PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907263

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907263

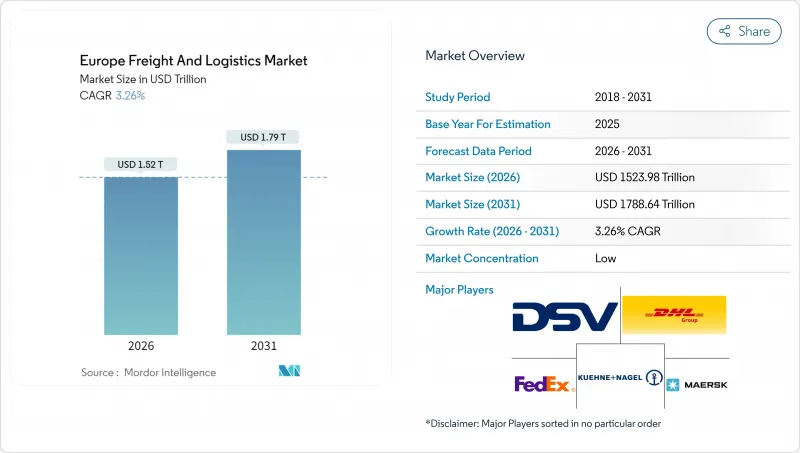

Europe Freight And Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Europe freight and logistics market was valued at USD 1475.88 billion in 2025 and estimated to grow from USD 1523.98 billion in 2026 to reach USD 1788.64 billion by 2031, at a CAGR of 3.26% during the forecast period (2026-2031).

The solid outlook stems from the continent's central role in global trade corridors, continued investments in smart infrastructure, and policy pressure to decarbonize supply chains. Freight transport retains the largest logistics function share, while courier, express, and parcel (CEP) activities record the fastest growth as cross-border e-commerce reorders distribution models. Real-time network visibility enabled by the Pan-European 5G corridor, together with EU Green Deal incentives that favor rail over road, is reshaping route economics. Simultaneously, the rapid reshoring of high-value manufacturing, wider deployment of automated parcel machines, and defense-related flows into Eastern Europe spur fresh demand for integrated "Europe freight and logistics market" solutions. Competitive dynamics intensify as scale players pursue M&A, invest in cold-chain assets, and race to certify autonomous yard-truck pilots that promise cost and safety gains.

Europe Freight And Logistics Market Trends and Insights

Pan-European 5G Corridor Transforms Real-Time Logistics Visibility

Digital Europe dedicates EUR 7.5 billion (USD 8.27 billion) to 5G infrastructure, with logistics lanes topping the priority list. This backbone enables sensor-rich trucks, trains, and vessels to communicate location, condition, and weather data every millisecond. FERNRIDE secured TUV SUD certification in 2024, allowing autonomous trucks to operate in live yard environments. Predictive maintenance analytics already trim downtime by up to 20% and reduce chilled-cargo loss rates in the "Europe freight and logistics market" cold chain.

EU Green Deal Accelerates Modal Shift from Road to Rail

The Fit-for-55 legislative package compels a 55% carbon cut by 2030, encouraging shippers to swap long-haul trucks for rail or waterways. France alone earmarked EUR 1.1 billion (USD 1.21 billion) for intermodal terminals through 2030. Yet rail freight fell 2.8% year-on-year in H1 2024, exposing capacity shortfalls that hinder modal ambitions. Rising EU ETS surcharges on maritime and road make the rail alternative progressively cost-competitive in the Europe freight and logistics industry.

Driver Shortage Crisis Triggers Wage Inflation Spiral

The International Road Transport Union calculates a 500,000-driver shortfall that could swell to 745,000 by 2028. Operators have raised wages 15-25% annually, driving road freight rates up 18-22% in major corridors. Temperature-controlled units feel the pinch more acutely, as qualified drivers command EUR 60,000 packages in high-demand hubs.

Other drivers and restraints analyzed in the detailed report include:

- Critical Manufacturing Reshoring Drives Logistics Demand

- B2C Parcel Density Expands Beyond Tier-1 Cities

- Port Labour Disruptions Create Vessel Backlogs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Manufacturing supplied 32.01% of the Europe freight and logistics market share in 2025, anchored by automotive, machinery, and chemicals. Reshoring capital outlays of USD 2 trillion tilt volumes toward continental routes, sustaining robust contract-logistics pipelines.

Wholesale and retail trade, powered by 73% consumer e-commerce penetration, grows at 3.47% CAGR (2026-2031). Omnichannel models demand hyper-local distribution, favoring micro-fulfillment facilities. Construction logistics benefits moderately from Next Generation EU spending, while renewable-energy projects introduce special-cargo lanes for turbine blades and battery chemicals.

Freight transport remained the backbone of the Europe freight and logistics market size, accounting for 62.74% revenue in 2025. CEP operations, though smaller, are scaling faster at a 3.70% CAGR between 2026-2031. Growth is rooted in cross-border e-commerce, with international parcels advancing at a 5.33% pace. Digital customs gateways shorten clearance cycles by up to two days, translating into repeat B2C volumes.

The Europe freight and logistics market is increasingly shaped by CEP network upgrades such as automated sortation, AI-guided route planning, and temperature-controlled lockers. Warehousing services rise in tandem, as next-day delivery promises hinge on expandable urban fulfillment nodes. Freight forwarding adapts through multimodal bundles, while value-added services-reverse logistics, labeling, kitting-gain relevance under EU circular-economy rules.

The Europe Freight and Logistics Market Report Segments the Industry Into End User Industry (Agriculture, Fishing, and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, and More), by Logistics Function (Courier, Express, and Parcel, Freight Forwarding, Freight Transport, and More), and Country (Denmark, Finland, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- A.P. Moller - Maersk

- C.H. Robinson

- CMA CGM Group (Including CEVA Logistics)

- DACHSER

- DHL Group

- DSV A/S (Including DB Schenker)

- Expeditors International of Washington, Inc.

- FedEx

- GEFCO

- Hapag-Lloyd

- Hellmann Worldwide Logistics

- International Distributions Services (Including GLS)

- Kuehne+Nagel

- La Poste Group

- Mainfreight

- Panattoni Europe

- Rhenus Group

- SNCF Group

- United Parcel Service of America, Inc. (UPS)

- XPO, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Demographics

- 4.3 GDP Distribution by Economic Activity

- 4.4 GDP Growth by Economic Activity

- 4.5 Inflation

- 4.6 Economic Performance and Profile

- 4.6.1 Trends in E-Commerce Industry

- 4.6.2 Trends in Manufacturing Industry

- 4.7 Transport and Storage Sector GDP

- 4.8 Export Trends

- 4.9 Import Trends

- 4.10 Fuel Price

- 4.11 Trucking Operational Costs

- 4.12 Trucking Fleet Size by Type

- 4.13 Major Truck Suppliers

- 4.14 Logistics Performance

- 4.15 Modal Share

- 4.16 Maritime Fleet Load Carrying Capacity

- 4.17 Liner Shipping Connectivity

- 4.18 Port Calls and Performance

- 4.19 Freight Pricing Trends

- 4.20 Freight Tonnage Trends

- 4.21 Infrastructure

- 4.22 Regulatory Framework (Road and Rail)

- 4.22.1 France

- 4.22.2 Germany

- 4.22.3 Italy

- 4.22.4 Netherlands

- 4.22.5 Nordics

- 4.22.6 Russia

- 4.22.7 Spain

- 4.22.8 United Kingdom

- 4.23 Regulatory Framework (Sea and Air)

- 4.23.1 France

- 4.23.2 Germany

- 4.23.3 Italy

- 4.23.4 Netherlands

- 4.23.5 Nordics

- 4.23.6 Russia

- 4.23.7 Spain

- 4.23.8 United Kingdom

- 4.24 Value Chain and Distribution Channel Analysis

- 4.25 Market Drivers

- 4.25.1 Pan-European 5G Corridor Roll-Out

- 4.25.2 EU Green Deal Modal-Shift Incentives

- 4.25.3 Reshoring of Critical Manufacturing

- 4.25.4 Rapid B2C Parcel Density Beyond Tier-1 Cities

- 4.25.5 Defence-Logistics Uptick Post-Ukraine

- 4.25.6 Autonomous Yard-Truck Pilots Reaching Scale

- 4.26 Market Restraints

- 4.26.1 Driver-Shortage Inflation Spiral

- 4.26.2 Rail Network Capacity Bottlenecks

- 4.26.3 Port Labour-Union Disruptions

- 4.26.4 Carbon-Border Adjustment Compliance Costs

- 4.27 Technology Innovations in the Market

- 4.28 Porter's Five Forces Analysis

- 4.28.1 Threat of New Entrants

- 4.28.2 Bargaining Power of Buyers

- 4.28.3 Bargaining Power of Suppliers

- 4.28.4 Threat of Substitutes

- 4.28.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Logistics Function

- 5.2.1 Courier, Express, and Parcel (CEP)

- 5.2.1.1 By Destination Type

- 5.2.1.1.1 Domestic

- 5.2.1.1.2 International

- 5.2.1.1 By Destination Type

- 5.2.2 Freight Forwarding

- 5.2.2.1 By Mode of Transport

- 5.2.2.1.1 Air

- 5.2.2.1.2 Sea and Inland Waterways

- 5.2.2.1.3 Others

- 5.2.2.1 By Mode of Transport

- 5.2.3 Freight Transport

- 5.2.3.1 By Mode of Transport

- 5.2.3.1.1 Air

- 5.2.3.1.2 Pipelines

- 5.2.3.1.3 Rail

- 5.2.3.1.4 Road

- 5.2.3.1.5 Sea and Inland Waterways

- 5.2.3.1 By Mode of Transport

- 5.2.4 Warehousing and Storage

- 5.2.4.1 By Temperature Control

- 5.2.4.1.1 Non-Temperature Controlled

- 5.2.4.1.2 Temperature Controlled

- 5.2.4.1 By Temperature Control

- 5.2.5 Other Services

- 5.2.1 Courier, Express, and Parcel (CEP)

- 5.3 Country

- 5.3.1 Denmark

- 5.3.2 Finland

- 5.3.3 France

- 5.3.4 Germany

- 5.3.5 Iceland

- 5.3.6 Italy

- 5.3.7 Netherlands

- 5.3.8 Norway

- 5.3.9 Russia

- 5.3.10 Spain

- 5.3.11 Sweden

- 5.3.12 United Kingdom

- 5.3.13 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Key Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 A.P. Moller - Maersk

- 6.4.2 C.H. Robinson

- 6.4.3 CMA CGM Group (Including CEVA Logistics)

- 6.4.4 DACHSER

- 6.4.5 DHL Group

- 6.4.6 DSV A/S (Including DB Schenker)

- 6.4.7 Expeditors International of Washington, Inc.

- 6.4.8 FedEx

- 6.4.9 GEFCO

- 6.4.10 Hapag-Lloyd

- 6.4.11 Hellmann Worldwide Logistics

- 6.4.12 International Distributions Services (Including GLS)

- 6.4.13 Kuehne+Nagel

- 6.4.14 La Poste Group

- 6.4.15 Mainfreight

- 6.4.16 Panattoni Europe

- 6.4.17 Rhenus Group

- 6.4.18 SNCF Group

- 6.4.19 United Parcel Service of America, Inc. (UPS)

- 6.4.20 XPO, Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment