PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906253

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906253

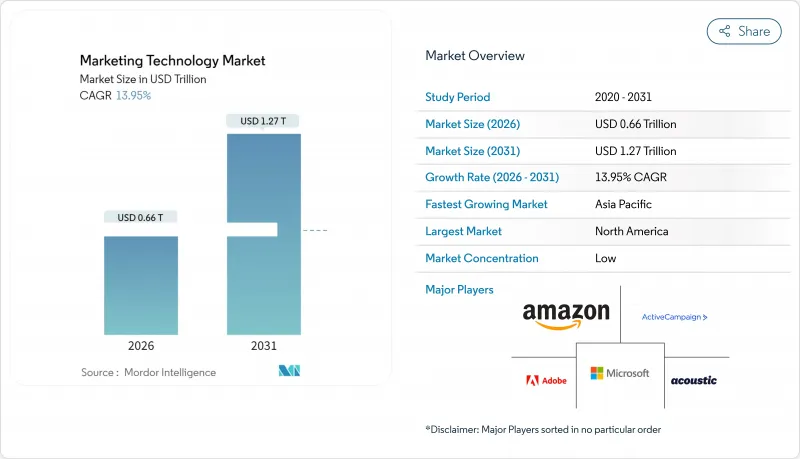

Marketing Technology Market - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Marketing Technology Market was valued at USD 580 billion in 2025 and estimated to grow from USD 660.91 billion in 2026 to reach USD 1,270.82 billion by 2031, at a CAGR of 13.95% during the forecast period (2026-2031).

Enterprise demand for cloud-first, AI-embedded stacks is the primary accelerator, enabling real-time orchestration of campaigns, dynamic content generation, and cross-channel attribution at scale. Market leaders are embedding generative AI in core products, while regulatory pressure to transition toward privacy-first data strategies raises the value of first-party and zero-party data assets. Competitive dynamics favor vendors that can unify creative, data, and activation workflows inside a composable architecture, giving enterprises granular control over costs, latency, and compliance. Operational efficiency gains from automated content pipelines are already improving campaign ROI enough to offset rising AI compute expenditures.

Global Marketing Technology Market Trends and Insights

Cloud-First Marketing Stacks Adoption Surge

Enterprises continue an aggressive pivot toward cloud-native architectures to collapse data silos and enable real-time decisioning across every customer touchpoint. Microsoft's USD 1.3 billion Mexico and USD 2.7 billion Brazil data-center commitments underscore the need for regional infrastructure that supports low-latency customer data processing. IT teams report cycle-time reductions that let marketers shrink campaign rollouts from weeks to hours, boosting personalization accuracy and revenue velocity.

GenAI Embedded Across Campaign Orchestration

Generative AI is transforming what used to be manual, reactive workflows into proactive experience orchestration engines. Adobe's Customer Experience Orchestration platform illustrates how AI unites creative and marketing functions under one roof, enabling continuous content optimization without relying on labor-intensive A/B testing. Enterprises highlight margin expansion as proprietary models deliver 50-60% gross margins versus legacy SaaS tools.

Rising Total Cost of Ownership and Integration Debt

Organizations layering AI tools onto legacy stacks face unplanned data-migration and maintenance bills that exceed initial budgets by 40-60%. Cloud storage alone surpassed USD 200 billion of IT spend in 2025, pressuring CFOs to reassess platform choices.

Other drivers and restraints analyzed in the detailed report include:

- Privacy-Driven First-Party Data Strategies

- Zero-Party Data Micro-Exchange Programs

- Skills Gap for Complex Martech Stacks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Marketing Automation captured 25.60% of the marketing technology market share in 2025, validating its role as the control center for omnichannel journey management. The marketing technology market size tied to Marketing Automation is projected to grow alongside enterprises' pivot to unified orchestration engines that connect data, content, and activation workflows. GenAI-Powered Content Tools, while representing a smaller revenue base today, are forecast to post a 25.92% CAGR through 2031 as brands redistribute spend toward scalable, AI-driven content generation. Social media and content marketing suites post steady gains by enabling direct audience engagement, whereas rich-media creation tools benefit from rising video demand.

Enterprises view content velocity as a durable moat, directing budgets toward platforms that marry creative excellence with real-time performance insights. Adobe's GenStudio Foundation exemplifies how vendors integrate automation into the content supply chain, allowing marketers to publish without sacrificing brand integrity. Sales-enablement suites now embed predictive lead scoring that draws on AI-trained historical win data to accelerate pipeline conversion.

The Marketing Technology Market Report is Segmented by Product (Social Media Tools, Content Marketing Tools, Rich-Media Creation Tools, and More), Application (IT and Telecommunications, Retail and E-Commerce, Healthcare, Media and Entertainment, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America controlled 37.60% of the marketing technology market in 2025 due to mature cloud adoption, venture funding, and advanced AI research capabilities. Regional leaders leverage deep ecosystem integrations to maintain competitive edge, even as state-level privacy statutes multiply compliance tasks. Canadian enterprises refine consent strategies in anticipation of Bill C-27, while US-based firms deploy privacy-preserving analytics to stay ahead of litigation exposure.

APAC is the fastest-growing region, projected to log a 15.95% CAGR over 2026-2031. Governments support digital infrastructure build-outs, enabling widespread uptake of marketing tech among mobile-first consumers. India expects its digital marketing sector to reach INR 1.12 lakh crore (USD 13.4 billion) by 2025, powered by local-language content and AI-enabled ad-targeting innovations. Southeast Asian advertisers are directing larger shares of media spend toward social commerce, and Australian enterprises are expanding AI marketing budgets to capture incremental conversion gains.

Europe's outlook is colored by stringent regulations: GDPR 2025, the Digital Markets Act, and the Digital Services Act collectively redefine data stewardship obligations. Vendors serving the region must design default-privacy architectures that comply across all 27 member states, often rolling those standards global. In Latin America, Mexico welcomed both Netflix's USD 1 billion production pledge and Alibaba's first local cloud region, signals that international players foresee robust digital growth. Meanwhile, Middle East and Africa developers accelerate e-commerce stack adoption as payment rails mature and cross-border logistics improve.

- Adobe Inc.

- Alphabet Inc. (Google Marketing Platform)

- Amazon Web Services (AWS for Martech)

- Salesforce Inc.

- Microsoft Corp.

- Oracle Corp.

- HubSpot Inc.

- SAP SE

- Shopify Inc.

- Mailchimp (Intuit)

- Hootsuite Inc.

- Sprinklr Inc.

- Zoho Corp. (Zoho Marketing Plus)

- Optimizely

- Klaviyo

- Acoustic L.P.

- ActiveCampaign

- FullCircl Ltd.

- Buzzoole Holdings Ltd.

- Konnect Insights

- Iterable

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Mainstream - Cloud-first marketing stacks adoption surge

- 4.2.2 Mainstream - GenAI embedded across campaign orchestration

- 4.2.3 Mainstream - Privacy-driven first-party data strategies

- 4.2.4 Under-the-radar - Zero-party data micro-exchange programs

- 4.2.5 Under-the-radar - Composable CDP architectures beating suite lock-in

- 4.3 Market Restraints

- 4.3.1 Mainstream - Rising total cost of ownership and integration debt

- 4.3.2 Mainstream - Skills gap for complex martech stacks

- 4.3.3 Under-the-radar - Apple Private Relay and browser-level ad-blocking

- 4.3.4 Under-the-radar - ESG-driven cloud carbon limits on data-heavy martech

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Industry Funding and M&A Trends

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product

- 5.1.1 Social Media Tools

- 5.1.2 Content Marketing Tools

- 5.1.3 Rich-Media Creation Tools

- 5.1.4 Marketing Automation Platforms

- 5.1.5 Data and Analytics Tools

- 5.1.6 Sales Enablement Tools

- 5.2 By Application

- 5.2.1 IT and Telecommunications

- 5.2.2 Retail and E-commerce

- 5.2.3 Healthcare

- 5.2.4 Media and Entertainment

- 5.2.5 Sports and Events

- 5.2.6 BFSI

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 South America

- 5.3.3 Europe

- 5.3.4 Asia-Pacific

- 5.3.5 Middle East

- 5.3.6 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Adobe Inc.

- 6.4.2 Alphabet Inc. (Google Marketing Platform)

- 6.4.3 Amazon Web Services (AWS for Martech)

- 6.4.4 Salesforce Inc.

- 6.4.5 Microsoft Corp.

- 6.4.6 Oracle Corp.

- 6.4.7 HubSpot Inc.

- 6.4.8 SAP SE

- 6.4.9 Shopify Inc.

- 6.4.10 Mailchimp (Intuit)

- 6.4.11 Hootsuite Inc.

- 6.4.12 Sprinklr Inc.

- 6.4.13 Zoho Corp. (Zoho Marketing Plus)

- 6.4.14 Optimizely

- 6.4.15 Klaviyo

- 6.4.16 Acoustic L.P.

- 6.4.17 ActiveCampaign

- 6.4.18 FullCircl Ltd.

- 6.4.19 Buzzoole Holdings Ltd.

- 6.4.20 Konnect Insights

- 6.4.21 Iterable

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment