PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844612

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844612

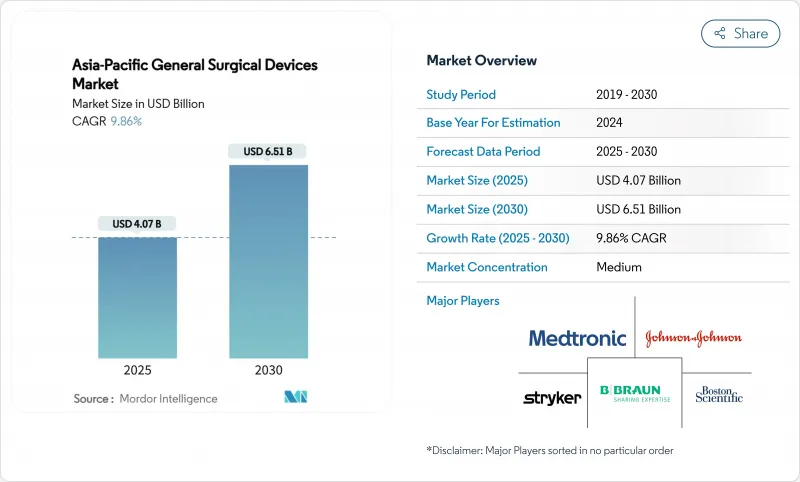

Asia-Pacific General Surgical Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Asia-Pacific General Surgical Devices Market size is estimated at USD 4.07 billion in 2025, and is expected to reach USD 6.51 billion by 2030, at a CAGR of 9.86% during the forecast period (2025-2030).

Sustained modernisation of surgical care, an ageing population, and rapid adoption of minimally invasive and robotic platforms are the primary engines of growth. Converging regulatory regimes, particularly the ASEAN Medical Device Directive, are shortening go-to-market timelines for multinational and regional innovators. China leads regional revenue with a 31.97% stake in 2024, while India shows the fastest trajectory on the back of double-digit healthcare spending increases and strong localisation policies. Minimally invasive procedures dominate operating theatres, underpinning resilient demand for laparoscopic and energy-based tools, even as premium-priced robotic systems register the highest growth. Outpatient migration to ambulatory surgical centres (ASCs) is reshaping procurement strategies toward compact, workflow-oriented equipment, and pan-regional partnerships between global manufacturers and domestic firms are widening access to next-generation technology.

Asia-Pacific General Surgical Devices Market Trends and Insights

Heightened Adoption of Minimally Invasive & Robotic Surgery Across APAC

Hospitals across the region are accelerating procurement of robotic systems as evidence mounts that force-feedback instrumentation and AI-assisted guidance improve resection accuracy and shorten learning curves. Japan recorded its first colorectal procedure with the fifth-generation da Vinci in 2025, underscoring acceptance of data-rich consoles for complex oncology cases. China's National Medical Products Administration cleared domestic robotic platforms offering 0.1 mm precision, signalling policy support for indigenous high-tech solutions. Cross-border 5G demonstrations have proven that expert surgeons can supervise laparoscopy at distances over 1,000 km, opening a viable model for serving remote areas without full-time specialists. AI image-analysis modules now embedded in endoscopic towers provide real-time margin assessment, integrating seamlessly with existing laparoscopic workflows and accelerating the upgrade path for mid-tier hospitals. These gains collectively reinforce the Asia Pacific General Surgery Devices market as a hotbed for digital surgical innovation.

Rapid Capacity Build-out of Public & Private Surgical Facilities

Annual health-budget increases in major economies are translating into bricks-and-mortar expansion of operating suites. India raised central health outlays by 12.59% for FY 2024-25 and activated five new AIIMS institutes, each housing multi-specialty theatres ready for advanced energy devices and robotic carts. China's coupling-coordination metrics show improved alignment between supply and ageing-related demand, but resource deserts in western provinces persist, spurring policy to fast-track equipment tenders that close service gaps. Multinationals such as Medtronic have responded by opening robotics training studios in Singapore and Korea, creating demonstration hubs that anchor vendor relationships and swing future device standardisation decisions toward their platforms. Construction of dedicated day-surgery centres attached to private hospitals is equally brisk, feeding incremental volumes to suppliers focused on high-turnover consumables.

Prolonged & Complex Regulatory Approval Pathways

Despite ASEAN moves toward convergence, firms still navigate a mosaic of country-specific forms, device classifications, and import checks that prolong commercial launches. China's updated medical-device law tightened post-market surveillance, adding iterative testing that can postpone revenue. India's new marketing code requires explicit disclosure of value transfers, complicating clinician-engagement strategies. Japan continues to experience "device lag" as thorough domestic reviews extend beyond submissions already cleared in the United States or Europe. While third-party conformity assessments are authorised in several jurisdictions, uneven adoption limits their time-saving potential. The net effect clips momentum in the Asia Pacific General Surgery Devices market, especially for SMEs lacking dedicated regulatory staff.

Other drivers and restraints analyzed in the detailed report include:

- Ageing Population and Rising Chronic Disease Burden Boosting Surgical Volumes

- Escalating Obesity-Linked Demand for Bariatric & GI Procedures

- Shortage of Skilled Surgical Workforce

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Robotic-assisted platforms represent the fastest-rising product line at a 12.11% CAGR, yet laparoscopic devices still supply the highest absolute revenue with 26.65% share in 2024. Hospitals appreciate laparoscopy's versatility across gynaecology, GI, and urology, guaranteeing baseline orders for trocar sets and clip appliers. Hand-held instruments remain indispensable for basic tissue manipulation, keeping entry price points accessible in smaller centres. Electrosurgical generators are benefiting from refinements in waveform modulation that cut collateral thermal injury, aligning with safety mandates.

Wound-closure innovations include electroceutical dressings that accelerate chronic-wound granulation, widening indications beyond theatre into postoperative wards. Single-use ancillaries are growing rapidly as infection-control committees weigh sterility assurance against waste-management costs; manufacturers now publicise recycling take-back schemes to overcome sustainability objections. With AI-ready robotic chassis marketed as modular, upgradeable investments, capital budgets are increasingly earmarked for systems that future-proof against data-driven surgical expectations, bolstering long-run value capture in the Asia Pacific General Surgery Devices market.

Minimally invasive surgery accounted for 62.43% of the Asia Pacific General Surgery Devices market in 2024 and retains the highest growth forecast at 10.57% CAGR. Hospitals report reduced average length of stay by up to two days for laparoscopic cholecystectomy compared with open techniques, reinforcing procurement of high-definition camera heads and insufflators. Robotic platforms augment the MIS advantage with articulated wrist instruments that deliver suturing accuracy previously possible only via open access.

Innovations such as cold atmospheric plasma for wound sterilisation are entering MIS postoperative protocols, broadening device baskets sold alongside core scopes. AI-guided colonoscopy systems now flag polyps in real time, increasing adenoma-detection rates and expanding revenue for compatible processors. Open surgery retains relevance for extensive oncological resections and polytrauma, but these cases increasingly incorporate adjunct technologies such as smoke evacuation and ultrasonic dissection, ensuring all procedure types continue to consume devices.

The Asia Pacific General Surgery Devices Market Report is Segmented by Product (Hand-Held Devices, Laparoscopic Devices, Electrosurgical Devices, and More), Procedure Approach (Open Surgery, Minimally Invasive Surgery), Application (Gynecology & Urology, and More), End User (Hospitals, Ambulatory Surgical Centres, Specialty Clinics), and Geography (China, Japan, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Johnson & Johnson

- Medtronic

- Olympus Corp.

- Stryker

- B. Braun

- Boston Scientific

- Conmed

- Smiths Group

- Intuitive Surgical

- Zimmer Biomet

- Karl Storz

- Terumo Corp.

- Applied Medical Resources

- MicroPort Scientific Corp.

- Nipro Corp.

- Integra LifeSciences Corporation.

- Getinge

- Integer Holdings Corp.

- Solventum

- Poly Medicure

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Heightened Adoption of Minimally-Invasive & Robotic Surgery Across APAC

- 4.2.2 Rapid Capacity Build-out of Public & Private Surgical Facilities

- 4.2.3 Ageing Population and Rising Chronic Disease Burden Boosting Surgical Volumes

- 4.2.4 Escalating Obesity-Linked Demand for Bariatric & GI Procedures

- 4.2.5 Persistently High Trauma & Orthopedic Injury Incidence

- 4.2.6 Product Launches and Local Partnerships

- 4.3 Market Restraints

- 4.3.1 Prolonged & Complex Regulatory Approval Pathways

- 4.3.2 Inconsistent and Limited Reimbursement for Advanced Devices

- 4.3.3 Capital Constraints in Tier-2/3 Hospitals Favor Refurbished / Low-Cost Equipment

- 4.3.4 Shortage of Skilled Surgical Workforce

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Hand-Held Devices

- 5.1.2 Laparoscopic Devices

- 5.1.3 Electrosurgical Devices

- 5.1.4 Wound-Closure Devices

- 5.1.5 Trocars & Access Devices

- 5.1.6 Robotic-Assisted Platforms

- 5.1.7 Single-Use & Other Ancillary Products

- 5.2 By Procedure Approach

- 5.2.1 Open Surgery

- 5.2.2 Minimally Invasive Surgery (MIS)

- 5.3 By Application

- 5.3.1 Gynecology & Urology

- 5.3.2 Cardiology & Thoracic

- 5.3.3 Orthopedic & Trauma

- 5.3.4 Neurology & Spine

- 5.3.5 Bariatric & Gastrointestinal

- 5.3.6 Other Surgical Applications

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Ambulatory Surgical Centres

- 5.4.3 Specialty Clinics

- 5.5 By Country

- 5.5.1 China

- 5.5.2 Japan

- 5.5.3 India

- 5.5.4 Australia

- 5.5.5 South Korea

- 5.5.6 Rest of Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Johnson & Johnson (Ethicon)

- 6.3.2 Medtronic plc

- 6.3.3 Olympus Corp.

- 6.3.4 Stryker Corp.

- 6.3.5 B. Braun SE

- 6.3.6 Boston Scientific Corp.

- 6.3.7 Conmed Corp.

- 6.3.8 Smith & Nephew plc

- 6.3.9 Intuitive Surgical Inc.

- 6.3.10 Zimmer Biomet Holdings Inc.

- 6.3.11 Karl Storz SE & Co. KG

- 6.3.12 Terumo Corp.

- 6.3.13 Applied Medical Resources Corporation

- 6.3.14 MicroPort Scientific Corp.

- 6.3.15 Nipro Corp.

- 6.3.16 Integra LifeSciences Corporation.

- 6.3.17 Getinge AB

- 6.3.18 Integer Holdings Corp.

- 6.3.19 Solventum

- 6.3.20 Polymedicure

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment