PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937389

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937389

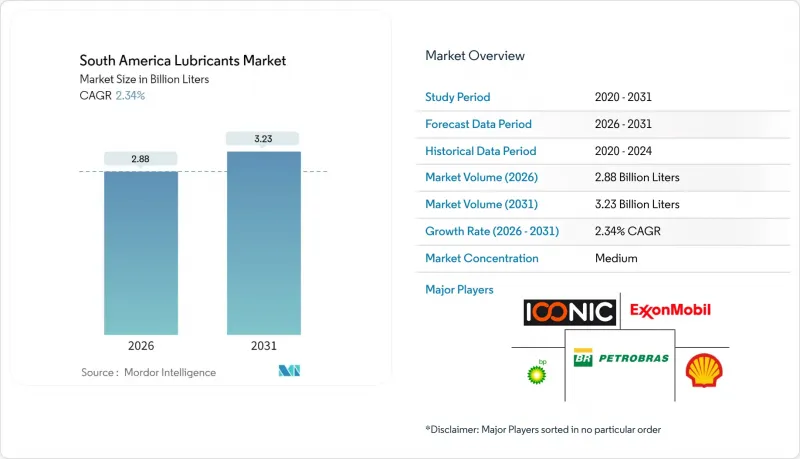

South America Lubricants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

South America Lubricants Market size in 2026 is estimated at 2.88 Billion Liters, growing from 2025 value of 2.81 Billion Liters with 2031 projections showing 3.23 Billion Liters, growing at 2.34% CAGR over 2026-2031.

Recovering regional freight mileage, expanding offshore oil activity, and ongoing industrial modernization underpin demand, even as currency volatility and policy shifts create pockets of risk. Automotive manufacturing in Brazil, deep-water exploration in Brazil and Guyana, and mining automation in Chile and Peru together secure a broad consumption base. Renewable power additions, led by wind and solar, are introducing new needs for turbine and hydraulic fluids, while stricter emissions standards are accelerating migration toward low-SAPS and synthetic formulations. Competitive intensity remains moderate but rising as multinationals strengthen local supply chains and regional firms seek scale through mergers and distribution alliances.

South America Lubricants Market Trends and Insights

Strong Rebound in On-Road Freight Mileage Post-COVID

Freight activity has surpassed pre-pandemic levels as near-shoring shifts and e-commerce intensify long-haul truck movements across Brazil, Argentina, and Chile. Brazil's trucking sector alone handles more than 60% of domestic cargo and now demands premium engine and transmission oils that enable extended drain intervals and fuel economy gains. Harvest cycles for soy, corn, and copper further lift lubricant volumes during peak logistics seasons, locking in a short-term consumption surge that sustains baseline market growth.

Accelerated Deep-Water Energy and Power Activity in Brazil and Guyana Boosting Demand for High-Performance Drilling Fluids

Brazil's pre-salt fields and Guyana's Stabroek Block collectively require synthetic drilling muds, subsea gear oils, and hydraulic fluids capable of withstanding extreme temperatures and 2,000 m water depths. ExxonMobil's multiplatform program and Petrobras subsea boosting contracts exemplify the specialized service models that command premium pricing and deepen supplier-client technical ties.

Prolonged Fuel-Price Subsidies in Argentina Discouraging Premium-Lube Consumption

Subsidized pump prices reduce consumer motivation to purchase high-efficiency synthetics, locking many motorists into short-interval mineral oils and capping value growth in passenger-car motor oils. The subsidy system has historically favored volume over value, encouraging frequent oil changes with conventional mineral oils rather than extended-service premium products. This dynamic particularly affects the passenger vehicle segment, where cost-conscious consumers prioritize immediate savings over long-term engine protection and fuel economy benefits.

Other drivers and restraints analyzed in the detailed report include:

- Mandatory Euro VI-Equivalent Emissions Phase-In (Brazil PROCONVE P-8) Driving Low-SAPS Engine-Oil Adoption

- Surge in Regional Soybean-Oil Biodiesel Blends Spurring Growth of Bio-Based Hydraulic Fluids

- Currency-Devaluation Risk Inflating Import Costs of PAO and Additive Packages

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Engine oils retained 39.72% of the 2025 South America lubricants market share, but hydraulic fluids are poised for a 2.66% CAGR through 2031 as automation spreads in mining, agriculture, and renewables. Specialized hydraulics formulated from synthetic or bio-based stocks ensure oxidative stability and temperature resilience demanded by high-pressure systems. Transmission and gear oils gain from fleet modernization programs, whereas greases protect bearings in harsh marine and industrial environments.

Emissions mandates push engine oil upgrades toward Group III and synthetic blends, yet price sensitivity keeps mineral products relevant in older vehicles. Hydraulic-fluid demand benefits from renewable-energy build-outs, where biodegradable formulations are preferred for environmental compliance. Continuous research and development in additive chemistry allows regional blenders to position differentiated offerings in the South America lubricants market.

The South America Lubricants Report is Segmented by Product Type (Engine Oils, Transmission and Gear Oils, Hydraulic Fluids, Greases, and More), Base Oil (Mineral, Synthetic, Semi-Synthetic, and Bio-Based), End-User (Automotive, Heavy Equipment, Metallurgy and Metalworking, Power Generation, Marine and Offshore, and Other Industries), and Geography (Argentina, Brazil, Chile, Colombia, Peru, and Rest of South America).

List of Companies Covered in this Report:

- AMSOIL INC.

- BP plc (Castrol)

- Chevron Corporation

- Exxon Mobil Corporation

- FUCHS

- Gulf Oil International Ltd

- ICONIC

- Petrobras

- Petroliam Nasional Berhad (PETRONAS)

- Repsol

- Shell plc

- Terpel

- TotalEnergies

- YPF

- ZF Friedrichshafen AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Strong rebound in on-road freight mileage post-COVID

- 4.2.2 Accelerated deep-water energy and power activity in Brazil and Guyana boosting demand for high-performance drilling fluids

- 4.2.3 Mandatory Euro VI-equivalent emissions phase-in (Brazil PROCONVE P-8) driving low-SAPS engine-oil adoption

- 4.2.4 Surge in regional soybean-oil biodiesel blends spurring growth of bio-based hydraulic fluids

- 4.2.5 Rapid automation of mining fleets in Chile and Peru requiring long-drain synthetic gear oils.

- 4.3 Market Restraints

- 4.3.1 Prolonged fuel-price subsidies in Argentina discouraging premium-lube consumption

- 4.3.2 Currency-devaluation risk inflating import costs of PAO and additive packages

- 4.3.3 Rising penetration of EV two-wheelers in urban centers eroding motorcycle-oil volumes

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Rivalry

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 Engine Oils

- 5.1.2 Transmission and Gear Oils

- 5.1.3 Hydraulic Fluids

- 5.1.4 Greases

- 5.1.5 Metalworking Fluids

- 5.1.6 Process Oils and Others

- 5.2 By Base Oil

- 5.2.1 Mineral

- 5.2.2 Synthetic (PAO, Esters, PAG)

- 5.2.3 Semi-synthetic

- 5.2.4 Bio-based

- 5.3 By End-User Industry

- 5.3.1 Automotive

- 5.3.2 Heavy Equipment

- 5.3.3 Metallurgy and Metalworking

- 5.3.4 Power Generation

- 5.3.5 Marine and Offshore

- 5.3.6 Other Industries

- 5.4 By Country

- 5.4.1 Argentina

- 5.4.2 Brazil

- 5.4.3 Chile

- 5.4.4 Colombia

- 5.4.5 Peru

- 5.4.6 Rest of South America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)**/Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share for key companies, Products and Services, Recent Developments)

- 6.4.1 AMSOIL INC.

- 6.4.2 BP plc (Castrol)

- 6.4.3 Chevron Corporation

- 6.4.4 Exxon Mobil Corporation

- 6.4.5 FUCHS

- 6.4.6 Gulf Oil International Ltd

- 6.4.7 ICONIC

- 6.4.8 Petrobras

- 6.4.9 Petroliam Nasional Berhad (PETRONAS)

- 6.4.10 Repsol

- 6.4.11 Shell plc

- 6.4.12 Terpel

- 6.4.13 TotalEnergies

- 6.4.14 YPF

- 6.4.15 ZF Friedrichshafen AG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment