PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907302

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907302

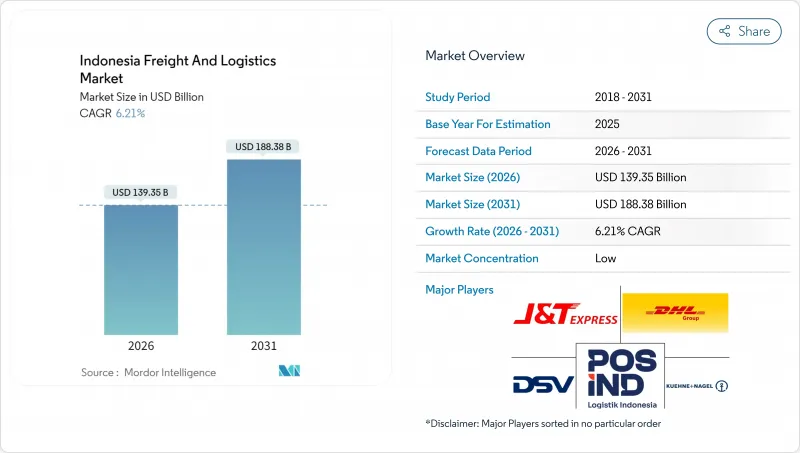

Indonesia Freight And Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Indonesia freight and logistics market size in 2026 is estimated at USD 139.35 billion, growing from 2025 value of USD 131.20 billion with 2031 projections showing USD 188.38 billion, growing at 6.21% CAGR over 2026-2031.

The archipelago's e-commerce boom, the rollout of 2,700 km of new toll roads, and rising export manufacturing output collectively accelerate growth, while infrastructure megaprojects widen geographic coverage beyond Java. Investment in digital platforms such as the National Logistics Ecosystem (NLE) shortens customs clearance times and lowers administrative costs, giving the Indonesia freight and logistics market a structural efficiency lift. Simultaneously, cold-chain facility build-outs, Air freight capacity additions, and multimodal network upgrades provide operators with routes to higher service differentiation. Competitive dynamics favor technology-enabled providers that can navigate severe urban congestion, volatile fuel prices, and overlapping regulations with data-driven route optimization and real-time visibility tools.

Indonesia Freight And Logistics Market Trends and Insights

E-Commerce Boom and Parcel-Volume Surge

Rapid digitization lifts online retail transactions by 15% annually to 2025, funneling unprecedented small-parcel volumes into last-mile networks. CEP specialists such as J&T Express and JNE scale automated hubs and pickup-point ecosystems to handle the flow efficiently. Java's dense conurbations dominate order originations, yet tier-2 cities now post double-digit volume gains as digital payments proliferate. Congested urban arteries in Jakarta limit average delivery speeds to 10-15 km/h, inflating per-package costs and pushing operators toward micro-fulfillment, two-wheeler fleets, and AI-driven route planning. Players with granular address databases and dynamic routing enjoy cost advantages, while traditional freight forwarders scramble to retrofit bulk-cargo processes for consumer-level deliveries.

Infrastructure Megaprojects (Toll Roads, Ports, Airports)

The National Strategic Projects program channels USD 400 billion into roads, ports, and airports, slicing transit times between Java's industrial hubs by as much as 40%. Over 2,700 km of new tollways integrate inland factories with main ports, while INAPORTNET port digitalization shaves customs dwell times. Makassar Port's elevation to major-hub status creates new eastern export corridors that dilute Java congestion. Enhanced connectivity allows freight forwarders to redesign multimodal routes, lowering inventory buffers and facilitating cold-chain expansion into fisheries regions. Benefits accrue gradually as supporting hinterland rail spurs and industrial estates come online, but early adopters already re-optimize warehouse footprints around improved linehaul reliability.

Severe Urban Congestion and Last-Mile Bottlenecks

Jakarta's average peak-hour speed hovers at 10-15 km/h, inflating last-mile fees that can reach 50% of delivery cost. CEP providers deploy night deliveries, micro-depots, and motorcycle couriers to sidestep gridlock, yet these workarounds add labor complexity. Temperature-sensitive goods risk spoilage when idling in traffic, pushing shippers toward premium guaranteed-time services. Government measures such as odd-even license plate schemes offer marginal relief for commercial trucks that lack schedule flexibility. As e-commerce parcel volumes rise, congestion costs are expected to intensify unless city logistics zoning and off-street loading regulations evolve.

Other drivers and restraints analyzed in the detailed report include:

- Manufacturing-Export Rebound (Autos, Electronics, Textiles)

- Rising Domestic Consumption and Middle-Class Spending

- Fragmented Regulations and Overlapping Licenses

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Manufacturing generated 28.45% of Indonesia freight and logistics market demand in 2025, driven by automotive, electronics, and textiles. High export orientation demands bonded logistics centers and just-in-time deliveries to ports and airports. Wholesale and Retail Trade, however, expands at a 6.64% CAGR (2026-2031) as middle-class consumption proliferates, forcing logistics firms to design multi-node distribution architectures. Agriculture, Fishing, and Forestry maintain steady volumes tied to commodity exports, while Construction logistics climb with infrastructure capex.

Wholesale and Retail Trade clients increasingly stipulate same-day or next-day delivery for nationwide orders, escalating the need for regional fulfillment centers and robust line-haul linkages. Manufacturing shippers adopt circular-economy objectives, adding reverse-logistics flows for returns and recycling, further diversifying service portfolios within the Indonesia freight and logistics industry.

Freight Transport contributed a 58.95% share to the Indonesia freight and logistics market in 2025. CEP, though smaller, posts a 7.12% CAGR (2026-2031) on the back of rising B2C shipments, overtaking other functions in growth velocity. Freight Forwarding remains indispensable for multimodal coordination, especially on sea-road chains linking industrial estates to export ports. Warehousing and Storage revenue scales steadily as firms adopt inventory-as-a-service models to support omnichannel fulfillment. Other Services, such as customs brokerage and supply-chain consulting, benefit from regulatory complexity and trade digitalization.

CEP's surge stems from 15% annual e-commerce transaction growth, necessitating dense delivery networks and high sortation throughput. Automated hubs reduce cost-per-package and enable same-day delivery promises. Freight Transport operators invest in parcel lockers and collaboration with ride-hailing fleets to retain relevance. Meanwhile, warehouse operators retrofit cross-dock areas for parcel flow, underscoring functional convergence within the Indonesia freight and logistics market.

The Indonesia Freight and Logistics Market Report is Segmented by End User Industry (Agriculture, Fishing, and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, and Others), Logistics Function (Courier, Express, and Parcel (CEP), Freight Forwarding, Freight Transport, Warehousing and Storage, and Other Services). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- DHL Group

- DSV A/S (Including DB Schenker)

- Expeditors International of Washington, Inc.

- FedEx

- J&T Express

- Kuehne+Nagel

- Linfox Pty Ltd.

- LOGWIN

- Ninja Van (Including Ninja Express)

- NYK (Nippon Yusen Kaisha) Line

- Pancaran Group

- PT ABM Investama TBK (including CKB Logistics)

- PT Bina Sinar Amity (BSA Logistics Indonesia)

- PT Cardig International

- PT Citrabati Logistik International

- PT Dunia Express Transindo

- PT Jalur Nugraha Ekakurir (JNE Express)

- PT Kamadjaja Logistics

- PT Lautan Luas TBK

- PT Pandu Siwi Group (Pandu Logistics)

- PT Perusahaan Perdagangan Indonesia (including BGR Indonesia)

- PT Pos Indonesia (Persero)

- PT Repex Wahana (RPX)

- PT Samudera Indonesia Tangguh

- PT Satria Antaran Prima TBK (SAPX Express)

- PT Siba Surya

- PT Soechi Lines Tbk

- Puninar Logistics

- SF Express (KEX-SF)

- Sinotrans, Ltd.

- United Parcel Service of America, Inc. (UPS)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Demographics

- 4.3 GDP Distribution by Economic Activity

- 4.4 GDP Growth by Economic Activity

- 4.5 Inflation

- 4.6 Economic Performance and Profile

- 4.6.1 Trends in E-Commerce Industry

- 4.6.2 Trends in Manufacturing Industry

- 4.7 Transport and Storage Sector GDP

- 4.8 Export Trends

- 4.9 Import Trends

- 4.10 Fuel Price

- 4.11 Trucking Operational Costs

- 4.12 Trucking Fleet Size By Type

- 4.13 Major Truck Suppliers

- 4.14 Logistics Performance

- 4.15 Modal Share

- 4.16 Maritime Fleet Load Carrying Capacity

- 4.17 Liner Shipping Connectivity

- 4.18 Port Calls And Performance

- 4.19 Freight Pricing Trends

- 4.20 Freight Tonnage Trends

- 4.21 Infrastructure

- 4.22 Regulatory Framework (Road and Rail)

- 4.23 Regulatory Framework (Sea and Air)

- 4.24 Value Chain and Distribution Channel Analysis

- 4.25 Market Drivers

- 4.25.1 E-Commerce Boom and Parcel-Volume Surge

- 4.25.2 Infrastructure Megaprojects (Toll Roads, Ports, Airports)

- 4.25.3 Manufacturing-Export Rebound (Autos, Electronics, Textiles)

- 4.25.4 Rising Domestic Consumption and Middle-Class Spending

- 4.25.5 National Logistics Ecosystem (NLE) Digital Platform Rollout

- 4.25.6 Cold-Chain Demand from Aquaculture and Seafood Exports

- 4.26 Market Restraints

- 4.26.1 Severe Urban Congestion and Last-Mile Bottlenecks

- 4.26.2 Fragmented Regulations and Overlapping Licenses

- 4.26.3 High Fuel-Price Volatility

- 4.26.4 Shortage of Logistics-Tech Talent

- 4.27 Technology Innovations in the Market

- 4.28 Porter's Five Forces Analysis

- 4.28.1 Threat of New Entrants

- 4.28.2 Bargaining Power of Buyers

- 4.28.3 Bargaining Power of Suppliers

- 4.28.4 Threat of Substitutes

- 4.28.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Logistics Function

- 5.2.1 Courier, Express, and Parcel (CEP)

- 5.2.1.1 By Destination Type

- 5.2.1.1.1 Domestic

- 5.2.1.1.2 International

- 5.2.1.1 By Destination Type

- 5.2.2 Freight Forwarding

- 5.2.2.1 By Mode of Transport

- 5.2.2.1.1 Air

- 5.2.2.1.2 Sea and Inland Waterways

- 5.2.2.1.3 Others

- 5.2.2.1 By Mode of Transport

- 5.2.3 Freight Transport

- 5.2.3.1 By Mode of Transport

- 5.2.3.1.1 Air

- 5.2.3.1.2 Pipelines

- 5.2.3.1.3 Rail

- 5.2.3.1.4 Road

- 5.2.3.1.5 Sea and Inland Waterways

- 5.2.3.1 By Mode of Transport

- 5.2.4 Warehousing and Storage

- 5.2.4.1 By Temperature Control

- 5.2.4.1.1 Non-Temperature Controlled

- 5.2.4.1.2 Temperature Controlled

- 5.2.4.1 By Temperature Control

- 5.2.5 Other Services

- 5.2.1 Courier, Express, and Parcel (CEP)

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Key Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 DHL Group

- 6.4.2 DSV A/S (Including DB Schenker)

- 6.4.3 Expeditors International of Washington, Inc.

- 6.4.4 FedEx

- 6.4.5 J&T Express

- 6.4.6 Kuehne+Nagel

- 6.4.7 Linfox Pty Ltd.

- 6.4.8 LOGWIN

- 6.4.9 Ninja Van (Including Ninja Express)

- 6.4.10 NYK (Nippon Yusen Kaisha) Line

- 6.4.11 Pancaran Group

- 6.4.12 PT ABM Investama TBK (including CKB Logistics)

- 6.4.13 PT Bina Sinar Amity (BSA Logistics Indonesia)

- 6.4.14 PT Cardig International

- 6.4.15 PT Citrabati Logistik International

- 6.4.16 PT Dunia Express Transindo

- 6.4.17 PT Jalur Nugraha Ekakurir (JNE Express)

- 6.4.18 PT Kamadjaja Logistics

- 6.4.19 PT Lautan Luas TBK

- 6.4.20 PT Pandu Siwi Group (Pandu Logistics)

- 6.4.21 PT Perusahaan Perdagangan Indonesia (including BGR Indonesia)

- 6.4.22 PT Pos Indonesia (Persero)

- 6.4.23 PT Repex Wahana (RPX)

- 6.4.24 PT Samudera Indonesia Tangguh

- 6.4.25 PT Satria Antaran Prima TBK (SAPX Express)

- 6.4.26 PT Siba Surya

- 6.4.27 PT Soechi Lines Tbk

- 6.4.28 Puninar Logistics

- 6.4.29 SF Express (KEX-SF)

- 6.4.30 Sinotrans, Ltd.

- 6.4.31 United Parcel Service of America, Inc. (UPS)

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment