PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910689

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910689

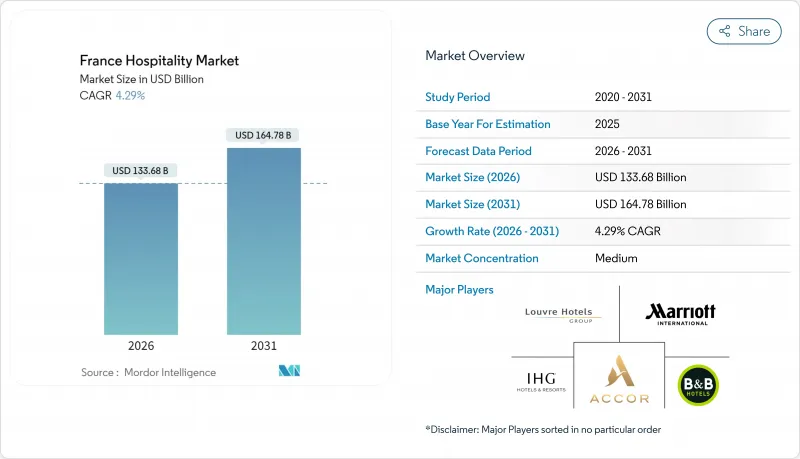

France Hospitality - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The France Hospitality market is expected to grow from USD 128.18 billion in 2025 to USD 133.68 billion in 2026 and is forecast to reach USD 164.78 billion by 2031 at 4.29% CAGR over 2026-2031.

Robust domestic demand, strong international arrivals, and purposeful government investments such as the EUR 1.9 billion (USD 2.071 billion) Destination France program are collectively reinforcing revenue visibility and underpinning this expansion path. Competitive intensity is moderate because the five largest operators hold roughly 47% of national room capacity, leaving ample room for niche concepts and regional independents to flourish. Structural drivers include Olympic-legacy infrastructure upgrades, favorable work-from-anywhere policies that blur leisure and business trips, and tax incentives aimed at accelerating energy-efficient retrofits in aging hotel stock. At the same time, operators must navigate upward wage adjustments tied to union agreements and stricter municipal limits on short-term rentals that may restrict flexible accommodation models while cushioning traditional hotels from peer-to-peer competition. Taken together, the France hospitality market continues to demonstrate resilience and adaptability as it aligns with sustainability imperatives and evolving traveler expectations.

France Hospitality Market Trends and Insights

Post-Olympics infrastructure legacy strengthens inbound demand

Paris 2024 delivered a permanent lift to hotel performance as revamped transport nodes, expanded venue capacity, and global media exposure elevate France's appeal well beyond the Games period. Airlines added seats, rail operators boosted frequencies, and new way-finding systems simplified visitor mobility, thereby reducing perceived barriers to travel and lengthening average stays. Hoteliers in Ile-de-France reported nearly USD 218 million in incremental revenue during the event window and now benefit from sustained brand visibility that supports premium room rates. The infrastructure halo has also tightened regional connectivity, enabling leisure travelers to incorporate multi-city itineraries that distribute spending across the France hospitality market. Coupled with the government's stated goal of hosting 100 million visitors annually, these improvements generate a stable base of international demand while encouraging repeat visitation. Operators regard the legacy projects as catalysts that de-risk pipeline developments and justify continued capital deployment into upscale and lifestyle-oriented assets.

Remote work puts staycations on a structural growth path

Hybrid employment models allow professionals to relocate temporarily without sacrificing job productivity, thereby creating mid-week shoulder-day demand that evades prior seasonality norms. Platforms such as Staycation report partner growth to more than 700 hotels nationwide, underscoring appetite for quick escapes within a one-hour travel radius of major urban hubs. The typical guest is younger than 35 and favors boutique properties that package wellness, gastronomy, and outdoor activities into value-added bundles. Chains and independents alike respond with extended-stay packages, flexible check-in windows, and loyalty perks tailored to domestic leisure segments. The trend directly benefits regional destinations craving weekday occupancy lifts, thus redistributing revenues away from a Paris-centric footprint and supporting balanced regional development across the France hospitality market. As employers formalize remote-work allowances, analysts expect staycation demand to solidify as a structural rather than cyclical tailwind through at least 2028.

Labor cost inflation compresses operating margins

The sector-specific minimum wage now exceeds the general SMIC at EUR 12.00 (USD 13.08) per hour, reflecting aggressive collective bargaining needed to resolve chronic staffing shortages that intensified during the pandemic. Hoteliers also absorb reinstated social charges on tips, elevating payroll's share of total expenses and narrowing EBITDA headroom. Operators counter by deploying labor-saving technologies such as contactless check-in and back-of-house automation, though upfront investment can strain liquidity for smaller properties. Chains leverage centralized procurement and shared-service centers to mitigate cost creep, whereas many independents respond by trimming service offerings or shortening restaurant hours. Sustained wage escalation risks eroding price competitiveness relative to Southern European destinations with lower labor cost bases, thus tempering the achievable CAGR of the France hospitality market. Policy dialogues continue between employer federations and unions to balance fair compensation with long-term sector viability.

Other drivers and restraints analyzed in the detailed report include:

- Energy policy accelerates modernization of aging assets

- Wellness integration moves beyond traditional spa menus

- Municipal restrictions reshape the short-term rental landscape

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Independent hotels held a commanding 61.74% of the France hospitality market share in 2025, anchored in the nation's deep heritage of family-owned auberges and boutique establishments that deliver place-based authenticity. These properties capitalize on culinary storytelling, architectural character, and personalized service that resonate with travelers seeking immersive local experiences. Chains, however, are growing faster at a 5.12% CAGR because standardized operating playbooks, brand recognition, and loyalty ecosystems reassure risk-averse international guests and corporate travel buyers. Strategic mergers, such as Accor's full acquisition of Paris Society, illustrate how large groups blend operational scale with experiential depth to compete on both efficiency and uniqueness. Independents respond by adopting cloud-based PMS solutions and consortium affiliations that unlock marketing reach without surrendering brand individuality. The interplay between authenticity and consistency is expected to define competitive positioning through 2031 as both segments pursue operational excellence while safeguarding guest intimacy.

The France hospitality market size for chain hotels is projected to expand as multinationals deploy premium-economy concepts like Spark by Hilton, which target value-conscious travelers who still demand modern design and digital convenience. Franchise and management contracts offer asset-light growth avenues that entice domestic owners seeking professional branding amid tightening regulatory oversight. Independent players counter by curating hyper-local partnerships and experiential add-ons such as chef residencies, artisan workshops, and heritage tours that chains often struggle to replicate at scale. Investors increasingly weigh asset-quality metrics alongside ESG credentials, rewarding operators that integrate energy-efficiency upgrades and equitable labor policies into value-creation plans. Consequently, a measured consolidation wave may emerge, especially among mid-market independents facing cap-ex obligations, thereby gradually increasing concentration without extinguishing France's celebrated independent lodging tradition.

The France Hospitality Market Report is Segmented by Type (Chain Hotels, Independent Hotels), Accommodation Class (Luxury, Mid & Upper-Mid-Scale, Budget & Economy, Service Apartments), Booking Channel (Direct Digital, Otas, Corporate/MICE, Wholesale & Traditional Agents), and Geography (Ile-De-France, Provence-Alpes-Cote D'Azur, Auvergne-Rhone-Alpes, and Other). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Accor

- Louvre Hotels Group

- B&B Hotels

- Marriott International

- IHG Hotels & Resorts

- Best Western Hotels & Resorts

- Pierre & Vacances Center Parcs

- Hyatt Hotels Corporation

- Minor Hotels (NH Collection)

- Hilton Worldwide

- Radisson Hotel Group

- Grape Hospitality

- Mama Shelter (Ennismore)

- Okko Hotels

- CitizenM

- JJW Hotels & Resorts

- Vacanceole

- Evok Collection

- The Ascott Limited

- Staycity Aparthotels

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Post-Olympics inbound-tourism boom

- 4.2.2 "Work-from-anywhere" domestic staycations

- 4.2.3 Government tax incentives for energy-efficient retrofits

- 4.2.4 Mainstreaming of wellness-integrated hotel formats

- 4.2.5 AI-based guest-experience personalization

- 4.3 Market Restraints

- 4.3.1 Labor-cost inflation amid unionisation waves

- 4.3.2 Stricter zoning against short-term lets

- 4.3.3 Volatile power prices squeezing margins

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Type

- 5.1.1 Chain Hotels

- 5.1.2 Independent Hotels

- 5.2 By Accommodation Class

- 5.2.1 Luxury

- 5.2.2 Mid & Upper-Mid-scale

- 5.2.3 Budget & Economy

- 5.2.4 Service Apartments

- 5.3 By Booking Channel

- 5.3.1 Direct Digital

- 5.3.2 OTAs

- 5.3.3 Corporate / MICE

- 5.3.4 Wholesale & Traditional Agents

- 5.4 By Geographic Region

- 5.4.1 Ile-de-France

- 5.4.2 Provence-Alpes-Cote d'Azur

- 5.4.3 Auvergne-Rhone-Alpes

- 5.4.4 Nouvelle-Aquitaine

- 5.4.5 Rest of France

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Accor

- 6.4.2 Louvre Hotels Group

- 6.4.3 B&B Hotels

- 6.4.4 Marriott International

- 6.4.5 IHG Hotels & Resorts

- 6.4.6 Best Western Hotels & Resorts

- 6.4.7 Pierre & Vacances Center Parcs

- 6.4.8 Hyatt Hotels Corporation

- 6.4.9 Minor Hotels (NH Collection)

- 6.4.10 Hilton Worldwide

- 6.4.11 Radisson Hotel Group

- 6.4.12 Grape Hospitality

- 6.4.13 Mama Shelter (Ennismore)

- 6.4.14 Okko Hotels

- 6.4.15 CitizenM

- 6.4.16 JJW Hotels & Resorts

- 6.4.17 Vacanceole

- 6.4.18 Evok Collection

- 6.4.19 The Ascott Limited

- 6.4.20 Staycity Aparthotels

7 Market Opportunities & Future Outlook

- 7.1 Experiential boutique-hotel concepts in secondary cities

- 7.2 AI-driven dynamic-pricing platforms for independents