PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836552

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836552

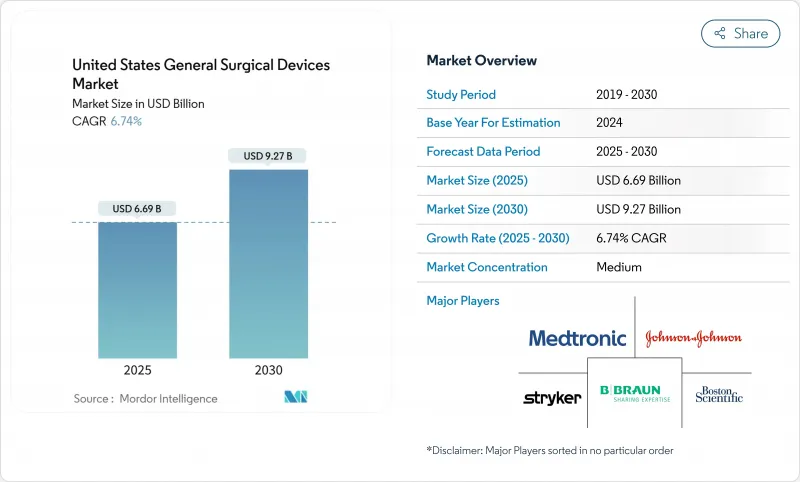

United States General Surgical Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The United States General Surgical Devices Market size is estimated at USD 6.69 billion in 2025, and is expected to reach USD 9.27 billion by 2030, at a CAGR of 6.74% during the forecast period (2025-2030).

Rising procedure volumes, rapid diffusion of minimally invasive techniques, and the migration of high-acuity cases into ambulatory settings together redefine how the United States general surgical devices market allocates capital and manages inventory. Federal incentives that reward domestic production help manufacturers shorten lead times and counter tariff exposure, while AI-enabled imaging and navigation systems improve precision and labor efficiency across specialties. At the same time, payers accelerate value-based purchasing, encouraging hospitals and ASCs to favor solutions that prove lower cost per procedure. These dynamics collectively sustain robust demand even as device buyers negotiate aggressively for better pricing.

United States General Surgical Devices Market Trends and Insights

Aging Population & Rising Chronic Disease Burden Driving Surgical Demand

Medicare projections show spinal instrumentation costs accelerating as the 65+ cohort grows, reinforcing long-run demand for surgical care. Providers, therefore, invest in minimally invasive and outpatient-ready platforms that reduce length of stay and complication risk. The United States general surgical devices market consequently favors systems with smaller footprints and enhanced safety profiles. Device makers also emphasize training modules that allow staff to manage complex cases in lower-acuity settings. These shifts amplify procurement of energy devices, smart staplers, and AI-guided visualization tools tailored for higher-risk elderly patients.

Increasing Adoption of Minimally Invasive and Robotic-Assisted Procedures

Robotic hernia repairs, colon resections, and knee arthroplasties now capture rising shares of routine general surgery, with robotic TKAs already representing 13% of total knee replacements from 2018 to 2023. Hospitals leverage robotics to attract surgeons and boost OR throughput, offsetting capital costs through higher case volumes. As a result, the United States general surgical devices market sees growing orders for single-console systems, reusable end effectors, and cloud-linked analytics packages. Smaller facilities prioritize cost-efficient laparoscopic kits, creating a two-tier adoption curve that vendors address with modular pricing strategies.

Escalating Cost-Containment & Value-Based Reimbursement Pressure on Device Pricing

Value analysis committees now emphasize total cost of ownership, with 32% of hospitals ranking evidence-based purchasing as their top priority. Bulk-buying intermediaries negotiate transparent contract prices that compress margins for high-end platforms. Device makers therefore bundle service agreements and offer outcome-based guarantees to defend premium positioning. Over time these pressures encourage lean product design and intensified competition inside the United States general surgical devices market.

Other drivers and restraints analyzed in the detailed report include:

- ASC Expansion Driving Device Uptake

- Integration of AI-Guided Imaging & Navigation Boosting Procedural Efficiency

- Shortage of Skilled Surgical Workforce Slowing Adoption of Advanced Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Electrosurgical devices are projected to post an 8.41% CAGR, the fastest among product lines, reflecting sustained demand for AI-optimized tissue interaction systems. Laparoscopic instruments still account for 26.65% of the United States general surgical devices market size in 2024. Hospitals upgrade to advanced generators that reduce thermal spread, aligning with safety imperatives and cost-controlled ASC workflows. Research in Annals of Surgery shows new energy modalities lowering collateral damage without compromising hemostasis.

Handheld devices retain relevance because of standardized designs and lower price points, while zipper-based closure tools shorten closure time by 298 seconds compared with sutures. Access device quality lapses, evidenced by the 2024 recall of 165,356 units of blunt-tip trocars, underscore the value of robust manufacturing controls. Breakthrough designations, such as Absolutions' abdominal wall closure system, further widen innovation pipelines. As a result, the United States general surgical devices market channels R&D toward versatile energy platforms and safer access solutions that cater to both inpatient and outpatient settings.

Minimally invasive techniques commanded 69.24% share of the United States general surgical devices market in 2024 and are on course for a 7.16% CAGR to 2030. Robotic platforms intensify this lead by expanding into complex abdominal and orthopedic repairs, creating an ecosystem of reusable instruments, vision towers, and cloud analytics packages. Value in Health data confirm that robotic usage rises across almost every specialty01352-8/fulltext).

Open surgery remains essential for multilevel reconstructions yet cedes unit volume as laparoscopic and robotic suites penetrate smaller hospitals. To stay relevant, open-approach suppliers introduce advanced headlights, high-definition visualization, and AI-assisted hemostasis technologies. In combination, these shifts reinforce patient expectations for smaller scars and quicker returns to routine life, sustaining momentum behind the United States general surgical devices market.

The United States General Surgical Devices Market Report is Segmented by Product (Handheld Devices, Laparoscopic Devices, Electrosurgical Devices, Wound Closure Devices, and More), Procedure Approach (Open Surgery, and Minimally Invasive Surgery), and Application (Gynecology and Urology, Cardiology, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Medtronic

- Johnson & Johnson (Ethicon & DePuy)

- Stryker

- Boston Scientific

- B. Braun

- Olympus

- Conmed

- Applied Medical Resources

- Getinge

- Zimmer Biomet

- Smiths Group

- Intuitive Surgical

- Teleflex

- Cook Group

- Karl Storz

- The Cooper Companies

- Arthrex

- Beckton Dickinson

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Aging population & rising chronic disease burden driving surgical demand

- 4.2.2 Increasing adoption of minimally-invasive and robotic-assisted procedures

- 4.2.3 ASC (Ambulatory Surgical Center) expansion driving device uptake

- 4.2.4 Rapid technology advancements

- 4.2.5 Integration of AI-guided imaging & navigation boosting procedural efficiency

- 4.2.6 Federal incentives for domestic manufacturing reshaping device supply chains

- 4.3 Market Restraints

- 4.3.1 Escalating cost-containment & value-based reimbursement pressure on device pricing

- 4.3.2 Stringent FDA scrutiny and recall risk prolonging product launch timelines

- 4.3.3 Supply-chain vulnerabilities & raw-material inflation elevating production costs

- 4.3.4 Shortage of skilled surgical workforce slowing adoption of advanced systems

- 4.4 Pricing Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Handheld Devices

- 5.1.2 Laparoscopic Devices

- 5.1.3 Electrosurgical Devices

- 5.1.4 Wound Closure Devices

- 5.1.5 Trocars and Access Devices

- 5.1.6 Other Products

- 5.2 By Procedure Approach

- 5.2.1 Open Surgery

- 5.2.2 Minimally Invasive Surgery

- 5.3 By Application

- 5.3.1 Gynecology and Urology

- 5.3.2 Cardiology

- 5.3.3 Orthopedic

- 5.3.4 Neurology

- 5.3.5 Other Applications

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Ambulatory Surgical Centres

- 5.4.3 Specialty Clinics

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Medtronic plc

- 6.3.2 Johnson & Johnson (Ethicon & DePuy)

- 6.3.3 Stryker Corporation

- 6.3.4 Boston Scientific Corporation

- 6.3.5 B. Braun SE

- 6.3.6 Olympus Corporation

- 6.3.7 Conmed Corporation

- 6.3.8 Applied Medical Resources Corp.

- 6.3.9 Getinge AB

- 6.3.10 Zimmer Biomet Holdings Inc.

- 6.3.11 Smith & Nephew plc

- 6.3.12 Intuitive Surgical Inc.

- 6.3.13 Teleflex Incorporated

- 6.3.14 Cook Medical LLC

- 6.3.15 Karl Storz SE & Co. KG

- 6.3.16 CooperSurgical Inc.

- 6.3.17 Arthrex Inc.

- 6.3.18 Becton, Dickinson and Company

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment