PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910705

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910705

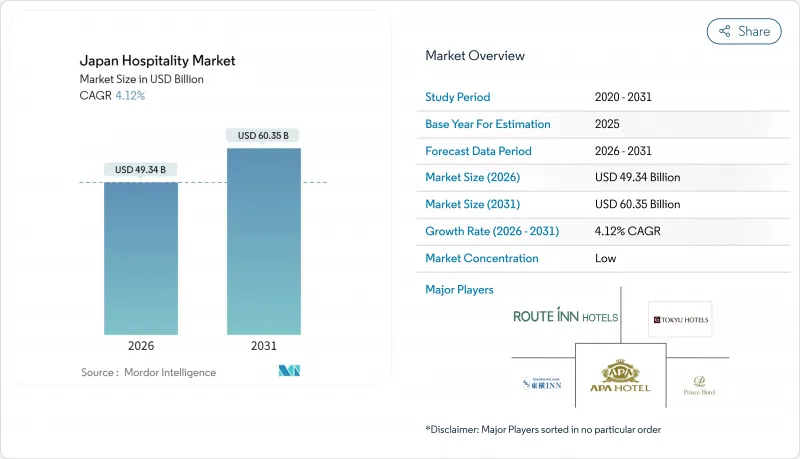

Japan Hospitality - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Japan Hospitality market is expected to grow from USD 47.39 billion in 2025 to USD 49.34 billion in 2026 and is forecast to reach USD 60.35 billion by 2031 at 4.12% CAGR over 2026-2031.

The growth momentum is driven by a mix of inbound demand, technology adoption, and supportive regulation. Strong visitor inflows tied to a weaker yen, steady domestic leisure spending, and robust investment in regional tourism assets are strengthening top-line revenue streams for operators. Government stimulus programs that subsidize barrier-free retrofits, together with relaxed visa policies for priority source markets, underpin a medium-term surge in room demand that offsets lingering softness in domestic corporate travel. Operators are also deploying service robots, smart-check-in kiosks, and energy-saving systems to counter labor shortages and rising utilities, which improves operating margins even as wage levels move higher. New supply remains disciplined because construction-material inflation and seismic-retrofit costs raise development hurdles, so existing properties enjoy solid pricing power during the recovery phase.

Japan Hospitality Market Trends and Insights

Post-pandemic inbound tourism surge

International arrivals rebounded to 36.87 million in 2024 and visitor spending climbed to JPY 8.14 trillion (USD 57.79 billion), reflecting the potent mix of pent-up demand and currency advantage that positions Japan as a value destination. Average length of stay rose to 11.5 days as travelers stretched budgets further under favorable exchange rates. Hotels in Tokyo achieved 91.22% occupancy with average daily rates of JPY 18,965 (USD 134.58), confirming that robust international demand is filling inventory that once relied on domestic corporate guests. The Japan National Tourism Organization is targeting 60 million annual visitors by 2030, a milestone now perceived as attainable given current traction. Dynamic pricing tools have allowed urban hotels to lift rates 60% above 2019 levels without eroding occupancy. Operators that focus on multilingual digital marketing and seamless contactless service are capturing the highest share of incremental spending.

Expansion of visa-free short-stay agreements

The government's push to ease entry for Southeast Asian and GCC nationals opens large, fast-growing visitor pools, diversifying away from the traditional China-South Korea corridor. Multiple-entry visas for Chinese travelers and pilot e-visa programs for ASEAN nations have already reduced processing backlogs and encouraged repeat visits. These policy steps underpin a structural lift in room nights rather than a temporary spike. Airports in Fukuoka and Naha are tailoring facilities for new feeder routes, accelerating the regional dispersion of inbound traffic. Operators in secondary cities are responding by localizing menus, adding prayer rooms, and expanding foreign-language support. The sustained flow of new markets bolsters year-round occupancy and smooths seasonality that once defined leisure peaks.

Construction-material inflation

Steel and cement prices rose 30-40% between 2023 and 2025 as raw-material costs and new labor regulations pushed project budgets higher, eroding returns on greenfield hotel developments. Developers now require higher average daily rates or alternative financing to hit hurdle yields, delaying several pipeline projects in central Tokyo. Some investors pivot to conversion of existing office stock or mixed-use towers that spread cost across multiple income streams. Prefectural authorities have responded with limited infrastructure grants, but the gap between replacement cost and achievable room revenue keeps new supply muted. The supply constraint supports pricing for incumbent operators yet limits capacity in high-demand periods. Sustained inflation would lengthen development timelines and further concentrate capital toward premium assets.

Other drivers and restraints analyzed in the detailed report include:

- Government subsidies for barrier-free retrofits

- Service-robotics deployment to ease labor gaps

- Shrinking domestic business-travel budgets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Independent hotels accounted for 70.78% of the Japan hospitality market share in 2025, reflecting the country's preference for locally run properties that showcase cultural authenticity. Chain hotels, however, are growing at a 6.11% CAGR, supported by standardized systems and strong loyalty programs that tackle labor shortages with centralized training and technology. Marriott opened its 100th Japanese property in 2024 and has 12 more projects slated, signaling confidence in brand power to attract international guests. Seibu Prince Hotels adopted a cloud reservation platform that strengthens distribution reach and data analytics, improving revenue management across its expanding estate. Independent operators are responding by joining soft-brand collections or investing in property-management systems that integrate with OTAs. Consolidation is expected as family-owned ryokans face succession challenges, creating acquisition opportunities for well-capitalized chains. Over time, the combined room count of top brands will increase even if independents hold numerical property advantage, subtly reshaping competitive intensity across major gateways.

The Japan hospitality market size for Chain Hotels is projected to climb steadily as investors favor scalable models with predictable returns. Franchising frameworks have eased entry for domestic real-estate players who supply land while global brands deliver booking engines and loyalty pipelines. Independent hotels must leverage unique location attributes, bespoke design and high-touch service to stay competitive. Some adopt automation selectively to protect warm service elements while trimming back-office tasks. Others collaborate with regional tourism boards to craft thematic itineraries that highlight local culture, thereby winning group bookings from niche operators. Market share movement will hinge on each segment's ability to balance authenticity, efficiency and digital reach under tightening labor and cost conditions.

The Japan Hospitality Market is Segmented by Type (Chain Hotels, Independent Hotels), Accommodation Class (Luxury, Mid & Upper-Mid-Scale, Budget & Economy, Service Apartments), Booking Channel (Direct Digital, Otas, Corporate/MICE, Wholesale & Traditional Agents), and Geography (Hokkaido, Tohoku, Kanto, Chubu, Kansai, Chugoku, Shikoku, Kyushu & Okinawa). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- APA Hotel & Resort

- Fujita Kanko Inc.

- Prince Hotels, Inc.

- Tokyu Hotels & Resorts Co., Ltd.

- Hotel Okura Co., Ltd.

- HOSHINO RESORTS Inc.

- Hilton Worldwide Holdings Inc.

- Marriott International, Inc.

- InterContinental Hotels Group PLC

- Accor S.A.

- Hyatt Hotels Corporation

- Wyndham Hotels & Resorts, Inc.

- Mitsui Fudosan Hotels & Resorts Co., Ltd.

- Washington Hotel Corporation

- Daiwa Resort Co., Ltd.

- Smile Hotel Chain

- Route Inn Japan Co., Ltd.

- Toyoko Inn Co., Ltd.

- Kintetsu Miyako Hotels International, Inc.

- JR-East Hotels (Nippon Hotel Co., Ltd.)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Post-pandemic inbound tourism surge sustained by weaker Yen

- 4.2.2 Visa-free short-stay agreements expanding to ASEAN & GCC nations

- 4.2.3 Government subsidies accelerating hotel refurbishments for barrier-free access

- 4.2.4 Deployment of service-robotics to curb chronic labour shortages

- 4.2.5 24/7 smart-check-in kiosks boosting ADR & ancillary spend

- 4.2.6 Decentralised energy solutions lowering OPEX for remote resorts

- 4.3 Market Restraints

- 4.3.1 Construction-material inflation squeezing ROI on greenfield projects

- 4.3.2 Shrinking domestic business-travel budgets amid hybrid-work adoption

- 4.3.3 Tight municipal zoning caps on short-term rentals in Osaka & Kyoto

- 4.3.4 Aging building stock facing costly seismic retrofits

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Type

- 5.1.1 Chain Hotels

- 5.1.2 Independent Hotels

- 5.2 By Accommodation Class

- 5.2.1 Luxury

- 5.2.2 Mid & Upper-Mid-scale

- 5.2.3 Budget & Economy

- 5.2.4 Service Apartments

- 5.3 By Booking Channel

- 5.3.1 Direct Digital

- 5.3.2 OTAs

- 5.3.3 Corporate / MICE

- 5.3.4 Wholesale & Traditional Agents

- 5.4 By Geographic Region

- 5.4.1 Hokkaido

- 5.4.2 Tohoku

- 5.4.3 Kanto

- 5.4.4 Chubu

- 5.4.5 Kansai

- 5.4.6 Chugoku

- 5.4.7 Shikoku

- 5.4.8 Kyushu & Okinawa

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 APA Hotel & Resort

- 6.4.2 Fujita Kanko Inc.

- 6.4.3 Prince Hotels, Inc.

- 6.4.4 Tokyu Hotels & Resorts Co., Ltd.

- 6.4.5 Hotel Okura Co., Ltd.

- 6.4.6 HOSHINO RESORTS Inc.

- 6.4.7 Hilton Worldwide Holdings Inc.

- 6.4.8 Marriott International, Inc.

- 6.4.9 InterContinental Hotels Group PLC

- 6.4.10 Accor S.A.

- 6.4.11 Hyatt Hotels Corporation

- 6.4.12 Wyndham Hotels & Resorts, Inc.

- 6.4.13 Mitsui Fudosan Hotels & Resorts Co., Ltd.

- 6.4.14 Washington Hotel Corporation

- 6.4.15 Daiwa Resort Co., Ltd.

- 6.4.16 Smile Hotel Chain

- 6.4.17 Route Inn Japan Co., Ltd.

- 6.4.18 Toyoko Inn Co., Ltd.

- 6.4.19 Kintetsu Miyako Hotels International, Inc.

- 6.4.20 JR-East Hotels (Nippon Hotel Co., Ltd.)

7 Market Opportunities & Future Outlook

- 7.1 AI-driven automation suites to offset labour scarcity and lift GOP margins

- 7.2 Extended-stay products tailored to inbound digital-nomad visas