PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934835

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934835

Vietnam ICT - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

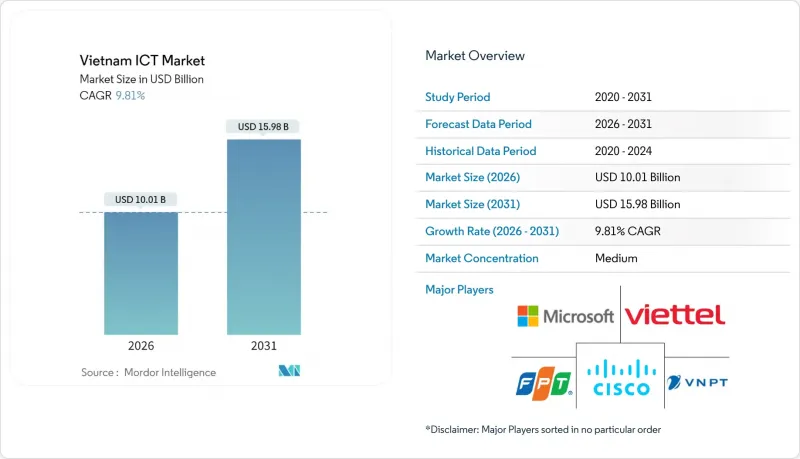

The Vietnam ICT market was valued at USD 9.12 billion in 2025 and estimated to grow from USD 10.01 billion in 2026 to reach USD 15.98 billion by 2031, at a CAGR of 9.81% during the forecast period (2026-2031).

Government-led digitalization programs, sizable foreign direct investment, and the push to localize semiconductor production continue to accelerate adoption across hardware, software, and services. Large-scale 5G rollouts, paired with expanding cloud and data-center capacity, are fueling new revenue streams for telecommunications operators and global hyperscalers. At the same time, smart-city initiatives in 48 municipalities are driving demand for integrated connectivity, analytics, and cybersecurity solutions. The competitive dynamic remains balanced between state-owned carriers and multinational technology vendors that are deepening local partnerships to address industry-specific digital-transformation mandates. Although funding constraints in secondary cities and a shortage of advanced engineering talent pose headwinds, the Vietnam ICT market is expected to maintain double-digit momentum through 2030 as enterprises modernize operations and new digital-services models scale.

Vietnam ICT Market Trends and Insights

Smart-City Infrastructure Programs

Government approval of 48 municipal digitalization roadmaps has created a USD 2 billion pipeline for connectivity, sensor networks, and cybersecurity platforms. Ho Chi Minh City's flood-management upgrade and Da Nang's sustainable-city plan both require real-time data analytics, strengthening demand for edge computing and IoT gateways. Mandatory allocation of at least 10% of public-sector IT budgets to cybersecurity further expands the addressable market for threat-detection vendors. The national VNeID digital-identity roll-out already serves millions of citizens and is scaling authentication services for e-government portals. These projects generate multiplier effects for telecom carriers, cloud providers, and systems integrators while positioning Vietnam as a testbed for regional smart-city solutions.

Digital Transformation Across Industry 4.0 Value Chains

Manufacturing plants adopting AI-driven predictive-maintenance systems report production-efficiency gains of 30-50%. Textile exporters such as Vinatex have boosted consolidated revenue by 6.1% after deploying IoT-enabled supply-chain analytics. Samsung's USD 920 million expansion underscores rising capital inflows devoted to machine-learning-based quality control and automated logistics. Decree 109, which lowered registration taxes for locally produced vehicles, has accelerated automotive digitalization through robotics and connected-factory platforms. Blockchain-powered provenance tracking and AI-enhanced demand forecasting are helping Vietnamese manufacturers capture higher-margin global orders while shortening time-to-market.

High Up-Front Network and Data-Center Build Costs

The capital intensity of 5G spectrum, fiber backhaul, and Tier III data-center construction strains operator balance sheets, especially outside the two largest metros. Secondary cities often lack the demand density to hit utilization thresholds, extending payback periods for investors. Currency fluctuation risk and rising interest rates elevate funding costs, while land-use approvals add administrative delays. Although public-private-partnership models are emerging, financing gaps persist for small regional carriers and neutral-host tower companies. These constraints could defer rural broadband timelines and limit edge-computing coverage that many Industry 4.0 use cases require.

Other drivers and restraints analyzed in the detailed report include:

- Surging Cloud- and AI-Linked Capex

- "Make-in-Vietnam" Digital-Economy Roadmap

- Shortage of Specialized ICT Talent

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

IT Hardware maintained a 22.88% share of the Vietnam ICT market in 2025 as operators upgraded base-station and data-center equipment to support nationwide 5G backbones. However, the Vietnam ICT market size for hardware is expected to expand more slowly than that for services as infrastructure build-outs mature. In contrast, IT Services is on track for a 12.07% CAGR through 2031, propelled by consulting, systems integration, and managed-security projects that require specialized know-how. Hybrid cloud, ERP modernization, and AI implementation demand continuous professional-services support, creating sticky revenue streams for vendors and integrators.

