PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939095

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939095

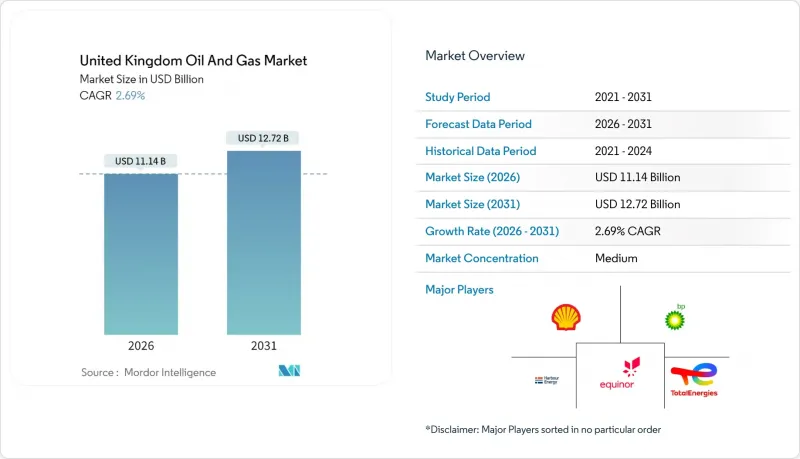

United Kingdom Oil And Gas - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The United Kingdom Oil And Gas market is expected to grow from USD 10.85 billion in 2025 to USD 11.14 billion in 2026 and is forecast to reach USD 12.72 billion by 2031 at 2.69% CAGR over 2026-2031.

A strategic shift toward squeezing maximum value from mature North Sea reservoirs, paired with a deliberate slowdown in greenfield exploration, underpins this measured expansion. Operators have reduced lifting costs by 15-20% since 2020, thereby protecting profitability even as fiscal burdens increase. The 2024 investment outlay of more than £6 billion, half again above regulator expectations, flowed mainly into life-extension programs and midstream upgrades that support carbon-capture infrastructure. Consolidation among independents accelerated, with two headline acquisitions totaling more than USD 2 billion, unlocking cost synergies and decommissioning efficiencies. At the same time, floating-wind pilots and on-platform electrification cut diesel burn, proving that emissions compliance and production stability can coexist.

United Kingdom Oil And Gas Market Trends and Insights

Declining North Sea Lifting Costs Drive Operational Efficiency

North Sea lifting costs have decreased substantially, creating competitive advantages for UK operators amid global energy market challenges. Technological breakthroughs in subsea systems and enhanced drilling techniques have cut per-barrel extraction costs by 15-20% since 2020, sustaining production viability despite heightened fiscal pressures. This cost reduction trajectory positions UK fields favorably against international alternatives, particularly as energy security concerns elevate domestic production value. The efficiency gains result from advanced reservoir management systems and optimized production scheduling, which maximize recovery rates while minimizing operational expenses. Operators leverage these cost improvements to extend field life and justify continued investment in mature assets that might otherwise face early decommissioning.

UK North Sea Transition Deal Incentives Reshape Investment Priorities

The UK North Sea Transition Deal offers structured fiscal incentives to operators demonstrating measurable progress toward net-zero emissions targets, thereby fundamentally altering capital allocation decisions across the sector. Investment allowances and enhanced depletion rates reward companies that integrate carbon capture, utilization, and storage technologies into their operations, with qualifying projects receiving accelerated tax relief worth up to 40% of eligible expenditures. This policy framework has catalyzed over £2 billion in committed CCUS investments since 2024, transforming previously uneconomical projects into viable development opportunities. The deal creates competitive advantages for operators demonstrating technological leadership in emissions reduction, effectively subsidizing the transition toward lower-carbon hydrocarbon production. ISO 14001 environmental management certification has become increasingly critical for accessing these incentives, with operators investing heavily in compliance processes.

Accelerated CCS Levy Strains Operator Cash Flows

The introduction of accelerated carbon capture and storage levies on upstream operators has created immediate financial pressure across the UK Continental Shelf, with compliance costs estimated at £150-200 million annually for major producers. This regulatory framework requires operators to contribute to national CCS infrastructure development regardless of their individual project participation, effectively subsidizing broader energy transition objectives through sector-specific taxation. The levy structure disproportionately impacts smaller independents who lack the scale to absorb these additional costs, potentially accelerating consolidation as marginal operators seek larger partners or exit the market entirely. Compliance with the levy requirements demands enhanced monitoring and reporting capabilities, which add operational complexity and further strain resources.

Other drivers and restraints analyzed in the detailed report include:

- Floating Wind Platform Integration Reduces Operational Carbon Intensity

- Teesside and Humber Industrial Clusters Create Blue Hydrogen Demand

- Offshore Wind Grid Integration Reduces Peak Gas Demand

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The upstream segment's commanding 71.65% market share in 2025 reflects the continued centrality of extraction activities to UK oil and gas operations, yet the midstream segment's 4.18% CAGR through 2031 signals a fundamental shift toward infrastructure and processing investments. Upstream activities benefit from enhanced recovery techniques and extended field life programs that maximize value from existing North Sea assets. Operators like Harbour Energy have invested over USD 1.3 billion in asset acquisitions during 2024 to consolidate production capabilities. The midstream segment's accelerated growth stems from critical infrastructure requirements for carbon capture, utilization, and storage projects, with pipeline networks and processing facilities requiring substantial upgrades to handle CO2 transport and hydrogen production. Downstream operations maintain steady performance through refined product demand, though the segment faces long-term headwinds from electrification trends and renewable fuel mandates.

Midstream infrastructure investments are particularly concentrated in the East Coast Cluster, where Kellas Midstream's H2NorthEast facility represents a 1 GW blue hydrogen production capability that necessitates extensive pipeline modifications and the installation of new compression stations. The UK oil and gas market size for midstream operations reached USD 2.19 billion in 2025, with annual growth rates exceeding the sector average by 1.5 percentage points. The UK's gas transmission system spans over 7,600 km of high-pressure pipelines, with National Grid investing £2.5 billion annually in network maintenance and enhancement projects that support both traditional gas transport and emerging hydrogen applications. Processing capabilities are expanding through the deployment of floating production, storage, and offloading vessels, which enable the development of previously stranded reserves. Meanwhile, storage infrastructure benefits from strategic petroleum reserve requirements and seasonal demand balancing needs.

The United Kingdom Oil and Gas Market is Segmented by Sector (Upstream, Downstream, and Midstream), Location (Onshore and Offshore), and Service (Construction, Maintenance and Turn-Around, and Decommissioning). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Shell plc

- BP plc

- Harbour Energy plc

- TotalEnergies SE

- Equinor ASA

- Chevron Corp.

- Centrica plc

- Valaris plc

- INEOS Group Ltd

- ConocoPhillips UK Ltd

- EnQuest plc

- Ithaca Energy plc

- Neptune Energy Group

- Cadent Gas Ltd

- Dana Petroleum Ltd

- ESSO UK Ltd

- BG Group Ltd

- Premier Oil (Chrysaor)

- Wood plc

- Subsea 7 SA

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Declining North Sea lifting costs

- 4.2.2 UK "North Sea Transition Deal" incentives

- 4.2.3 Surge in floating-wind-powered platforms (E&P cost cuts)

- 4.2.4 Re-industrialisation of Teesside & Humber (blue hydrogen demand)

- 4.2.5 AI-enabled seismic imaging success rates

- 4.3 Market Restraints

- 4.3.1 Accelerated CCS levy on upstream operators

- 4.3.2 Grid-connected offshore wind cannibalising peak-time gas demand

- 4.3.3 Heightened decommissioning bond requirements

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Crude-Oil Production & Consumption Outlook

- 4.8 Natural-Gas Production & Consumption Outlook

- 4.9 Installed Pipeline Capacity Analysis

- 4.10 Unconventional Resources CAPEX Outlook (tight oil, oil sands, deep-water)

- 4.11 Porter's Five Forces

- 4.11.1 Bargaining Power of Suppliers

- 4.11.2 Bargaining Power of Consumers

- 4.11.3 Threat of New Entrants

- 4.11.4 Threat of Substitutes

- 4.11.5 Intensity of Competitive Rivalry

- 4.12 PESTLE Analysis

5 Market Size & Growth Forecasts

- 5.1 By Sector

- 5.1.1 Upstream

- 5.1.2 Midstream

- 5.1.3 Downstream

- 5.2 By Location of Deployment

- 5.2.1 Onshore

- 5.2.2 Offshore

- 5.3 By Service

- 5.3.1 Construction

- 5.3.2 Maintenance and Turn-around

- 5.3.3 Decommissioning

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Shell plc

- 6.4.2 BP plc

- 6.4.3 Harbour Energy plc

- 6.4.4 TotalEnergies SE

- 6.4.5 Equinor ASA

- 6.4.6 Chevron Corp.

- 6.4.7 Centrica plc

- 6.4.8 Valaris plc

- 6.4.9 INEOS Group Ltd

- 6.4.10 ConocoPhillips UK Ltd

- 6.4.11 EnQuest plc

- 6.4.12 Ithaca Energy plc

- 6.4.13 Neptune Energy Group

- 6.4.14 Cadent Gas Ltd

- 6.4.15 Dana Petroleum Ltd

- 6.4.16 ESSO UK Ltd

- 6.4.17 BG Group Ltd

- 6.4.18 Premier Oil (Chrysaor)

- 6.4.19 Wood plc

- 6.4.20 Subsea 7 SA

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment