PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934831

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934831

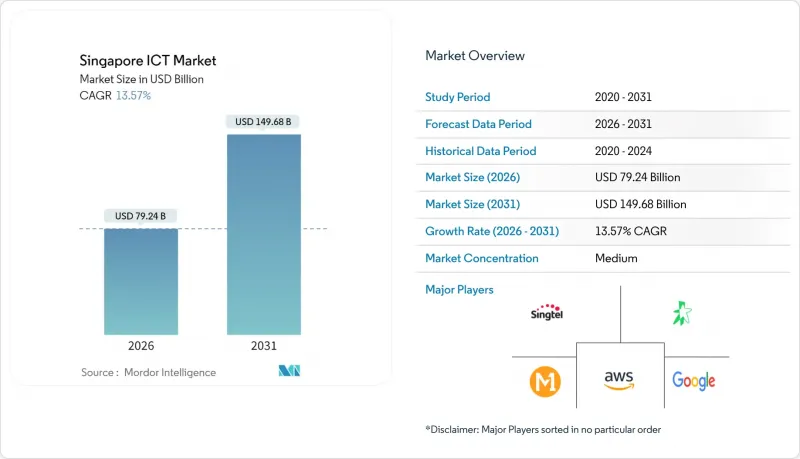

Singapore ICT - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Singapore ICT market is expected to grow from USD 69.77 billion in 2025 to USD 79.24 billion in 2026 and is forecast to reach USD 149.68 billion by 2031 at 13.57% CAGR over 2026-2031.

Singapore's surge pivots on Smart Nation 2.0 funding, hyperscale data-center investments, and accelerated enterprise migration to cloud and AI platforms. Multinational cloud providers are racing to expand local capacity, while small and medium enterprises (SMEs) leverage software-as-a-service to close capability gaps with larger rivals. Sector momentum is also reinforced by healthcare digitalization, digital-only banking licenses, and the National AI Compute Resource (NACR) that lowers barriers to advanced analytics. Heightened spending, however, collides with power-grid limits and a widening cybersecurity talent gap that lifts operating costs and elongate project lead times.

Singapore ICT Market Trends and Insights

Government Smart-Nation Expenditure Surge

Smart Nation 2.0 moves Singapore from digital adoption toward digital-first governance, channeling USD 3.3 billion in fiscal 2024 into cybersecurity, data platforms, and modernized infrastructure. The outlay accelerates procurement of analytics engines, edge devices, and real-time processing tools, catalyzing demand far beyond the public sector. Regulatory requirements that mirror these standards push private organizations, especially in finance and healthcare, to upgrade legacy systems. Vendors specializing in API orchestration and cross-platform security gain direct access to large multi-year contracts, while interoperable frameworks reduce integration friction across verticals.

Enterprise Cloud-first Mandates

Cloud-first policies have flipped infrastructure planning, with cloud workloads growing 17.7% against 11.2% for on-premise deployments. Multi-cloud strategies lessen vendor lock-in and satisfy data-sovereignty rules, prompting a USD 3.5 billion domestic cloud market. SMEs drive the fastest uptake, using subscription-based AI, analytics, and automation to match big-company capabilities. Secondary demand is emerging for unified observability dashboards, hybrid connectivity fabrics, and automated policy governance that keep distributed environments in regulatory compliance.

Scarcity of Skilled Digital Talent

A shortage of 2,800 to 4,400 cybersecurity professionals shackles rollout schedules and elevates salary costs, even as security demand is set to hit USD 4.82 billion by 2029. The gap extends to AI engineers and cloud architects, forcing SMEs to compete with multinationals on compensation. Government-backed upskilling programs, including IBM's SkillsBuild, which targets 4,500 learners, will narrow deficits only gradually. Firms therefore pivot to low-code platforms, AI-assisted development, and managed services that reduce reliance on scarce specialists.

Other drivers and restraints analyzed in the detailed report include:

- Digital Bank Licenses Boost BFSI Tech Spend

- National AI Compute Resource Roll-out

- Escalating Cyber-attack Surface

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

IT infrastructure owned 25.86% of Singapore ICT market size in 2025, underlining continued investment in data centers, networking gear, and server capacity . The segment benefits from hyperscale expansion commitments such as AWS's USD 12 billion plan, but year-on-year growth is moderating as virtualization densifies server racks. IT software outpaces all other categories with a 16.35% CAGR, propelled by cloud-native platforms, AI toolchains, and workflow automation suites. This software pivot lifts demand for container orchestration, micro-services security, and agile integration services. Parallel expansion of infrastructure and applications underpins a balanced growth profile. Companies increasingly adopt subscription pricing for enterprise software, flattening capex spikes and smoothing cash flows. Hardware margins tighten amid commoditization, though specialized AI accelerators and edge devices command premiums. Major vendors such as SAP anchor R&D in Singapore, exemplified by its Digital Innovation Accelerator that aligns industry-specific AI models with local use cases . The interplay of high-capacity infrastructure with advanced software creates a virtuous cycle that keeps the Singapore ICT market on its upward trajectory.

Large enterprises held 66.78% of Singapore ICT market share in 2025, leveraging budgets and in-house talent to execute complex, multi-domain digitization. Growth, however, is slowing to 12.84% as many have already completed first-wave transformations. SMEs, in contrast, are posting a 14.88% CAGR, driven by government grants and cloud subscriptions that compress deployment cycles. The widening availability of turnkey AI services empowers small firms to integrate chatbots, analytics, and robotic process automation without owning expensive hardware. Training initiatives keep the pipeline of digital talent flowing to smaller companies. IBM's SkillsBuild is one example that provides free certification tracks for data analytics and cybersecurity . Financial incentives such as the Productivity Solutions Grant reimburse up to 70% of qualifying tech investments, further equalizing adoption conditions. As SMEs scale, they form a sizeable customer base for managed-service providers and value-added resellers, reinforcing a diversified vendor ecosystem that underpins the Singapore ICT market.

The Singapore ICT Market Report is Segmented by Type (IT Hardware, IT Software, and More), End-User Enterprise Size (Small and Medium Enterprises and Large Enterprises), Deployment Model (On-Premise, and More), and End-User Industry (Government and Public Administration, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Amazon Web Services (AWS) Singapore

- International Business Machines Corporation (IBM Singapore Pte. Ltd.)

- Cognizant Technology Solutions Asia Pacific Pte. Ltd.

- Micron Semiconductor Asia Operations Pte. Ltd.

- SAP Asia Pte. Ltd.

- Wipro Ltd. (Singapore)

- Hewlett Packard Enterprise Singapore Pte. Ltd.

- Intel Technology Asia Pte. Ltd.

- Singapore Telecommunications Ltd. (Singtel)

- StarHub Ltd.

- M1 Ltd.

- TPG Telecom Pte. Ltd. (SIMBA Telecom)

- NCS Pte. Ltd.

- NEC Asia Pacific Pte. Ltd.

- Dell Technologies Singapore Pte. Ltd.

- Google Asia Pacific Pte. Ltd.

- Microsoft Operations Pte. Ltd. (Microsoft Singapore)

- Equinix Singapore Pte. Ltd.

- Alibaba Cloud (Singapore) Private Limited

- Palo Alto Networks (Singapore) Pte. Ltd.

- Check Point Software Technologies (Singapore) Pte. Ltd.

- Trend Micro (Singapore) Pte. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Market Definition and Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government Smart-Nation Expenditure Surge

- 4.2.2 Rapid 5G Roll-out and Adoption

- 4.2.3 Enterprise Cloud-first Mandates

- 4.2.4 Digital Bank Licences Boost BFSI Tech Spend

- 4.2.5 National AI Compute Resource (NACR) Roll-out

- 4.2.6 Green-Powered Hyperscale Data-centre Incentives

- 4.3 Market Restraints

- 4.3.1 Scarcity of Skilled Digital Talent

- 4.3.2 Escalating Cyber-attack Surface

- 4.3.3 Power-grid Capacity Caps on New DC Builds

- 4.3.4 Wage Inflation from Foreign-Labour Curbs

- 4.4 Value Chain Analysis

- 4.5 Evaluation of Critical Regulatory Framework

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macro-economic Factors

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 IT Hardware

- 5.1.1.1 Computer Hardware

- 5.1.1.2 Networking Equipment

- 5.1.1.3 Peripherals

- 5.1.2 IT Software

- 5.1.3 IT Services

- 5.1.3.1 Managed Services

- 5.1.3.2 Business Process Services

- 5.1.3.3 Business Consulting Services

- 5.1.3.4 Cloud Services

- 5.1.4 IT Infrastructure

- 5.1.5 Communication Services

- 5.1.1 IT Hardware

- 5.2 By End-User Enterprise Size

- 5.2.1 Small and Medium Enterprises

- 5.2.2 Large Enterprises

- 5.3 By Deployment Model

- 5.3.1 On-premise

- 5.3.2 Cloud

- 5.3.3 Hybrid

- 5.4 By End-user Industry Vertical

- 5.4.1 Government and Public Administration

- 5.4.2 BFSI

- 5.4.3 Energy and Utilities

- 5.4.4 Retail, E-commerce and Logistics

- 5.4.5 Manufacturing and Industry 4.0

- 5.4.6 Healthcare and Life Sciences

- 5.4.7 Oil and Gas (Up-, Mid-, Down-stream)

- 5.4.8 Gaming and Esports

- 5.4.9 Other Verticals

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amazon Web Services (AWS) Singapore

- 6.4.2 International Business Machines Corporation (IBM Singapore Pte. Ltd.)

- 6.4.3 Cognizant Technology Solutions Asia Pacific Pte. Ltd.

- 6.4.4 Micron Semiconductor Asia Operations Pte. Ltd.

- 6.4.5 SAP Asia Pte. Ltd.

- 6.4.6 Wipro Ltd. (Singapore)

- 6.4.7 Hewlett Packard Enterprise Singapore Pte. Ltd.

- 6.4.8 Intel Technology Asia Pte. Ltd.

- 6.4.9 Singapore Telecommunications Ltd. (Singtel)

- 6.4.10 StarHub Ltd.

- 6.4.11 M1 Ltd.

- 6.4.12 TPG Telecom Pte. Ltd. (SIMBA Telecom)

- 6.4.13 NCS Pte. Ltd.

- 6.4.14 NEC Asia Pacific Pte. Ltd.

- 6.4.15 Dell Technologies Singapore Pte. Ltd.

- 6.4.16 Google Asia Pacific Pte. Ltd.

- 6.4.17 Microsoft Operations Pte. Ltd. (Microsoft Singapore)

- 6.4.18 Equinix Singapore Pte. Ltd.

- 6.4.19 Alibaba Cloud (Singapore) Private Limited

- 6.4.20 Palo Alto Networks (Singapore) Pte. Ltd.

- 6.4.21 Check Point Software Technologies (Singapore) Pte. Ltd.

- 6.4.22 Trend Micro (Singapore) Pte. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-space and Unmet-need Assessment