Cloud-services adoption is escalating as enterprises pursue pay-as-you-go scalability; this, in turn, lifts demand for connectivity and cybersecurity offerings bundled by telecom carriers. Software revenue is also climbing as firms migrate from perpetual licenses to subscription-based SaaS, lowering up-front costs. Communication services benefit from growing mobile-data consumption and enterprise 5G use cases. Managed-services contracts, especially for cybersecurity monitoring, allow SMEs to outsource complex functions and keep headcount lean while meeting regulatory mandates.

The Vietnam ICT Market Report is Segmented by Type (IT Hardware, IT Software, IT Services, IT Infrastructure, Communication Services), End-User Enterprise Size (Small and Medium Enterprises, Large Enterprises), End-User Industry Vertical (Government and Public Administration, BFSI, Energy and Utilities, Retail, E-Commerce and Logistics, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Microsoft Corporation

- Cisco Systems Inc.

- Viettel Group

- VNPT Group

- FPT Corporation

- CMC Corporation

- Qualcomm Technologies Inc.

- Google LLC (Alphabet Inc.)

- Fujitsu Ltd.

- Fortinet Inc.

- Vietnamobile

- D-Link Systems Inc.

- Hewlett Packard Enterprise

- Telehouse Vietnam

- Oracle Corporation

- IBM Corporation

- Samsung Electronics Vietnam

- VNG Corporation

- MobiFone

- TMA Solutions

- KMS Technology

- NashTech

- Axon Active Vietnam

- Ciena Corporation

- Ericsson Vietnam

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Smart-city infrastructure programmes

- 4.2.2 Digital transformation across Industry 4.0 value-chains

- 4.2.3 Surging cloud- and AI-linked capex

- 4.2.4 Government "Make-in-Vietnam" digital-economy roadmap

- 4.2.5 Semiconductor self-sufficiency incentives

- 4.2.6 Hyperscale and regional IDC hub build-out

- 4.3 Market Restraints

- 4.3.1 High up-front network and data-centre build costs

- 4.3.2 Shortage of specialised ICT talent

- 4.3.3 Heavy reliance on imported core components

- 4.3.4 Fragmented cyber-regulatory compliance burden

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.6.1 Key Technology Investments

- 4.6.1.1 Cloud Technology

- 4.6.1.2 Artificial Intelligence

- 4.6.1.3 Cyber-security

- 4.6.1.4 Digital Services

- 4.6.1.5 Edge Computing and IoT

- 4.6.1 Key Technology Investments

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Ecosystem Analysis

- 4.9 Industry Stakeholder Analysis

- 4.10 Impact and Recovery from COVID-19 and Macro Shifts

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 IT Hardware

- 5.1.1.1 Computer Hardware

- 5.1.1.2 Networking Equipment

- 5.1.1.3 Peripherals

- 5.1.2 IT Software

- 5.1.3 IT Services

- 5.1.3.1 Managed Services

- 5.1.3.2 Business Process Services

- 5.1.3.3 Business Consulting Services

- 5.1.3.4 Cloud Services

- 5.1.4 IT Infrastructure

- 5.1.5 Communication Services

- 5.1.1 IT Hardware

- 5.2 By End-User Enterprise Size

- 5.2.1 Small and Medium Enterprises

- 5.2.2 Large Enterprises

- 5.3 By End-user Industry Vertical

- 5.3.1 Government and Public Administration

- 5.3.2 BFSI

- 5.3.3 Energy and Utilities

- 5.3.4 Retail, E-commerce and Logistics

- 5.3.5 Manufacturing and Industry 4.0

- 5.3.6 Healthcare and Life Sciences

- 5.3.7 Oil and Gas (Up-, Mid-, Down-stream)

- 5.3.8 Gaming and Esports

- 5.3.9 Other Verticals

- 5.3.10 By Industry Vertical (Value)

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Microsoft Corporation

- 6.4.2 Cisco Systems Inc.

- 6.4.3 Viettel Group

- 6.4.4 VNPT Group

- 6.4.5 FPT Corporation

- 6.4.6 CMC Corporation

- 6.4.7 Qualcomm Technologies Inc.

- 6.4.8 Google LLC (Alphabet Inc.)

- 6.4.9 Fujitsu Ltd.

- 6.4.10 Fortinet Inc.

- 6.4.11 Vietnamobile

- 6.4.12 D-Link Systems Inc.

- 6.4.13 Hewlett Packard Enterprise

- 6.4.14 Telehouse Vietnam

- 6.4.15 Oracle Corporation

- 6.4.16 IBM Corporation

- 6.4.17 Samsung Electronics Vietnam

- 6.4.18 VNG Corporation

- 6.4.19 MobiFone

- 6.4.20 TMA Solutions

- 6.4.21 KMS Technology

- 6.4.22 NashTech

- 6.4.23 Axon Active Vietnam

- 6.4.24 Ciena Corporation

- 6.4.25 Ericsson Vietnam

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment