS, S.A. (Bioiberica Group)

- 9.11 Armor Proteines

- 9.12 AMCO Proteins

- 9.13 Tate & Lyle

- 9.14 ADM (Archer Daniels Midland)

- 9.15 Cargill

- 9.16 Ingredion Incorporated

- 9.17 Roquette Freres

- 9.18 Symrise

- 9.19 Gelita AG

- 9.20 Weishardt Group