PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1835647

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1835647

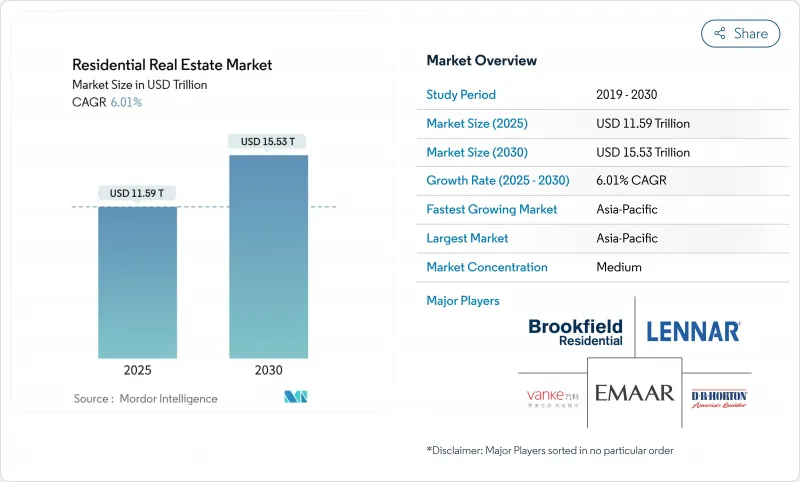

Residential Real Estate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global residential real estate market was valued at USD 11.59 trillion in 2025 and is forecast to reach USD 15.53 trillion by 2030, expanding at a 6.01% CAGR.

Demographic shifts, persistent supply shortages, and fresh institutional capital are enlarging the addressable pool of buyers and renters. Wealth migration toward tax-advantaged hubs, rising climate-related relocation, and stricter energy-efficiency mandates further reinforce underlying demand. At the same time, labor shortages and material-cost inflation are slowing new-build pipelines, magnifying the premium on ready inventory. Digital platforms that enable fractional ownership and streamlined leasing add liquidity and help global investors participate in residential assets.

Global Residential Real Estate Market Trends and Insights

Rapid urbanisation & middle-class expansion

Emerging cities continue to add residents at rates that outpace historic averages. Every new urban migrant creates multiplier effects on household formation, with estimates suggesting that one arrival eventually stimulates demand for 1.3 housing units through indirect employment gains. Dubai illustrates the pattern: population surpassed 3.8 million in 2024 and 20% year-on-year apartment price growth followed. Similar pressure is evident across Latin America where GDP growth is rebounding, lifting disposable incomes and mortgage eligibility. In Asia-Pacific, vertical developments remain the most practical response to land scarcity, reinforcing sustained demand for condominiums. Supply lags are therefore structural rather than cyclical, underpinning long-run price resilience.

Institutional BTR & SFR capital inflows

As conventional office and retail yields compress, large asset managers pivot toward residential strategies. A USD 2.1 billion portfolio purchase by KKR covering 18 Class A multifamily communities signaled confidence in stable cash flows from sun-belt cities. Build-to-rent platforms now command average monthly rents of USD 2,181 and continue to address an estimated 3.9 million-unit shortage in the United States. Europe mirrors the shift: residential assets captured 27% of total property investment by value in 2024, up from 20% three years earlier. Institutional bids compress yields but increase professionally managed stock, enhancing tenant experience and liquidity.

Global housing-affordability crisis

In Sydney median house values reached AUD 1.3 million in 2024, driving price-to-income ratios to 16.4 and leaving only 10% of listings affordable for median earners. Canada faces similar stress as mortgage delinquency crept to 0.20% nationally, doubling in Toronto. The United States still confronts a shortfall of up to 3.8 million homes; 45% of renters spend over 30% of income on housing. Political pressure for subsidised supply is therefore mounting, yet fast-tracked approvals rarely keep pace with demand, capping absorption in entry-level brackets.

Other drivers and restraints analyzed in the detailed report include:

- Wealth migration & second-home demand in tax-advantaged hubs

- Net-zero mandates driving green-retrofit premium

- Rising policy rates & tighter credit standards

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Apartments and condominiums controlled 58% of global residential real estate market revenue in 2024, supported by urban density and affordability relative to land-based homes. Demand is strongest in Asia-Pacific capitals where land constraints force vertical solutions and where rapid transit expansions raise condominium values. Dubai's prime high-rise corridors show transaction volumes rising even as villa prices appreciate faster, underscoring the liquidity of the segment.

The villa and landed-house category is forecast to grow at 6.19% CAGR to 2030. Wealth migration, remote-work flexibility, and post-pandemic lifestyle preferences are driving buyers to larger plots outside congested cores. Institutional investors are also assembling single-family rental portfolios across the United Kingdom and the United States, capitalising on energy-efficient builds that fetch premium rents. Prefabricated construction has cut build times by up to 50%, allowing supply to respond more nimbly. As a result, the global residential real estate market size attached to landed formats is set to expand more rapidly than historical averages.

The mid-market bracket captured 45% of 2024 spending, reflecting the sheer volume of households earning close to median wages. Government incentives such as Canada's 30-year insured mortgage for first-time buyers bolster this tier. Institutional build-to-rent projects often target this affordability band, given its resilient occupancy and predictable cash flows.

Luxury stock, which includes super-prime assets above USD 10 million, is poised for 6.26% CAGR. Dubai led the world in USD 10 million-plus transactions during 2024, while coastal Portugal and alpine Switzerland posted double-digit price gains. Tokenised co-ownership schemes are widening the buyer base and could lift the global residential real estate market share of luxury assets during the forecast horizon. Limited trophy supply and the brand value of marquee destinations underpin further upside.

Residential Real Estate Market is Segmented by Property Type (Apartments & Condominiums, and Landed Houses & Villas), by Price Band (Affordable, Mid-Market, and Luxury/Super-prime), by Business Model (Sales and Rental), by Mode of Sale (Primary and Secondary), and by Region (North America, South America, Europe, Asia-Pacific, and Middle East & Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific accounted for 33.10% of global residential real estate market revenue in 2024 and is projected to expand at a 6.91% CAGR through 2030. China's policy support for affordable housing is stabilising sales volumes, while Japan's multifamily sector benefits from low vacancy and limited new supply. Australia faces acute shortages; median Sydney values reached AUD 1.3 million, prompting a USD 33 billion federal programme that targets 1.2 million new homes in five years. Transaction volumes picked up in Singapore, Korea, and India, helped by easing border restrictions and increased foreign enrolment in education hubs.

North America maintains a sizeable base but wrestles with affordability and financing headwinds. The United States faces a deficit of up to 3.8 million units, keeping 45% of renters cost-burdened. Canada's Build Canada Homes vehicle committed more than USD 25 billion to modular construction and aims for 500,000 annual starts. Institutional buyers remain active; KKR's coastal portfolio acquisition underscores confidence in demographic resilience despite mortgage rate pressure.

Europe shows resilience through robust rental demand. Residential investment volumes rose 33% year-on-year to EUR 47 billion, representing 27% of total real-estate capital flows. Germany may be short more than 1 million units by 2027, with tax incentives lifting investor returns to as much as 25% per year on energy-efficient refurbishments. The UK offers the highest projected total return at 9.8% annually, supported by tight vacancy and upward-trending rents aew.com. In the Middle East, Dubai posted 20% price appreciation and 19% rental growth in 2024 on the back of 6.6% population growth.

South America is regaining momentum; regional GDP growth is anticipated to improve from 2.2% in 2024 to 2.5% in 2025, led by Argentina's 3% real-estate expansion outlook. Climate-induced relocations, particularly within Brazil and Chile, are altering internal migration maps and encouraging mixed-use master-planned communities that embed resilience into design standards.

- Brookfield Residential

- Lennar Corporation

- Country Garden

- Emaar Properties

- China Vanke

- D.R. Horton

- Poly Developments

- Mitsui Fudosan

- Hon Hai (House+ JV)

- Grupo Lar

- Savills PLC

- Tokyo Tatemono

- Simon Property's SFR Platform

- CapitaLand Development

- Peab AB

- Lendlease

- Redrow PLC

- Cyrela Brazil

- Aedas Homes

- Helical PLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Overview of the Global Economy and Market

- 4.2 Residential Real Estate Buying Trends - Socio-economic and Demographic Insights

- 4.3 Government Initiatives and Regulatory Aspects for the Residential Real Estate Sector

- 4.4 Regulatory Outlook

- 4.5 Technological Outlook

- 4.6 Focus on Technology Innovation, Start-ups, and PropTech in Real Estate

- 4.7 Insights into Rental Yields in the Residential Segment

- 4.8 Real Estate Lending Dynamics

- 4.9 Insights into Affordable-Housing Support Provided by Government & Public-private Partnerships

- 4.10 Market Drivers

- 4.10.1 Rapid urbanisation & middle-class expansion

- 4.10.2 Institutional BTR & SFR capital inflows

- 4.10.3 Wealth migration & second-home demand in tax-advantaged hubs

- 4.10.4 Net-zero mandates driving green-retrofit premium (under-reported)

- 4.10.5 Climate-risk migration reshaping housing pipelines (under-reported)

- 4.10.6 Blockchain-enabled fractional ownership (under-reported)

- 4.11 Market Restraints

- 4.11.1 Global housing-affordability crisis

- 4.11.2 Rising policy rates & tighter credit standards

- 4.11.3 Construction-labour shortages & material-cost volatility (under-reported)

- 4.11.4 Hybrid-work vacancy drag in urban cores (under-reported)

- 4.12 Value / Supply-Chain Analysis

- 4.12.1 Overview

- 4.12.2 Real-estate Developers & Contractors - Key Quantitative and Qualitative Insights

- 4.12.3 Real-estate Brokers and Agents - Key Quantitative and Qualitative Insights

- 4.12.4 Property-management Companies - Key Quantitative and Qualitative Insights

- 4.12.5 Insights on Valuation Advisory and Other Real-estate Services

- 4.12.6 State of the Building-materials Industry & Partnerships with Key Developers

- 4.12.7 Insights on Key Strategic Real-estate Investors/Buyers in the Market

- 4.13 Porter's Five Forces

- 4.13.1 Bargaining Power of Suppliers

- 4.13.2 Bargaining Power of Buyers

- 4.13.3 Threat of New Entrants

- 4.13.4 Threat of Substitutes

- 4.13.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Property Type

- 5.1.1 Apartments & Condominiums

- 5.1.2 Landed Houses & Villas

- 5.2 By Price Band

- 5.2.1 Affordable

- 5.2.2 Mid-Market

- 5.2.3 Luxury / Super-prime

- 5.3 By Business Model

- 5.3.1 Primary (New-Build)

- 5.3.2 Secondary (Existing-home Resale)

- 5.4 By Mode of Sale

- 5.4.1 Sales

- 5.4.2 Rental

- 5.5 By Region

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East & Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Nigeria

- 5.5.5.5 Rest of Middle East & Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, JV, Land-bank Acquisitions, IPOs)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Brookfield Residential

- 6.4.2 Lennar Corporation

- 6.4.3 Country Garden

- 6.4.4 Emaar Properties

- 6.4.5 China Vanke

- 6.4.6 D.R. Horton

- 6.4.7 Poly Developments

- 6.4.8 Mitsui Fudosan

- 6.4.9 Hon Hai (House+ JV)

- 6.4.10 Grupo Lar

- 6.4.11 Savills PLC

- 6.4.12 Tokyo Tatemono

- 6.4.13 Simon Property's SFR Platform

- 6.4.14 CapitaLand Development

- 6.4.15 Peab AB

- 6.4.16 Lendlease

- 6.4.17 Redrow PLC

- 6.4.18 Cyrela Brazil

- 6.4.19 Aedas Homes

- 6.4.20 Helical PLC

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment (Senior-Living, Net-Zero Homes, Co-Living / PBSA)