PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850122

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850122

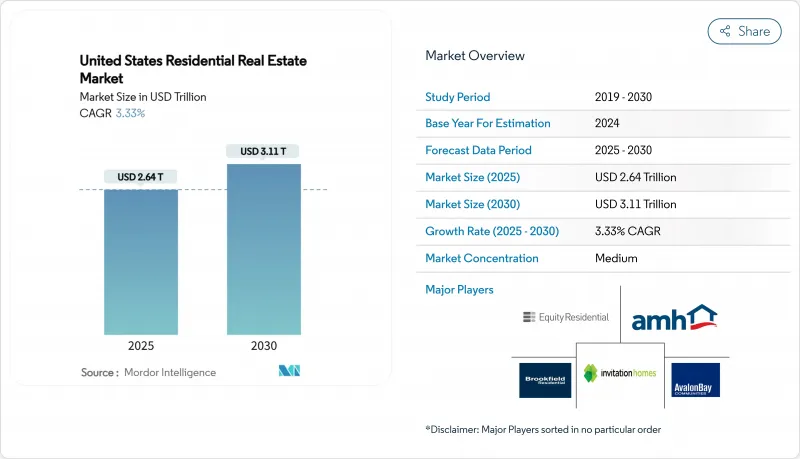

United States Residential Real Estate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The United States residential real estate market size is valued at USD 2.64 trillion in 2025 and is forecast to reach USD 3.11 trillion by 2030, reflecting a compound annual growth rate (CAGR) of 3.33%.

Growth appears modest, yet it masks decisive structural changes such as the surge of institutional capital, the build-to-rent boom in Sunbelt states, and a demographic wave of millennial buyers who are overcoming past affordability barriers. Regional divergence is a defining feature: the South commands the largest share, while the West posts the fastest growth, driven by technology-led job creation, extreme supply shortages, and persistent remote-work migration flows. Institutional investors-led by Blackstone, Invitation Homes, and other REITs-continue to scale portfolios, accelerating professional management standards and deepening liquidity across asset classes. At the same time, federal energy-efficiency incentives, advanced property-management tools, and fractional-ownership platforms are re-shaping demand patterns and opening new entry points for retail investors. Countervailing headwinds remain, particularly mortgage-rate volatility, construction-labor shortages, and fast-rising insurance premiums in climate-risk zones, creating a bifurcated market in which affordable and luxury segments move in opposite directions.

United States Residential Real Estate Market Trends and Insights

Accelerated Build-to-Rent Single-Family Demand in Sunbelt States

Single-family build-to-rent (BTR) deliveries tripled from 2019 to 2023, surging 307% as developers raced to meet demand in Texas, Florida, Arizona, Georgia, and North Carolina. A record 27,495 BTR homes were completed in 2023, up 75% year on year, with an additional pipeline of 45,400 units slated for delivery between 2024 and 2026. American Homes 4 Rent recently surpassed 10,000 purpose-built homes and disclosed another 10,000 in planning, underscoring the institutional confidence in the model. Phoenix, Dallas, and Atlanta have become focal points for BTR communities, reflecting shifting consumer preferences toward single-family living without ownership burdens. The segment is expected to remain a principal growth engine through 2030 as affordability constraints and lifestyle flexibility reinforce tenant demand.

Surge in Remote-Work-Driven Migration to Second-Tier Metros

Remote work accounted for roughly 28% of paid workdays in early 2024, enabling households to decouple employment from housing location and relocate to more affordable cities. Small towns under 250,000 residents attracted 291,400 new inhabitants in 2023, surpassing large-city inflows for the first time since the 1970s. Relocating workers saved between USD 1,200 and USD 12,000 in annual housing costs and often purchased homes priced USD 7,500 below those in their origin cities. Charlotte, Raleigh, and Orlando emerge as beneficiaries, combining job creation with lower costs. The migration trend is structurally expanding the United States residential real estate market by redirecting capital and labor to second-tier metros poised for sustained demand.

Mortgage-Rate Volatility Dampening Affordability

Average 30-year fixed mortgage rates hovered near 6.93% in January 2025, a level that widened the gap between historic and prevailing rates, locking many owners into existing loans. Freddie Mac calculated the monetary value of this lock-in at USD 47,800 for the typical conventional borrower in late 2024. Inventory scarcity stemming from the lock-in feeds upward price pressure, even as first-time buyers' share fell to 24% in 2024, the lowest since 1981. Forecasts suggest rates may drift to 6.5% by Q4 2025, yet they remain far above sub-4% levels from 2021, signaling ongoing friction that tempers activity in the United States residential real estate market.

Other drivers and restraints analyzed in the detailed report include:

- Institutional Capital Inflow via Residential REITs & PE Funds

- Federal Incentives for Net-Zero & Energy-Efficient Homes

- Restraint - Rising Insurance Premiums in Climate-Risk Zones

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Apartments and condominiums accounted for 81% of the United States residential real estate market in 2024, outpacing villas and landed houses, and are set to grow at a 2.10% CAGR through 2030. Institutions accelerated multifamily supply as Blackstone acquired AIR Communities for USD 10 billion, reinforcing confidence in stabilized rental income. Build-to-rent momentum further expands the rental pool, with 27,495 dedicated BTR units delivered in 2023. The United States residential real estate market size for apartments is therefore poised to widen as household formation shifts toward flexible, amenity-rich communities.

Villas and landed houses represent 19% of inventory yet confront climate insurance and affordability headwinds, especially in high-risk coastal counties where premiums spike. Demand persists in luxury enclaves with robust wealth inflows, but new supply remains constrained by land scarcity and zoning. Institutional entry into purpose-built single-family rentals is bridging the gap, offering detached living without ownership hurdles and further diversifying the United States residential real estate market.

The sales channel held 78% of the United States residential real estate market share in 2024, though rental revenue is expanding at a 2.26% CAGR through 2030 as mortgages stay elevated. Invitation Homes alone earmarked USD 600 million to USD 1 billion in acquisitions for 2025. Institutional financing capacity and professional management enhance tenant experiences, reinforcing demand for leased housing.

Owner-occupier transactions still dominate the United States residential real estate market size; however, the lock-in effect and tighter credit standards push more households to rent longer. Demographic trends amplify this shift as millennials seek optionality before committing to ownership, suggesting the rental share will rise gradually yet persistently.

The United States Residential Real Estate Market is Segmented by Property Type (Apartments and Condominiums, and Villas and Landed Houses), by Price Band (Affordable, Mid-Market and Luxury), by Business Model (Sales and Rental), by Mode of Sale (Primary and Secondary), and by Region (Northeast, Midwest, Southeast, West and Southwest). The Market Forecasts are Provided in Terms of Value (USD)

List of Companies Covered in this Report:

- Invitation Homes Inc.

- Equity Residential

- AvalonBay Communities Inc.

- American Homes 4 Rent

- Brookfield Residential Properties Inc.

- Greystar Real Estate Partners LLC

- Lennar Corporation

- D.R. Horton Inc.

- PulteGroup Inc.

- KB Home

- Toll Brothers Inc.

- Mill Creek Residential Trust LLC

- Alliance Residential Company

- Lincoln Property Company

- The Michaels Organization

- Essex Property Trust Inc.

- Simon Property Group (Residential Arm)

- RE/MAX Holdings Inc.

- Keller Williams Realty Inc.

- Redfin Corporation

- Opendoor Technologies Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Overview of the Economy and Market

- 4.2 Real Estate Buying Trends - Socioeconomic and Demographic Insights

- 4.3 Regulatory Outlook

- 4.4 Technological Outlook

- 4.5 Insights into Rental Yields in Real Estate Segment

- 4.6 Real Estate Lending Dynamics

- 4.7 Insights Into Affordable Housing Support Provided by Government and Public-private Partnerships

- 4.8 Market Drivers

- 4.8.1 Accelerated Build-for-Rent Single-Family Demand in Sunbelt States

- 4.8.2 Surge in Remote-Work-Driven Migration to Second-Tier Metros

- 4.8.3 Institutional Capital Inflow via Residential REITs and PE Funds

- 4.8.4 Federal Incentives for Net-Zero and Energy-Efficient Homes

- 4.8.5 Technology-Enabled Sales Channels (iBuying, Fractional Ownership)

- 4.8.6 Demographic Tailwinds from Millennials Entering Prime Buying Years

- 4.9 Market Restraints

- 4.9.1 Mortgage-Rate Volatility Dampening Affordability

- 4.9.2 Construction-Labor Shortages and Escalating Material Costs

- 4.9.3 Local Zoning Restrictions Limiting New Supply

- 4.9.4 Rising Insurance Premiums in Climate-Risk Zones

- 4.10 Value / Supply-Chain Analysis

- 4.10.1 Overview

- 4.10.2 Real Estate Developers and Contractors - Key Quantitative and Qualitative Insights

- 4.10.3 Real Estate Brokers and Agents - Key Quantitative and Qualitative Insights

- 4.10.4 Property Management Companies - Key Quantitative and Qualitative Insights

- 4.10.5 Insights on Valuation Advisory and Other Real Estate Services

- 4.10.6 State of the Building Materials Industry and Partnerships with Key Developers

- 4.10.7 Insights on Key Strategic Real Estate Investors/Buyers in the Market

- 4.11 Porter's Five Forces

- 4.11.1 Threat of New Entrants

- 4.11.2 Bargaining Power of Buyers/Consumers

- 4.11.3 Bargaining Power of Suppliers

- 4.11.4 Threat of Substitute Products

- 4.11.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Property Type

- 5.1.1 Apartments and Condominiums

- 5.1.2 Villas and Landed Houses

- 5.2 By Price Band

- 5.2.1 Affordable

- 5.2.2 Mid-Market

- 5.2.3 Luxury

- 5.3 By Business Model

- 5.3.1 Sales

- 5.3.2 Rental

- 5.4 By Mode of Sale

- 5.4.1 Primary (New-Build)

- 5.4.2 Secondary (Existing-Home Resale)

- 5.5 By Region

- 5.5.1 Northeast

- 5.5.2 Midwest

- 5.5.3 Southeast

- 5.5.4 West

- 5.5.5 Southwest

6 Competitive Landscape

- 6.1 Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, Recent Developments)

- 6.3.1 Invitation Homes Inc.

- 6.3.2 Equity Residential

- 6.3.3 AvalonBay Communities Inc.

- 6.3.4 American Homes 4 Rent

- 6.3.5 Brookfield Residential Properties Inc.

- 6.3.6 Greystar Real Estate Partners LLC

- 6.3.7 Lennar Corporation

- 6.3.8 D.R. Horton Inc.

- 6.3.9 PulteGroup Inc.

- 6.3.10 KB Home

- 6.3.11 Toll Brothers Inc.

- 6.3.12 Mill Creek Residential Trust LLC

- 6.3.13 Alliance Residential Company

- 6.3.14 Lincoln Property Company

- 6.3.15 The Michaels Organization

- 6.3.16 Essex Property Trust Inc.

- 6.3.17 Simon Property Group (Residential Arm)

- 6.3.18 RE/MAX Holdings Inc.

- 6.3.19 Keller Williams Realty Inc.

- 6.3.20 Redfin Corporation

- 6.3.21 Opendoor Technologies Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment