PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910688

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910688

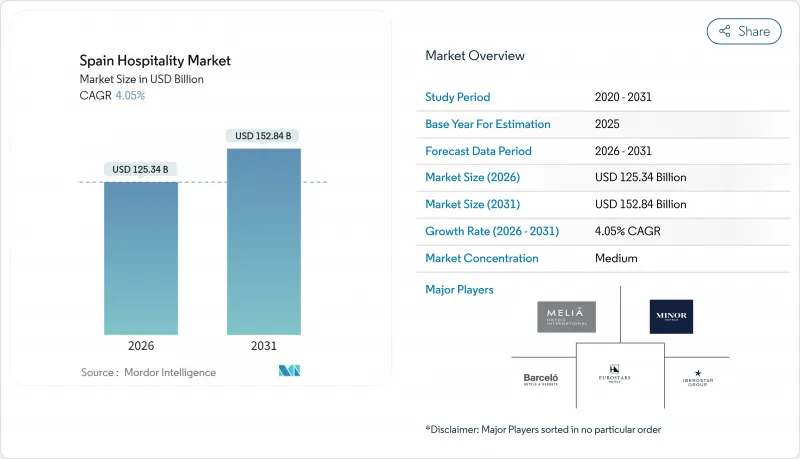

Spain Hospitality - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Spain Hospitality market size in 2026 is estimated at USD 125.34 billion, growing from 2025 value of USD 120.46 billion with 2031 projections showing USD 152.84 billion, growing at 4.05% CAGR over 2026-2031.

This growth momentum underscores the sector's post-pandemic resilience and its status as the world's second-largest tourism destination. Spain hospitality market growth is reinforced by a 16.1% jump in 2024 tourist spending, steady gains in disposable income in the United Kingdom, Germany, and France, and sustained geopolitical stability that redirects leisure flows from competing Mediterranean destinations. A government pivot from volume to value under Tourism Strategy 2030 channels Recovery and Resilience funds toward digitalization, sustainability, and inland diversification, thereby easing seasonality and stimulating higher-spending arrival. Robust urban demand, notably in Madrid and Barcelona, pushes average daily rates upward, while Canary Islands' year-round climate elevates off-peak occupancy, mitigating traditional winter troughs. Technology-enabled direct booking initiatives and SOCIMI-led asset reinvestment complement these macro drivers, positioning the Spain hospitality market for durable gains across the forecast horizon.

Spain Hospitality Market Trends and Insights

Rising Inbound Leisure Tourism Post-Pandemic

Visitor arrivals rebounded to 94 million in 2024, surpassing pre-crisis peaks and generating EUR 126 billion (USD 137.34 billion) in spending, a performance that lifted tourism GDP by 6% twice the national economic growth rate. The United Kingdom delivered 18.4 million visitors, while the United States posted 40% growth as long-haul connectivity improved. Hotel occupancy climbed to 74.6% in 2024, and average daily rates reached EUR 158.40 (USD 172.66) as supply discipline preserved pricing power. Off-peak travel accelerated faster than high-season bookings, confirming seasonality dilution that sustains year-round employment. This demand uptick is projected to keep Spain's hospitality market ADR above inflation across the medium term. Employment expanded 3.8% by December 2024, highlighting labor absorption capacity that underpins wider economic contributions.

Surge in Boutique & Lifestyle Concepts Driving ADR

Design-led hotels command rate premiums as travelers favor authentic urban experiences; Room Mate Hotels reported 37% sales growth in 2023 after launching its upscale Room Mate Collection and integrating contactless tech to reinforce guest personalization. Luxury ADR now ranges EUR 479-761 (USD 522.11-830.49), well above mid-scale averages, and RevPAR for top-tier assets rose beyond USD 128.62 per room in 2024. Environmental certification also plays a pricing role, with 52.4% of surveyed travelers willing to pay premiums for eco-certified stays. Food and beverage contribute up to 40% of total revenue in luxury properties, confirming experiential dining as a profit lever. Dynamic pricing tools adopted by independents generated 15% revenue gains, narrowing the distribution gap with branded chains. Consumers increasingly book boutique properties directly, amplifying margin benefits. Continued urbanization of lifestyle brands is expected to widen rate differentials and elevate Spain hospitality market earnings.

Over-Tourism Regulations in Key Coastal Cities

Barcelona will phase out 10,000 short-term rental licenses by 2028, reducing alternative supply and nudging demand toward hotels, where 75% of visitors already stay. Malaga froze new holiday-rental permits across 43 districts, while Mallorca tightened cruise berthing rules to alleviate congestion. New guest-registration mandates effective December 2024 require 40-plus data fields per traveler, raising compliance costs for small operators. Valencia now issues five-year accommodation permits and bans room-only lets, adding administrative hurdles. Expanded tourist taxes and insurance requisites also temper price competitiveness. Although hotels may benefit from reduced peer-to-peer competition, cap-ex for regulatory adaptation can dilute immediate gains. These measures collectively shave 0.9 percentage points off Spain hospitality market CAGR in the near term.

Other drivers and restraints analyzed in the detailed report include:

- Government Push for High-Spending Visitors

- Expansion of Hotel REIT Structures Boosting Capex

- Escalating Labour Shortages & Wage Inflation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Independent Hotels captured 57.65% Spain hospitality market share in 2025, reflecting a legacy of family-owned establishments embedded in local communities. Many independents leverage cultural authenticity and flexible service models to match dynamic traveler expectations, yet they often lag in technology adoption and international distribution reach. Chain Hotels, supported by loyalty programs and standardized service, are expanding via franchise and management contracts, with IHG signing four new Spanish properties in 2024 and targeting 50 openings by 2026. The segment's projected 5.78% CAGR indicates sustained investor appetite for brand penetration, particularly in secondary cities seeking uplift in average daily rate and RevPAR. Management-light "manchise" models help owners pivot from lease agreements to variable-fee structures that share demand risk, thereby elevating Spain hospitality market efficiency. Synergies between local knowledge and global standards continue to blur the distinction between pure independent and branded operations through soft-brand programs.

Independent operators increasingly collaborate with distribution technology providers, narrowing rate-shopping disadvantages and boosting direct digital traffic. Meanwhile, multinational platforms such as Wyndham's Super 8 expansion and Hyatt's joint venture with Grupo Pinero introduce budget and all-inclusive scale economies that independents struggle to replicate. Consolidation among domestic chains is expected, given the under-30% combined share held by the top five groups. Overall, competitive dynamics signify that Spain hospitality market size for chain operators will rise faster than independents', albeit from a lower base, as branding, standardized safety protocols, and loyalty perks resonate with price-insensitive travelers.

The Spain Hospitality Market Report is Segmented by Type (Chain Hotels, Independent Hotels), Accommodation Class (Luxury, Mid & Upper-Mid-Scale, Budget & Economy, Service Apartments), Booking Channel (Direct Digital, Otas, Corporate/MICE, Wholesale & Traditional Agents), and Geography (Andalusia, Catalonia, Madrid, Valencia, Canary Islands, Rest of Spain). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Melia Hotels International

- NH Hotel Group (Minor)

- Barcelo Hotels & Resorts

- Iberostar Group

- Eurostars Hotel Company

- Hotusa Group

- Selenta Group

- Room Mate Hotels

- Palladium Hotel Group

- Paradores de Turismo

- Riu Hotels & Resorts

- H10 Hotels

- Sercotel Hotels

- Vincci Hoteles

- Catalonia Hotels & Resorts

- Petit Palace Hotels

- Kivir Hotels

- One Shot Hotels

- Silken Hotels

- B&B Hotels Spain

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising inbound leisure tourism post-pandemic

- 4.2.2 Surge in boutique & lifestyle concepts driving ADR

- 4.2.3 Government push for high-spending visitors (Tourism Strategy 2030)

- 4.2.4 Expansion of hotel REIT structures boosting capex

- 4.2.5 Emergence of digital nomad visas expanding long-stay demand

- 4.2.6 Climate-driven shoulder-season travel shift

- 4.3 Market Restraints

- 4.3.1 Over-tourism regulations in key coastal cities

- 4.3.2 Escalating labour shortages & wage inflation

- 4.3.3 Rising energy costs squeezing GOP margins

- 4.3.4 Airbnb cap expansions limiting supply growth

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Industry Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Type

- 5.1.1 Chain Hotels

- 5.1.2 Independent Hotels

- 5.2 By Accommodation Class

- 5.2.1 Luxury

- 5.2.2 Mid & Upper-Mid-scale

- 5.2.3 Budget & Economy

- 5.2.4 Service Apartments

- 5.3 By Booking Channel

- 5.3.1 Direct Digital

- 5.3.2 OTAs

- 5.3.3 Corporate / MICE

- 5.3.4 Wholesale & Traditional Agents

- 5.4 By Geography

- 5.4.1 Andalusia

- 5.4.2 Catalonia

- 5.4.3 Madrid

- 5.4.4 Valencia

- 5.4.5 Canary Islands

- 5.4.6 Rest of Spain

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Melia Hotels International

- 6.4.2 NH Hotel Group (Minor)

- 6.4.3 Barcelo Hotels & Resorts

- 6.4.4 Iberostar Group

- 6.4.5 Eurostars Hotel Company

- 6.4.6 Hotusa Group

- 6.4.7 Selenta Group

- 6.4.8 Room Mate Hotels

- 6.4.9 Palladium Hotel Group

- 6.4.10 Paradores de Turismo

- 6.4.11 Riu Hotels & Resorts

- 6.4.12 H10 Hotels

- 6.4.13 Sercotel Hotels

- 6.4.14 Vincci Hoteles

- 6.4.15 Catalonia Hotels & Resorts

- 6.4.16 Petit Palace Hotels

- 6.4.17 Kivir Hotels

- 6.4.18 One Shot Hotels

- 6.4.19 Silken Hotels

- 6.4.20 B&B Hotels Spain

7 Market Opportunities & Future Outlook

- 7.1 Hybrid leisure-work hotel formats for digital nomads

- 7.2 Net-zero retrofit solutions for aging coastal assets