PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934795

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934795

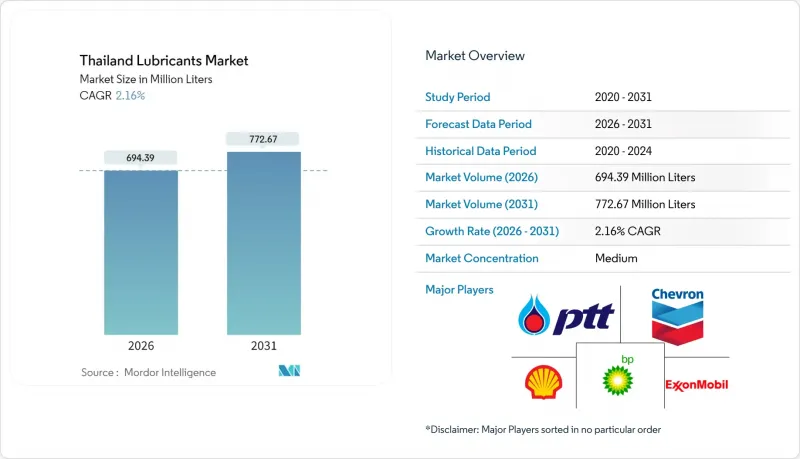

Thailand Lubricants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Thailand Lubricants Market is expected to grow from 679.70 Million Liters in 2025 to 694.39 Million Liters in 2026 and is forecast to reach 772.67 Million Liters by 2031 at 2.16% CAGR over 2026-2031.

The softer demand for internal-combustion-engine (ICE) oils from electrification is balanced by Thailand's continued role as Southeast Asia's pickup-truck production hub and its position as a regional distribution center for finished vehicles and components. Ongoing data center construction valued at above USD 7 billion, along with steady investment in the Eastern Economic Corridor (EEC), drives the consumption of specialty cooling fluids and high-performance industrial oils. Macro factors, such as a rebound in merchandise exports, a 0.4% GDP contribution from logistics, and the enforcement of Euro 5 diesel quality standards, which tighten product specifications and support the shift toward synthetic formulations. Competitive pressure from lower-cost ASEAN imports keeps margins thin for mainstream mineral oil blends, yet premiumization opportunities in EV fluids, immersion-cooling solutions, and methanol-compatible marine lubricants are expanding.

Thailand Lubricants Market Trends and Insights

Post-pandemic rebound in manufacturing and exports

Factory utilization improved after supply-chain disruptions eased, and Board of Investment approvals rose 13% in value during Q1 2024, with a focus on electronics, automotive, and machinery ventures. Higher metalworking activity and longer operating hours raise demand for hydraulic oils, cutting fluids, and anti-wear greases in precision machining lines. Export-oriented firms specify tighter viscosity tolerances that favor semi-synthetic and full-synthetic blends. Production scheduling stability also restores lubricant procurement cycles that had been delayed during 2023's logistics bottlenecks. The Thailand lubricants market benefits from the country's established supplier network, which provides consistent product availability for multinational OEMs.

Expansion of commercial-vehicle fleet and e-commerce logistics

Online retail penetration exceeded 18% of total retail sales in 2024, prompting fleet additions among parcel carriers and third-party logistics firms. Vehicle-kilometer-traveled growth translates into higher oil drain frequency, particularly for delivery vans operating stop-start urban routes. Operators are increasingly adopting SAE 10W-30 synthetics to reduce fuel consumption and extend drain intervals, trading upfront lubricant costs for lower total operating expenses. Provincial road upgrades under Thailand's THB 450 billion fiscal stimulus reduce transit times but increase average speeds, elevating axle and transmission temperature loads that require high-film-strength gear oils.

Accelerated EV adoption shrinking ICE lubricant pool

Registrations of battery electric cars grew fivefold between 2022 and 2024, reaching 9% of all new light-duty vehicles, supported by subsidies of THB 50,000-100,000 per unit. EVs eliminate demand for crankcase oils and reduce automatic transmission-fluid volumes, shrinking the core automotive lubricant reservoir. Fleets in Bangkok are shifting taxis and last-mile delivery vans to battery electric models to capitalize on charging infrastructure grants. However, manufacturing of e-axles, battery trays, and thermal-management subsystems introduces new requirements for assembly greases and dielectric coolants, providing a partial offset for the Thailand lubricants market.

Other drivers and restraints analyzed in the detailed report include:

- Industrial automation boosting demand for high-performance synthetics

- Data-center buildouts driving specialty cooling and genset lubricants

- Stricter mineral-oil disposal regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Automotive engine oil captured 46.89% of Thailand lubricants market share in 2025, reflecting annual vehicle output above 2 million units and a robust aftermarket servicing fleet that exceeds 21 million cars and pickups. Factory-fill contracts with Japanese OEMs ensure baseline volume stability, while pickup-centric exports to Australia and the Middle East create incremental demand spikes leading up to year-end shipping windows.

Greases deliver the highest 3.17% CAGR through 2031 as Shell's plant expansion to 15,000 tonnes per year turns Thailand into Southeast Asia's largest grease supply base. Precision robotics and conveyor systems installed in EEC packaging plants prefer lithium-complex greases tolerant to water washout. The Thailand lubricants market size for greases is projected to exceed 46,200 tonnes by 2031, accounting for a growing share of specialty product revenue. Concurrently, transmission-fluid demand holds steady, bolstered by automatic-gearbox penetration approaching 95% in urban passenger cars.

The Thailand Lubricants Market Report is Segmented by Product Type (Automotive Engine Oil, Industrial Engine Oil, Transmission Fluids, Gear Oil, Brake Fluids, Hydraulic Fluids, Greases, and More), End-User Industry (Automotive, Marine, Aerospace, Heavy Equipment, and More), and Base Stock Type (Mineral Oil-Based Lubricants, Semi-Synthetic Lubricants, and More). The Market Forecasts are Provided in Terms of Volume (Liters).

List of Companies Covered in this Report:

- Bangchak Corporation Public Company Limited

- BP p.l.c.

- Chevron Corporation

- ENEOS Corporation

- ExxonMobil Corporation

- FUCHS

- Idemitsu Kosan Co., Ltd. (Apollo (Thailand) Co., Ltd.)

- MOTUL ( Thailand ) Co., Ltd.

- P.S.P. Specialties Public Company Limited

- PETRONAS Lubricants International

- PTT PUBLIC COMPANY LIMITED

- Shell Thailand

- Siam Pan Group Public Co., Ltd.

- Total Energies

- Valvoline

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Post-pandemic Rebound in Manufacturing and Exports

- 4.2.2 Expansion of Commercial-vehicle Fleet and E-commerce Logistics

- 4.2.3 Industrial Automation Boosting Demand for High-performance Synthetics

- 4.2.4 Data-center Buildouts Driving Specialty Cooling/genset Lubricants

- 4.2.5 Biodiesel (B20) Mandate Raising Engine-oil Change Frequency

- 4.3 Market Restraints

- 4.3.1 Accelerated EV Adoption Shrinking ICE Lubricant Pool

- 4.3.2 Stricter Mineral-oil Disposal Regulations

- 4.3.3 Margin Pressure from Low-cost ASEAN Imports

- 4.4 Value Chain Analysis

- 4.5 Regulatory Framework

- 4.6 End-User Trends

- 4.6.1 Automotive Industry

- 4.6.2 Manufacturing Industry

- 4.6.3 Power Generation Industry

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 Automotive Engine Oil

- 5.1.2 Industrial Engine Oil

- 5.1.3 Transmission Fluids

- 5.1.4 Gear Oil

- 5.1.5 Brake Fluids

- 5.1.6 Hydraulic Fluids

- 5.1.7 Greases

- 5.1.8 Process Oil (Including Rubber Process Oil & White Oil)

- 5.1.9 Metalworking Fluids

- 5.1.10 Turbine Oil

- 5.1.11 Transformer Oil

- 5.1.12 Other Product Types

- 5.2 By End-user Industry

- 5.2.1 Automotive

- 5.2.1.1 Passenger Vehicles

- 5.2.1.2 Commercial Vehicles

- 5.2.1.3 Two-Wheelers

- 5.2.2 Marine

- 5.2.3 Aerospace

- 5.2.4 Heavy Equipment

- 5.2.4.1 Construction

- 5.2.4.2 Mining

- 5.2.4.3 Agriculture

- 5.2.5 Industrial

- 5.2.5.1 Power Generation

- 5.2.5.2 Metallurgy & Metalworking

- 5.2.5.3 Textiles

- 5.2.5.4 Oil and Gas

- 5.2.5.5 Other End-Use Industries

- 5.2.1 Automotive

- 5.3 By Base Stock Type

- 5.3.1 Mineral Oil-Based Lubricants

- 5.3.2 Synthetic Lubricants

- 5.3.3 Semi-Synthetic Lubricants

- 5.3.4 Bio-Based Lubricants

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share**(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Bangchak Corporation Public Company Limited

- 6.4.2 BP p.l.c.

- 6.4.3 Chevron Corporation

- 6.4.4 ENEOS Corporation

- 6.4.5 ExxonMobil Corporation

- 6.4.6 FUCHS

- 6.4.7 Idemitsu Kosan Co., Ltd. (Apollo (Thailand) Co., Ltd.)

- 6.4.8 MOTUL ( Thailand ) Co., Ltd.

- 6.4.9 P.S.P. Specialties Public Company Limited

- 6.4.10 PETRONAS Lubricants International

- 6.4.11 PTT PUBLIC COMPANY LIMITED

- 6.4.12 Shell Thailand

- 6.4.13 Siam Pan Group Public Co., Ltd.

- 6.4.14 Total Energies

- 6.4.15 Valvoline

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

8 Key Strategic Questions for CEOs