PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850053

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850053

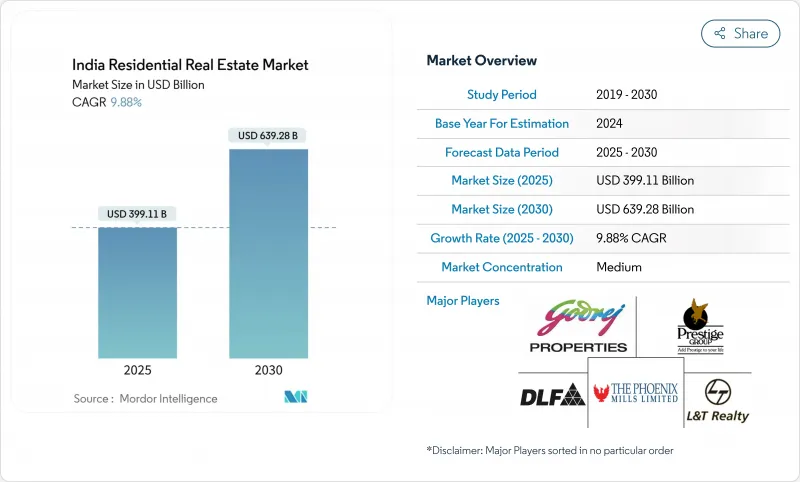

India Residential Real Estate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The India Residential Real Estate Market size is estimated at USD 399.11 billion in 2025, and is expected to reach USD 639.28 billion by 2030, at a CAGR of 9.88% during the forecast period (2025-2030).

Demand is rising on the back of technology-sector hiring, government housing incentives, and lifestyle shifts toward larger dwellings in peripheral micro-markets. Faster approvals under PMAY-U and SWAMIH Fund deployment have unlocked stalled supply, while the June 2025 repo-rate reduction has lowered effective home-loan rates below 8%, improving affordability. Hyderabad is the fastest-growing city segment, forecast to post a 10.58% CAGR through 2030. The IT and life-sciences clusters around the Outer Ring Road continue to attract high-skill migrants whose housing preferences span from premium condominiums in the Financial District to expansive villas in Kondapur and Kokapet. Robust state-government digitization of approval workflows has reduced median project-clearance times, prompting national developers to intensify land banking near upcoming metro extensions.

India Residential Real Estate Market Trends and Insights

Surging Demand from IT/ITeS Workforce Concentrations in Bengaluru & Hyderabad Driving Mid-segment Sales

Technology employment hubs have triggered localized demand surges that extend into suburban corridors of Bengaluru and Hyderabad. Hybrid work policies reinforce appetite for mid-segment apartments with home-office space, evidenced by a 4% rise in Bengaluru housing sales during H1 2024. Developers such as Prestige Group have responded with multi-tower launches in peripheral zones that offer improved amenities. Supply chain partners benefit from predictable volume pipelines, while municipal authorities accelerate infrastructure upgrades to sustain commuter flows. Continued momentum relies on persistent IT hiring and stable remote-working practices that keep mid-segment absorption elevated in the India residential real estate market.

Expedited Approvals under PMAY-U and SWAMIH Fund Accelerating Stalled Affordable Housing Projects

Government support has unlocked 90.25 lakh completed homes as of January 2025 and extended the scheme deadline to December 2025, aided by SWAMIH Fund financing that registered more than 6,500 apartments in Greater Noida. Combined with PMAY-U 2.0's Rs 10 lakh crore budget, these approvals shorten construction cycles and restore buyer confidence. Developers secure faster cash inflows, allowing rotation of capital into new phases. States that digitize permit workflows gain early household relocations, raising urban service demand and reinforcing property tax bases. The India residential real estate market therefore absorbs affordable units without re-introducing earlier execution risks.

Persistently Elevated Input Costs Compressing Developer Margins and Project Launches

Steel and cement price stickiness has squeezed gross margins, forcing developers to widen premium inventory or slow affordable launches. Affordable supply share fell to 18% in 2023 as material escalation outpaced consumer price sensitivity. Builders experiment with procurement cooperatives and contract indexation clauses to tame volatility. The India residential real estate market will reclaim lost momentum when commodity costs align with pre-COVID trends.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Household Nuclearization in Urban India Increasing Unit Absorption per 1,000 People

- Escalating Interest from NRIs Leveraging Rupee Depreciation to Acquire Premium Homes in Metros

- Slow Insolvency Resolution for Stressed Projects Prolonging Supply Overhang in NCR

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Apartments & condominiums accounted for 64.2% of India residential real estate market share in 2024. High-rise formats fit land-scarce metros and enable shared utility costs. Developers capture scale economics through repeatable design templates, maintaining price points attractive to nuclear families. Villas & landed houses, although a smaller base, are forecast to rise at 10.30% CAGR, lifting India residential real estate market size for this segment. Post-pandemic preferences for private gardens and flexible indoor areas underpin demand. The hybrid work model legitimizes longer commutes, allowing villa buyers to choose peripheral plots where larger floorplates align with aspirational living.

The villa uptrend has prompted integrated townships that combine apartment towers, plotted developments, and recreational amenities. Such mixed-use formats diversify revenue and hedge project risk. For apartments, smart-home features and EV-charging infrastructure increasingly appear as standard, reinforcing consumer perceptions of value. In both cases, differentiated amenity packages remain the decisive factor that converts site visits to bookings, sustaining depth in the India residential real estate market.

The mid-market tier held 48% of India residential real estate market size in 2024. Ticket sizes between Rs 40 lakh and Rs 1 crore align with white-collar income growth and favorable loan-to-value norms. This stability helps lenders keep delinquency rates low and encourages developers to prioritize volume. Affordable housing, projected to grow at 10.19% CAGR, benefits from PMAY-U subsidies and low-cost funding, yet margin stress persists because price ceilings tighten profit windows.

Listed developers have shifted toward premium and luxury projects where margin buffers absorb commodity shocks. Luxury bookings rose 49% year on year, aided by NRI inflows. Nonetheless, policy clarity on credit-linked subsidies and input tax rebates could re-accelerate affordable launches. Balanced execution across tiers keeps the India residential real estate market resilient across business cycles.

The India Residential Real Estate Market is Segmented by Property Type (Apartments & Condominiums and Villas & Landed Houses), Price Band (Affordable, Mid-Market and Luxury), Mode of Sale (Primary and Secondary), Business Model (Sales and Rental) and Cities (Bengaluru, Mumbai, Delhi-NCR, Hyderabad, Pune, Chennai, Ahmedabad, Kolkata and Rest of India). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- DLF Ltd

- Godrej Properties

- Prestige Estates Projects

- Brigade Enterprises

- Sobha Ltd

- Oberoi Realty

- L&T Realty

- Phoenix Mills

- Mahindra Lifespace Developers

- Puravankara Ltd

- Kolte-Patil Developers

- Sunteck Realty

- Lodha Group (Macrotech Developers)

- Indiabulls Real Estate

- NBCC (India)

- Omaxe Ltd

- Ansal Properties & Infrastructure

- Bharti Realty

- Total Environment

- Casagrand Builders

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Overview of the Economy and Market

- 4.2 Real Estate Buying Trends - Socioeconomic and Demographic Insights

- 4.3 Regulatory Outlook

- 4.4 Technological Outlook

- 4.5 Insights into Rental Yields in Real Estate Segment

- 4.6 Real Estate Lending Dynamics

- 4.7 Insights Into Affordable Housing Support Provided by Government and Public-private Partnerships

- 4.8 Market Drivers

- 4.8.1 Surging Demand from IT/ITeS Workforce Concentrations in Bengaluru & Hyderabad Driving Mid-segment Sales

- 4.8.2 Expedited Approvals under 'PMAY-U' and SWAMIH Fund Accelerating Stalled Affordable Housing Projects

- 4.8.3 Rapid Household Nuclearization in Urban India Increasing Unit Absorption per 1,000 People

- 4.8.4 Escalating Interest from NRIs Leveraging Rupee Depreciation to Acquire Premium Homes in Metros

- 4.8.5 RERA-led Transparency Enhancing Consumer Confidence and Sales Velocity on Digital Platforms

- 4.8.6 Hybrid Work Model Boosting Peripheral Suburb Projects Offering Larger Configurations

- 4.9 Market Restraints

- 4.9.1 Persistently Elevated Input Costs (Steel, Cement) Compressing Developer Margins and Project Launches

- 4.9.2 Slow Insolvency Resolution for Stressed Projects Prolonging Supply Overhang in NCR

- 4.9.3 High Stamp Duty and Registration Levies in Key States Dampening Upgrade Transactions

- 4.9.4 Rising Mortgage Rates Post-2022 Pushing Affordability Index Above 60 in Tier-1 Cities

- 4.10 Value / Supply-Chain Analysis

- 4.10.1 Overview

- 4.10.2 Real estate developers & Contractors - Key Quantitative and Qualitative insights

- 4.10.3 Real estate brokers and agents - Key Quantitative and Qualitative insights

- 4.10.4 Property management companies -- Key Quantitative and Qualitative insights

- 4.10.5 Insights on Valuation Advisory and Other Real Estate Services

- 4.10.6 State of the building materials industry and partnerships with kep developers

- 4.10.7 Insights on key strategic real estate investors/buyers in the market

- 4.11 Porter's Five Forces

- 4.11.1 Bargaining Power of Suppliers

- 4.11.2 Bargaining Power of Buyers

- 4.11.3 Threat of New Entrants

- 4.11.4 Threat of Substitutes (Commercial, Co-living, Rentals)

- 4.11.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Property Type

- 5.1.1 Apartments & Condominiums

- 5.1.2 Villas & Landed Houses

- 5.2 By Price Band

- 5.2.1 Affordable

- 5.2.2 Mid-Market

- 5.2.3 Luxury

- 5.3 By Business Model

- 5.3.1 Sales

- 5.3.2 Rental

- 5.4 By Mode of Sale

- 5.4.1 Primary (New-Build)

- 5.4.2 Secondary (Existing Home Resale)

- 5.5 By Cities

- 5.5.1 Bengaluru

- 5.5.2 Mumbai

- 5.5.3 Delhi-NCR

- 5.5.4 Hyderabad

- 5.5.5 Pune

- 5.5.6 Chennai

- 5.5.7 Ahmedabad

- 5.5.8 Kolkata

- 5.5.9 Rest of India

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, JV, Land Acquisition)

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 DLF Ltd

- 6.4.2 Godrej Properties

- 6.4.3 Prestige Estates Projects

- 6.4.4 Brigade Enterprises

- 6.4.5 Sobha Ltd

- 6.4.6 Oberoi Realty

- 6.4.7 L&T Realty

- 6.4.8 Phoenix Mills

- 6.4.9 Mahindra Lifespace Developers

- 6.4.10 Puravankara Ltd

- 6.4.11 Kolte-Patil Developers

- 6.4.12 Sunteck Realty

- 6.4.13 Lodha Group (Macrotech Developers)

- 6.4.14 Indiabulls Real Estate

- 6.4.15 NBCC (India)

- 6.4.16 Omaxe Ltd

- 6.4.17 Ansal Properties & Infrastructure

- 6.4.18 Bharti Realty

- 6.4.19 Total Environment

- 6.4.20 Casagrand Builders

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment