PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885805

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885805

Geriatric Nutrition Protein Hydrolysates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

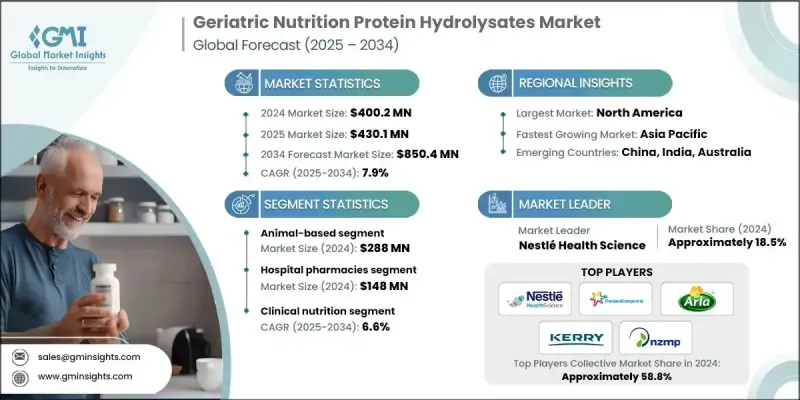

The Global Geriatric Nutrition Protein Hydrolysates Market was valued at USD 400.2 million in 2024 and is estimated to grow at a CAGR of 7.9% to reach USD 850.4 million by 2034.

The market continues to expand as the share of individuals aged 65 and above increases worldwide, establishing a lasting demand for tailored nutritional solutions. As aging populations grow across both mature and emerging economies, the need for protein sources that support muscle maintenance, mobility, and overall vitality becomes more pressing. Rising cases of malnutrition and sarcopenia-driven by reduced appetite, chronic health conditions, and physiological decline-are reinforcing reliance on specialized dietary interventions. Protein hydrolysates are becoming foundational in geriatric nutrition due to their rapid absorption and superior digestibility compared with intact proteins. Older adults often face weaker digestive function, diminished enzymatic activity, and slower nutrient assimilation, making traditional protein formats difficult to tolerate. Hydrolyzed proteins, therefore, play a vital role in preventing muscle loss, supporting recovery, and helping older individuals maintain functional independence, which ensures sustained demand for advanced therapeutic formulations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $400.2 Million |

| Forecast Value | $850.4 Million |

| CAGR | 7.9% |

The animal-based segment generated USD 288 million in 2024 and is expected to grow at a CAGR of 7.3% through 2034. Animal-derived hydrolysates continue to hold a dominant position because of their strong amino acid composition and high digestibility, which are essential in elderly-focused nutrition. Their use remains widespread in clinical environments, eldercare nutrition programs, and specialized therapeutic preparations aimed at muscle preservation and metabolic support. Ongoing improvements in hydrolysis efficiency and flavor development are contributing to greater acceptance among older consumers.

The hospital pharmacies segment generated USD 148 million in 2024 and is projected to grow at a CAGR of 5.7% from 2025 to 2034. Hospital pharmacies maintain a consistent role in distributing hydrolysate-based clinical nutrition for aging patients who require enhanced dietary support, faster recovery, or easily digestible formulations due to medical limitations. These products are integrated into chronic care management, postoperative nutrition strategies, and inpatient feeding programs, providing reliable access to medically supervised formulations as healthcare systems adapt to aging populations.

North America Geriatric Nutrition Protein Hydrolysates Market held USD 144 million in 2024. Growth in the region remains steady due to the expanding older population, strong clinical nutrition infrastructure, and substantial healthcare spending. Hydrolyzed proteins are widely utilized in managing age-related muscle loss, improving recovery outcomes, and reducing malnutrition in eldercare and medical facilities. Demand for powdered, beverage-based, and senior-targeted nutritional products continues to rise as consumers prioritize healthy aging, while advances in formulation technologies and home-based nutritional care broaden the adoption of these products.

Key companies in the Global Geriatric Nutrition Protein Hydrolysates Market include Arla Foods Ingredients, Kerry Group, Fonterra Co-operative Group, Nestle Health Science, Royal FrieslandCampina N.V., and others. To strengthen their presence, companies are focusing on specialized formulation development tailored to older adults' digestive and metabolic needs, emphasizing high bioavailability and improved tolerability. Many are increasing investments in clinical research to validate the efficacy of hydrolysates in preventing muscle loss and enhancing recovery outcomes, which supports medical adoption and regulatory credibility. Expansion of partnerships with hospitals, eldercare networks, and nutritional clinics is helping brands secure consistent demand channels. Companies are also reformulating products with cleaner labels, enhanced flavor profiles, and user-friendly formats such as ready-to-drink options to improve acceptance among seniors.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Source

- 2.2.3 Distribution Channel

- 2.2.4 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Source, 2021 - 2034 (USD Million, Kilo Tons)

- 5.1 Key trends

- 5.2 Animal-based

- 5.2.1 Milk protein hydrolysates (casein, whey)

- 5.2.2 Egg protein hydrolysates

- 5.2.3 Meat protein hydrolysates

- 5.2.4 Fish protein hydrolysates

- 5.3 Plant-based

- 5.3.1 Soy protein hydrolysates

- 5.3.2 Pea protein hydrolysates

- 5.3.3 Rice protein hydrolysates

- 5.3.4 Other plant sources (e.g., wheat, corn)

Chapter 6 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Million, Kilo Tons)

- 6.1 Key trends

- 6.2 Hospital pharmacies

- 6.3 Retail pharmacies

- 6.4 Online stores

- 6.5 Specialty stores

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million, Kilo Tons)

- 7.1 Key trends

- 7.2 Clinical nutrition

- 7.2.1 Hospital-based nutrition

- 7.2.2 Tube feeding formulations

- 7.3 Functional foods & beverages

- 7.3.1 Nutritional drinks

- 7.3.2 Fortified foods

- 7.4 Dietary supplements

- 7.4.1 Capsules

- 7.4.2 Tablets

- 7.4.3 Sachets

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million, Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East & Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 Arla Foods Ingredients

- 9.2 Mead Johnson Nutrition

- 9.3 Merck KGaA

- 9.4 Fonterra Co-operative Group

- 9.5 Agropur Cooperative

- 9.6 Milk Specialties Global

- 9.7 Tatua Co-operative Dairy Company

- 9.8 Royal FrieslandCampina N.V.

- 9.9 Hilmar Cheese Company

- 9.10 Kerry Group

- 9.11 DuPont (Danisco)

- 9.12 Nestle Health Science

- 9.13 Rousselot

- 9.14 Gelita AG

- 9.15 Evonik Industries