PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939720

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939720

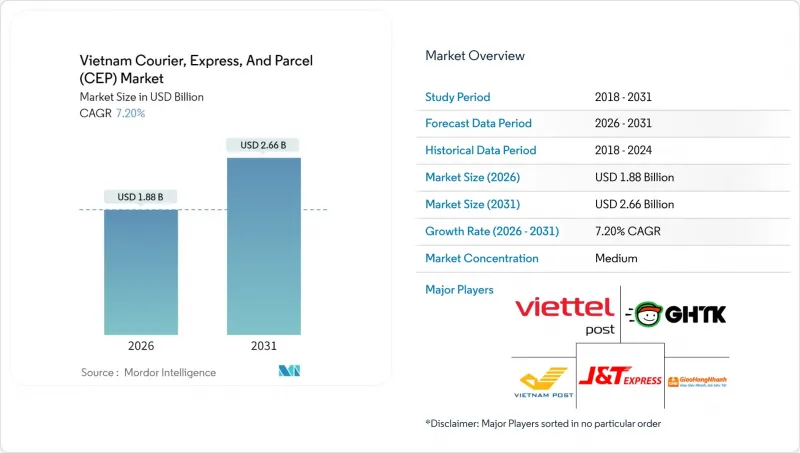

Vietnam Courier, Express, And Parcel (CEP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Vietnam courier express parcel market is expected to grow from USD 1.75 billion in 2025 to USD 1.88 billion in 2026 and is forecast to reach USD 2.66 billion by 2031 at 7.2% CAGR over 2026-2031.

Digitally savvy consumers, an expanding manufacturing base, and supportive infrastructure programs are accelerating shipment volumes. Social-commerce platforms-from TikTok Shop to Shopee-are reshaping order profiles toward small, high-frequency parcels that demand agile last-mile networks. At the same time, foreign direct investment (FDI) in export-oriented electronics and apparel supports steady B2B flows, underpinning capacity utilization for long-haul and cross-border lanes. Battery-swap electric-vehicle (EV) fleets are emerging as a cost lever, promising faster rounds and sharply lower fuel expenses. Yet operators continue to battle Vietnam's 16-20% logistics-cost-to-GDP burden, forcing relentless cost discipline and route-optimization investments.

Vietnam Courier, Express, And Parcel (CEP) Market Trends and Insights

E-commerce Boom and Rising Digital-Wallet Adoption

Explosive online retail growth, reinforced by 78% smartphone penetration, is pouring small parcels into city hubs at double-digit monthly rates. Digital wallets now settle more than 55% of B2C checkouts, shortening cash-on-delivery cycles and supporting same-day service pilots in Ho Chi Minh City and Hanoi. CEP operators upgraded OCR-based address recognition and automated sorters to manage the surge, while marketplace alliances guarantee volume pools that justify constant-route motorcycles. Wider wallet acceptance is also unlocking suburban and tier-2 demand, expanding the Vietnam courier express parcel market well beyond primary retail districts. Intensifying competition, however, is compressing unit yields, pushing carriers toward higher drop densities and shared line-haul assets.

Ongoing Transport-Infrastructure Expansion

USD 13.1 billion in airport, seaport, and expressway projects is shrinking average interprovincial transit times by up to 18%. The new Long Thanh International Airport cargo facilities promise 1.2 million tons of annual throughput, a capacity boost that eases pressure on Tan Son Nhat and Noi Bai. For the Vietnam courier express parcel market, faster line-haul turns translate into higher network velocity and better aircraft utilization on Hanoi-Ho Chi Minh trunk routes. Inland barge terminals feeding Cai Mep port, meanwhile, are steering high-value electronics exports into integrated multimodal chains, burning less diesel per parcel kilometre. These improvements will reach full scale only after 2027, but forwarders already lock in warehouse plots near new interchanges to pre-empt capacity shortages.

High Logistics-Cost-to-GDP Ratio

Total system costs absorb close to 18% of national output, more than double the OECD average, squeezing carrier margins and hindering investment headroom. Multiple road-use tolls, port surcharges, and informal fees inflate per-parcel operating expenditure, especially outside major corridors. The Vietnam courier express parcel market, therefore, relies heavily on densification plays-clustered deliveries and shared trans-shipment nodes-to dilute fixed costs. Large platforms negotiate discounted network access, but small shippers bear higher tariffs, stunting rural e-commerce order frequency and slowing overall market expansion.

Other drivers and restraints analyzed in the detailed report include:

- Manufacturing-FDI Shift to Vietnam (China+1)

- Rapid Growth of Social-Commerce

- Urban Traffic Congestion and Last-Mile Delays

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Manufacturing generated 32.60% of 2025 revenue, providing volume stability and multi-year contracts. Electronics and textiles anchor predictable shipment calendars tied to seasonal fashion cycles and product-launch events. Vietnam courier express parcel market size from e-commerce is set to surge, given its 8.02% CAGR between 2026-2031, powered by rising per-capita income and aggressive free-shipping promotions.

Healthcare, banking, and insurance verticals represent smaller but fast-growing niches. Cold-chain pharmaceutical deliveries and secure document dispatches carry high margins, attracting specialist entrants with GDP-compliant packaging and chain-of-custody protocols.

International parcels accounted for 37.90% of volume in 2025, but their 7.60% CAGR between 2026-2031 outpaces the domestic track. Tariff relief under EVFTA and digitized customs pipelines have cut average EU-bound clearance to 24 hours, catalyzing apparel and sneaker exports. As overseas share widens, the Vietnam courier express parcel market size for cross-border flows is projected to close the decade at USD 1.06 billion. Domestic services retain scale advantages in dense urban sprawl, though rural push initiatives such as Voso/Postmart chip away at unit economics by forcing carriers to serve low-drop zones. Carriers therefore hedge by bundling outbound export freight with domestic reverse logistics to reduce empty backhauls.

A stronger international orientation also raises service-quality benchmarks. ISO-certified processes, double-scan tracking, and bonded warehousing-once exclusive to express giants-are diffusing to mid-tier local firms. This technology diffusion tightens competition and nudges overall Vietnam courier express parcel market share toward operators that can match global-standard KPIs without eroding profitability.

The Vietnam Courier, Express, and Parcel (CEP) Market Report is Segmented by Destination (Domestic and International), Speed of Delivery (Express and Non-Express), Model (Business-To-Business (B2B), and More), Shipment Weight (Heavy Weight, Light Weight, and Medium Weight), Mode of Transport (Air, Road, and Others), and End User Industry (E-Commerce, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- 247 Express

- DHL Group

- FedEx

- Giao Hang Nhanh

- Giaohangtietkiem

- J&T Express

- United Parcel Service (UPS)

- Vietnam Posts and Telecommunications Group (including Vietnam Post Corporation)

- Vietstar Express

- ViettelPost

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Demographics

- 4.3 GDP Distribution by Economic Activity

- 4.4 GDP Growth by Economic Activity

- 4.5 Inflation

- 4.6 Economic Performance and Profile

- 4.6.1 Trends in E-Commerce Industry

- 4.6.2 Trends in Manufacturing Industry

- 4.7 Transport and Storage Sector GDP

- 4.8 Export Trends

- 4.9 Import Trends

- 4.10 Fuel Price

- 4.11 Logistics Performance

- 4.12 Infrastructure

- 4.13 Regulatory Framework

- 4.14 Value Chain and Distribution Channel Analysis

- 4.15 Market Drivers

- 4.15.1 E-commerce Boom and Rising Digital-Wallet Adoption

- 4.15.2 Ongoing Transport-Infrastructure Expansion

- 4.15.3 Manufacturing-FDI Shift to Vietnam (China + 1)

- 4.15.4 Rapid Growth of Social-Commerce (Tiktok Shop, etc.)

- 4.15.5 Government Push for Rural E-Commerce via Voso/Postmart

- 4.15.6 Battery-Swap EV Networks Enabling Ultra-Low-Cost Last-Mile

- 4.16 Market Restraints

- 4.16.1 High Logistics-Cost-to-GDP Ratio (≈ 16-20 %)

- 4.16.2 Urban Traffic Congestion and Last-Mile Delays

- 4.16.3 Shortage of Digitally-Skilled Logistics Labour

- 4.16.4 Fragmented Road-Transport Base Limiting Scale Economies

- 4.17 Technology Innovations in the Market

- 4.18 Porter's Five Forces Analysis

- 4.18.1 Threat of New Entrants

- 4.18.2 Bargaining Power of Buyers

- 4.18.3 Bargaining Power of Suppliers

- 4.18.4 Threat of Substitutes

- 4.18.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 Destination

- 5.1.1 Domestic

- 5.1.2 International

- 5.2 Speed of Delivery

- 5.2.1 Express

- 5.2.2 Non-Express

- 5.3 Model

- 5.3.1 Business-to-Business (B2B)

- 5.3.2 Business-to-Consumer (B2C)

- 5.3.3 Consumer-to-Consumer (C2C)

- 5.4 Shipment Weight

- 5.4.1 Heavy Weight Shipments

- 5.4.2 Light Weight Shipments

- 5.4.3 Medium Weight Shipments

- 5.5 Mode of Transport

- 5.5.1 Air

- 5.5.2 Road

- 5.5.3 Others

- 5.6 End User Industry

- 5.6.1 E-Commerce

- 5.6.2 Financial Services (BFSI)

- 5.6.3 Healthcare

- 5.6.4 Manufacturing

- 5.6.5 Primary Industry

- 5.6.6 Wholesale and Retail Trade (Offline)

- 5.6.7 Others

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Key Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 247 Express

- 6.4.2 DHL Group

- 6.4.3 FedEx

- 6.4.4 Giao Hang Nhanh

- 6.4.5 Giaohangtietkiem

- 6.4.6 J&T Express

- 6.4.7 United Parcel Service (UPS)

- 6.4.8 Vietnam Posts and Telecommunications Group (including Vietnam Post Corporation)

- 6.4.9 Vietstar Express

- 6.4.10 ViettelPost

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment