PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934832

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934832

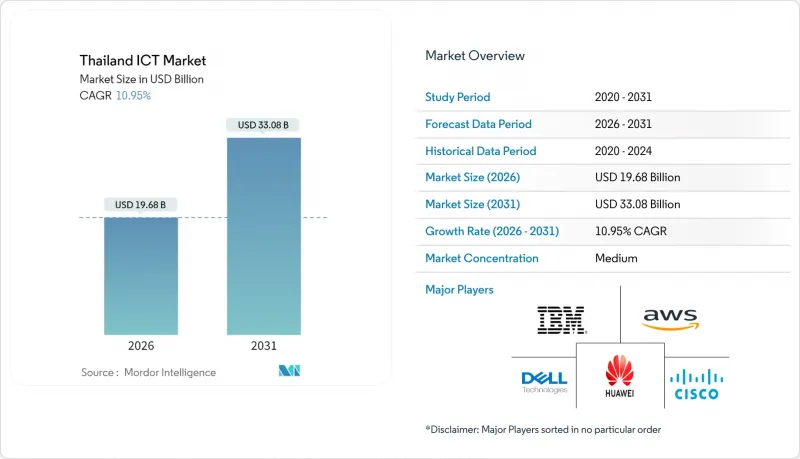

Thailand ICT - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Thailand ICT market is expected to grow from USD 17.74 billion in 2025 to USD 19.68 billion in 2026 and is forecast to reach USD 33.08 billion by 2031 at 10.95% CAGR over 2026-2031.

This expansion reflects the country's push to become a regional digital hub, propelled by nationwide 5G coverage, hyperscale data-center investment, and a government cloud-first mandate. Telecommunications service providers monetize 5G network slicing for industrial IoT, while foreign direct investment exceeding USD 1 billion in AI-ready, liquid-cooled facilities anchors the data-center ecosystem. The Thailand ICT market is also buoyed by Industry 4.0 modernization across the Eastern Economic Corridor, rising demand for cybersecurity services, and virtual-bank licensing that expands fintech infrastructure. At the same time, the market confronts talent shortages and stricter data-localization rules that heighten compliance costs.

Thailand ICT Market Trends and Insights

Rapid 5G Network Deployment and Subscriber Uptake

Nationwide 5G roll-out reached 95% population coverage by 2024, enabling edge-computing use cases for predictive maintenance in manufacturing and real-time logistics tracking. Operators deploy network-slicing to offer dedicated throughput for mission-critical applications, unlocking enterprise revenue streams that move beyond consumer voice and data. The National Broadcasting and Telecommunications Commission's spectrum allocations and infrastructure-sharing rules lower deployment costs for rural areas, accelerating adoption outside Bangkok. Manufacturers in the Eastern Economic Corridor integrate 5G sensors with AI analytics to cut unplanned downtime and boost throughput. Rising 5G handset penetration fuels subscriber migration, pushing average data consumption to double-digit gigabyte levels per user each month.

Government "Cloud-First" Policy Accelerating Adoption

Since 2024, every public-sector agency must justify on-premises procurements as exceptions, prompting ministries to migrate legacy systems onto domestic cloud regions certified under ISO 27001 and the Personal Data Protection Act. The THB 15 billion (USD 0.47 billion) Smart Nation Smart Life program funds shared API gateways and a sovereign large-language-model platform dubbed ThaiLLM hosted in government-approved clouds. State-owned enterprises now publish service catalogs through a single procurement portal, giving private vendors a clear roadmap for integration. The policy has catalyzed similar behavior in regulated industries, with financial institutions benchmarking cloud-security baselines against the government framework. As a result, the Thailand ICT market enjoys a multiplier effect as cloud skills, reference architectures, and procurement templates trickle into the private sector.

Fragmented SME Digital-Skills and Cyber-Readiness Gap

Nine in ten Thai SMEs lack formal digital investment plans, and many who do migrate to cloud overlook basic security configurations such as multi-factor authentication or role-based access. Limited awareness of zero-trust frameworks leaves smaller firms exposed to phishing and ransomware that can cripple operations for weeks. Government vouchers under the SME 4.0 program subsidize training and consulting, yet usage remains below 30% because owners prioritize immediate cash-flow concerns. Cyber-insurance premiums climb as underwriters factor in elevated breach frequency among small businesses. Without continuous skills development, the Thailand ICT market risks slower cloud uptake outside the urban core.

Other drivers and restraints analyzed in the detailed report include:

- Enterprise Industry 4.0 Digital-Transformation Surge

- Hyperscale Data-Center FDI Inflows

- Shortage of Advanced ICT Talent and Rising Labor Cost

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

IT Services contributed the largest 32.08% slice of the Thailand ICT market share in 2025, led by managed services contracts and multi-cloud migration projects. Telecom operators outsource network operations centers, and manufacturers engage system integrators for predictive-maintenance deployments. Within this umbrella, Cloud Services is forecast to grow at an 11.45% CAGR as enterprises refactor monolithic applications into API-driven microservices. Hardware demand holds steady on the back of 5G radio upgrades and data-center capital expenditure, while cybersecurity outlays accelerate due to persistent threat vectors.

The migration from capex to opex spending reshapes vendor revenue models. PTT Exploration and Production's move to a cloud-native development platform reduced application release cycles by 480%, illustrating payoffs realized when legacy systems are modernized. Edge-computing appliances proliferate in manufacturing plants to meet low-latency requirements, creating fresh revenue for hardware vendors certified under National Broadcasting and Telecommunications Commission standards. The Thailand ICT market incorporates low-code development tools that empower business analysts to prototype applications, easing pressure on scarce developer talent.

The Thailand ICT Market Report is Segmented by Product Type (IT Hardware, IT Software, IT Services, IT Infrastructure, IT Security, Communication Services), End-User Enterprise Size (Small and Medium Enterprises, Large Enterprises), and End-User Industry Vertical (Government and Public Administration, BFSI, Energy and Utilities, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Advanced Info Service Public Company Limited

- True Corporation Public Company Limited

- National Telecom Public Company Limited

- Huawei Technologies Co., Ltd.

- Cisco Systems, Inc.

- International Business Machines Corporation

- Dell Technologies Inc.

- Amazon Web Services, Inc.

- Google LLC

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- Cognizant Technology Solutions Corporation

- Wipro Limited

- Ericsson AB

- Nokia Corporation

- Check Point Software Technologies Ltd.

- Palo Alto Networks, Inc.

- Alibaba Cloud Computing Co., Ltd.

- VMware, Inc.

- Fujitsu Limited

- NEC Corporation

- Accenture plc

- Hewlett Packard Enterprise Company

- Seagate Technology Holdings plc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid 5G network deployment and subscriber uptake

- 4.2.2 Government "Cloud-First" policy accelerating adoption

- 4.2.3 Enterprise Industry 4.0 digital-transformation surge

- 4.2.4 Hyperscale data-center FDI inflows

- 4.2.5 Virtual-bank licensing fuelling fintech infrastructure

- 4.2.6 AI-ready, liquid-cooling data-center hub ambitions

- 4.3 Market Restraints

- 4.3.1 Fragmented SME digital-skills and cyber-readiness gap

- 4.3.2 Shortage of advanced ICT talent and rising labor cost

- 4.3.3 Stricter data-localization mandates increasing TCO

- 4.3.4 Soaring cyber-fraud liability dampening ICT budgets

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

- 4.9 Impact of Macroeconomic Factors

- 4.10 Industry Stakeholder Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 IT Hardware

- 5.1.1.1 Computer Hardware

- 5.1.1.2 Networking Equipment

- 5.1.1.3 Peripherals

- 5.1.2 IT Software

- 5.1.3 IT Services

- 5.1.3.1 IT Consulting and Implementation

- 5.1.3.2 IT Outsourcing (ITO)

- 5.1.3.3 Business Process Outsourcing (BPO)

- 5.1.3.4 Managed Security Services

- 5.1.3.5 Cloud and Platform Services

- 5.1.4 IT Infrastructure

- 5.1.5 IT Security/Cybersecurity

- 5.1.6 Communication Services

- 5.1.1 IT Hardware

- 5.2 By Enterprise Size

- 5.2.1 Small and Medium-sized Enterprises

- 5.2.2 Large Enterprises

- 5.3 By End-user Industry Vertical

- 5.3.1 Government and Public Administration

- 5.3.2 BFSI

- 5.3.3 IT and Telecom

- 5.3.4 Energy and Utilities

- 5.3.5 Retail, E-commerce, and Logistics

- 5.3.6 Manufacturing and Industry 4.0

- 5.3.7 Healthcare and Life Sciences

- 5.3.8 Oil and Gas

- 5.3.9 Gaming and Esports

- 5.3.10 Other Verticals

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Advanced Info Service Public Company Limited

- 6.4.2 True Corporation Public Company Limited

- 6.4.3 National Telecom Public Company Limited

- 6.4.4 Huawei Technologies Co., Ltd.

- 6.4.5 Cisco Systems, Inc.

- 6.4.6 International Business Machines Corporation

- 6.4.7 Dell Technologies Inc.

- 6.4.8 Amazon Web Services, Inc.

- 6.4.9 Google LLC

- 6.4.10 Microsoft Corporation

- 6.4.11 Oracle Corporation

- 6.4.12 SAP SE

- 6.4.13 Cognizant Technology Solutions Corporation

- 6.4.14 Wipro Limited

- 6.4.15 Ericsson AB

- 6.4.16 Nokia Corporation

- 6.4.17 Check Point Software Technologies Ltd.

- 6.4.18 Palo Alto Networks, Inc.

- 6.4.19 Alibaba Cloud Computing Co., Ltd.

- 6.4.20 VMware, Inc.

- 6.4.21 Fujitsu Limited

- 6.4.22 NEC Corporation

- 6.4.23 Accenture plc

- 6.4.24 Hewlett Packard Enterprise Company

- 6.4.25 Seagate Technology Holdings plc

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and unmet-need assessment