PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934729

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934729

Spain Ceramic Tiles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

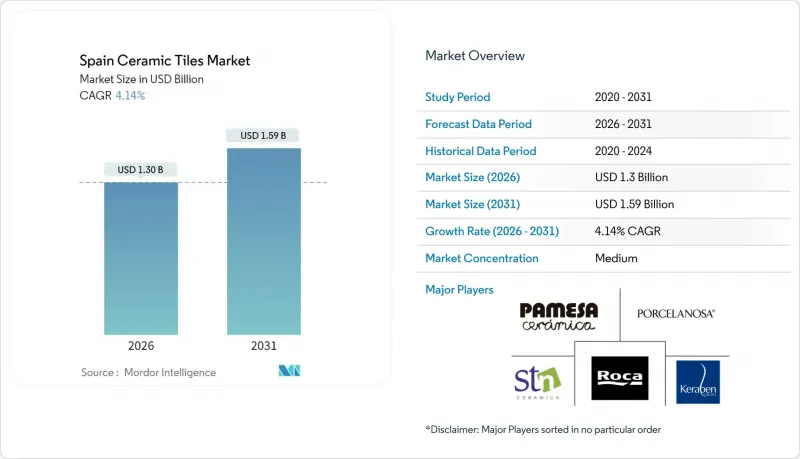

The Spain ceramic tiles market was valued at USD 1.25 billion in 2025 and estimated to grow from USD 1.3 billion in 2026 to reach USD 1.59 billion by 2031, at a CAGR of 4.14% during the forecast period (2026-2031).

Growth hinges on Spain's tourism rebound-85 million international arrivals in 2023 that spent EUR 108.66 billion (USD 117.12 billion)-which is driving hotel and resort refurbishments across Catalonia, the Balearics, and Valencia. Premium porcelain tiles, known for sub-0.5% water absorption and high mechanical strength, meet the durability demands of these hospitality projects while supporting energy-efficient envelopes in residential retrofits financed by Next Generation EU grants. Online DIY platforms, empowered by augmented-reality visualization and streamlined click-and-collect logistics, are eroding traditional store footfall yet broadening nationwide access to specialty formats. Environmental regulations-from silica-dust exposure limits to looming carbon-pricing schemes-continue reshaping capital-spending priorities and cement manufacturers' shift toward green-hydrogen kiln conversions.

Spain Ceramic Tiles Market Trends and Insights

Surge in renovation & refurbishment of Spain's aging housing stock

The comprehensive retrofits to meet EU Green Deal performance thresholds, and the EUR 3.42 billion Next Generation EU allocation is earmarked for remediating 355,000 dwellings by 2030. Provincial programs such as Andalusia's Plan Eco Vivienda offer 40% subsidies that cap direct homeowner outlays at EUR 3,000, spurring demand for long-life ceramic facades with low thermal conductivity. Because the national renovation rate remains 1% annually-well below the EU-mandated 3%-developers are accelerating permit applications, creating predictability for tile orders that favor porcelain due to its insulation value and durability. Third-party financing under the IDAE PAREER mechanism is easing upfront cash needs, broadening homeowner participation and further anchoring future orders for energy-compliant surfaces. This driver ties directly to the Spain ceramic tiles market by supplying a multi-year project pipeline that cushions manufacturers from cyclical new-build fluctuations.

Recovery of tourism-led hospitality refurbishments

International tourist spending surged 24.7% year-over-year in 2023, yielding EUR 108.66 billion that coastal hotels are deploying to refresh guestrooms, spas, and terraces with high-specification porcelain slabs. Average spend per visitor rose to EUR 1,278, signaling a shift toward higher quality experiences that require visually striking yet low-maintenance finishes. Renovation windows now extend across the calendar because reduced seasonality allows continuous works, smoothing demand for tiles in both peak and off-peak quarters. Operators increasingly choose antibacterial glazes that eliminate 99.9% of microbes, fulfilling hygiene expectations of post-pandemic travelers. CaixaBank Research forecasts tourism GDP will grow 2.5% annually through 2026, guaranteeing continued refurbishment cycles that elevate the Spain ceramic tiles market.

Volatile natural-gas prices inflating manufacturing costs

Spot gas soared above EUR 120 per MWh in 2023, forcing factories in Castellon's ceramic corridor to sign short tenors or suspend kilns intermittently. Pamesa mitigated exposure by switching from Endesa to Naturgy, a move that saved EUR 85-90 million and nearly doubled EBITDA from EUR 106 million to EUR 192 million in one fiscal cycle. Such volatility complicates budgeting for glaze formulation and kiln scheduling, sometimes prompting price surcharges that erode customer loyalty. Manufacturers hedge with financial derivatives, but margin calls strain liquidity when price spikes outpace credit lines. Until green hydrogen scales economically, fuel swings will continue to compress profits and temper growth expectations for the Spain ceramic tiles market.

Other drivers and restraints analyzed in the detailed report include:

- Government incentives for energy-efficient building envelopes

- Expansion of online DIY channels and click-&-collect models

- Rising inflow of low-cost imports (Turkey, India) in budget segment

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Porcelain retained 68.10% Spain ceramic tiles market share in 2025 and is forecast to record a 4.54% CAGR through 2031, underscoring its technical supremacy in high-traffic environments. Water absorption below 0.5% allows seamless indoor-to-outdoor transitions, satisfying hospitality designers who need continuity across lobbies and pool decks. KERAjet's inkjet systems now print 1,000 dpi textures on 20 mm-thick slabs, enabling hyper-real stone looks without quarrying environmental costs. Glazed ceramic, holding 18.30%, continues attracting price-conscious renovators seeking color variety, while unglazed technical bodies serve factories and transit hubs requiring slip resistance.

Porcelain's market leadership stems equally from manufacturing efficiency: continuous milling and spray-drying innovations let producers shorten kilning cycles by 15%, shaving energy use and supporting ESG compliance. Supply risk is minimal because Iberian clay seams near Teruel provide abundant low-iron feedstock ideal for white-body formulations. Export prospects remain bright; although U.S. volumes dipped, Latin American architects increasingly specify Spanish porcelain for upscale malls, diversifying revenue streams. Digital glazing lines with water-based inks cut volatile-organic compounds, enabling plants to meet ISO 50001 energy-management audits. As premium positioning intensifies, porcelain is likely to widen its margin gap over entry-level alternatives, reinforcing its anchor role within the Spain ceramic tiles market.

Flooring accounted for 72.10% of Spain ceramic tiles market size in 2025, reflecting the historical importance of durable pavements in Mediterranean architecture. Commercial malls in Seville and Valencia now request 1200 X 600 mm rectified planks, which minimize grout lines and streamline nightly cleaning. Yet wall applications grow 4.44% annually because open-plan kitchens favor seamless backsplashes extending into dining zones, a design motif amplified by social-media influencers. Large-format wall slabs over 3 m tall reduce vertical joints, accelerating installation and cutting labor hours-a key consideration given installer shortages. Roofing tiles, though a smaller slice, receive a boost from Spain's updated Technical Building Code that rewards high-albedo surfaces for summer heat mitigation.

Hybrid SKUs marketed as "floor-and-wall interchangeables" simplify inventory for distributors and appeal to DIY shoppers navigating online catalogs. Digital-printing multi-pass heads now reproduce terrazzo speckles and terrazzo's chip-aggregate randomness convincingly, aligning with the retro design trend sweeping Barcelona cafes. Manufacturers integrate recycled glass frit into glazes, helping projects earn LEED credits and cementing tile's reputation as a circular-economy material. The segment's evolution demonstrates how product innovation fills aesthetic niches while sustaining the Spain ceramic tiles market's core revenue engine.

The Spain Ceramic Tiles Market Report is Segmented by Product Type (Porcelain Tiles, Glazed Ceramic Tiles, and More), Application (Floor, Wall, Roofing), End-User (Residential, Commercial), Construction Type (New Construction, Renovation and Replacement), Distribution Channel (Specialty Tile & Stone Stores, Home Improvement & DIY Stores, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Porcelanosa Grupo

- Pamesa Ceramica

- Roca Tile

- Keraben Grupo

- Grupo STN

- Saloni Ceramica

- TAU Ceramica

- Azulev Grupo

- Grupo Halcon Ceramicas

- Ape Grupo

- Grespania

- Vives Azulejos y Gres

- Colorker Group

- Emigres

- Rocersa

- Ceracasa

- Dune Ceramica

- Lev-antina y Asociados de Minerales

- Marazzi (Mohawk Industries)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge In Renovation & Refurbishment of Spain Ageing Housing Stock

- 4.2.2 Recovery of Tourism-Led Hospitality Refurbishments

- 4.2.3 Government Incentives For Energy-Efficient Building Envelopes

- 4.2.4 Expansion of Online Diy Channels And Click-&-Collect Models

- 4.2.5 Adoption of Antibacterial Glazed Surfaces In Healthcare & Transport Hubs

- 4.2.6 Spain Green-Hydrogen Kiln Conversions Lowering Energy Bills Post-2027

- 4.3 Market Restraints

- 4.3.1 Volatile Natural-Gas Prices Inflating Manufacturing Costs

- 4.3.2 Rising Inflow of Low-Cost Imports (Turkey, India) In Budget Segment

- 4.3.3 Tightening EU Silica-Dust Limits Driving Compliance Capex

- 4.3.4 Scarcity of Skilled Tile Installers Delaying Project Timelines

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Industry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product Type

- 5.1.1 Porcelain Tiles

- 5.1.2 Glazed Ceramic Tiles

- 5.1.3 Unglazed Ceramic Tiles

- 5.1.4 Mosaic Tiles

- 5.1.5 Others (Decorative, Patterned, Handmade)

- 5.2 By Application

- 5.2.1 Floor

- 5.2.2 Wall

- 5.2.3 Roofing

- 5.3 By End-User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.2.1 Hospitality (Hotels, Resorts)

- 5.3.2.2 Retail Spaces

- 5.3.2.3 Offices & Institutions

- 5.3.2.4 Healthcare

- 5.3.2.5 Educational Facilities

- 5.3.2.6 Transport Hubs (Airports, Metro, Bus Terminals)

- 5.3.2.7 Other Commercial Users

- 5.4 By Construction Type

- 5.4.1 New Construction

- 5.4.2 Renovation and Replacement

- 5.5 By Distribution Channel

- 5.5.1 Specialty Tile & Stone Stores

- 5.5.2 Home Improvement & DIY Stores

- 5.5.3 Online Retail

- 5.5.4 Direct Sales to Contractors

- 5.6 By Geography

- 5.6.1 Valencian Community

- 5.6.2 Catalonia

- 5.6.3 Andalusia

- 5.6.4 Madrid Region

- 5.6.5 Other Regions

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Porcelanosa Grupo

- 6.4.2 Pamesa Ceramica

- 6.4.3 Roca Tile

- 6.4.4 Keraben Grupo

- 6.4.5 Grupo STN

- 6.4.6 Saloni Ceramica

- 6.4.7 TAU Ceramica

- 6.4.8 Azulev Grupo

- 6.4.9 Grupo Halcon Ceramicas

- 6.4.10 Ape Grupo

- 6.4.11 Grespania

- 6.4.12 Vives Azulejos y Gres

- 6.4.13 Colorker Group

- 6.4.14 Emigres

- 6.4.15 Rocersa

- 6.4.16 Ceracasa

- 6.4.17 Dune Ceramica

- 6.4.18 Lev-antina y Asociados de Minerales

- 6.4.19 Marazzi (Mohawk Industries)

7 Market Opportunities & Future Outlook

- 7.1 Integration of Iot-Embedded Tiles For Smart-Floor Occupancy Analytics In Retail & Transport Hubs

- 7.2 Rapid Uptake of Digital Inkjet Technology Enabling Hyper-Realistic Large-Format Slabs