PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1445658

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1445658

France Prefabricated Buildings Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

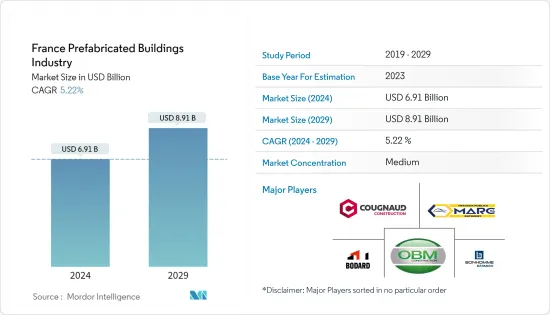

The France Prefabricated Buildings Industry is expected to grow from USD 6.91 billion in 2024 to USD 8.91 billion by 2029, at a CAGR of 5.22% during the forecast period (2024-2029).

Key Highlights

- The large increase in modular building in France is likely to help the prefabricated building industry grow in the country. In the next few years, the growth of the prefab housing market in the country is expected to outpace the growth of the overall housing market. Comparing France to other European countries like Germany and Sweden, France has less prefabricated construction than those countries.

- In France, 3D models are often used when building new buildings, but they aren't used as often when remodeling. However, not all project stakeholders who participate in it actually implement the BIM process, and only a small number of them do so. Also, BIM is often used during the planning and design phases, but not during the execution phase. Concerning the use of BIM in public sector projects, BIM may play a key role within the next year, but it's not clear when.

- In the French prefabricated construction industry, products made of concrete and wood have significant market shares. Compared to other countries, France seems to have a lot of important precast concrete buildings. The country was a pioneer in the development of heavy prefabrication systems. In addition to the Camus system, a large number of internationally successful heavy prefabrication systems were developed in France, which include Coignet, Barets, Cauvet, Estiot, Tracoba, Balency (Balency et Schuhl), and Porte des Lilas.

France Prefabricated Buildings Market Trends

Advanced Solutions in The Construction Sector to Help Boost the Prefab

The industry is using new materials and digital technologies that make it easier to design and make changes, make manufacturing more precise and productive, and make logistics easier.Some builders are focusing on sustainability, good looks, and the higher end of the market to change the old idea that prefabricated housing is ugly, cheap, and of low quality.There is mounting evidence that this disruption is now happening. Many construction, real estate, and infrastructure clients are already adopting a more industrialized model or developing strategies on how they can do so.

A 3D volumetric approach has the potential to be the most efficient and save the most time, but it comes with costs for shipping and size limits. Maximizing productivity benefits 3D volumetric solutions are fully fitted-out units, which could constitute a room or part of a room, that can be assembled onsite like a series of Lego bricks. They are being developed in timber, steel, or concrete, with the first two materials being more common due to weight and logistics advantages. Onsite assembly involves lifting the modules into place and connecting services such as electrical and plumbing.

Growing investments in Real Estate boosting the Market

France is one of the continent's major investment markets. France is appealing to property investors due to its stable economy and legal framework, as well as its history and culture. Currently, France can count on low interest rates and a rental market that is expanding, particularly in major cities such as Paris, Lyon, and Bordeaux. While this has drawn institutional investors interested in retail and tourism, it has also attracted individual investors searching for investment possibilities or second residences.

The French property market remains robust, with the greatest price increases in a decade. House prices in Metropolitan France increased by 5.85% year on year to Q2 2021 (4.41% adjusted for inflation), following a y-o-y rise of 5.86% in Q1, 6.4% in Q4 2020, 5.21% in Q3 and 5.64% in Q2.

Meanwhile, the public sector plays an important role in the development of the French housing market by implementing various plans, such as the French Housing Policy and the government's housing policy. These policies are aimed at balancing housing supply and demand, developing better and cheaper housing units, addressing the requirements of every individual, safeguarding the most vulnerable, and enhancing French residents' living standards.

France Prefabricated Buildings Industry Overview

The market is highly competitive, with no players occupying the majority of the shares. The market is expected to grow during the forecast period due to the increase in prefabrication building investments and upcoming major projects in the country. Other factors are also driving the market.

Some major players in prefab construction include OBM Construction, Cougnaud Construction, Bodard Construction, and Bonhomme Batiment. Prefabricated building systems and construction hold high potential to improve the efficiency and performance of the French construction industry in a more sustainable sense.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers/Consumers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Brief on Different Structures Used in the Prefabricated Buildings Industry

- 4.7 Cost Structure Analysis of the Prefabricated Buildings Industry

- 4.8 Impact of COVID-19 on the Textile Industry

5 MARKET SEGMENTATION

- 5.1 Material Type

- 5.1.1 Concrete

- 5.1.2 Glass

- 5.1.3 Metal

- 5.1.4 Timber

- 5.1.5 Other Material Types

- 5.2 Application

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Other Applications ( Industrial, Institutional, and Infrastructure)

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 MARC SA

- 6.2.2 Cougnaud Construction

- 6.2.3 Bonhomme Batiment

- 6.2.4 OBM Construction

- 6.2.5 Bouygues Construction

- 6.2.6 Bodard Construction

- 6.2.7 Fertighaus Weiss GmbH

- 6.2.8 Algeco

- 6.2.9 ALHO Modulare Gebude

- 6.2.10 Skanska AB*

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 APPENDIX

- 8.1 Marcroeconomic Indicators (GDP breakdown by sector, Contribution of construction to economy, etc.)

- 8.2 Key Production , Consumption,Exports & import statistics of construction Materials