PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851022

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851022

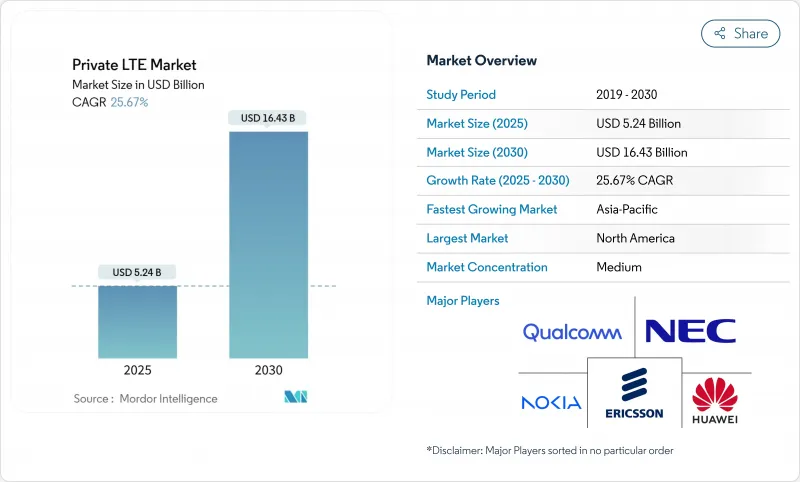

Private LTE - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The private LTE market is valued at USD 5.24 billion in 2025 and is forecast to reach USD 16.43 billion by 2030, expanding at a 25.67% CAGR.

Security-focused, deterministic performance is propelling adoption as enterprises digitize operations and place mission-critical workloads on dedicated cellular infrastructure. Early commercialization of shared spectrum, rapid progress on Industry 4.0 programs, and the rising need for ultra-reliable low-latency communications (URLLC) in harsh settings all reinforce growth. Industrial sites now favour private LTE over public alternatives because it delivers predictable coverage, streamlined quality-of-service management, and the option to retain full control of sensitive operational data. Edge computing integration is another accelerant, enabling local analytics on massive sensor streams without round-trip delays. Ecosystem innovation-in particular, open RAN, small-cell form factors, and CBRS device proliferation-is lowering entry barriers and widening the private LTE market addressable base.

Global Private LTE Market Trends and Insights

Spectrum Liberalization Unlocks Enterprise Deployment Surge

Key Highlights

- Regulators are reallocating mid-band frequencies, giving enterprises unprecedented access to high-quality spectrum under frameworks such as CBRS. Around 370,000 CBRS devices had been deployed by end-2023, underscoring how shared bands reduce licensing hurdles and democratize network ownership.Affordable, interference-managed access has opened the private LTE market to mid-sized firms that previously lacked resources for exclusive licences. Beyond the United States, Germany, Japan, and Australia have issued local licences that let factories, ports, and utilities implement bespoke coverage footprints. The policy shift is expanding vendor ecosystems, stimulating small-cell innovation, and creating a pipeline of new industrial sites expected to deploy private LTE networks over the next three years.

Industrial IoT Drives Manufacturing Transformation

Smart-factory rollouts now hinge on reliable wireless backbones capable of sustaining thousands of sensors with latencies below 30 ms. Nearly 79% of early adopters said they achieved positive ROI within six months after installing private LTE to support automated guided vehicles, AR-assisted maintenance, and digital twins. Low-variance connectivity improves line-balance efficiency, which in turn drives predictive maintenance, quality analytics, and plant-wide energy optimisation. Manufacturers consistently discover incremental use cases, such as yard management and worker-safety wearables, once the initial network is live, creating a self-reinforcing adoption curve inside the private LTE market.

Capital Intensity Creates Adoption Barriers

Private LTE deployments involve radio and core equipment, resilient backhaul, site works and, in some regions, spectrum fees. Upfront costs often exceed internal hurdle rates, especially for mid-tier firms. Interest in network-as-a-service contracts is rising because OPEX subscriptions reduce capital shock and match spending to productivity gains. Quantifying intangible benefits such as cyber-hardening and downtime avoidance remains challenging, prolonging budget cycles. Open RAN hardware promises lower unit prices, yet integration overheads can erase savings for organisations lacking cellular expertise.

Other drivers and restraints analyzed in the detailed report include:

- Mission-Critical Communications Enable Remote Operations

- Seamless Migration Path Toward 5G SA

- Integration Complexity Slows Implementation Velocity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The infrastructure segment held 63% of the private LTE market in 2024, reflecting heavy spending on small cells, packet cores, and transport gear. Yet, services revenue is rising faster at an 18.4% CAGR because organisations lean on system integrators to sidestep internal skills shortages. Managed offerings bundle design, integration, and 24/7 operations, giving factories and utilities predictable budgets while accelerating time-to-value. Professional services demand remains high during greenfield projects, but recurring managed contracts are capturing a larger share of new bookings.

Radio access networks still account for the biggest slice of capital, though enterprises increasingly emphasise onsite core systems to enforce security policies. Transport backhaul upgrades are non-negotiable when connecting multiple plant zones to cloud dashboards. Vendors now promote "network-in-a-box" kits-pre-configured core plus small cells-capable of same-day activation. One such kit from Pente Networks maintained communications for emergency crews during the 2025 Los Angeles wildfires, highlighting how turnkey packaging broadens the private LTE market beyond technically-savvy buyers.

Time-division duplexing captured 55% of revenue in 2024 and is projected to sustain the highest 17.1% CAGR. Asymmetric traffic in video surveillance and telemetry favours TDD's dynamic allocation, maximising throughput within scarce mid-band channels. TDD also aligns with CBRS band allocations, reinforcing its position as the default in new private LTE market deployments.

Frequency-division duplexing retains a foothold in latency-sensitive control systems where strict separation of uplink and downlink is prized. However, modern schedulers reduce TDD jitter to sub-10 ms, narrowing the historical gap. Upcoming 5G releases will further refine TDD numerologies, assuring enterprises that today's investment will remain relevant once they transition to 5G NR carrier aggregation.

The Private LTE Market Report is Segmented by Component (Infrastructure and Services), Technology (Frequency-Division Duplexing (FDD) and Time Division Duplex (TDD)), Deployment Model (Centralized (C-RAN), Distributed), End-User Industry (Industrial (Manufacturing, Energy and Utilities, Mining and Oil and Gas, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with 38% of 2024 revenue thanks to the CBRS framework and a mature ecosystem of radio, device, and integrator partners. More than 4,700 private LTE and 5G networks were operational worldwide by end-2024, and a substantial share was in the United States. Local 5G pilots in manufacturing, healthcare, and utilities amplify demand, while hyperscaler edge zones make low-latency workload offload straightforward across major metros.

Asia-Pacific records the fastest 12.8% CAGR from 2025 to 2030. China deploys state-backed factory and mine networks, Japan issues local 5G licences in millimetre and mid-bands, and South Korea capitalises on its dense fibre backbone to host campus cores. India's recent spectrum policy changes have unlocked trials in automotive and pharmaceutical plants. Australia already operates more than 50 private LTE systems, primarily to streamline remote-area iron ore and lithium extraction, and its market is forecast to hit AUD 695 million by 2027, according to ACMA.

Europe ranks second in deployment count, holding roughly 40% of global private installations by mid-2023, according to GSMA. Germany's 3.7-3.8 GHz local licences spur manufacturing adoption; the United Kingdom's Shared Access framework simplifies licences for ports and farms. The European 5G Observatory reports that 73% of pioneer bands were assigned by March 2024, forming a solid spectral foundation for industrial networks. Vodafone's pledge to roll out open RAN on 2,500 sites is expected to reduce equipment costs across Continental Europe, indirectly benefiting enterprise buyers seeking turnkey private LTE projects.

- Nokia

- Ericsson

- Huawei Technologies

- NEC Corp.

- Qualcomm

- Druid Software

- Sierra Wireless

- JMA Wireless

- Ruckus Networks (CommScope)

- Celona

- Airspan Networks

- Cisco Systems

- ZTE Corp.

- Samsung Electronics

- Airspan Networks

- Athonet (HPE)

- Motorola Solutions

- Mavenir Systems

- Amazon AWS Private 5G

- Verizon Business

- General Dynamics Mission Systems

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Spectrum liberalization and CBRS commercialization

- 4.2.2 Industrial IoT and Industry 4.0 uptake

- 4.2.3 Mission-critical URLLC demand in harsh sites

- 4.2.4 Seamless migration path toward 5G SA

- 4.2.5 On-prem edge-AI bandwidth requirements

- 4.2.6 Lower TCO via Open RAN small-cell ecosystems

- 4.3 Market Restraints

- 4.3.1 High CAPEX and uncertain ROI

- 4.3.2 Scarcity of integration talent

- 4.3.3 Fragmented device-band support

- 4.3.4 Budget cannibalisation by private 5G pilots

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Infrastructure

- 5.1.1.1 Radio Access (RAN)

- 5.1.1.2 Core (EPC/5GC)

- 5.1.1.3 Backhaul and Transport

- 5.1.2 Services

- 5.1.2.1 Professional Services

- 5.1.2.2 Managed Services

- 5.1.1 Infrastructure

- 5.2 By Technology

- 5.2.1 Frequency-Division Duplexing (FDD)

- 5.2.2 Time-Division Duplexing (TDD)

- 5.3 By Deployment Model

- 5.3.1 Centralised (C-RAN)

- 5.3.2 Distributed

- 5.4 By Spectrum

- 5.4.1 Licensed

- 5.4.2 Unlicensed (MulteFire, 5 GHz)

- 5.4.3 Shared (CBRS, LAA)

- 5.5 By End-user Industry

- 5.5.1 Manufacturing

- 5.5.2 Energy and Utilities

- 5.5.3 Mining and Oil and Gas

- 5.5.4 Transportation and Logistics

- 5.5.5 Public Safety and Defense

- 5.5.6 Healthcare

- 5.5.7 Enterprise / Campuses

- 5.5.8 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 United Arab Emirates

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 Qatar

- 5.6.5.1.4 Israel

- 5.6.5.1.5 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Nokia

- 6.4.2 Ericsson

- 6.4.3 Huawei Technologies

- 6.4.4 NEC Corp.

- 6.4.5 Qualcomm

- 6.4.6 Druid Software

- 6.4.7 Sierra Wireless

- 6.4.8 JMA Wireless

- 6.4.9 Ruckus Networks (CommScope)

- 6.4.10 Celona

- 6.4.11 Airspan Networks

- 6.4.12 Cisco Systems

- 6.4.13 ZTE Corp.

- 6.4.14 Samsung Electronics

- 6.4.15 Airspan Networks

- 6.4.16 Athonet (HPE)

- 6.4.17 Motorola Solutions

- 6.4.18 Mavenir Systems

- 6.4.19 Amazon AWS Private 5G

- 6.4.20 Verizon Business

- 6.4.21 General Dynamics Mission Systems

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment