PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940749

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940749

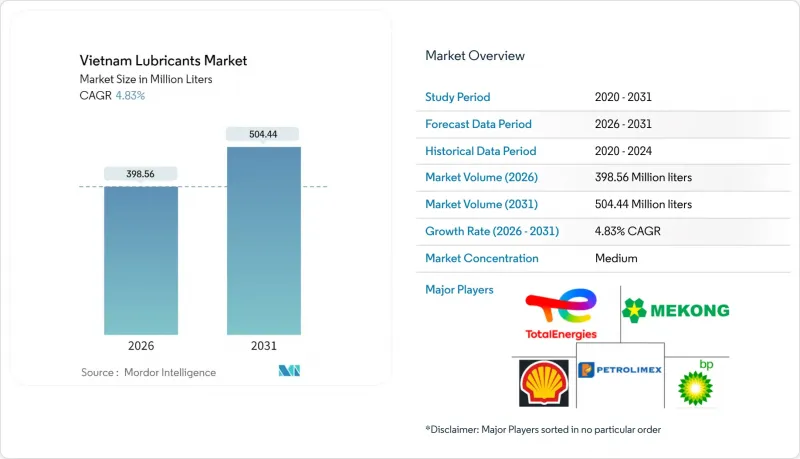

Vietnam Lubricants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Vietnam Lubricants Market size in 2026 is estimated at 398.56 million liters, growing from 2025 value of 380.20 million liters with 2031 projections showing 504.44 million liters, growing at 4.83% CAGR over 2026-2031.

This growth persists even as electrification advances, because two-wheelers continue to dominate mobility, and new manufacturing investments keep industrial activity rising. An expanding vehicle parc sustains momentum, a shift toward higher-performance formulations, and steady foreign direct investment that lifts machinery demand across industrial zones. Market participants emphasize premium drain-interval products, broad distribution, and localized blending to protect margins against base-oil cost fluctuations. At the same time, looming environmental taxes and Extended Producer Responsibility (EPR) rules are steering producers toward synthetic and bio-based lines that command higher price points yet trim lifecycle emissions. These intersecting trends frame a resilient near-term outlook for the Vietnam lubricants market even as electric vehicles (EVs) gradually erode conventional engine oil volumes.

Vietnam Lubricants Market Trends and Insights

Rising Vehicle Parc and Two-Wheeler Dominance

Vietnam's industrial policy aims to achieve annual passenger-car and two-wheeler sales of approximately 1.0-1.1 million units by 2030. Two-wheelers still account for the majority of the vehicle fleet, preserving a large base of internal-combustion engines that require frequent oil changes. Although electric motorcycles accounted for a significant portion of new two-wheeler registrations in 2024, range anxiety outside urban cores continues to underpin sustained demand for mineral oil and semi-synthetic products. Regular maintenance cycles associated with motorcycles, combined with rising disposable incomes, continue to anchor volume growth for engine oils and transmission fluids.

Accelerating Industrialization and FDI Manufacturing Growth

Manufacturing FDI reached USD 15.2 billion in the first six months of 2024, with processing and electronics plants accounting for more than two-thirds of the inflows. These capital injections translate into machinery installations that demand hydraulic, gear, and metalworking fluids engineered for longer drain intervals and lower downtime. Industrial parks in Hai Phong, Bac Ninh, and Dong Nai require OEM-approved lubricants that comply with global supply-chain audit standards. The resulting pull for synthetic and bio-based lubricants helps lift overall premium-product penetration through the forecast window.

Base-Oil Import Price Volatility

Vietnam imports the majority of its base-oil requirement, exposing local blenders to global crude swings. A spike in Group II base-oil spot prices in 2024 compressed margins and led to retail price hikes across most viscosity grades. Independent blenders with limited inventory credit struggled to pass on costs, risking volume losses to heavily promoted international brands. As a result, some distributors trimmed rural stock levels, causing sporadic shortages in tier-3 cities until supply contracts normalized.

Other drivers and restraints analyzed in the detailed report include:

- Shift Toward Synthetic and Higher-Performance Lubricants

- Growth of Foreign-Invested Auto-Component Plants

- Rapid Rise of Electric Motorcycles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, automotive engine oil commands a 37.90% share of the market, underscoring Vietnam's transportation landscape, which is heavily skewed towards motorcycles. Here, both 2-stroke and 4-stroke engine oils cater to a staggering 77 million registered two-wheelers. Industrial engine oil is the fastest-growing product category, expanding at a 5.22% CAGR through 2031, driven by new gas-fired and renewable power projects. The demand is driven by OEM requirements for low-ash formulations that enable longer maintenance intervals. Transmission fluids are expected to benefit from increased automatic-transmission penetration in passenger cars, while gear oil demand is expected to align with the expansion of light-commercial and logistics fleets.

Metalworking fluids escalate in tandem with precision-machining investments by Samsung and Foxconn suppliers, and Master Fluid Solutions' localized distribution underscores this trend. Turbine and transformer oils are experiencing steady growth as Vietnam's Power Development Plan targets a 29% renewable capacity by 2030, creating specialty-fluid opportunities that offer attractive margins. Overall, the product mix is tilting toward higher-performance synthetics that accommodate high-load, high-temperature operating conditions in modern equipment.

The Vietnam Lubricants Market Report is Segmented by Product Type (Automotive Engine Oil, Industrial Engine Oil, Transmission Fluids, Gear Oil, Brake Fluids, Hydraulic Fluids, Greases, and More), End-User Industry (Automotive, Marine, Aerospace, Heavy Equipment, and Industrial), and Base Stock Type (Mineral Oil-Based, Synthetic, Semi-Synthetic, and Bio-Based). The Market Forecasts are Provided in Terms of Volume (Litres).

List of Companies Covered in this Report:

- AP SAIGON PETRO

- BP p.l.c.

- Chevron Corporation

- ENEOS Vietnam Company Limited.

- Exxon Mobil Corporation

- Fuchs Petrolub SE

- Idemitsu Kosan Co. Ltd

- Lubrizol

- Mekong Petrochemical JSC

- Motul

- Nikko Lubricant Vietnam.

- Petrolimex (PLX)

- PETRONAS Lubricants International

- PVOIL

- Shell plc

- SK Enmove Ltd

- T&T Viet Nam Lubricants Co.,LTD.

- TotalEnergies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising vehicle parc and two-wheeler dominance

- 4.2.2 Accelerating industrialisation and FDI manufacturing growth

- 4.2.3 Shift toward synthetic/higher-performance lubricants

- 4.2.4 Growth of foreign-invested auto-component plants

- 4.2.5 Expansion of cross-border e-commerce logistics fleets

- 4.3 Market Restraints

- 4.3.1 Base-oil import price volatility

- 4.3.2 Rapid rise of electric motorcycles

- 4.3.3 Stricter used-oil disposal rules

- 4.4 Value Chain Analysis

- 4.5 Regulatory Framework

- 4.6 End-User Trends

- 4.6.1 Automotive Industry

- 4.6.2 Manufacturing Industry

- 4.6.3 Power Generation Industry

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 Automotive Engine Oil

- 5.1.2 Industrial Engine Oil

- 5.1.3 Transmission Fluids

- 5.1.4 Gear Oil

- 5.1.5 Brake Fluids

- 5.1.6 Hydraulic Fluids

- 5.1.7 Greases

- 5.1.8 Process Oil (Including Rubber Process Oil and White Oil)

- 5.1.9 Metalworking Fluids

- 5.1.10 Turbine Oil

- 5.1.11 Transformer Oil

- 5.1.12 Other Product Types

- 5.2 By End-user Industry

- 5.2.1 Automotive

- 5.2.1.1 Passenger Vehicles

- 5.2.1.2 Commercial Vehicles

- 5.2.1.3 Two-Wheelers

- 5.2.2 Marine

- 5.2.3 Aerospace

- 5.2.4 Heavy Equipment

- 5.2.4.1 Construction

- 5.2.4.2 Mining

- 5.2.4.3 Agriculture

- 5.2.5 Industrial

- 5.2.5.1 Power Generation

- 5.2.5.2 Metallurgy and Metalworking

- 5.2.5.3 Textiles

- 5.2.5.4 Oil and Gas

- 5.2.5.5 Other End-Use Industries

- 5.2.1 Automotive

- 5.3 By Base Stock Type

- 5.3.1 Mineral Oil-Based Lubricants

- 5.3.2 Synthetic Lubricants

- 5.3.3 Semi-Synthetic Lubricants

- 5.3.4 Bio-Based Lubricants

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 AP SAIGON PETRO

- 6.4.2 BP p.l.c.

- 6.4.3 Chevron Corporation

- 6.4.4 ENEOS Vietnam Company Limited.

- 6.4.5 Exxon Mobil Corporation

- 6.4.6 Fuchs Petrolub SE

- 6.4.7 Idemitsu Kosan Co. Ltd

- 6.4.8 Lubrizol

- 6.4.9 Mekong Petrochemical JSC

- 6.4.10 Motul

- 6.4.11 Nikko Lubricant Vietnam.

- 6.4.12 Petrolimex (PLX)

- 6.4.13 PETRONAS Lubricants International

- 6.4.14 PVOIL

- 6.4.15 Shell plc

- 6.4.16 SK Enmove Ltd

- 6.4.17 T&T Viet Nam Lubricants Co.,LTD.

- 6.4.18 TotalEnergies

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

8 Key Strategic Questions for CEOs