PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836533

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836533

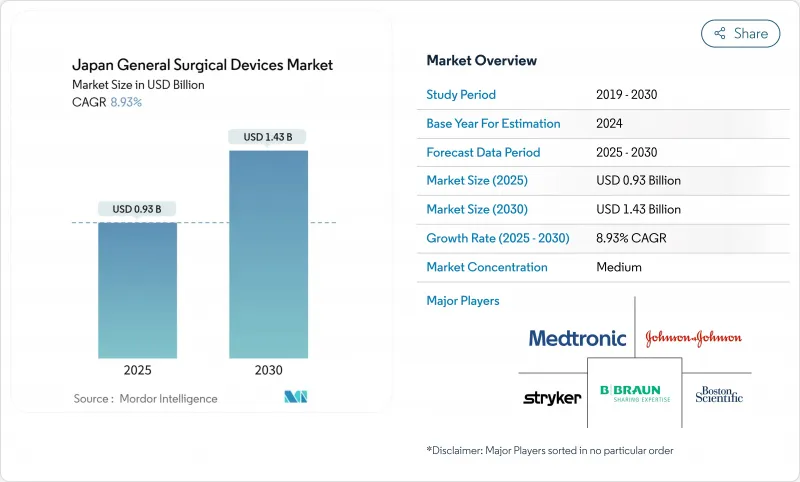

Japan General Surgical Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Japan General Surgical Devices Market size is estimated at USD 0.93 billion in 2025, and is expected to reach USD 1.43 billion by 2030, at a CAGR of 8.93% during the forecast period (2025-2030).

Growing surgical demand from an aging society where 29.1% of citizens are 65 years or older, an aggressive shift toward minimally invasive techniques, and the country's deep bench strength in robotics and artificial intelligence are the foundational forces that keep the market on a steep upward path. Hospitals are scaling integrated digital operating rooms, private investors are funding ambulatory surgical centers, and government policies that reimburse remote proctoring are accelerating technology diffusion. Laparoscopic systems remain the revenue anchor, yet electrosurgical platforms paired with robotic consoles are setting the growth pace. Domestic manufacturers such as Olympus and Terumo secure share through local service networks, while global leaders work through strategic partnerships and Japan's demanding approval pathway to keep competitive parity. Supply-chain re-shoring incentives, telepresence-enabled training models, and fast prototype-to-pilot cycles in university hospitals collectively create fertile ground for next-generation devices that embed imaging, analytics, and automation at the point of care.

Japan General Surgical Devices Market Trends and Insights

Aging-driven escalation in surgical volumes

Japan's demographic curve now places 20% of citizens in the 75-plus segment, pushing hospital case mix toward complex, multi-morbidity surgeries that rely on precise, low-trauma instrumentation. Older patients present higher perioperative risk, raising the premium on devices that shorten procedure times and reduce blood loss. Multicenter evidence shows that laparoscopic gastric cancer resections deliver 99.8% five-year disease-free survival, reinforcing confidence in minimally invasive approaches for senior cohorts. Workforce gaps intensify the imperative for robotic assistance that lets a leaner clinical team maintain throughput. Device makers that bundle analytics for pre-operative planning with ergonomic instruments positioned for arthritic hands are meeting an urgent and escalating need.

Surge in minimally invasive procedures

Minimally invasive surgery already dominates operating rooms and keeps growing as AI-driven visualization, 3-D mapping, and robotics tilt the risk-to-benefit ratio further in its favor. A comparative study of elderly liver resection patients showed no difference in complications versus younger cohorts, validating broader use in the oldest demographic. Tokyo startups now supply algorithms that illuminate loose connective tissue planes with 91.8% accuracy, reducing inadvertent injury and shortening learning curves. Office-based vitreoretinal surgery reached a single-session success rate of 97.3%, demonstrating how refined instruments migrate complex care from hospitals to outpatient suites. As clinical guidelines update, procurement cycles increasingly favor consoles and handpieces with plug-and-play AI modules that can be upgraded through software rather than hardware swaps.

Lengthy PMDA approval & re-approval timelines

Despite recent Sakigake and fast-track schemes, the median 12-month technical review for Class II-III devices plus quality-system audits slows commercial launches. Inventors must budget for local clinical data, bilingual dossiers, and five-year quality re-certifications that divert capital from innovation. Smaller firms face disproportionate burden, narrowing the competitive field and occasionally delaying novel tools that could raise procedural safety.

Other drivers and restraints analyzed in the detailed report include:

- Rapid device innovation (robotics, AI, 4K/8K imaging)

- Remote-proctoring reimbursement accelerating adoption

- OR nursing & technician shortages

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Laparoscopic systems held 35.16% revenue leadership in 2024, underscoring their entrenched role across gastrointestinal, bariatric, and hepatobiliary specialties. Over 700 hospitals now staff fellowship-trained laparoscopic surgeons, and five-year survival data reinforce the modality's oncologic adequacy. The segment attracts upgrades to 4K cameras and articulating instruments, driving replacement cycles rather than first-time adoption. Handheld graspers and staplers maintain steady base demand, while wound-closure kits grow along with overall surgical volume. Trocars, insufflators, and access devices post mid-single-digit growth as procedural mix extends to colorectal, urologic, and gynecologic indications.

Electrosurgical platforms, although smaller today, expand at 9.82% and anchor the pivot toward fully digital suites. Integrated generators sync with robotic arms, detect tissue impedance, and auto-adjust energy delivery to minimize thermal spread. As these systems pair with AI algorithms that predict optimal coagulation settings, procedure times drop and consistency rises. Robotic and computer-assisted microscopes further blur traditional product lines, making energy systems a core module in smart OR ecosystems. Other niche tools, from fluorescence-guided clips to vessel sealing pens, capitalize on Japan's appetite for specialized upgrades that boost precision without large workflow disruption. The transition signals that market value migrates from single-function devices to platform compatibility and software-driven enhancements.

Minimally invasive surgery encompassed 72.74% of all operations in 2024 and sustains a 9.52% CAGR as evidence keeps mounting for shorter stays, lower infection rates, and faster return to work. AI-modified visualization now identifies dissection planes, and standardized two-surgeon robot techniques in liver resection cut median operative time to 156 minutes with negligible complications.

Open surgery, while shrinking in relative terms, remains imperative for emergencies and late-stage malignancies. Hospitals therefore still procure high-throughput suction devices, lights, and retractors tailored for open fields, yet budgets shift incrementally toward laparoscopic stacks and robotic carts. Cross-training programs let surgeons alternate between open and laparoscopic techniques, sustaining a baseline for instrument demand across both categories. The outlook suggests that the binary open-versus-laparoscopic framing will fade, replaced by an integrated workflow where digital adjuncts optimize every incision size.

The Japan General Surgical Devices Market Report is Segmented by Product (Handheld Devices, Laparoscopic Devices, Electrosurgical Devices, Wound-Closure Devices, and More), Procedure Approach (Open Surgery, and Minimally Invasive Surgery), Application (Gynecology and Urology, Cardiology, Orthopedic, and More) and End User (Hospitals, Ambulatory Surgical Centres and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Medtronic

- Johnson & Johnson (Ethicon & DePuy Synthes)

- Olympus Corp.

- Terumo Corp.

- Fujifilm Holdings Corp.

- B. Braun

- Stryker

- Boston Scientific

- Smiths Group

- Conmed

- Intuitive Surgical

- Karl Storz

- HOYA Corp. (Pentax Medical)

- Nipro Corp.

- Zimmer Biomet

- Nihon Kohden Corp.

- Sekisui Medical Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Ageing-driven escalation in surgical volumes

- 4.2.2 Surge in minimally invasive procedures

- 4.2.3 Rapid device innovation (robotics, AI, 4K/8K imaging)

- 4.2.4 Remote-proctoring reimbursement accelerating adoption

- 4.2.5 Domestic manufacturing-reshoring incentives

- 4.2.6 Expansion of private hospitals and ambulatory surgical centers

- 4.3 Market Restraints

- 4.3.1 Lengthy PMDA approval & re-approval timelines

- 4.3.2 High cost of stem cell therapies and manufacturing

- 4.3.3 OR nursing/technician shortages

- 4.3.4 Limited standardization and scalability

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Handheld Devices

- 5.1.2 Laparoscopic Devices

- 5.1.3 Electrosurgical Devices

- 5.1.4 Wound-Closure Devices

- 5.1.5 Trocars and Access Systems

- 5.1.6 Robotic and Computer-Assisted Systems

- 5.1.7 Other Devices

- 5.2 By Procedure Approach

- 5.2.1 Open Surgery

- 5.2.2 Minimally Invasive Surgery

- 5.3 By Application

- 5.3.1 Gynecology and Urology

- 5.3.2 Cardiology

- 5.3.3 Orthopedic

- 5.3.4 Neurology

- 5.3.5 Other Applications

- 5.4 By End-User

- 5.4.1 Hospitals

- 5.4.2 Ambulatory Surgical Centres

- 5.4.3 Specialty Clinics

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Medtronic plc

- 6.3.2 Johnson & Johnson (Ethicon & DePuy Synthes)

- 6.3.3 Olympus Corp.

- 6.3.4 Terumo Corp.

- 6.3.5 Fujifilm Holdings Corp.

- 6.3.6 B. Braun Melsungen AG

- 6.3.7 Stryker Corp.

- 6.3.8 Boston Scientific Corp.

- 6.3.9 Smith & Nephew plc

- 6.3.10 Conmed Corp.

- 6.3.11 Intuitive Surgical Inc.

- 6.3.12 Karl Storz SE & Co. KG

- 6.3.13 HOYA Corp. (Pentax Medical)

- 6.3.14 Nipro Corp.

- 6.3.15 Zimmer Biomet Holdings Inc.

- 6.3.16 Nihon Kohden Corp.

- 6.3.17 Sekisui Medical Co. Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment