PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907211

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907211

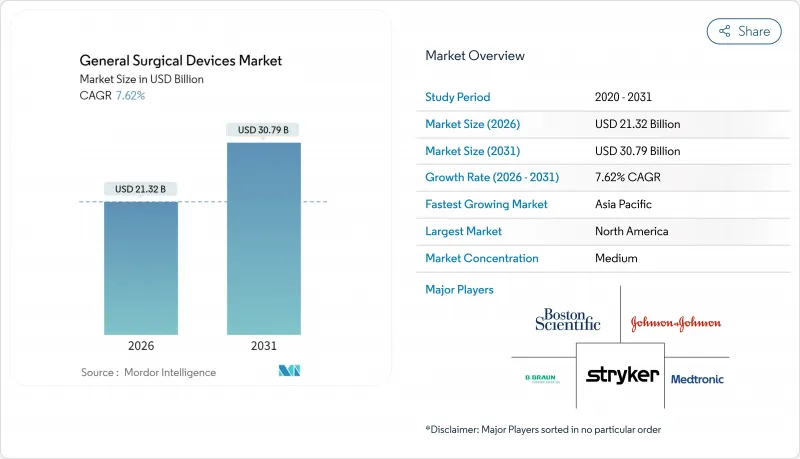

General Surgical Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The general surgical devices market was valued at USD 19.81 billion in 2025 and estimated to grow from USD 21.32 billion in 2026 to reach USD 30.79 billion by 2031, at a CAGR of 7.62% during the forecast period (2026-2031).

Momentum comes from rising surgical volumes, accelerated adoption of minimally invasive techniques, and continuous product innovation aimed at shortening recovery times and lowering complication rates. North America leads the general surgical devices market thanks to advanced infrastructure and favorable reimbursement, while Asia-Pacific is advancing fastest as governments scale hospital capacity and private operators add ambulatory sites. Disposable supplies retain dominance because infection-control rules favor single-use tools, yet rapid gains in robotic platforms illustrate the industry's pivot toward precision. Competitive intensity is increasing as large conglomerates defend their share against focused entrants bringing niche technologies to market.

Global General Surgical Devices Market Trends and Insights

Minimally invasive surgery adoption accelerates across specialties

Robotic navigation systems, specialized access ports, and refined imaging together help surgeons reduce tissue trauma, which in turn lowers length of stay by 2-3 days and halves the time patients need before returning to work. Orthopedics illustrates the shift as 68% of eligible procedures in 2024 already used MIS, and Stryker's Mako SmartRobotics platform cut intra-operative force by 43%. Cardiovascular, gynecology, and neurosurgery specialties show comparable trajectories as device makers add single-port or catheter-based solutions that fit existing workflows. The economic upside strengthens the case: lowering readmissions and freeing beds help hospitals meet value-based payment targets, which further stimulates procurement of MIS-compatible systems. Collectively, these factors will keep the general surgical devices market on a robust expansion path as health systems continue replacing open approaches with keyhole alternatives.

AI Integration Transforms Surgical Decision-Making and Outcomes

Artificial intelligence now supports pre-operative planning, intra-operative guidance, and post-operative monitoring. FastGlioma, a University of Michigan-UCSF model, identified residual brain tumor tissue with 92% accuracy and reduced miss rates from 25% to 3.8%. Predictive engines such as MySurgeryRisk outperform conventional assessments, cutting complication incidence by up to 30%. Hospitals using these tools see fewer ICU days, and payers note cost avoidance; thus, AI is moving from pilot projects into routine procurement line-items. As algorithms migrate onto consoles and endoscopes, vendors differentiate through data pipelines rather than purely mechanical features yet another evolution that underpins sustained demand in the general surgical devices market.

High Capital and Maintenance Costs

Advanced robotics and imaging suites require investments that can exceed USD 2 million per operating room, a hurdle for facilities in middle-income countries where paybacks stretch beyond standard budgeting cycles. Service contracts, software upgrades, and disposables compound total cost of ownership, dampening uptake despite clear clinical benefits. Consequently, value-engineered systems and pay-per-use models are gaining traction as vendors attempt to keep the general surgical devices market accessible across income tiers.

Other drivers and restraints analyzed in the detailed report include:

- Energy-based Devices Evolve Beyond Vessel Sealing

- Ambulatory Surgical Centers Reshape Care Delivery Models

- Regulatory Harmonization Gains Momentum Globally

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Disposable surgical supplies generated the largest revenue share in 2025 as infection-control protocols favored single-use drapes, trocars, and blades. Their 43.78% command of the general surgical devices market size underscores hospital preference for standardization when tracking nosocomial infection metrics. Segment growth nevertheless converges toward mid-single-digit rates because sustainability efforts encourage selective reusability in low-risk cases, a nuance reshaping procurement guidelines without dislodging disposables from top position.

Robotic-assisted instruments, though smaller in absolute dollars, are set to outpace every other category through 2031, riding an 10.62% CAGR. Systems tailored for hip revision, partial knee, and soft-tissue work broaden indications and shorten learning curves. As throughput improvements offset capital outlays, administrators increasingly view robotics as productivity tools rather than prestige purchases. This dynamic points to sustained momentum for the general surgical devices market.

The General Surgical Devices Market Report is Segmented by Product Type (Minimally Invasive Surgery Instruments, Robotic-Assisted Surgery Instruments, Energy-Based Surgery Instruments (RF, Ultrasonic), and More), Application (Orthopaedic, Cardiology, and More), End User (Hospitals, Ambulatory Surgical Centres, and More) and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 37.45% of 2025 revenue, buoyed by high procedure counts, rapid uptake of robotics, and supportive reimbursement. The U.S. benefits from a dense innovation ecosystem, but market saturation in staples and electrosurgery means growth increasingly stems from software-enhanced systems and AI modules. Canada's push toward value-based care encourages hospitals to track device performance closely, a trend likely to ripple into procurement across the general surgical devices market.

Europe ranks second and maintains steady expansion despite rigorous conformity assessments under the Medical Device Regulation. Germany, the United Kingdom, and France lead adoption, particularly for joint arthroplasty robots and advanced imaging. Southern and Eastern European states are upgrading facilities, creating fresh avenues for mid-priced solutions. Currency fluctuations and budget constraints remain hurdles, but harmonized standards improve cross-border commercialization inside the general surgical devices market.

Asia-Pacific represents the fastest-growing region with a 10.15% CAGR. China invests heavily in county-level hospitals while fostering domestic robotic challengers that aim to lower acquisition costs. Japan's aging demographic catalyzes spine and cardiac device demand, and India's private chains expand operating theatre capacity to capture elective orthopedic work. This momentum elevates the region's contribution to overall general surgical devices market size and heightens competitive jockeying among multinationals and local entrants alike.

- Medtronic

- Johnson & Johnson (Ethicon, DePuy & Robotics)

- Stryker

- Boston Scientific

- Olympus

- B. Braun

- Conmed

- Smiths Group

- Zimmer Biomet

- Arthrex

- Teleflex

- Beckton Dickinson

- Karl Storz

- STERIS

- Intuitive Surgical

- CMR Surgical Ltd.

- Integra LifeSciences Corporation.

- Gesco Healthcare Pvt. Ltd

- Solventum

- Richard Wolf

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Global Surgical Procedure Volume Driven by Aging Population & Chronic Disease

- 4.2.2 Adoption of Minimally Invasive Surgery Techniques Across Major Specialties

- 4.2.3 Continuous Technological Advancements in Energy-Based & Imaging-Assisted Tools

- 4.2.4 Expanding Healthcare Infrastructure & Spending in Emerging Economies

- 4.2.5 Surge in Ambulatory Surgical Centers Driving Demand for Portable Instruments

- 4.2.6 Increasing Preference for Single-Use, Sterile Devices to Lower HAIs

- 4.3 Market Restraints

- 4.3.1 High Capital & Maintenance Costs of Advanced Surgical Systems

- 4.3.2 Stringent Regulatory Approval Pathways & Compliance Timelines

- 4.3.3 Shortage of Surgeons Trained on Advanced Tech in Developing Regions

- 4.3.4 Supply-Chain Disruptions

- 4.4 Regulatory Outlook

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Minimally Invasive Surgery Instruments

- 5.1.2 Robotic-Assisted Surgery Instruments

- 5.1.3 Energy-Based Surgery Instruments (RF, Ultrasonic)

- 5.1.4 Open Surgery Instruments

- 5.1.5 Disposable Surgical Supplies

- 5.1.6 Others

- 5.2 By Application

- 5.2.1 Orthopaedic

- 5.2.2 Cardiology

- 5.2.3 Gynecology nd Urology

- 5.2.4 Neurology

- 5.2.5 Gastrointestinal

- 5.2.6 Others

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgical Centres

- 5.3.3 Specialty Clinics

- 5.3.4 Academic and Research Institutes

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Medtronic PLC

- 6.3.2 Johnson & Johnson (Ethicon, DePuy & Robotics)

- 6.3.3 Stryker Corporation

- 6.3.4 Boston Scientific Corporation

- 6.3.5 Olympus Corporation

- 6.3.6 B. Braun SE

- 6.3.7 Conmed Corporation

- 6.3.8 Smith & Nephew PLC

- 6.3.9 Zimmer Biomet Holdings

- 6.3.10 Arthrex Inc.

- 6.3.11 Teleflex Incorporated

- 6.3.12 Becton, Dickinson & Co.

- 6.3.13 Karl Storz SE & Co. KG

- 6.3.14 STERIS PLC

- 6.3.15 Intuitive Surgical Inc.

- 6.3.16 CMR Surgical Ltd.

- 6.3.17 Integra LifeSciences Corporation.

- 6.3.18 Gesco Healthcare Pvt. Ltd

- 6.3.19 Solventum

- 6.3.20 Richard Wolf GmbH

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment