PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940699

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940699

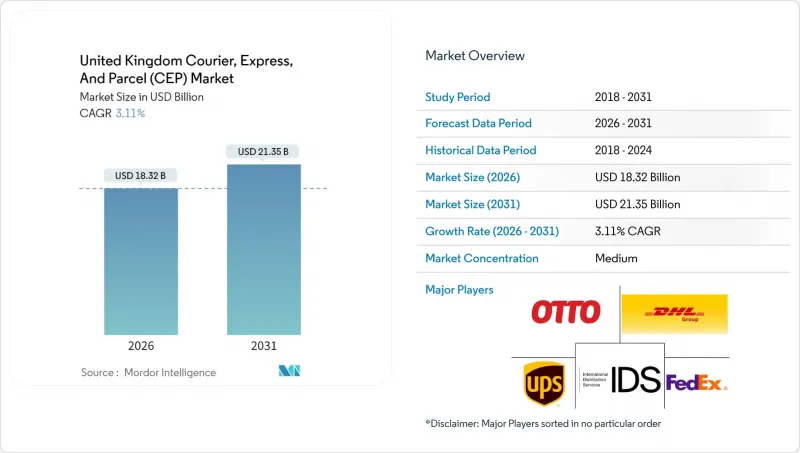

United Kingdom Courier, Express, And Parcel (CEP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The United Kingdom courier, express, and parcel market was valued at USD 17.77 billion in 2025 and estimated to grow from USD 18.32 billion in 2026 to reach USD 21.35 billion by 2031, at a CAGR of 3.11% during the forecast period (2026-2031).

This measured expansion indicates a mature competitive arena in which technology-led efficiency, automation, and network optimization now influence profitability more than headline volume growth. Domestic deliveries still dominate activity, but cross-border volumes are rebounding as post-Brexit trade protocols stabilize, while consumer-centric e-commerce is redefining service mix and delivery speed expectations. Competitive strategies emphasize data-driven routing, asset-light partnerships, and targeted acquisitions that deepen last-mile density. Regulatory oversight has intensified under the Digital Markets, Competition and Consumers Act 2024, sharpening compliance costs but also creating a clearer operating framework that rewards transparency and consumer protection.

United Kingdom Courier, Express, And Parcel (CEP) Market Trends and Insights

E-commerce Penetration Surge

Online retail continues to lift parcel volumes, reshaping service expectations toward faster, traceable, and flexible deliveries. Operators able to guarantee narrow time windows capture premium yields, while those relying on standard services face margin pressure. Specialist networks that handle fragile or high-value items leverage their service differentiation to win customer loyalty. At the same time, peer-to-peer resale platforms are scaling shipments that bypass traditional store-based supply chains, broadening the customer base for locker networks and label-free shipping options offered by major carriers. These forces collectively push investment into routing software and automated sortation systems that underpin profitable high-velocity last-mile operations.

Cross-Border E-commerce Expansion

The re-establishment of predictable customs rules has reignited international parcel flows, especially toward EU destinations. Carriers with customs brokerage depth and multilingual support are now widening market share by shortening clearance cycles through data-rich pre-declaration tools exemplified by AI-enabled classification engines. Northern Ireland enjoys a unique dual-market profile under the Windsor Framework, encouraging service propositions that span Great Britain and the EU without duplicative paperwork. As shoppers regain confidence in ordering from continental merchants, shipment value density rises, favoring time-definite express products.

Driver Shortages and Wage Inflation

The industry confronts persistent recruitment gaps that elevate labor costs and threaten on-time performance. Independent operators with limited wage flexibility see profitability squeezed, whereas larger networks deploy retention bonuses, in-cab safety tech, and career pathways to stabilize turnover. Some carriers are piloting crowd-sourced fleets and autonomous delivery pilots to reduce reliance on traditional HGV licenses. Rising payroll also inflates insurance premiums and training overheads, compounding cost pressure during seasonal surges.

Other drivers and restraints analyzed in the detailed report include:

- Automation and Real-Time Tracking Roll-Out

- Rise of Micro-Fulfillment Q-commerce

- Urban Congestion and ULEZ Charging Zones

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Manufacturing maintains a 33.27% share in 2025, leveraging predictable production schedules and inbound component flows. However, e-commerce is the brightest growth spot at 3.41% CAGR between 2026-2031 as omnichannel retailers outsource fulfillment and last-mile delivery. Healthcare logistics registers brisk momentum, supported by home-based clinical trials and direct-to-patient pharmaceutical deliveries that demand strict temperature and chain-of-custody protocols.

Financial services continue to require secure documentation transport, but digitalization is gradually trimming physical shipment volumes. Industrial and raw-material flows depend on carriers equipped to handle hazardous or regulated goods, reinforcing the value of specialized certifications inside the United Kingdom courier, express, and parcel market.

International values, expanding at a 3.24% CAGR between 2026-2031, illustrate how stabilized customs frameworks are reinvigorating trade flows between the United Kingdom and continental Europe. Express carriers that integrate digital customs pre-clearance into booking platforms facilitate seamless cross-border shopping experiences, thereby capturing demand for time-definite delivery. Domestic traffic still anchors 64.62% of the United Kingdom courier, express, and parcel market share in 2025, buoyed by e-commerce and reshoring initiatives that prioritize local supply chain resilience.

The United Kingdom courier, express, and parcel market size benefits from volume diversification as platform-based merchants tap foreign consumer bases and U.K. shoppers broaden sourcing choices. Operators with multilingual support desks, transparent duty calculators, and consumer-friendly returns processes convert these flows into profitable repeat business. Northern Ireland, enjoying streamlined EU access, is emerging as a logistics bridgehead, enabling carriers to reposition hubs that serve both Great Britain and Europe efficiently.

The United Kingdom Courier, Express, and Parcel (CEP) Market Report is Segmented by End User Industry (E-Commerce, Manufacturing, and More), Destination (Domestic and International), Speed of Delivery (Express and Non-Express), Shipment Weight (Heavy Weight Shipments, and More), Mode of Transport (Air, Road, and Others), and Model (Business-To-Business, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- APC Overnight

- DHL Group

- FedEx

- GEODIS

- International Distributions Services (including Royal Mail)

- La Poste Group

- Otto Group (including The Hermes Group)

- Rapid Parcel

- United Parcel Service (UPS)

- Yodel

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Demographics

- 4.3 GDP Distribution by Economic Activity

- 4.4 GDP Growth by Economic Activity

- 4.5 Inflation

- 4.6 Economic Performance and Profile

- 4.6.1 Trends in E-Commerce Industry

- 4.6.2 Trends in Manufacturing Industry

- 4.7 Transport and Storage Sector GDP

- 4.8 Export Trends

- 4.9 Import Trends

- 4.10 Fuel Price

- 4.11 Logistics Performance

- 4.12 Infrastructure

- 4.13 Regulatory Framework

- 4.14 Value Chain and Distribution Channel Analysis

- 4.15 Market Drivers

- 4.15.1 E-Commerce Penetration Surge

- 4.15.2 Cross-Border E-Commerce Expansion

- 4.15.3 Automation and Real-Time Tracking Roll-Out

- 4.15.4 Fleet Electrification Incentives

- 4.15.5 Rise of Micro-Fulfilment Q-Commerce

- 4.15.6 Indoor/Out-of-Home Locker Ecosystems

- 4.16 Market Restraints

- 4.16.1 Driver Shortages and Wage Inflation

- 4.16.2 Volatile Fuel and Energy Prices

- 4.16.3 Urban Congestion/ULEZ Charging Zones

- 4.16.4 Land-Scarce Hub Capacity Constraints

- 4.17 Technology Innovations in the Market

- 4.18 Porter's Five Forces Analysis

- 4.18.1 Threat of New Entrants

- 4.18.2 Bargaining Power of Buyers

- 4.18.3 Bargaining Power of Suppliers

- 4.18.4 Threat of Substitutes

- 4.18.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 Destination

- 5.1.1 Domestic

- 5.1.2 International

- 5.2 Speed of Delivery

- 5.2.1 Express

- 5.2.2 Non-Express

- 5.3 Model

- 5.3.1 Business-to-Business (B2B)

- 5.3.2 Business-to-Consumer (B2C)

- 5.3.3 Consumer-to-Consumer (C2C)

- 5.4 Shipment Weight

- 5.4.1 Heavy Weight Shipments

- 5.4.2 Light Weight Shipments

- 5.4.3 Medium Weight Shipments

- 5.5 Mode of Transport

- 5.5.1 Air

- 5.5.2 Road

- 5.5.3 Others

- 5.6 End User Industry

- 5.6.1 E-Commerce

- 5.6.2 Financial Services (BFSI)

- 5.6.3 Healthcare

- 5.6.4 Manufacturing

- 5.6.5 Primary Industry

- 5.6.6 Wholesale and Retail Trade (Offline)

- 5.6.7 Others

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Key Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 APC Overnight

- 6.4.2 DHL Group

- 6.4.3 FedEx

- 6.4.4 GEODIS

- 6.4.5 International Distributions Services (including Royal Mail)

- 6.4.6 La Poste Group

- 6.4.7 Otto Group (including The Hermes Group)

- 6.4.8 Rapid Parcel

- 6.4.9 United Parcel Service (UPS)

- 6.4.10 Yodel

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment