PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910693

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910693

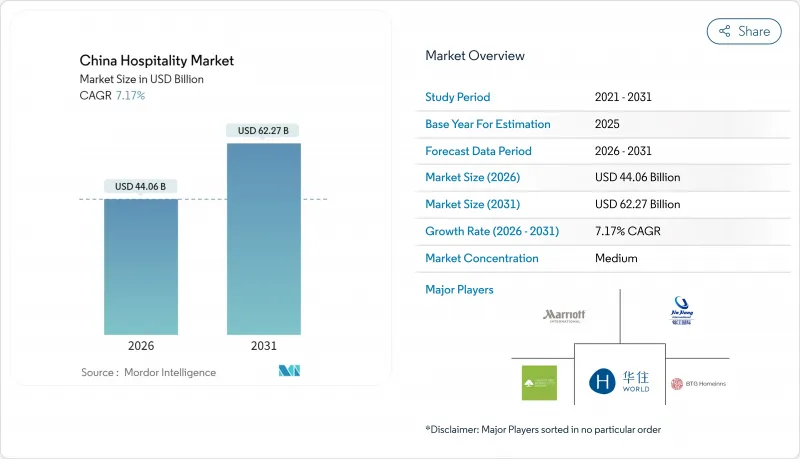

China Hospitality - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The China Hospitality market is expected to grow from USD 41.11 billion in 2025 to USD 44.06 billion in 2026 and is forecast to reach USD 62.27 billion by 2031 at 7.17% CAGR over 2026-2031.

This trajectory is underpinned by robust domestic leisure demand, rapid high-speed rail expansion, and government programs that promote night-time spending. Chain hotel expansion, service-apartment momentum, and smart-hotel technology gains are reinforcing profitability across property classes. Operators are also benefiting from structured cultural-tourism subsidies that stimulate regional travel, even as land-lease inflation and OTA commission pressure temper margins. Private-sector investments remain strong because loyalty programs, cost-saving automation, and experiential positioning are creating durable competitive moats. The sector's expansion aligns with China's broader economic recovery, where domestic tourism reached 2.725 billion trips in the first half of 2024, representing a 14.3% year-over-year increase.

China Hospitality Market Trends and Insights

Post-pandemic Domestic Leisure Boom

Pent-up demand after border restrictions lifted ignited a sharp rebound in weekend and short-haul trips that has lifted occupancy across all lodging tiers. Domestic tourism revenue rose to CNY 4.91 trillion (USD 673 billio) in 2024, a 140.3% jump from 2023, and trip volume recovered to 81.44% of pre-pandemic levels. Service spending has been expanding twice as fast as goods purchases, confirming a durable experiential shift that favors properties with differentiated leisure offerings. Mid-scale and boutique hotels are capturing outsized gains because travelers prioritize unique settings and local immersion. Government cultural-tourism subsidies have magnified the surge by lowering barriers to off-peak travel. These demand characteristics make the China hospitality market unusually resilient against macro headwinds.

High-speed Rail Expanding Weekend Trips

China's 50,000-kilometer HSR grid compresses travel times between mega-cities and secondary markets, adding more than 3.4 million incremental tourists per connected city. The Yangtze River Delta exemplifies the effect: inter-city travel times have fallen by about 50%, enabling two-night excursions that once required extra vacation days. Boutique and mid-scale hotels in regional clusters now draw demand once limited to primary urban cores. Occupancy uplift is strongest where rail stations sit near cultural landmarks, and many properties are realigning marketing calendars around rail-timetable peaks. The connectivity advantage supports a hub-and-spoke tourism pattern that spreads the benefits of the China hospitality market beyond coastal cities.

Land-lease Cost Inflation

Urban land auction prices have created significant cost pressures for new hotel development, particularly in tier-1 cities where commercial real estate values have outpaced revenue growth potential. The commercial real estate market has experienced absorption pressure and downward rent adjustments in office segments, though hospitality assets in prime locations continue to command premium valuations. Rising land costs have shifted investment patterns toward renovation and repositioning of existing assets rather than ground-up development, as investors seek to optimize returns within constrained cost structures. This dynamic has particularly impacted independent hotel operators and smaller chains that lack the scale advantages of major groups in securing favorable lease terms. Overall, land-lease inflation weighs on pipeline diversity and slows supply growth in the densest nodes of the China hospitality market.

Other drivers and restraints analyzed in the detailed report include:

- Government Push for Night-time Economy

- Gen-Z Demand for Experiential Stays

- OTA Marketing Fee Escalation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Chain hotels accounted for 55.74% of the China hospitality market share in 2025, underscoring a rising chainization rate that hit 40.95% by year-end. The cohort is expected to post an 7.95% CAGR to 2031 as franchise signings dominate new supply pipelines. The China hospitality market size attached to chain operations is therefore set to expand faster than that of independents, supported by loyalty ecosystems that funnel direct traffic and reduce OTA reliance.

Rapid roll-outs by H World Group and Jin Jiang are demonstrating the scalability of asset-light models, while occupancy levels above 80% signal strong brand equity. Independent operators continue to lose negotiating leverage on procurement and digital distribution, accelerating buy-out or conversion prospects. Technology scale, combined with membership data, gifts chains superior revenue-management precision, which further enlarges market-share gaps.

The China Hospitality Market Report is Segmented by Type (Chain Hotels, Independent Hotels), Accommodation Class (Luxury, Mid & Upper-Mid-Scale, Budget & Economy, Service Apartments), Booking Channel (Direct Digital, Otas, Corporate/MICE, Wholesale & Traditional Agents), and Geography (North China, Northeast China, East China, South-Central China, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Jin Jiang International

- Huazhu Group

- BTG Homeinns

- Dossen International

- GreenTree Hospitality

- Plateno Group

- Atour Lifestyle

- New Century Hotels

- Shanghai Yitel

- IHG Hotels & Resorts (China)

- Marriott International (China)

- Hilton Hotels (China)

- Accor (China)

- Wyndham Hotels (China)

- Shangri-La Hotels

- Mandarin Oriental (China)

- BTG Jianguo

- OCT Hotels

- HNA Hospitality

- Artyzen Hospitality

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Post-pandemic domestic leisure boom

- 4.2.2 High-speed rail expanding weekend trips

- 4.2.3 Government push for night-time economy

- 4.2.4 Gen-Z demand for experiential stays

- 4.2.5 Smart-hotel tech cost savings (under-the-radar)

- 4.2.6 Low-carbon certification as booking filter (under-the-radar)

- 4.3 Market Restraints

- 4.3.1 Land-lease cost inflation

- 4.3.2 OTA marketing fee escalation

- 4.3.3 Rising labour shortages in tier-1 cities (under-the-radar)

- 4.3.4 Persistent local COVID-19 flare-up risk (under-the-radar)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Type

- 5.1.1 Chain Hotels

- 5.1.2 Independent Hotels

- 5.2 By Accommodation Class

- 5.2.1 Luxury

- 5.2.2 Mid & Upper-Mid-scale

- 5.2.3 Budget & Economy

- 5.2.4 Service Apartments

- 5.3 By Booking Channel

- 5.3.1 Direct Digital

- 5.3.2 OTAs

- 5.3.3 Corporate / MICE

- 5.3.4 Wholesale & Traditional Agents

- 5.4 By Geographic Region

- 5.4.1 North China

- 5.4.2 Northeast China

- 5.4.3 East China

- 5.4.4 South-Central China

- 5.4.5 Southwest China

- 5.4.6 Northwest China

- 5.4.7 Hong Kong & Macau

- 5.4.8 Taiwan

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Jin Jiang International

- 6.4.2 Huazhu Group

- 6.4.3 BTG Homeinns

- 6.4.4 Dossen International

- 6.4.5 GreenTree Hospitality

- 6.4.6 Plateno Group

- 6.4.7 Atour Lifestyle

- 6.4.8 New Century Hotels

- 6.4.9 Shanghai Yitel

- 6.4.10 IHG Hotels & Resorts (China)

- 6.4.11 Marriott International (China)

- 6.4.12 Hilton Hotels (China)

- 6.4.13 Accor (China)

- 6.4.14 Wyndham Hotels (China)

- 6.4.15 Shangri-La Hotels

- 6.4.16 Mandarin Oriental (China)

- 6.4.17 BTG Jianguo

- 6.4.18 OCT Hotels

- 6.4.19 HNA Hospitality

- 6.4.20 Artyzen Hospitality

7 Market Opportunities & Future Outlook

- 7.1 Wellness-focused resorts tied to Hainan duty-free tourism

- 7.2 Upscaling mid-tier chains in lower-tier cities