PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850020

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850020

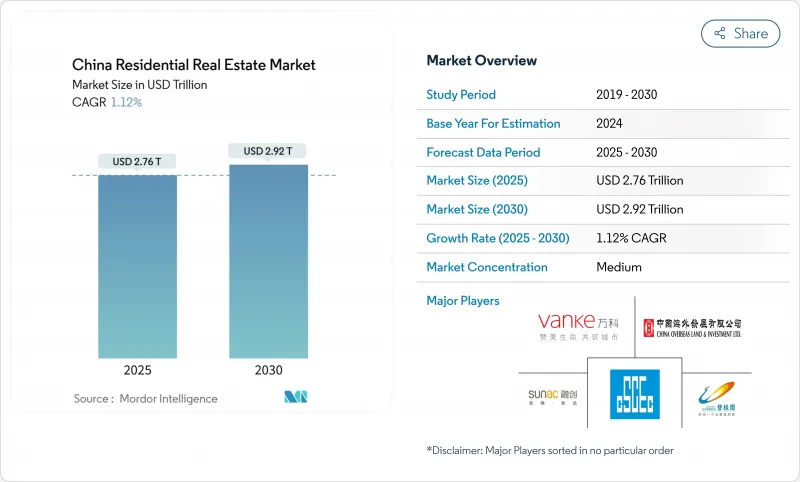

China Residential Real Estate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The China residential real estate market size is valued at USD 2.76 trillion in 2025 and is forecast to reach USD 2.9 trillion by 2030, advancing at a 1.12% CAGR over the period.

This growth path signals a decisive pivot from rapid expansion toward a policy-guided model anchored in "housing for living," a shift accelerated by the "Three Red Lines" financing regime. Shanghai remains the single-largest city-level contributor, yet Guangzhou is posting the strongest forward momentum as relaxed hukou rules and infrastructure upgrades lift transaction volumes. Apartments and condominiums keep an overwhelming lead in unit sales, while the rental business model is gaining traction on the back of central-bank directives that promote long-term leasing platforms. Intensifying state-owned enterprise (SOE) consolidation, demographic headwinds, and the emergence of smart-home demand collectively shape the competitive and investment landscape of the China residential real estate market.

China Residential Real Estate Market Trends and Insights

Post-COVID Urbanisation Surge in Greater Bay Area

Shenzhen's removal of transfer restrictions and shortening of capital-gains tax exemption periods frame a new regional playbook that other metros are already studying. The policy mix links residential demand to the region's integration with Hong Kong's capital markets, creating financing channels beyond onshore bank credit. Migratory inflows of highly educated workers reinforce premium-segment absorption even as national population growth turns negative. Improved cross-border infrastructure-from the Hong Kong-Zhuhai-Macau Bridge to high-speed rail extensions-elevates commuter reach and underpins multi-city housing demand in the China residential real estate market.

Relaxed Hukou Rules in Tier-2 Cities Boosting Migrant Home-ownership

More than 20 municipalities have tied residency permits to property purchases, potentially releasing CNY 2 trillion in household consumption upside. Access to urban social services raises effective disposable income for new migrants and multiplies housing spend across furnishings, appliances, and renovation. Tier-2 locales-Wuhan, Chengdu, and Xi'an-offer moderate land costs and employment centres that appeal to upwardly mobile households priced out of Tier-1 markets. Inventories accumulated during the 2021-2023 downturn now serve as a ready stock of units, reducing the time lag between policy stimulus and transaction closures across the China residential real estate market.

"Three-Red-Lines" Leverage Caps Curtailing New Launches

Defaults exceeding USD 100 billion since 2020 underline the liquidity crunch dogging highly geared private developers. New housing starts dropped over 60% versus pre-pandemic peaks, tightening future supply pipelines, especially in Tier-1 land-scarce sub-markets. SOEs, less restricted by the ratio thresholds, gain land-bank access, accelerating market concentration. While the policy reduces systemic risk, it constrains the China residential real estate market's capacity to meet latent demand once sentiment revives.

Other drivers and restraints analyzed in the detailed report include:

- Housing Provident Fund Mortgage Subsidies Underpinning First-time Purchases

- Demand for Smart-home-ready Apartments Among Tech-savvy Millennials

- Youth Unemployment Shrinking the First-time Buyer Pool

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The apartment category accounted for 87% of China residential real estate market share in 2024, anchored by land-use efficiency mandates in dense urban cores. Villas and landed houses, while representing a smaller base, are on track for a 1.16% CAGR through 2030 as easing family-size limits and remote-work preferences lift larger-unit demand. Land-scarce Tier-1 cities will continue to rely on high-rise supply; however, suburban parcels in Guangzhou, Chengdu, and Suzhou are earmarked for low-density developments. Developers re-design multigenerational floor plans, incorporating dual master suites, home offices, and garden spaces to capture emerging villa spending power, widening product segmentation in the China residential real estate market.

A parallel trend elevates amenity thresholds in core-city apartments. Smart-home infrastructure and community-level co-working hubs now appear in sales brochures as standard features rather than premiums. This quality leap narrows the traditional perception gap between high-rise living and villa lifestyles. Intensified buyer scrutiny of construction quality, following high-profile project delays, is nudging developers to adopt prefabricated components that reduce delivery risk and enhance brand equity across the China residential real estate market.

The mid-market captured 51% of transaction value in 2024, demonstrating its central role as the affordability sweet spot for China's urban middle class. Housing Provident Fund subsidies and tiered down-payment ratios sustain this volume cornerstone. Concurrently, luxury homes chart a 1.17% CAGR to 2030 as wealth concentration intensifies and buyers treat prime assets as inflation hedges. Price ceilings in select cities are loosening, enabling developers to test ultra-luxury price points and bespoke fit-outs, including private elevators and in-unit wellness suites.

The affordable tier confronts structural issues despite policy support to convert unsold commercial stock into subsidised rentals. Quality concerns and location drawbacks limit uptake, prompting municipal authorities to re-evaluate conversion criteria. The divergence underscores policy challenges in balancing inclusivity with sustainable economics in the China residential real estate market.

The China Residential Real Estate Market is Segmented by Property Type (Apartments & Condominiums and Villas & Landed Houses), Price Band (Affordable, Mid-Market and Luxury), Mode of Sale (Primary and Secondary), Business Model (Sales and Rental) and Key Cities (Shenzhen, Beijing, Shanghai, Hangzhou, Guangzhou, and Other Key Cities). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- China Vanke Co., Ltd

- Country Garden Holdings Co., Ltd

- China State Construction Engineering Corp. Ltd

- China Overseas Land & Investment Ltd

- Poly Developments & Holdings Group Co., Ltd

- Greenland Holdings Corp. Ltd

- Longfor Group Holdings Ltd

- Sunac China Holdings Ltd

- Evergrande Real Estate Group Ltd

- Shimao Group Holdings Ltd

- CIFI Holdings (Group) Co., Ltd

- Greentown China Holdings Ltd

- Seazen Holdings Co., Ltd

- R&F Properties Co., Ltd

- Agile Group Holdings Ltd

- KWG Group Holdings Ltd

- Yango Group Co., Ltd

- China Jinmao Holdings Group Ltd

- China Merchants Shekou Industrial Zone Holdings Co., Ltd*

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Overview of the Economy and Market

- 4.2 Real Estate Buying Trends - Socioeconomic and Demographic Insights

- 4.3 Regulatory Outlook

- 4.4 Technological Outlook

- 4.5 Insights into Rental Yields in Real Estate Segment

- 4.6 Real Estate Lending Dynamics

- 4.7 Insights Into Affordable Housing Support Provided by Government and Public-private Partnerships

- 4.8 Market Drivers

- 4.8.1 Post-COVID urbanisation surge in Greater Bay Area

- 4.8.2 Relaxed Hukou rules in Tier-2 cities boosting migrant home-ownership

- 4.8.3 Housing Provident Fund mortgage subsidies underpinning first-time purchases

- 4.8.4 Demand for smart-home-ready apartments among tech-savvy millennials

- 4.8.5 Domestic REIT listings unlocking fresh capital for developers

- 4.8.6 Rise of institutional buy-to-rent funds in mega-cities

- 4.9 Market Restraints

- 4.9.1 "Three-Red-Lines" leverage caps curtailing new launches

- 4.9.2 Oversupply of premium condos in Tier-3/4 cities depressing prices

- 4.9.3 Youth unemployment (16-24) shrinking first-time buyer pool

- 4.9.4 Demographic contraction in northern provinces weakening demand

- 4.10 Value / Supply-Chain Analysis

- 4.10.1 Overview

- 4.10.2 Real Estate Developers and Contractors - Key Quantitative and Qualitative Insights

- 4.10.3 Real Estate Brokers and Agents - Key Quantitative and Qualitative Insights

- 4.10.4 Property Management Companies - Key Quantitative and Qualitative Insights

- 4.10.5 Insights on Valuation Advisory and Other Real Estate Services

- 4.10.6 State of the Building Materials Industry and Partnerships with Key Developers

- 4.10.7 Insights on Key Strategic Real Estate Investors/Buyers in the Market

- 4.11 Porter's Five Forces

- 4.11.1 Bargaining Power of Suppliers

- 4.11.2 Bargaining Power of Buyers

- 4.11.3 Threat of New Entrants

- 4.11.4 Threat of Substitutes

- 4.11.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Property Type

- 5.1.1 Apartments & Condominiums

- 5.1.2 Villas & Landed Houses

- 5.2 By Price Band

- 5.2.1 Affordable

- 5.2.2 Mid-Market

- 5.2.3 Luxury

- 5.3 By Business Model

- 5.3.1 Sales

- 5.3.2 Rental

- 5.4 By Mode of Sale

- 5.4.1 Primary (New-Build)

- 5.4.2 Secondary (Existing Home Resale)

- 5.5 By Key Cities

- 5.5.1 Shenzhen

- 5.5.2 Beijing

- 5.5.3 Shanghai

- 5.5.4 Hangzhou

- 5.5.5 Guangzhou

- 5.5.6 Other Key Cities

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 China Vanke Co., Ltd

- 6.4.2 Country Garden Holdings Co., Ltd

- 6.4.3 China State Construction Engineering Corp. Ltd

- 6.4.4 China Overseas Land & Investment Ltd

- 6.4.5 Poly Developments & Holdings Group Co., Ltd

- 6.4.6 Greenland Holdings Corp. Ltd

- 6.4.7 Longfor Group Holdings Ltd

- 6.4.8 Sunac China Holdings Ltd

- 6.4.9 Evergrande Real Estate Group Ltd

- 6.4.10 Shimao Group Holdings Ltd

- 6.4.11 CIFI Holdings (Group) Co., Ltd

- 6.4.12 Greentown China Holdings Ltd

- 6.4.13 Seazen Holdings Co., Ltd

- 6.4.14 R&F Properties Co., Ltd

- 6.4.15 Agile Group Holdings Ltd

- 6.4.16 KWG Group Holdings Ltd

- 6.4.17 Yango Group Co., Ltd

- 6.4.18 China Jinmao Holdings Group Ltd

- 6.4.19 China Merchants Shekou Industrial Zone Holdings Co., Ltd*

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment