PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885851

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885851

Food Waste-Derived Protein Hydrolysates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

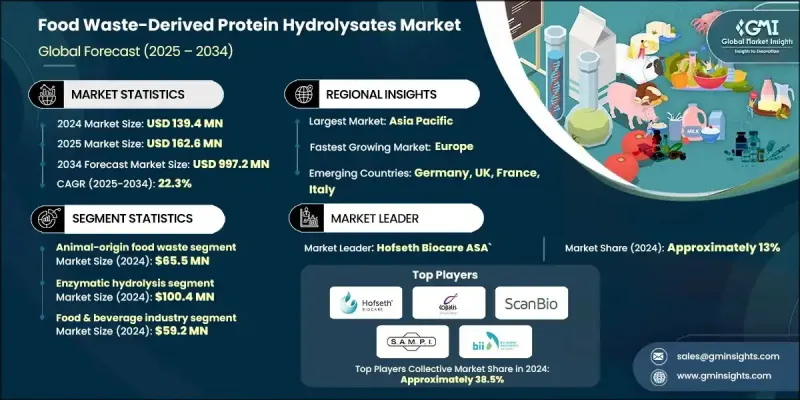

The Global Food Waste-Derived Protein Hydrolysates Market was valued at USD 139.4 million in 2024 and is estimated to grow at a CAGR of 22.3% to reach USD 997.2 million by 2034.

These proteins, generated through enzymatic and chemical hydrolysis of discarded plant and animal food materials, play a central role in the transition toward a circular bioeconomy. The process transforms otherwise wasted resources into functional proteins and bioactive peptides that deliver performance equal to or better than traditional protein sources. As sustainability expectations intensify, manufacturers are increasingly adopting waste-derived ingredients to align with strict waste reduction policies and environmental standards. Global commitments to reduce food loss and close nutrient loops are supporting the integration of hydrolysates into functional foods, dietary supplements, and sustainable animal nutrition solutions. Regulatory authorities worldwide continue to enforce policies encouraging the upcycling of food waste due to its lower ecological footprint compared to conventional disposal. Valorization of food waste significantly cuts greenhouse gas emissions and prevents a major share of organic waste from reaching landfills, making it an environmentally and economically appealing pathway. These combined regulatory, environmental, and industry-driven factors continue to accelerate demand for food waste-derived hydrolysate ingredients across multiple sectors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $139.4 Million |

| Forecast Value | $997.2 Million |

| CAGR | 22.3% |

The animal-origin food waste generated USD 65.5 million in 2024 and is expected to grow at a 22.1% CAGR from 2025 to 2034. This category leads because its protein content is highly nutritious and offers strong potential for bioactive peptides. High-quality amino acid profiles, elevated biological value, and excellent functional characteristics from various animal-based residues make these hydrolysates well-suited for nutritional supplements, specialized feed formulations, and functional food applications requiring robust bioactivity.

The enzymatic hydrolysis segment reached USD 100.4 million in 2024 and is anticipated to grow at a 22.4% CAGR from 2025 to 2034, accounting for 72% of the market. This method remains dominant because it enables the precise development of peptide structures and preserves sensitive bioactive components. Controlled use of proteolytic enzymes allows manufacturers to tailor molecular weight distribution and create consistent functional ingredients, making enzymatic hydrolysis the preferred approach for high-grade food, nutraceutical, and functional ingredient production.

North America Food Waste-Derived Protein Hydrolysates Market is projected to grow at a 20.7% CAGR from 2025 to 2034. Rising emphasis on sustainable supply chains and increasing corporate attention to circular bioeconomy strategies are strengthening regional adoption. Expanding interest in reducing food waste and replacing conventional protein sources with environmentally responsible alternatives is pushing companies to invest in advanced extraction and valorization technologies.

Major companies in the Global Food Waste-Derived Protein Hydrolysates Market include Scanbio Marine Group, Copalis Sea Solutions, Hofseth Biocare ASA, Bio-Marine Ingredients Ireland, Diana Aqua (Symrise), Triplenine Group, Agropur, SAMPI, FrieslandCampina Ingredients, Ingredia, Arla Foods Ingredients, and Janatha Fish Meal & Oil Products. Leading companies are strengthening their presence by expanding production capacity, improving extraction technologies, and enhancing supply chain integration. Many manufacturers are investing in advanced enzymatic processing systems to increase peptide purity, improve yield efficiency, and maintain consistent quality. Strategic partnerships with food processors and aquaculture firms help secure long-term access to raw materials, reducing waste and stabilizing sourcing. Firms are also focusing on product diversification to serve nutraceutical, food, and animal nutrition markets with tailored hydrolysate formulations.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Source material type trends

- 2.2.2 Hydrolysis technology trends

- 2.2.3 End use industry trends

- 2.2.4 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Drivers

- 3.2.2 Pitfalls & Challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By source material type trends

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Source Material Type, 2021-2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Animal-origin food waste

- 5.3 Plant-origin food waste

- 5.4 Mixed food waste streams

Chapter 6 Market Estimates and Forecast, By Hydrolysis Technology, 2021-2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 Enzymatic hydrolysis

- 6.3 Chemical hydrolysis

- 6.4 Combined processing technologies

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021-2034 (USD Million & Kilo Tons)

- 7.1 Key trends

- 7.2 Food & beverage industry

- 7.2.1 Functional foods

- 7.2.2 Bakery & confectionery

- 7.2.3 Beverages & fortified drinks

- 7.2.4 Other

- 7.3 Animal feed industry

- 7.3.1 Poultry feed

- 7.3.2 Aquaculture feed

- 7.3.3 Livestock feed (cattle, swine)

- 7.3.4 Others

- 7.4 Nutraceutical industry

- 7.4.1 Protein supplements

- 7.4.2 Amino acid supplements

- 7.4.3 Sports & performance nutrition

- 7.4.4 Dietary supplements

- 7.4.5 Others

- 7.5 Agricultural industry

- 7.5.1 Biofertilizers

- 7.5.2 Biostimulants

- 7.5.3 Soil conditioners

- 7.5.4 Others

- 7.6 Other end use industries

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Million & Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Hofseth Biocare ASA

- 9.2 Copalis Sea Solutions

- 9.3 Scanbio Marine Group

- 9.4 SAMPI

- 9.5 Bio-Marine Ingredients Ireland

- 9.6 Diana Aqua (Symrise)

- 9.7 Triplenine Group

- 9.8 Janatha Fish Meal & Oil Products

- 9.9 Agropur

- 9.10 FrieslandCampina Ingredients

- 9.11 Ingredia

- 9.12 Arla Foods Ingredients