PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910586

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910586

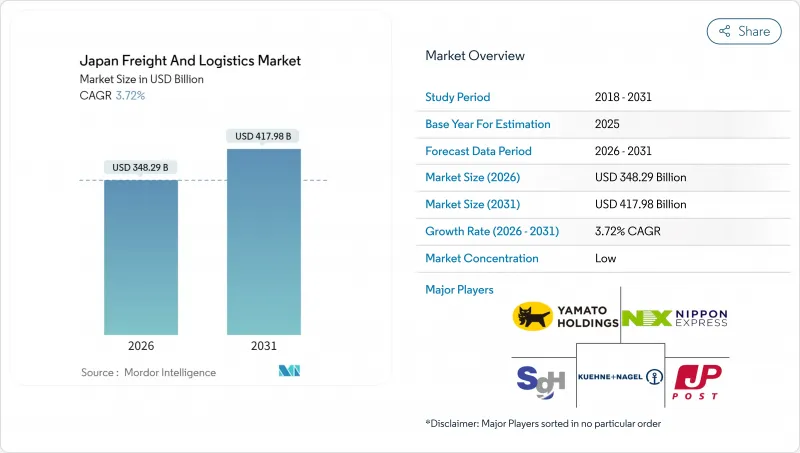

Japan Freight And Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Japan freight and logistics market size in 2026 is estimated at USD 348.29 billion, growing from 2025 value of USD 335.80 billion with 2031 projections showing USD 417.98 billion, growing at 3.72% CAGR over 2026-2031.

Rising e-commerce order volumes, greater third-party logistics (3PL) adoption in manufacturing hubs, and new government incentives for smart-logistics platforms are widening revenue streams across transport, warehousing, and value-added services. Platform interoperability mandates under the Cabinet Office's Society 5.0 framework are accelerating digital integration, while hydrogen fuel-cell corridor projects create pathways to decarbonize long-haul fleets and mitigate mounting driver shortages. At the same time, persistent urban warehouse land scarcity and higher road freight fuel costs intensify competition for capacity and push operators toward automation, multistory facilities, and network redesign. Cyber-risk exposure climbed sharply after high-profile ransomware attacks, prompting operators to embed zero-trust architectures and redundant data centers into supply-chain-wide digital rollouts.

Japan Freight And Logistics Market Trends and Insights

E-commerce Parcel Boom

Cross-border and domestic online retail have lifted parcel volumes to record highs, making CEP the fastest-growing logistics function segment. Domestic operators deploy automated sorters, AI route planning, and multistory depots to handle dense urban drop-offs, while international specialists streamline customs clearance to compress delivery windows. Partnerships such as Yamato Holdings and DHL's GoGreen Plus service show convergence between sustainability goals and premium parcel offerings that appeal to carbon-conscious consumers. Temperature-controlled micro-fulfillment nodes are being added to support fresh food and pharma e-commerce, reflecting a shift from generic handling to specialized last-mile solutions. Government digital-commerce policies simplify cross-border settlement and data sharing, reducing administrative frictions for small exporters. Accelerating parcel density simultaneously stresses driver availability, thereby reinforcing incentives for autonomous sidewalk robots and eco-depot rollouts in dense cities.

3PL Outsourcing by Manufacturers

Manufacturers are redefining 3PL relationships as value-creation partnerships rather than cost-reduction contracts. New Japanese supply-chain due-diligence laws demand CO2 traceability and regulatory proof points that most in-house logistics departments cannot maintain. Providers like Hitachi Transport System integrate AI planning suites and blockchain traceability to satisfy compliance audits, elevating technology as the new table stakes. Deal activity, typified by Mitsui's bolt-on acquisitions in food-service logistics, signals a pivot toward vertical expertise that blends sector know-how with digital capabilities. Manufacturers gain dynamic routing, real-time visibility, and embedded sustainability scores, while 3PLs secure stickier, multiyear contracts that grow beyond physical transport into data analytics and regulatory advisory. The trend positions the Japan freight and logistics market as a critical resilience lever for globally linked production networks.

Driver Shortage and Work-Hour Caps

Revised 2024 overtime limits capped annual hours at 960, curbing fleet productivity and adding upward wage pressure. Operators accelerate M&A to pool driver rosters, as seen in Meitetsu Transport's February 2025 regional consolidation. Shippers accept higher spot-rate surcharges or shift non-urgent volumes to rail and coastal shipping to secure capacity. The constraint magnifies the business case for autonomous trucks and relay-hub models that cut on-road hours per driver. Government fuel-cell corridor incentives seek to make zero-emission equipment economically viable for smaller carriers, easing compliance for over-worked staff. In the interim, selective service rationalization and higher load-factor targets characterize network redesign strategies.

Other drivers and restraints analyzed in the detailed report include:

- Government Push for Smart-Logistics Platforms

- Autonomous-Truck Pilot Acceleration (Ageing Drivers)

- Urban Warehouse Land Scarcity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Manufacturing accounted for 37.41% of the Japan freight and logistics market size in 2025, reflecting the country's export-oriented automotive, electronics, and precision machinery complexes. Tight production cycles force logistics providers to invest in synchronized parts-sequencing, bonded warehousing, and vendor-managed inventory programs. Semiconductor fabs in Kyushu and Tohoku elevate demand for clean-room grade air cargo solutions, pushing forwarders to certify pallets for controlled humidity and vibration thresholds. Supply-chain resiliency mandates drive manufacturers to diversify port routings and dual-source carriers, increasing the complexity-and value-of 3PL orchestration roles inside the Japan freight and logistics market.

Wholesale and Retail Trade, though smaller, is the fastest-expanding customer group, projected at a 3.98% CAGR between 2026-2031. Omnichannel models require near-real-time stock-keeping-unit visibility across stores, dark warehouses, and online platforms, compelling logistics partners to integrate inventory APIs directly with client enterprise planning systems. Retailers are co-financing regional fulfillment centers with carriers to secure capacity during mega sale events while lowering last-mile costs through zone skipping. Micro-fulfillment robotics and AI demand forecasting reduce split-order penalties, enhancing profitability for both shippers and service providers. As the Japan freight and logistics market matures, retail players are expected to approach manufacturing levels of logistics spend, underpinning segment diversification for 3PLs.

Freight Transport captured 70.52% of the Japan freight and logistics market share in 2025, anchored by dense industrial supply chains that rely on truck and coastal feeder services for just-in-time production cycles. The segment benefits from integrated multimodal offerings that balance cost, reliability, and carbon metrics across domestic and export flows. Although base volumes remain strong, margin pressure intensifies as diesel surcharges rise and labor costs climb. In response, leading carriers roll out AI-derived dynamic pricing and automated trans-shipment yards that elevate asset turns and support contractual service-level agreements. The Japan freight and logistics market is therefore witnessing a shift in value creation toward data-driven freight orchestration and predictive maintenance programs.

Conversely, CEP is accelerating at a 4.27% CAGR (2026-2031), supported by a structural pivot toward direct-to-consumer fulfillment and new subscription models in groceries and healthcare. Robotics-as-a-Service is scaling inside sortation hubs, allowing operators to flex capacity during seasonal peaks without owning surplus assets. Drone pilot deliveries in rural prefectures fill service gaps left by shrinking driver pools, while same-day urban cycles depend on electric cargo bikes operating from micro-depots. As parcel density further increases, asset-light network platforms partner with brick-and-mortar stores to extend parcel lockers and returns drop-off points. The competitive balance is moving from linear cost advantages to ecosystem orchestration, positioning tech-savvy players for lasting share gains in the Japan freight and logistics market.

The Japan Freight and Logistics Market Report is Segmented by Logistics Function (Courier Express, and Parcel (CEP), Freight Forwarding, Freight Transport, Warehousing and Storage, and Other Services), and by End User Industry (Agriculture, Fishing, and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, and Others). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- DHL Group

- DSV A/S (Including DB Schenker)

- FedEx

- Hitachi Transport System

- Japan Post Holdings Co., Ltd.

- Kintetsu Group Holdings Co., Ltd.

- Kuehne+Nagel

- Meitetsu World Transport

- Mitsubishi Logistics Corporation

- Mitsui O.S.K. Lines

- Nippon Express Holdings

- Nissin Corporation

- NYK (Nippon Yusen Kaisha) Line

- Sankyu Inc.

- SBS Holdings, Inc.

- Seino Holdings Co., Ltd.

- Senko Group Holdings Co., Ltd.

- SG Holdings Co., Ltd.

- United Parcel Service of America, Inc. (UPS)

- Yamato Transport Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Demographics

- 4.3 GDP Distribution by Economic Activity

- 4.4 GDP Growth by Economic Activity

- 4.5 Inflation

- 4.6 Economic Performance and Profile

- 4.6.1 Trends in E-Commerce Industry

- 4.6.2 Trends in Manufacturing Industry

- 4.7 Transport and Storage Sector GDP

- 4.8 Export Trends

- 4.9 Import Trends

- 4.10 Fuel Price

- 4.11 Trucking Operational Costs

- 4.12 Trucking Fleet Size by Type

- 4.13 Major Truck Suppliers

- 4.14 Logistics Performance

- 4.15 Modal Share

- 4.16 Maritime Fleet Load Carrying Capacity

- 4.17 Liner Shipping Connectivity

- 4.18 Port Calls and Performance

- 4.19 Freight Pricing Trends

- 4.20 Freight Tonnage Trends

- 4.21 Infrastructure

- 4.22 Regulatory Framework (Road and Rail)

- 4.23 Regulatory Framework (Sea and Air)

- 4.24 Value Chain and Distribution Channel Analysis

- 4.25 Market Drivers

- 4.25.1 E-Commerce Parcel Boom

- 4.25.2 3PL Outsourcing by Manufacturers

- 4.25.3 Government Push for Smart-Logistics Platforms

- 4.25.4 Autonomous-Truck Pilot Acceleration (Ageing Drivers)

- 4.25.5 Semiconductor Export Surge (Time-Critical)

- 4.25.6 Hydrogen Fuel-Cell Corridor Projects

- 4.26 Market Restraints

- 4.26.1 Driver Shortage and Work-Hour Caps

- 4.26.2 Escalating Fuel and Toll Charges

- 4.26.3 Urban Warehouse Land Scarcity

- 4.26.4 Cyber-Risk From Rapid Digitalisation

- 4.27 Technology Innovations in the Market

- 4.28 Porter's Five Forces Analysis

- 4.28.1 Threat of New Entrants

- 4.28.2 Bargaining Power of Buyers

- 4.28.3 Bargaining Power of Suppliers

- 4.28.4 Threat of Substitutes

- 4.28.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Logistics Function

- 5.2.1 Courier, Express, and Parcel (CEP)

- 5.2.1.1 By Destination Type

- 5.2.1.1.1 Domestic

- 5.2.1.1.2 International

- 5.2.1.1 By Destination Type

- 5.2.2 Freight Forwarding

- 5.2.2.1 By Mode of Transport

- 5.2.2.1.1 Air

- 5.2.2.1.2 Sea and Inland Waterways

- 5.2.2.1.3 Others

- 5.2.2.1 By Mode of Transport

- 5.2.3 Freight Transport

- 5.2.3.1 By Mode of Transport

- 5.2.3.1.1 Air

- 5.2.3.1.2 Pipelines

- 5.2.3.1.3 Rail

- 5.2.3.1.4 Road

- 5.2.3.1.5 Sea and Inland Waterways

- 5.2.3.1 By Mode of Transport

- 5.2.4 Warehousing and Storage

- 5.2.4.1 By Temperature Control

- 5.2.4.1.1 Non-Temperature Controlled

- 5.2.4.1.2 Temperature Controlled

- 5.2.4.1 By Temperature Control

- 5.2.5 Other Services

- 5.2.1 Courier, Express, and Parcel (CEP)

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Key Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 DHL Group

- 6.4.2 DSV A/S (Including DB Schenker)

- 6.4.3 FedEx

- 6.4.4 Hitachi Transport System

- 6.4.5 Japan Post Holdings Co., Ltd.

- 6.4.6 Kintetsu Group Holdings Co., Ltd.

- 6.4.7 Kuehne+Nagel

- 6.4.8 Meitetsu World Transport

- 6.4.9 Mitsubishi Logistics Corporation

- 6.4.10 Mitsui O.S.K. Lines

- 6.4.11 Nippon Express Holdings

- 6.4.12 Nissin Corporation

- 6.4.13 NYK (Nippon Yusen Kaisha) Line

- 6.4.14 Sankyu Inc.

- 6.4.15 SBS Holdings, Inc.

- 6.4.16 Seino Holdings Co., Ltd.

- 6.4.17 Senko Group Holdings Co., Ltd.

- 6.4.18 SG Holdings Co., Ltd.

- 6.4.19 United Parcel Service of America, Inc. (UPS)

- 6.4.20 Yamato Transport Co., Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment