PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910694

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910694

Italy Hospitality - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

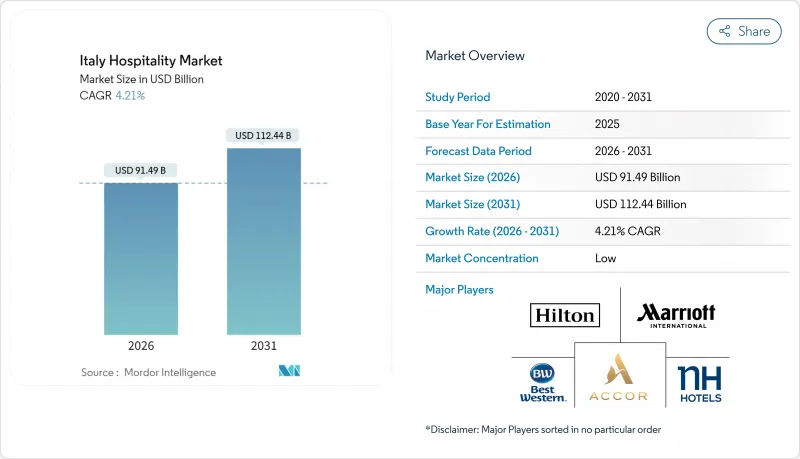

Italy Hospitality Market size in 2026 is estimated at USD 91.49 billion, growing from 2025 value of USD 87.79 billion with 2031 projections showing USD 112.44 billion, growing at 4.21% CAGR over 2026-2031.

Demand momentum flows from three intertwined factors: heritage tourism tied to Rome's Jubilee 2025, visitor inflows projected for the Milan-Cortina Winter Olympics 2026, and the steady expansion of branded hotel supply that professionalizes a highly fragmented landscape. Large-scale tax credits under the Superbonus Turismo scheme accelerate asset refurbishment, giving independent operators a path to energy-efficient upgrades that hedge against volatile utility costs. Meanwhile, digital distribution reshapes customer acquisition; direct channels still generate half of all room revenue, yet online travel agencies (OTAs) are expanding at 9.81% CAGR as travelers favor mobile search, instant price comparison, and frictionless booking. Labor shortages remain a pressing concern: unfilled hospitality positions tripled between 2019 and 2024, pushing payroll above 33% of revenue in many city-center properties. Finally, mandatory ESG reporting under Legislative Decree 125/2024 forces hotels, especially heritage buildings, to invest in metering, renewable energy, and transparent disclosures that add short-term cost but unlock green-finance opportunities.

Italy Hospitality Market Trends and Insights

Surge in luxury inbound tourism linked to Jubilee 2025 & Winter Olympics 2026

The dual spotlight of Rome's Jubilee 2025 and the Milan-Cortina Games lifts premium demand well beyond event months. Italy hosted 64.5 million arrivals in 2024, and luxury hotels alone generated EUR 9 billion (USD 9.9 billion) or 16.82% of total sector revenue, growing 9.23% year on year. Average daily rates reached EUR 840 (USD 924) in Rome and EUR 910 (USD 1,001) in Milan, signaling substantial price-setting power relative to peer European capitals. High-spending visitors from Germany, the United States, and the United Kingdom contributed more than 65% of five-star room nights, reinforcing Italy's reputation for experiential travel anchored in culture and cuisine. Up-market positioning extends to secondary destinations Lake Como, Taormina, and Bologna, where conversion of historic villas to boutique luxury formats attracts discerning guests. Because luxury assets operate at lower breakeven occupancy, operators can invest in wellness facilities and curated local experiences that lock in repeat visitation. The persistent premium signals sustainable upside even after the international spotlight shifts elsewhere.

Rapid penetration of international hotel chains

Branded supply crossed the 20% national threshold in 2024, double the penetration rate recorded a decade earlier. Roughly 155 international brands operate in Italy today, a 100% rise since 2015, underscoring investor appetite for stable cash-flow assets backed by global reservation systems. Conversion rather than new-build projects dominate pipelines; 73.40% of planned openings through 2026 involve upgrading family-owned properties into soft-brand or franchise formats, limiting zoning hurdles while elevating service standards. Marriott alone has 20 Italian projects announced, with heavy weighting toward full-service and luxury flags aimed at urban gateways. Accelerated chain growth introduces professional revenue-management tools, loyalty-program access, and unified ESG protocols that enhance asset value. Independent owners increasingly view brand affiliation as a hedge against market shocks, explaining the upward trajectory toward 22% room penetration by 2028.

Acute talent shortage & wage inflation

Despite a record 1.5 million hospitality employees in 2024, Italy posted 604,000 hard-to-fill positions, triple the deficit recorded in 2019. Vacancy rates exceed 30% for chefs and pastry chefs, forcing many hotels to cap room inventory during peak summer months. Rising competition for bilingual front-office staff and revenue-management analysts pushes average monthly salaries 14% above pre-pandemic benchmarks, lifting labor cost to more than one-third of total revenue. Younger workers cite seasonal instability and limited career growth as primary deterrents; 40% of unemployed hospitality staff intend to exit the sector permanently. Employers respond with signing bonuses, subsidized housing, and partnerships with vocational colleges, but scaled solutions remain elusive. Long-term exposure includes reputational risk: service shortfalls erode review ratings that heavily influence digitally savvy travelers. Unless the talent pipeline strengthens, capacity could lag demand, diluting growth across the Italy hospitality market.

Other drivers and restraints analyzed in the detailed report include:

- Digital-first booking behavior

- Tax incentives for hotel refurbishments

- Rising energy costs and ESG-compliance outlays

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Independent hotels held 77.68% of Italy hospitality market share in 2025, preserving numerical dominance despite steady chain expansion at 7.14% CAGR. Family-run assets thrive on local storytelling, culinary authenticity, and flexible guest interaction that repeat visitors prize. Yet, the fragmented owner base confronts rising guest expectations for omnichannel service and unified loyalty benefits. Conversion pipelines reveal that 67% of upcoming branded openings involve taking over existing independent structures, signaling owner appetite for franchise or soft-brand agreements that retain architectural character. Chains leverage centralized purchasing, robust digital-marketing budgets, and advanced revenue-management software, securing RevPAR premiums of 10-12% over comparable unbranded peers. While independent ethos will remain a hallmark of the Italy hospitality market, it is increasingly augmented by selective brand alliances that marry authenticity with global reach.

Italy Hospitality Market is Segmented by Type (Chain Hotels, Independent Hotels), Accommodation Class (Luxury, Mid & Upper-Mid-Scale, Budget & Economy, Service Apartments), Booking Channel (Direct, Digital OTAs, Corporate/MICE, Wholesale & Traditional Agents), and Geography (Northwest, Northeast, Central, South Italy, Islands). Market Forecasts are Provided in Terms of Value (EUR).

List of Companies Covered in this Report:

- Marriott International

- Accor SA

- Best Western Hotels & Resorts

- NH Hotel Group

- Hilton Worldwide

- B&B Hotels

- Starhotels SpA

- Gruppo UNA

- TH Resorts

- VOIhotels

- ITI Hotels Group

- Melia Hotels International

- Radisson Hotel Group

- IHG Hotels & Resorts

- Minor Hotels

- Four Seasons Hotels & Resorts

- Rocco Forte Hotels

- Baglioni Hotels & Resorts

- Belmond Ltd.

- Rosewood Hotels & Resorts

- JdV by Hyatt

- CitizenM Hotels

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in luxury inbound tourism linked to Jubilee 2025 & Winter Olympics 2026

- 4.2.2 Rapid penetration of international hotel chains (?22 % rooms by 2028)

- 4.2.3 Digital-first booking behaviour (84 % online sales expected by 2029)

- 4.2.4 Tax incentives for hotel refurbishments (Superbonus Turismo)

- 4.2.5 Short-term-rental curbs boosting demand for serviced apartments

- 4.2.6 Secondary-airport & high-speed-rail upgrades expanding regional demand

- 4.3 Market Restraints

- 4.3.1 Acute talent shortage & wage inflation

- 4.3.2 Rising energy costs and ESG-compliance outlays

- 4.3.3 Seasonal leisure dependence causing occupancy volatility

- 4.3.4 Lengthy zoning & heritage-permit approvals delaying projects

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Type

- 5.1.1 Chain Hotels

- 5.1.2 Independent Hotels

- 5.2 By Accommodation Class

- 5.2.1 Luxury

- 5.2.2 Mid & Upper-Mid-scale

- 5.2.3 Budget & Economy

- 5.2.4 Service Apartments

- 5.3 By Booking Channel

- 5.3.1 Direct

- 5.3.2 Digital OTAs

- 5.3.3 Corporate / MICE

- 5.3.4 Wholesale & Traditional Agents

- 5.4 By Geographic Region

- 5.4.1 Northwest Italy

- 5.4.2 Northeast Italy

- 5.4.3 Central Italy

- 5.4.4 South Italy

- 5.4.5 Islands

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Marriott International

- 6.4.2 Accor SA

- 6.4.3 Best Western Hotels & Resorts

- 6.4.4 NH Hotel Group

- 6.4.5 Hilton Worldwide

- 6.4.6 B&B Hotels

- 6.4.7 Starhotels SpA

- 6.4.8 Gruppo UNA

- 6.4.9 TH Resorts

- 6.4.10 VOIhotels

- 6.4.11 ITI Hotels Group

- 6.4.12 Melia Hotels International

- 6.4.13 Radisson Hotel Group

- 6.4.14 IHG Hotels & Resorts

- 6.4.15 Minor Hotels

- 6.4.16 Four Seasons Hotels & Resorts

- 6.4.17 Rocco Forte Hotels

- 6.4.18 Baglioni Hotels & Resorts

- 6.4.19 Belmond Ltd.

- 6.4.20 Rosewood Hotels & Resorts

- 6.4.21 JdV by Hyatt

- 6.4.22 CitizenM Hotels

7 Market Opportunities & Future Outlook

- 7.1 Conversion of heritage palazzi into upscale lifestyle hotels in secondary art cities

- 7.2 Carbon-neutral MICE venues clustered around new high-speed-rail hubs