Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690192

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690192

Thailand Courier, Express, and Parcel (CEP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 313 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

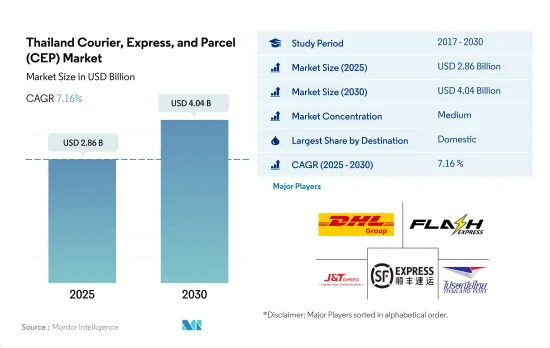

The Thailand Courier, Express, and Parcel (CEP) Market size is estimated at 2.86 billion USD in 2025, and is expected to reach 4.04 billion USD by 2030, growing at a CAGR of 7.16% during the forecast period (2025-2030).

The domestic segment, driven by robust e-commerce sales, is spearheading the demand in the CEP market

- In October 2023, Thailand Post, the leading parcel and postal service provider in Thailand, forged a partnership with Escher to revamp and digitize its delivery network and operations. This collaboration marks a pivotal move for Thailand Post, underscoring its commitment to enhancing its delivery network and embracing cutting-edge technology for enhanced customer service. The adoption of Escher's solutions will be anchored in a control tower framework, enabling Thailand Post to wield real-time operational insights and exercise better oversight over parcels, packets, and mail items across its expansive network.

- E-commerce emerged as a catalyst for the growth of both domestic and international CEP markets, surging to USD 16.41 billion in 2023 and projected to hit USD 24.81 billion by 2027. Electronics, personal and household items, food and beverages, as well as toys, hobbies, and DIY products, were key drivers of CEP delivery demand. The e-commerce market is poised to witness a surge in users, with an estimated count of 15,190,000 by 2028. User penetration is set to rise from 20.6% in 2024 to 24.8% by 2028.

Thailand Courier, Express, and Parcel (CEP) Market Trends

Thailand's transport and storage sector experienced growth in 2022 driven by international trade and e-commerce

- Despite a decline in economic growth in 2023, the government boosted FDI and tourism to act as economic stimulus and contribute towards Thailand becoming a manufacturing hub especially for electric trucks. Furthermore, the recently finalized "EV 3.5 package" in 2023 offers a reduced purchase subsidy of USD 2,889.23 per vehicle, further supporting GDP contribution from the sector.

- In February 2024, the Transport Ministry announced plans to invest USD 18.83 billion in around 150 transport projects by the end of 2025 to enhance the country's infrastructure. In 2024, 64 projects will commence, with an additional 31 projects valued at USD 11.23 billion in the pipeline. For 2025, there are 57 new projects planned, totaling USD 7.59 billion. These initiatives include 18 motorway projects, 9 railway projects, and plans for regional port development, all aimed at bolstering the transport and storage sector's contribution to GDP in the future.

USD 2.35 billion was approved by Thailand's cabinet for the 2023 state fund to subsidize fuel costs

- The Thai government decided to waive the diesel excise tax from February 2022 to relieve the impact of the global oil price surge, but this led the government to lose USD 4.56 billion in revenue. The tax exemption and the diesel price subsidy under the fund played a key role in keeping the domestic diesel price at around USD 1.01 a liter since Feb 2022 till March 2024. The diesel price has gradually fallen since February 2023 to USD 0.92 a liter in response to declining global oil prices. Thailand's cabinet approved another USD 2.35 billion of new borrowing in 2023 for a state fund to subsidize fuel costs as the government battles high inflation.

- Despite an anticipated sluggish economic growth, demand for refined oil in Thailand, particularly jet fuel, is predicted to rise in 2024. Jet fuel consumption is forecasted to grow by 24.2% to an average of 16.8 million litres per day (MLD), up from 13.5 MLD in 2023. Diesel, gasoline, and gasohol are currently part of a state price subsidy program. Additionally, LNG prices are expected to decrease in 2024, leading power plant operators to rely less on fuel oil.

Thailand Courier, Express, and Parcel (CEP) Industry Overview

The Thailand Courier, Express, and Parcel (CEP) Market is moderately consolidated, with the major five players in this market being DHL Group, Flash Express, J&T Express, SF Express (KEX-SF) and Thailand Post (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 70706

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Demographics

- 4.2 GDP Distribution By Economic Activity

- 4.3 GDP Growth By Economic Activity

- 4.4 Inflation

- 4.5 Economic Performance And Profile

- 4.5.1 Trends in E-Commerce Industry

- 4.5.2 Trends in Manufacturing Industry

- 4.6 Transport And Storage Sector GDP

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Price

- 4.10 Logistics Performance

- 4.11 Infrastructure

- 4.12 Regulatory Framework

- 4.12.1 Thailand

- 4.13 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes Market Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Destination

- 5.1.1 Domestic

- 5.1.2 International

- 5.2 Speed Of Delivery

- 5.2.1 Express

- 5.2.2 Non-Express

- 5.3 Model

- 5.3.1 Business-to-Business (B2B)

- 5.3.2 Business-to-Consumer (B2C)

- 5.3.3 Consumer-to-Consumer (C2C)

- 5.4 Shipment Weight

- 5.4.1 Heavy Weight Shipments

- 5.4.2 Light Weight Shipments

- 5.4.3 Medium Weight Shipments

- 5.5 Mode Of Transport

- 5.5.1 Air

- 5.5.2 Road

- 5.5.3 Others

- 5.6 End User Industry

- 5.6.1 E-Commerce

- 5.6.2 Financial Services (BFSI)

- 5.6.3 Healthcare

- 5.6.4 Manufacturing

- 5.6.5 Primary Industry

- 5.6.6 Wholesale and Retail Trade (Offline)

- 5.6.7 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Aqua Corporation (including Thai Parcel Public Company Limited)

- 6.4.2 BEST Inc.

- 6.4.3 CJ Logistics Corporation

- 6.4.4 DHL Group

- 6.4.5 FedEx

- 6.4.6 Flash Express

- 6.4.7 J&T Express

- 6.4.8 JWD Group

- 6.4.9 Nim Express Company Ltd.

- 6.4.10 SF Express (KEX-SF)

- 6.4.11 Thailand Post

- 6.4.12 United Parcel Service of America, Inc. (UPS)

7 KEY STRATEGIC QUESTIONS FOR CEP CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.1.5 Technological Advancements

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.