PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849972

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849972

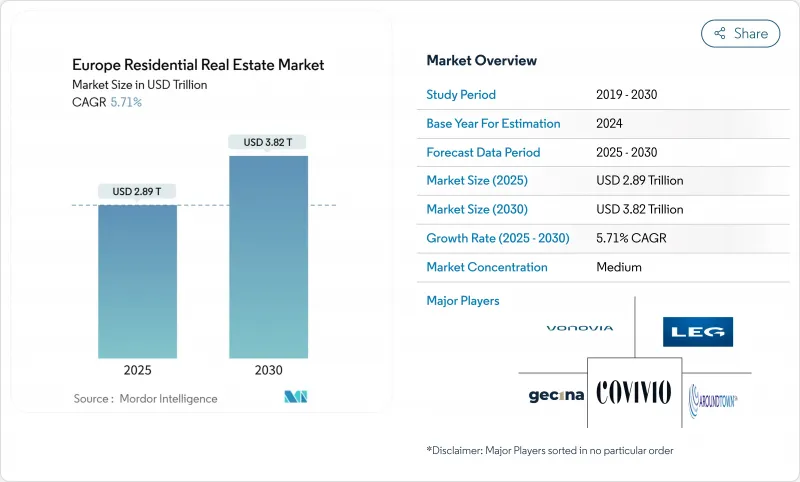

Europe Residential Real Estate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Europe residential real estate market size is valued at USD 2.89 trillion in 2025 and is forecast to expand to USD 3.82 trillion by 2030, reflecting a 5.71% CAGR.

This trajectory illustrates the European real estate market's capacity to absorb changing monetary policies, stricter energy regulations, and shifting demographic patterns. Demand is gravitating toward professionally managed rental platforms as institutional investors prioritise predictable cash flows, while supply bottlenecks in major conurbations keep overall vacancy below 3% in many gateway cities. Policy-driven retrofitting mandates under the EU Green Deal are reshaping construction pipelines, and secondary sales continue to dominate because Europe's housing inventory skews older. Digital-nomad visa programmes, single-person household growth, and the rise of purpose-built rental communities together underpin a balanced yet resilient expansion path for the European real estate market

Europe Residential Real Estate Market Trends and Insights

Surge in Cross-Border Private-Equity Inflows Targeting European Build-to-Rent Portfolios

Cross-border private equity tripled its residential spending over the past decade, underpinning a structural swing toward large-scale build-to-rent assets. Liquidity from global pension and sovereign-wealth funds severs the traditional wage-to-price tether by injecting capital more sensitive to interest-rate cycles than household income. The United Kingdom reclaimed the top spot for cross-border allocations, with 84% of surveyed investors planning exposure following currency readjustments. Build-to-rent strategies now account for 32% of institutional "living-sector" allocations, eclipsing industrial logistics. Stable cash flows, inflation-linked leases, and embedded refurbishment potential make these portfolios a hedge against office-market volatility. The resulting depth of capital supports construction financing despite higher funding costs, cushioning the European real estate market against rate-driven slowdowns.

EU Green Deal Incentives Accelerating Deep-Retrofit Demand Across Housing Stock

The revised Energy Performance of Buildings Directive mandates all residential stock to reach at least class E by 2030, pushing 85% of pre-2000 dwellings into renovation pipelines. Member States must issue "renovation passports," coordinate one-stop advisory shops, and phase out fossil-fuel boilers by 2035. Zero-emission targets for new builds after 2028 create a dual demand surge: upgrading legacy assets and delivering energy-positive developments. The policy injects a EUR 86 billion funding gap for 2025-2027 that lenders are filling through sustainability-linked mortgages and green bonds. Properties rated A or B now trade at premiums of up to 12% in core cities, incentivising landlords to accelerate cap-ex schedules. For the European real estate market, the directive anchors long-dated refurbishment cash flows and rewards forward-thinking owners with valuation upside.

ECB Rate Hikes Widening Mortgage Affordability Gap

The abrupt end to ultra-low financing saw average French mortgage rates peak at 3.63% before easing to 2.75% by late-2024, yet transactions still fell 35.6% from 2021 levels. ECB analysis classifies over 80% of euro-area housing markets as overvalued, exposing borrowers to income-stress risks if rates rebound. Norwegian variable mortgages stand near 5.56%, dampening purchasing power despite a projected base-rate cut in 2025. Younger buyers face stricter loan-to-income caps and shorter amortisation periods, extending the time needed to build down payments. Although new-build supply lags, tighter credit keeps the European real estate market's owner-occupier demand subdued in the short run.

Other drivers and restraints analyzed in the detailed report include:

- Rise in Single-Person Households Fuelling Multi-Family Apartment Uptake in Urban Cores

- Digital-Nomad Visa Adoption Boosting Southern-Europe Second-Home Purchases

- Stricter EPC Rules Inflating Landlord Cap-Ex

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Villas and Landed Houses held 65% of the Europe residential real estate market share in 2024 while Apartments and Condominiums are set to record a 5.96% CAGR through 2030. Institutional interest in scalable multi-family assets concentrates capital and accelerates construction pipelines, while wooden-hybrid designs trim embodied carbon and shorten build times.

The apartment surge is reinforced by ESG-linked loan pricing that rewards energy-efficient designs, helping sponsors secure debt at spreads 25-35 basis points tighter than less efficient stock. Villas remain attractive to families seeking outdoor space, and peripheral transit upgrades preserve demand for detached units. Yet the European real estate market size tied to urban apartments is rising as demographic trends favour compact living and as municipalities unlock brownfield sites for higher-density programmes.

Mid-Market transactions represented 46% of the Europe residential real estate market market size in 2024, yet the Affordable tier is projected to expand at a 5.90% CAGR on the back of public-private partnerships and zoning incentives. Governments tap institutional funds via long-income leases, offering inflation-indexed rents backed by social-housing agencies.

Greystar and ABP's EUR 420 million Essential Housing venture illustrates capital appetite for below-market-rent assets, delivering yields that compress only modestly compared with prime market-rate stock. Luxury remains resilient in global-city cores but captures a small volume share. The policy push toward affordability thus reshapes pipeline composition and injects social objectives into the European real estate market.

The Europe Residential Real Estate Market is Segmented by Property Type (Apartments & Condominiums and Villas & Landed Houses), Price Band (Affordable, Mid-Market and Luxury), Mode of Sale (Primary and Secondary), Business Model (Sales and Rental) and Country (Germany, United Kingdom, France, Spain, Italy, Netherlands, Sweden, Denmark, Norway and Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Vonovia SE

- LEG Immobilien AG

- Gecina SA

- Covivio SA

- Aroundtown SA

- Heimstaden Bostad AB

- Grainger PLC

- Aedifica SA

- CPI Property Group

- TAG Immobilien AG

- Consus Real Estate AG

- Bonava AB

- Nexity SA

- Barratt Developments PLC

- Taylor Wimpey PLC

- Persimmon PLC

- Skanska AB

- NCC AB

- Glenveagh Properties PLC

- Inmobiliaria Colonial SOCIMI SA

- Patrizia SE

- Adler Group SA

- Unite Group PLC (Student Housing)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Overview of the Economy and Market

- 4.2 Real Estate Buying Trends - Socioeconomic and Demographic Insights

- 4.3 Regulatory Outlook

- 4.4 Technological Outlook

- 4.5 Insights into Rental Yields in Real Estate Segment

- 4.6 Real Estate Lending Dynamics

- 4.7 Insights Into Affordable Housing Support Provided by Government and Public-private Partnerships

- 4.8 Market Drivers

- 4.8.1 Surge in cross-border private-equity inflows targeting European build-to-rent portfolios

- 4.8.2 EU Green Deal incentives accelerating deep-retrofit demand across housing stock

- 4.8.3 Rise in single-person households fuelling multi-family apartment uptake in urban cores

- 4.8.4 Digital-nomad visa adoption boosting Southern-Europe second-home purchases

- 4.8.5 Institutional capital pivot toward purpose-built rental communities

- 4.8.6 Ageing population expanding senior- and assisted-living developments in Germany & Nordics

- 4.9 Market Restraints

- 4.9.1 ECB rate hikes widening mortgage affordability gap

- 4.9.2 Stricter EPC rules inflating landlord cap-ex

- 4.9.3 Southern-Europe wage stagnation constraining first-time-buyer affordability

- 4.9.4 Urban growth boundaries limiting green-field land supply in core cities

- 4.10 Value / Supply-Chain Analysis

- 4.10.1 Overview

- 4.10.2 Real Estate Developers and Contractors - Key Quantitative and Qualitative Insights

- 4.10.3 Real Estate Brokers and Agents - Key Quantitative and Qualitative Insights

- 4.10.4 Property Management Companies - Key Quantitative and Qualitative Insights

- 4.10.5 Insights on Valuation Advisory and Other Real Estate Services

- 4.10.6 State of the Building Materials Industry and Partnerships with Key Developers

- 4.10.7 Insights on Key Strategic Real Estate Investors/Buyers in the Market

- 4.11 Porter's Five Forces

- 4.11.1 Bargaining Power of Suppliers

- 4.11.2 Bargaining Power of Buyers

- 4.11.3 Threat of New Entrants

- 4.11.4 Threat of Substitutes

- 4.11.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Property Type

- 5.1.1 Apartments & Condominiums

- 5.1.2 Villas & Landed Houses

- 5.2 By Price Band

- 5.2.1 Affordable

- 5.2.2 Mid-Market

- 5.2.3 Luxury

- 5.3 By Mode of Sale

- 5.3.1 Primary (New-Build)

- 5.3.2 Secondary (Existing Home Resale)

- 5.4 By Business Model

- 5.4.1 Sales

- 5.4.2 Rental

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Spain

- 5.5.5 Italy

- 5.5.6 Netherlands

- 5.5.7 Sweden

- 5.5.8 Denmark

- 5.5.9 Norway

- 5.5.10 Rest of Europe

6 Competitive Landscape

- 6.1 Strategic Moves & Investments

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 Vonovia SE

- 6.3.2 LEG Immobilien AG

- 6.3.3 Gecina SA

- 6.3.4 Covivio SA

- 6.3.5 Aroundtown SA

- 6.3.6 Heimstaden Bostad AB

- 6.3.7 Grainger PLC

- 6.3.8 Aedifica SA

- 6.3.9 CPI Property Group

- 6.3.10 TAG Immobilien AG

- 6.3.11 Consus Real Estate AG

- 6.3.12 Bonava AB

- 6.3.13 Nexity SA

- 6.3.14 Barratt Developments PLC

- 6.3.15 Taylor Wimpey PLC

- 6.3.16 Persimmon PLC

- 6.3.17 Skanska AB

- 6.3.18 NCC AB

- 6.3.19 Glenveagh Properties PLC

- 6.3.20 Inmobiliaria Colonial SOCIMI SA

- 6.3.21 Patrizia SE

- 6.3.22 Adler Group SA

- 6.3.23 Unite Group PLC (Student Housing)

7 Market Opportunities & Future Outlook