PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836460

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836460

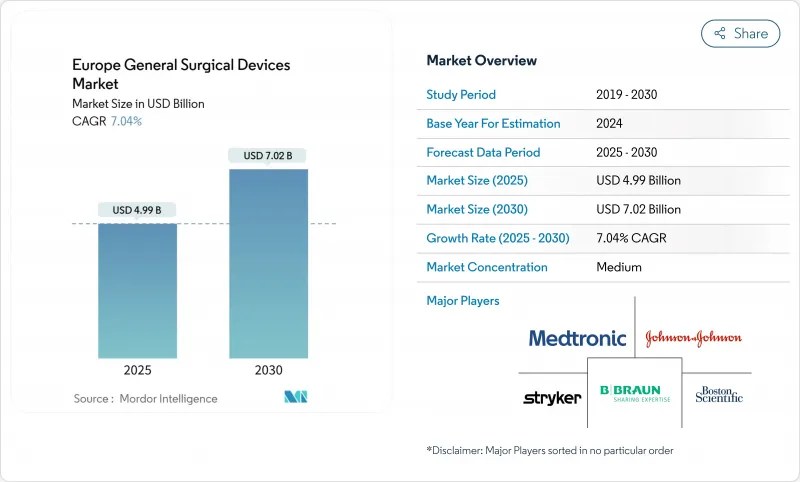

Europe General Surgical Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Europe General Surgical Devices Market size is estimated at USD 4.99 billion in 2025, and is expected to reach USD 7.02 billion by 2030, at a CAGR of 7.04% during the forecast period (2025-2030).

Robust procedure growth in minimally invasive and robotic platforms, coupled with a rapidly aging population and widening clinical indications, underpins this expansion. EU-MDR compliance costs have simultaneously driven strategic consolidation, positioning well-capitalized multinationals to absorb regulatory overheads while smaller firms either exit or seek partnerships. Hospital purchasers intensify price negotiations, yet procedure volumes keep climbing as health systems shift toward day-case models to relieve capacity constraints. Supply-chain resilience has become a board-level priority, with manufacturers now directing 3-5% of annual revenue to logistics diversification.

Europe General Surgical Devices Market Trends and Insights

Rising demand for minimally invasive procedures

Healthcare providers across Europe continue to transition from open to minimally invasive techniques, aiming to cut recovery times and free inpatient capacity. NHS England projects 500,000 robotic-assisted operations annually by 2035, signaling a steep adoption curve that will accelerate capital equipment refresh cycles. Nordic centers mirror this trend, installing more than 120 robotic platforms to support hernia repairs and other soft-tissue interventions. Energy-based devices such as Olympus ESG-410, which combine hybrid, bipolar, and ultrasonic modalities, are benefiting from the broader shift as surgeons seek multifunctional tools. Hospitals deploying Boston Scientific workflow-advisory solutions report 40% higher transcatheter volumes, illustrating how digital integration multiplies throughput.

Aging population & procedure volume growth

Citizens aged >= 65 represent a fast-growing cohort, particularly in Germany, Italy, and Spain, and this demographic shift fuels an uptick in joint replacements, cardiovascular interventions, and complex oncology resections. France still ranks 8th among OECD nations for hip replacement rates despite reimbursement cuts, underscoring latent demand. Ambulatory surgery centers (ASCs) have flagged cardiology as their highest-growth specialty, aided by favorable Medicare-aligned payments and private equity investment. Intensivist shortages prompt a tighter integration of surgery and critical-care services, with anesthesiologists now managing 70% of ICU beds across Europe.

EU-MDR compliance costs & approval delays

Conformity assurance can cost from EUR 5,000 for basic analyses to EUR 500,000 for Class III trials, squeezing SME cash flows and prompting portfolio rationalization. Only 43 notified bodies remain to review an estimated 500,000 devices, leading to extended approval cycles and deferred launches. Industry surveys show half of device makers plan to withdraw or limit EU portfolios due to regulatory burdens.

Other drivers and restraints analyzed in the detailed report include:

- Rapid innovations in laparoscopic & robotic systems

- Shift toward day-case surgeries & disposable kits

- Purchasing-group price pressure on OEM margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hand-held instruments retained a 34.57% Europe general surgical devices market share in 2024, reflecting their ubiquity in routine interventions. Robotic and computer-assisted systems, however, are set to outpace all categories at a 9.11% CAGR to 2030, powered by broader clinical acceptance and falling per-procedure costs. Olympus THUNDERBEAT and VISERA 4K platforms illustrate how imaging and energy technologies converge to enhance tissue handling and visualization. Medtronic's PlasmaBlade operates at significantly lower temperatures than legacy electrocautery, reducing collateral damage. Hybrid devices that integrate sensors and wireless connectivity are poised to stretch the competitive gap between premium and value tiers.

Second-generation robotics address prior cost and footprint limitations, opening adoption among mid-sized centers. Europe general surgical devices market vendors increasingly bundle capital equipment with digital workflow software to create stickier customer relationships. Virtual-Ports' CE-marked laparoscopic accessories and Johnson & Johnson's Ottava-compatible generator exemplify targeted product updates that fit new robotic ecosystems. Wound-closure systems and trocar lines benefit from the day-case push, with single-use options mitigating sterilization bottlenecks and infection risk.

Minimally invasive techniques accounted for 71.24% of the Europe general surgical devices market size in 2024 and are advancing at an 8.22% CAGR, consolidating their position as the preferred standard of care. Improved optics, energy delivery, and haptic feedback allow surgeons to tackle complex pathologies with smaller incisions. Open surgery maintains a vital role for trauma and large tumor resections but is ceding volume steadily.

Fast docking times reported for the Hugo platform illustrate cumulative efficiency gains that reduce anesthesia duration and improve turnover. HoloSurge's 3D holography enters pilot phases, supporting safer resection planes in hepatobiliary cases. Europe general surgical devices market participants invest heavily in training centers to help surgeons climb new learning curves quickly, a prerequisite for payer support and technology credentialing.

The Europe General Surgical Devices Market Report is Segmented by Product (Hand-Held Surgical Instruments, Laparoscopic Devices, Electrosurgical Devices, Wound Closure Devices, and More), Procedure Approach (Open Surgery, and Minimally Invasive Surgery), Application (Gynecology and Urology, Cardiology, Orthopedic, and More) and Country (Germany, United Kingdom, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- B. Braun

- Johnson & Johnson (Ethicon / DePuy Synthes)

- Medtronic

- Stryker

- Olympus

- Boston Scientific

- Integer Holdings

- Conmed

- Smiths Group

- Zimmer Biomet

- Karl Storz SE

- Becton Dickinson & Co.

- Teleflex

- Coloplast

- Cooper Companies (Cooper Surgical)

- Erbe Elektromedizin

- Richard Wolf

- Intuitive Surgical

- Smiths Group

- Applied Medical Resources

- Surgical Innovations Group plc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for minimally-invasive procedures

- 4.2.2 Aging population and procedure volume growth

- 4.2.3 Rapid innovations in laparoscopic & robotic systems

- 4.2.4 Shift toward day-case surgeries & disposable kits

- 4.2.5 Favourable, procedure-linked reimbursement structures

- 4.2.6 Expansion of private hospital groups and ambulatory surgery centres

- 4.3 Market Restraints

- 4.3.1 EU-MDR compliance costs & approval delays

- 4.3.2 Purchasing-group price pressure on OEM margins

- 4.3.3 OR staff shortages constraining throughput

- 4.3.4 Persistent supply-chain vulnerabilities

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Hand-held Surgical Instruments

- 5.1.2 Laparoscopic Devices

- 5.1.3 Electrosurgical Devices

- 5.1.4 Wound-Closure Devices

- 5.1.5 Trocars and Access Systems

- 5.1.6 Robotic and Computer-Assisted Systems

- 5.1.7 Other Products

- 5.2 By Procedure Approach

- 5.2.1 Open Surgery

- 5.2.2 Minimally Invasive Surgery

- 5.3 By Application

- 5.3.1 Gynecology and Urology

- 5.3.2 Cardiology

- 5.3.3 Orthopedic

- 5.3.4 Neurology

- 5.3.5 General and Bariatric Surgery

- 5.3.6 Oncology

- 5.3.7 Other Applications

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Ambulatory Surgical Centers

- 5.4.3 Specialty Clinics

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 B. Braun Melsungen AG

- 6.3.2 Johnson & Johnson (Ethicon / DePuy Synthes)

- 6.3.3 Medtronic plc

- 6.3.4 Stryker Corporation

- 6.3.5 Olympus Corporation

- 6.3.6 Boston Scientific Corporation

- 6.3.7 Integer Holdings Corporation

- 6.3.8 Conmed Corporation

- 6.3.9 Smith & Nephew plc

- 6.3.10 Zimmer Biomet Holdings

- 6.3.11 Karl Storz SE

- 6.3.12 Becton Dickinson & Co.

- 6.3.13 Teleflex Incorporated

- 6.3.14 Coloplast A/S

- 6.3.15 Cooper Companies (Cooper Surgical)

- 6.3.16 Erbe Elektromedizin GmbH

- 6.3.17 Richard Wolf GmbH

- 6.3.18 Intuitive Surgical Inc.

- 6.3.19 Smiths Medical

- 6.3.20 Applied Medical Resources

- 6.3.21 Surgical Innovations Group plc

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment