PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940681

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940681

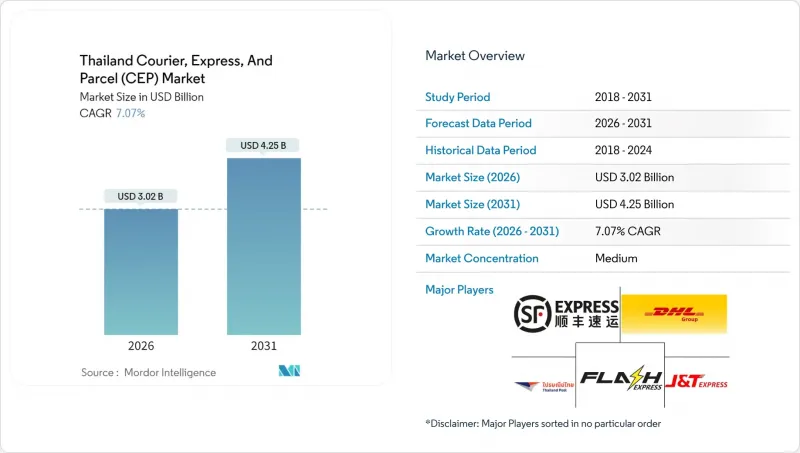

Thailand Courier, Express, And Parcel (CEP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Thailand courier express parcel market is expected to grow from USD 2.82 billion in 2025 to USD 3.02 billion in 2026 and is forecast to reach USD 4.25 billion by 2031 at 7.07% CAGR over 2026-2031.

This healthy trajectory reflects Thailand's role as a regional logistics hub benefiting from the government's Thailand 4.0 strategy, continued e-commerce adoption, and large-scale infrastructure upgrades that knit together road, rail, air, and port assets. Rising disposable income strengthens domestic parcel flows, while the high-speed rail link to the Laos-China corridor positions the country for rapid cross-border expansion. Cold-chain investment widens service breadth toward pharmaceuticals and perishables, and 5G connectivity plus AI investments enable route optimization, inventory visibility, and real-time tracking. Platform-owned logistics arms inject additional competition but also stimulate continuous efficiency improvements that keep service quality high and delivery times low.

Thailand Courier, Express, And Parcel (CEP) Market Trends and Insights

Explosive Growth of E-Commerce

Thailand's online retail sector continues to soar, lifted by digital-payment penetration and mobile-first shopping habits. Major platforms integrate same-day delivery promises, forcing couriers to tighten cutoff times while maintaining network reliability. Continuous discount events create peak-season surges that operators now manage with temporary hubs, AI-based demand forecasting, and crowdsourced driver pools. The resulting parcel density, especially in Bangkok, supports profitable route planning even at competitive price points. Government support for cashless transactions further expands the addressable customer base and lowers failed-delivery rates by shrinking cash-handling time.

Rising Middle-Class Disposable Income

The Bank of Thailand projects accelerating GDP growth that lifts household consumption power, nudging shoppers toward premium express options for convenience. The Ministry of Finance's digital-wallet stimulus injects liquidity that translates directly into online purchases. Domestic travel and tourism rebound adds demand from hospitality suppliers moving linen, food, and amenities to hotels statewide. Couriers expand next-day coverage to regional cities such as Chiang Mai and Phuket in response, while upgrading customer-facing apps to offer precise delivery slots. Luxury skincare, electronics, and specialty coffee now travel via temperature-controlled packs, signaling willingness to pay for service upgrades.

Aggressive Price Competition Eroding Margins

Cut-throat promotional tactics by platform-owned logistics groups compress per-parcel yields for incumbents. Discount vouchers and free-shipping festivals reset consumer expectations downward, forcing carriers to pursue scale and automation to stay profitable. Smaller players without capital for sort-center robotics struggle to match service levels, sparking a wave of strategic alliances. Thailand Post offsets pressure by monetizing value-added warehousing and customs brokerage, while private couriers pilot subscription models that bundle returns handling and parcel insurance.

Other drivers and restraints analyzed in the detailed report include:

- Government Thailand 4.0 Digital-Logistics Push

- Logistics-Infrastructure Upgrades (EEC, Highways)

- Fuel-Price Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

E-commerce consistently tops the volume chart with 34.86% revenue share in 2025, underpinned by social-commerce livestreams and payday flash sales. Temperature-controlled packs and secure ID-check delivery are gaining traction within cosmetics and alcohol verticals. Healthcare parcels generate less volume but higher margins, thanks to stringent regulatory compliance mandating GDP-certified handling. The Thailand courier express parcel industry expects healthcare revenue to grow by a 7.41% CAGR between 2026-2031, helped by aging demographics and national pharmaceutical distribution reforms.

Manufacturing parcels stay relevant as factories adopt just-in-time models that need dependable courier links for low-value high-urgency spares. Financial-services envelopes decline gradually as banks digitize statements, though secure-document couriers still serve legal filings and notarized contracts.

International parcels, though contributing a smaller proportion of revenue, are projected to grow faster than domestic flows at a 7.31% CAGR between 2026-2031. That momentum stems from supplier diversification out of China, duty-free thresholds that favor small parcels, and streamlined customs APIs under the ASEAN Single Window. The Thailand courier express parcel market size related to cross-border flows is forecast to surpass USD 1.53 billion by 2031, aided by the Kunming-Bangkok rail corridor that compresses line-haul times. Thailand Post already offers customs pre-payment to shorten last-mile cycles, while private couriers bundle fulfillment and customer-service add-ons for overseas merchants eyeing Thai consumers.

Domestic traffic remains the volume cornerstone with 64.35% revenue share of 2025, anchored by dense metropolitan demand that yields route densities above 150 parcels per driver per day in Bangkok. However, rural expansion programs and drone trial permits in agricultural provinces show carriers are preparing for next-wave growth beyond the capital. Service flexibility-parcel lockers in petrol stations, timed evening delivery, and real-time rescheduling-defines competitive advantage within this segment.

The Thailand Courier, Express, and Parcel (CEP) Market Report is Segmented by End User Industry (E-Commerce and More), Destination (Domestic and More), Speed of Delivery (Express and Non-Express), Shipment Weight (Heavy Weight Shipments and More), Mode of Transport (Air, Road, and Others), and Model (Business-To-Business, Business-To-Consumer, and Consumer-To-Consumer). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Aqua Corporation (including Thai Parcel Public Company Limited)

- BEST Inc.

- CJ Logistics Corporation

- DHL Group

- FedEx

- Flash Express

- J&T Express

- JWD Group

- Nim Express Company Ltd.

- SF Express (KEX-SF)

- Thailand Post

- United Parcel Service (UPS)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Demographics

- 4.3 GDP Distribution by Economic Activity

- 4.4 GDP Growth by Economic Activity

- 4.5 Inflation

- 4.6 Economic Performance and Profile

- 4.6.1 Trends in E-Commerce Industry

- 4.6.2 Trends in Manufacturing Industry

- 4.7 Transport and Storage Sector GDP

- 4.8 Export Trends

- 4.9 Import Trends

- 4.10 Fuel Price

- 4.11 Logistics Performance

- 4.12 Infrastructure

- 4.13 Regulatory Framework

- 4.14 Value Chain and Distribution Channel Analysis

- 4.15 Market Drivers

- 4.15.1 Explosive Growth of E-Commerce

- 4.15.2 Rising Middle-Class Disposable Income

- 4.15.3 Government "Thailand 4.0" Digital-Logistics Push

- 4.15.4 Logistics-Infrastructure Upgrades (EEC, Highways)

- 4.15.5 Cross-Border E-Commerce via Laos-Thailand High-Speed Rail

- 4.15.6 Expansion of Cold-Chain Last-Mile Networks

- 4.16 Market Restraints

- 4.16.1 Aggressive Price Competition Eroding Margins

- 4.16.2 Fuel-Price Volatility

- 4.16.3 Gig-Economy Courier Churn

- 4.16.4 Bangkok Traffic Congestion Bottlenecks

- 4.17 Technology Innovations in the Market

- 4.18 Porter's Five Forces Analysis

- 4.18.1 Threat of New Entrants

- 4.18.2 Bargaining Power of Buyers

- 4.18.3 Bargaining Power of Suppliers

- 4.18.4 Threat of Substitutes

- 4.18.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 Destination

- 5.1.1 Domestic

- 5.1.2 International

- 5.2 Speed of Delivery

- 5.2.1 Express

- 5.2.2 Non-Express

- 5.3 Model

- 5.3.1 Business-to-Business (B2B)

- 5.3.2 Business-to-Consumer (B2C)

- 5.3.3 Consumer-to-Consumer (C2C)

- 5.4 Shipment Weight

- 5.4.1 Heavy Weight Shipments

- 5.4.2 Light Weight Shipments

- 5.4.3 Medium Weight Shipments

- 5.5 Mode of Transport

- 5.5.1 Air

- 5.5.2 Road

- 5.5.3 Others

- 5.6 End User Industry

- 5.6.1 E-Commerce

- 5.6.2 Financial Services (BFSI)

- 5.6.3 Healthcare

- 5.6.4 Manufacturing

- 5.6.5 Primary Industry

- 5.6.6 Wholesale and Retail Trade (Offline)

- 5.6.7 Others

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Key Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Aqua Corporation (including Thai Parcel Public Company Limited)

- 6.4.2 BEST Inc.

- 6.4.3 CJ Logistics Corporation

- 6.4.4 DHL Group

- 6.4.5 FedEx

- 6.4.6 Flash Express

- 6.4.7 J&T Express

- 6.4.8 JWD Group

- 6.4.9 Nim Express Company Ltd.

- 6.4.10 SF Express (KEX-SF)

- 6.4.11 Thailand Post

- 6.4.12 United Parcel Service (UPS)

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment