PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937346

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937346

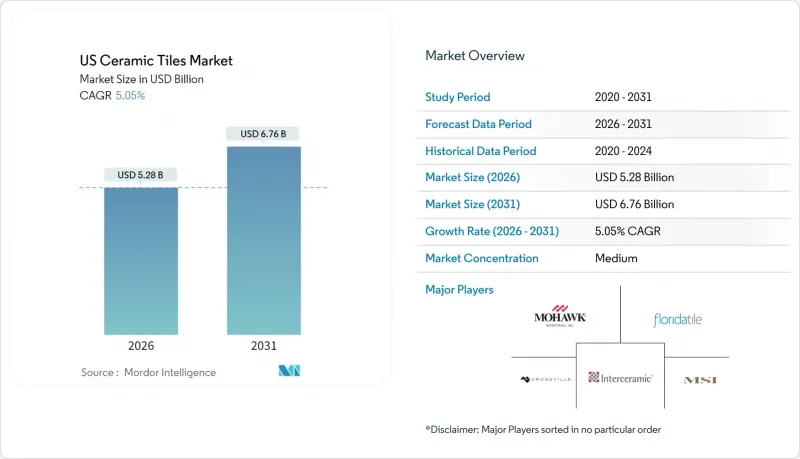

US Ceramic Tiles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The United States ceramic tiles market is expected to grow from USD 5.03 billion in 2025 to USD 5.28 billion in 2026 and is forecast to reach USD 6.76 billion by 2031 at 5.05% CAGR over 2026-2031.

Strong residential remodeling demand, steady Sun Belt housing starts, and regulatory preferences for low-VOC building materials underpin this expansion. Domestic producers are gaining ground as antidumping duties reduce low-priced imports, while favorable natural-gas prices lower firing costs and support competitive local manufacturing . Digital printing, large-format porcelain slabs, and radiant-floor compatible designs are widening application potential and average selling prices. At the same time, labor shortages in qualified installers and intensifying competition from rigid-core LVT restrain absolute volume growth.

US Ceramic Tiles Market Trends and Insights

Resilient Housing Starts in Sun Belt States

Sun Belt construction continues to anchor demand even as other regions cool, with Florida's construction materials revenue reaching USD 997.6 million in 2024. Favorable climate, population inflows, and pro-business policies keep building permits comparatively stable, supporting predictable orders for tile producers. Manufacturers optimize logistics networks around these high-volume corridors, trimming freight costs and delivery lead times. Energy-efficient codes in hot climates reward the thermal-mass benefits of ceramic, nudging architects toward specification. Ongoing climate-adaptation investments further elevate tile's appeal because of its moisture resistance and durability.

Growing Adoption of Large-Format Porcelain Slabs

Architectural preference for seamless surfaces is accelerating 6 mm and 12 mm porcelain panels, which reduce grout lines and installation time. Louisville Tile's 6 mm panels launched in 2025 demonstrate how pre-cut formats address installer scarcity while commanding premium pricing. Daltile's ONE Quartz extra-large slabs unveiled at KBIS 2025 extend marble aesthetics into high-traffic zones without repeat patterns. Digital inkjet advances generate photorealistic veining on macro surfaces, differentiating from conventional squares. Capital-intensive slab kilns and polishing lines act as entry barriers, favoring incumbents with scale advantages. The format also aligns with hygiene trends in healthcare, hospitality, and luxury residential projects.

Volatile Natural-Gas Prices Inflating Kiln Costs

Energy constitutes roughly 30% of porcelain production budgets, and natural gas supplies 90% of that load. After bottoming at USD 2.21 per MMBtu in 2024, EIA projects prices will climb past USD 4.00 by 2026, pressuring kiln operators. Larger groups hedge exposure through multiyear contracts and co-generation, but smaller independents face squeezed margins or pass-through price hikes. Energy volatility also resets parity against imports from regions with coal-fired kilns, complicating competitive pricing. Investments in electric kilns offer long-run stability yet require substantial capital and grid upgrades, delaying widespread adoption.

Other drivers and restraints analyzed in the detailed report include:

- Energy-Efficient Radiant-Heated Flooring Demand

- Post-Covid Commercial Renovation Wave

- Labor Shortages in Qualified Tile Installers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Porcelain holds 55.12% of United States ceramic tiles market share as of 2025, reflecting its low water-absorption rating and suitability for indoor-outdoor continuity. Advanced inkjet printing now renders deep veining, concrete patina, and textile textures, erasing historical design constraints. Manufacturers expand into 2 cm thick pavers and 6 mm thin panels, broadening end-uses from ventilated facades to furniture tops. Glazed ceramic remains relevant where cost sensitivity outweighs performance, sustaining value-oriented retail assortments. Unglazed quarry tiles cater to commercial kitchens that require coefficient-of-friction ratings exceeding 0.8. Mosaic and handmade formats occupy bespoke niches, often commanding multiples of average price per square foot. Sustainability credentials strengthen across categories as recycled glass frit and waste-heat recovery lower embodied carbon. Collectively, the mix illustrates how innovation allows the United States ceramic tiles market to serve mainstream and specialist demand simultaneously.

Investment in European-style Continua+ presses enables endless porcelain sizes, including 1.6 m-by-3.2 m slabs that cut to countertop blanks in three passes. These lines boost throughput and yield while reducing labor, supporting margin resilience even as commodity squares face price compression. Producers leverage proprietary glazes to deliver antimicrobial, anti-slip, or solar-reflective surfaces that open doors to healthcare, transportation, and exterior cladding specifications. Domestic capacity expansion also shields the United States ceramic tiles market from future tariff shocks by shortening supply chains and ensuring just-in-time replenishment. Continuous technological improvements position porcelain as both the growth engine and the competitive moat against substitute floorings.

Floor layouts account for 68.05% of United States ceramic tiles market size in 2025, rooted in bathrooms, kitchens, and high-traffic commercial corridors. Heavy-duty ratings, stain resistance, and lifetime wear warranties align with facility manager priorities. In multistory residential projects, dead-load limits increasingly permit large porcelain panels, reducing grout maintenance for owners. Conversely, wall cladding registers the fastest CAGR at 5.36%, propelled by design trends that run identical stone looks vertically for cohesion. Retail stores embrace tile feature walls to convey premium branding while meeting fire-code requirements. Health-care corridors adopt tiled wainscoting to survive aggressive chemical cleaning. Roofing, though niche, grows in Mediterranean-style luxury builds seeking thermal insulation and rain-shedding performance. These dynamics show the United States ceramic tiles market flexibly adapting to aesthetic, functional, and regulatory needs across surfaces.

Advances in high-bond, low-VOC mastics shorten cure times, allowing accelerated wall installations that fit compressed renovation schedules. Mechanical clip systems make 20 mm ventilated facades viable even for retrofit, slashing building-envelope energy loads. Manufacturers pack sample libraries with matching trims, thresholds, and bullnose options to encourage full-room specifications. Marketing emphasizes that uniform material across planes reduces visual clutter and future touch-up variance. As consumers view walls as canvases for personal expression, tile with metallic, fabric-inspired, or geometric relief finishes gains share. Collectively, these trends keep floor volume stable while elevating wall-segment growth within the broader United States ceramic tiles market.

The United States Ceramic Tiles Market Report is Segmented by Product Type (Porcelain Tiles, Glazed Ceramic Tiles and More), Application (Floor, Wall, Roofing), End-User (Residential, Commercial), Construction Type (New Construction, Renovation and Replacement), Distribution Channel (Specialty Stores and More), and Geography (Northeast, Midwest and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Mohawk Industries (Dal-Tile, Marazzi, American Olean)

- Florida Tile

- Crossville Inc.

- Interceramic USA

- MSI Surfaces

- Emser Tile

- Porcelanosa USA

- Roca Tile USA

- Bedrosians Tile & Stone

- Anatolia Tile + Stone

- Walker Zanger

- Artistic Tile

- American Wonder Porcelain

- Mariner USA

- Dal-Tile Mexico Imports

- StonePeak Ceramics

- LAUFEN Bathrooms (U.S.)

- Florim USA

- IWT Florida (Tesoro)

- Vitromex USA

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Resilient housing starts in Sun-Belt states

- 4.2.2 Growing adoption of large-format porcelain slabs

- 4.2.3 Energy-efficient radiant-heated flooring demand

- 4.2.4 Post-Covid commercial renovation wave

- 4.2.5 Indoor-air-quality regulations favoring low-VOC tiles

- 4.2.6 FEMA resilience grants for flood-resistant building materials

- 4.3 Market Restraints

- 4.3.1 Volatile natural-gas prices inflating kiln firing costs

- 4.3.2 Labor shortages in qualified tile installers

- 4.3.3 Competition from LVT/SPC rigid core flooring

- 4.3.4 PFAS litigation risk in certain glaze additives

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Industry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product Type

- 5.1.1 Porcelain Tiles

- 5.1.2 Glazed Ceramic Tiles

- 5.1.3 Unglazed Ceramic Tiles

- 5.1.4 Mosaic Tiles

- 5.1.5 Others (Decorative, Patterned, Handmade)

- 5.2 By Application

- 5.2.1 Floor

- 5.2.2 Wall

- 5.2.3 Roofing

- 5.3 By End-User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.2.1 Hospitality (Hotels, Resorts)

- 5.3.2.2 Retail Spaces

- 5.3.2.3 Offices & Institutions

- 5.3.2.4 Healthcare

- 5.3.2.5 Educational Facilities

- 5.3.2.6 Transport Hubs (Airports, Metro, Bus Terminals)

- 5.3.2.7 Other Commercial Users

- 5.4 By Construction Type

- 5.4.1 New Construction

- 5.4.2 Renovation and Replacement

- 5.5 By Distribution Channel

- 5.5.1 Specialty Tile & Stone Stores

- 5.5.2 Home Improvement & DIY Stores

- 5.5.3 Online Retail

- 5.5.4 Direct Sales to Contractors

- 5.6 By Geography

- 5.6.1 Northeast

- 5.6.2 Midwest

- 5.6.3 Southeast

- 5.6.4 Southwest

- 5.6.5 West

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Mohawk Industries (Dal-Tile, Marazzi, American Olean)

- 6.4.2 Florida Tile

- 6.4.3 Crossville Inc.

- 6.4.4 Interceramic USA

- 6.4.5 MSI Surfaces

- 6.4.6 Emser Tile

- 6.4.7 Porcelanosa USA

- 6.4.8 Roca Tile USA

- 6.4.9 Bedrosians Tile & Stone

- 6.4.10 Anatolia Tile + Stone

- 6.4.11 Walker Zanger

- 6.4.12 Artistic Tile

- 6.4.13 American Wonder Porcelain

- 6.4.14 Mariner USA

- 6.4.15 Dal-Tile Mexico Imports

- 6.4.16 StonePeak Ceramics

- 6.4.17 LAUFEN Bathrooms (U.S.)

- 6.4.18 Florim USA

- 6.4.19 IWT Florida (Tesoro)

- 6.4.20 Vitromex USA

7 Market Opportunities & Future Outlook

- 7.1 AI-assisted design personalization portals

- 7.2 Carbon-neutral tile certifications & EPD labeling